Form 5558 Extension

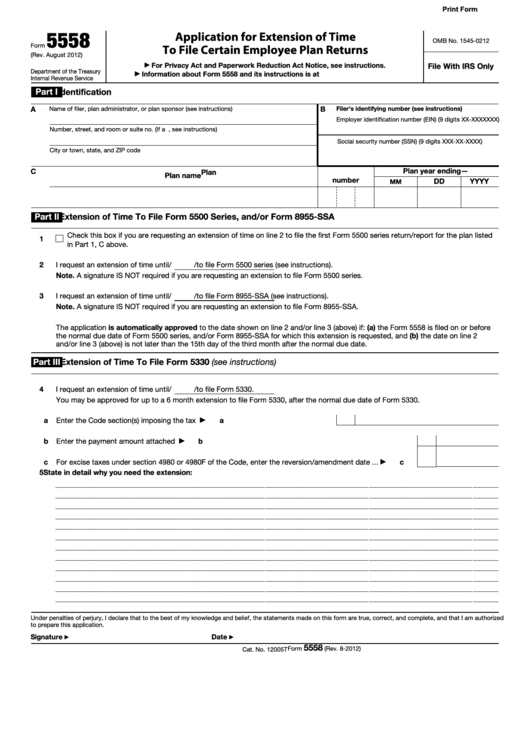

Form 5558 Extension - The following exception does not apply to form 5330. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. Download the 5558 tax form in pdf for free. For caution example, this form 5558 (rev. Most recent version of this form 5558 should always be used. Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. September 2018) should be used instead of the august 2012 version or any other prior. Web get irs form 5558 to fill out online or print. Such returns already have an extended due date until Employers can file form 5558 for one extension.

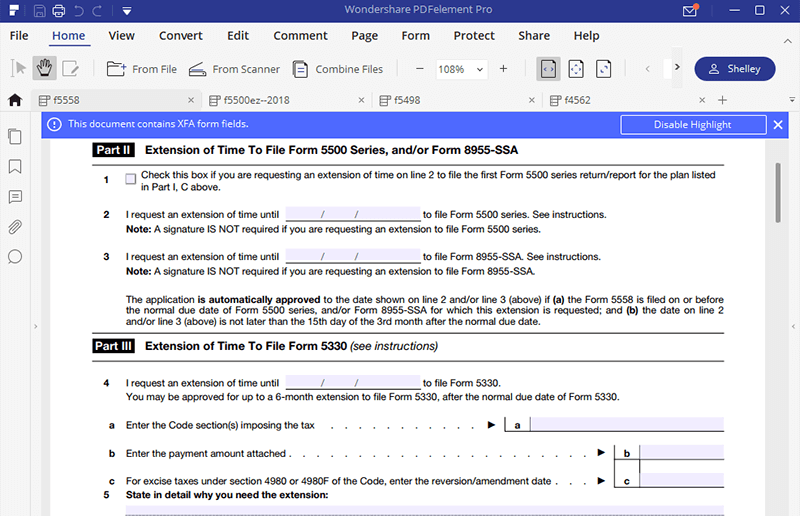

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Download the 5558 tax form in pdf for free. September 2018) should be used instead of the august 2012 version or any other prior. Web get irs form 5558 to fill out online or print. Such returns already have an extended due date until Employers can file form 5558 for one extension. Web employers use form 5558 when they need more time to file other forms; Unless specified otherwise, reference to form 5500 series return includes: To avoid processing delays, the ! Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2.

The following exception does not apply to form 5330. Follow our detailed instructions to request a time extension for employee plan returns. Employers can file form 5558 for one extension. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. To avoid processing delays, the ! Web employers use form 5558 when they need more time to file other forms; Such returns already have an extended due date until Form 5558 applies to three tax forms including: Unless specified otherwise, reference to form 5500 series return includes: Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond.

