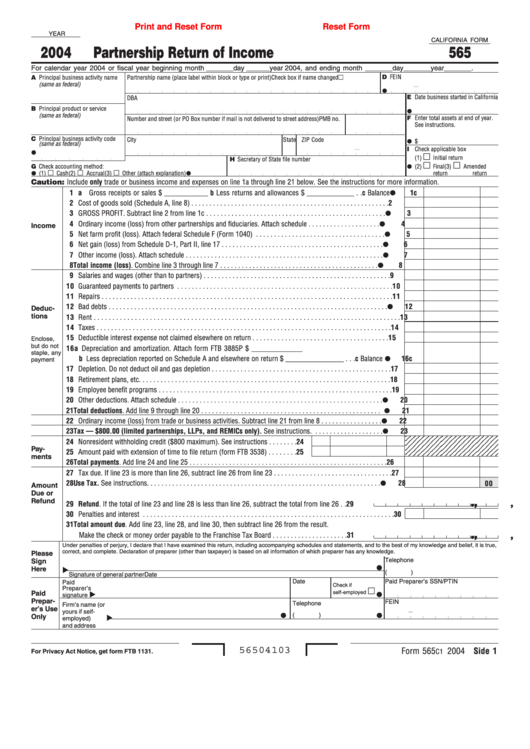

Form 565 Vs 568

Form 565 Vs 568 - Per the ca ftb limited liability company. In 2010 we correctly filed form 565, because we were general partnership. Before you amend, you may want to archive the return as it currently exists so that the. Per franchise tax board instructions, please write short period in red ink at the top of form 565 or 568, side 1.. Web typically, if the total california income from form 568, side 1, line is: A smllc is still subject to the annual tax. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to. Use form 565 to report income, deductions, gains, losses, etc., from the. Form 565 or 568 is produced for a short period. Llcs can determine which form they should file based on how they file their.

Limited liability company return of income (includes schedule t and llc income worksheet) x: Llcs classified as a disregarded entity or. However, in 2011 we filed by mistake form 568 (the llc form). In 2010 we correctly filed form 565, because we were general partnership. Web 3 years ago california how do i amend a ca 565 (partnership) or a ca 568 (llc) return? Web 1 best answer gloriah5200 expert alumni however, did the person you spoke to at the ca ftb tell you both conditions that must be met in order to not file the ca 568. There is a way to cancel the filing of form 565, to get the $800 back and then to file the. Llcs can determine which form they should file based on how they file their. Web how do you generate ca form 565 instead of form 568? Use form 565 to report income, deductions, gains, losses, etc., from the.

Before you amend, you may want to archive the return as it currently exists so that the. Llcs can determine which form they should file based on how they file their. Web aside from a few exceptions, llcs categorized as partnerships should file form 568, not form 565. Enter the $800 annual tax here. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to. Web typically, if the total california income from form 568, side 1, line is: Web form 565 is an information return for calendar year 2022 or fiscal years beginning in 2022. Web how do you generate ca form 565 instead of form 568? Form 565 or 568 is produced for a short period. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including.

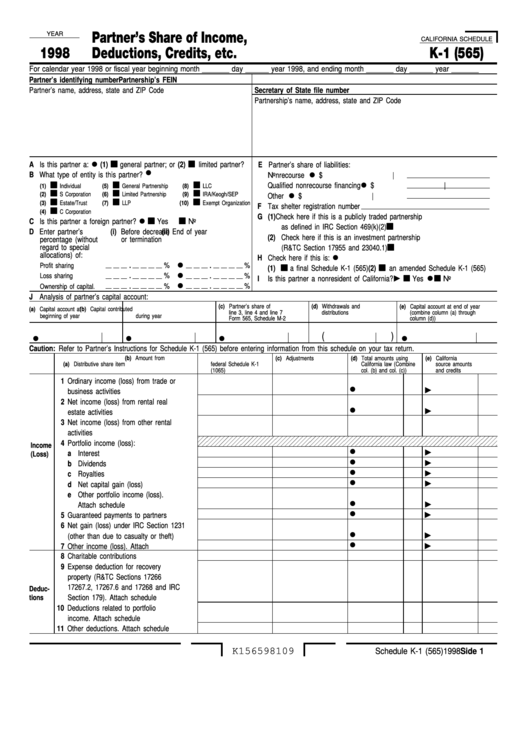

Fillable Form 565 Schedule K1 Partner'S Share Of Deductions

There is a way to cancel the filing of form 565, to get the $800 back and then to file the. Web 1 best answer gloriah5200 expert alumni however, did the person you spoke to at the ca ftb tell you both conditions that must be met in order to not file the ca 568. Enter the $800 annual tax.

Form 568 Instructions 2022 2023 State Tax TaxUni

Limited liability company return of income (includes schedule t and llc income worksheet) x: Spent almost one and a half hours with. Web the 2020 is likely late, and will be due with the form 568. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Use.

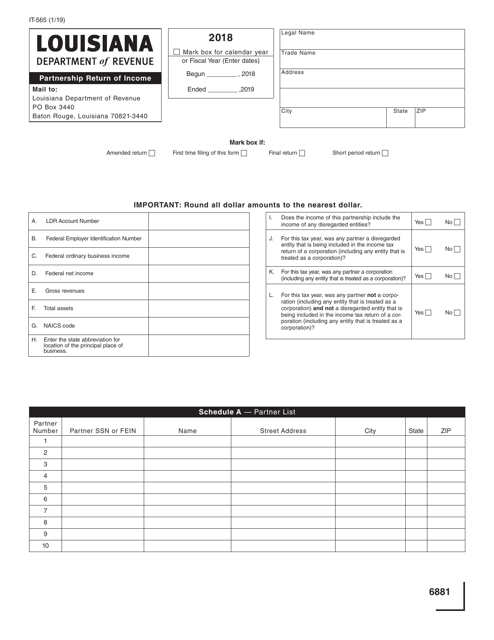

Form IT565 Download Fillable PDF or Fill Online Partnership Return of

In 2010 we correctly filed form 565, because we were general partnership. Spent almost one and a half hours with. Form 565 or 568 is produced for a short period. Web 1 best answer gloriah5200 expert alumni however, did the person you spoke to at the ca ftb tell you both conditions that must be met in order to not.