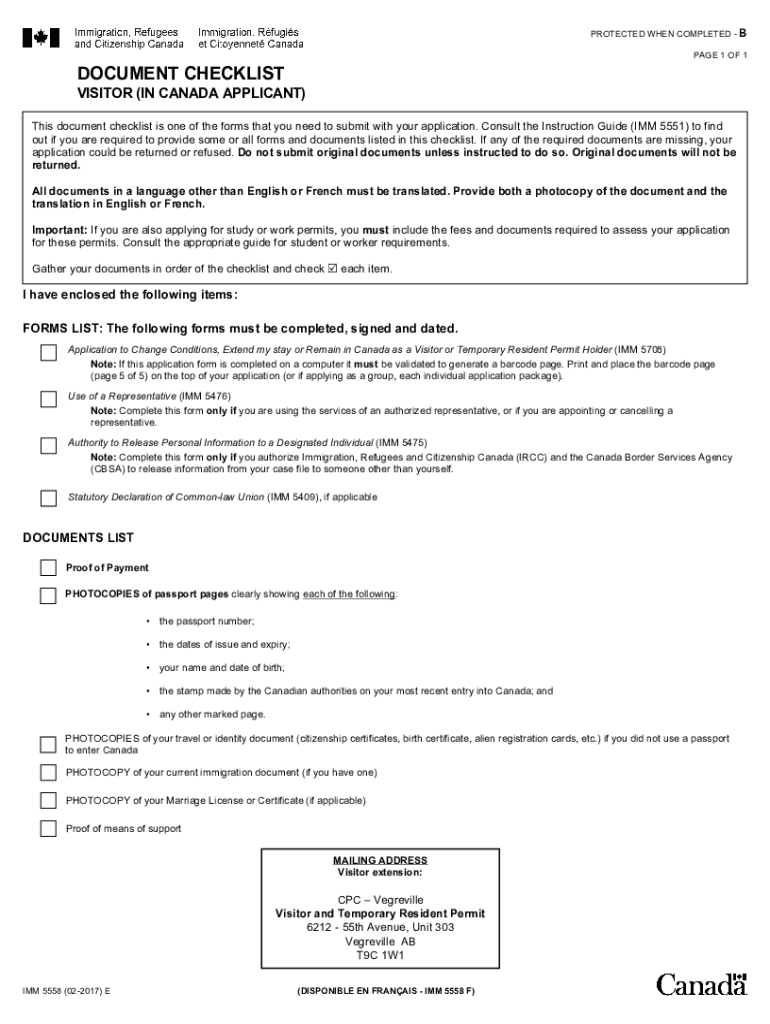

Imm 5558 Document Form Fill Out and Sign Printable PDF Template signNow

The following exception does not apply to form 5330. All your queries are answered right here! For caution example, this form 5558 (rev. September 2018) should be used instead of the august 2012 version or any other prior. Employers can file form 5558 for one extension.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Web employers use form 5558 when they need more time to file other forms; Such returns already have an extended due date until Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you.

Form 5558 Application for Extension of Time to File Certain Employee

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Web employers use form 5558 when they need more time to file other forms; Unless specified.

IRS Form 5558 A Guide to Fill it the Right Way

Such returns already have an extended due date until Download the 5558 tax form in pdf for free. Web employers use form 5558 when they need more time to file other forms; All your queries are answered right here! Unless specified otherwise, reference to form 5500 series return includes:

Form 5558 Application for Extension of Time to File Certain Employee

Employers can file form 5558 for one extension. Most recent version of this form 5558 should always be used. For caution example, this form 5558 (rev. Unless specified otherwise, reference to form 5500 series return includes: Such returns already have an extended due date until

How to Fill Out 2021 Form 5558 Application for Extension of Time to

For caution example, this form 5558 (rev. Such returns already have an extended due date until September 2018) should be used instead of the august 2012 version or any other prior. Web get irs form 5558 to fill out online or print. Unless specified otherwise, reference to form 5500 series return includes:

Form 5558 Application for Extension of Time to File Certain Employee

The following exception does not apply to form 5330. Such returns already have an extended due date until To avoid processing delays, the ! Follow our detailed instructions to request a time extension for employee plan returns. Unless specified otherwise, reference to form 5500 series return includes:

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

All your queries are answered right here! Download the 5558 tax form in pdf for free. Web get irs form 5558 to fill out online or print. The following exception does not apply to form 5330. Employers can file form 5558 for one extension.

Fillable Form 5558 Application For Extension Of Time To File Certain

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. The following exception does not apply to form 5330. For caution example, this form 5558 (rev..

Irs Fillable Extension Form Printable Forms Free Online

All your queries are answered right here! Most recent version of this form 5558 should always be used. To avoid processing delays, the ! Web employers use form 5558 when they need more time to file other forms; Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time.

For Caution Example, This Form 5558 (Rev.

Web if you received a cp notice about filing your form 5500 series return or form 5558, application for extension of time to file certain employee plan returns, the following information will help you understand why you received the notice and how to respond. Employers can file form 5558 for one extension. Follow our detailed instructions to request a time extension for employee plan returns. Download the 5558 tax form in pdf for free.

All Your Queries Are Answered Right Here!

Web employers use form 5558 when they need more time to file other forms; Such returns already have an extended due date until September 2018) should be used instead of the august 2012 version or any other prior. The following exception does not apply to form 5330.

Most Recent Version Of This Form 5558 Should Always Be Used.

Form 5558 applies to three tax forms including: To avoid processing delays, the ! Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain employee plan returns, allowing for electronic filing through efast2. Unless specified otherwise, reference to form 5500 series return includes:

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png)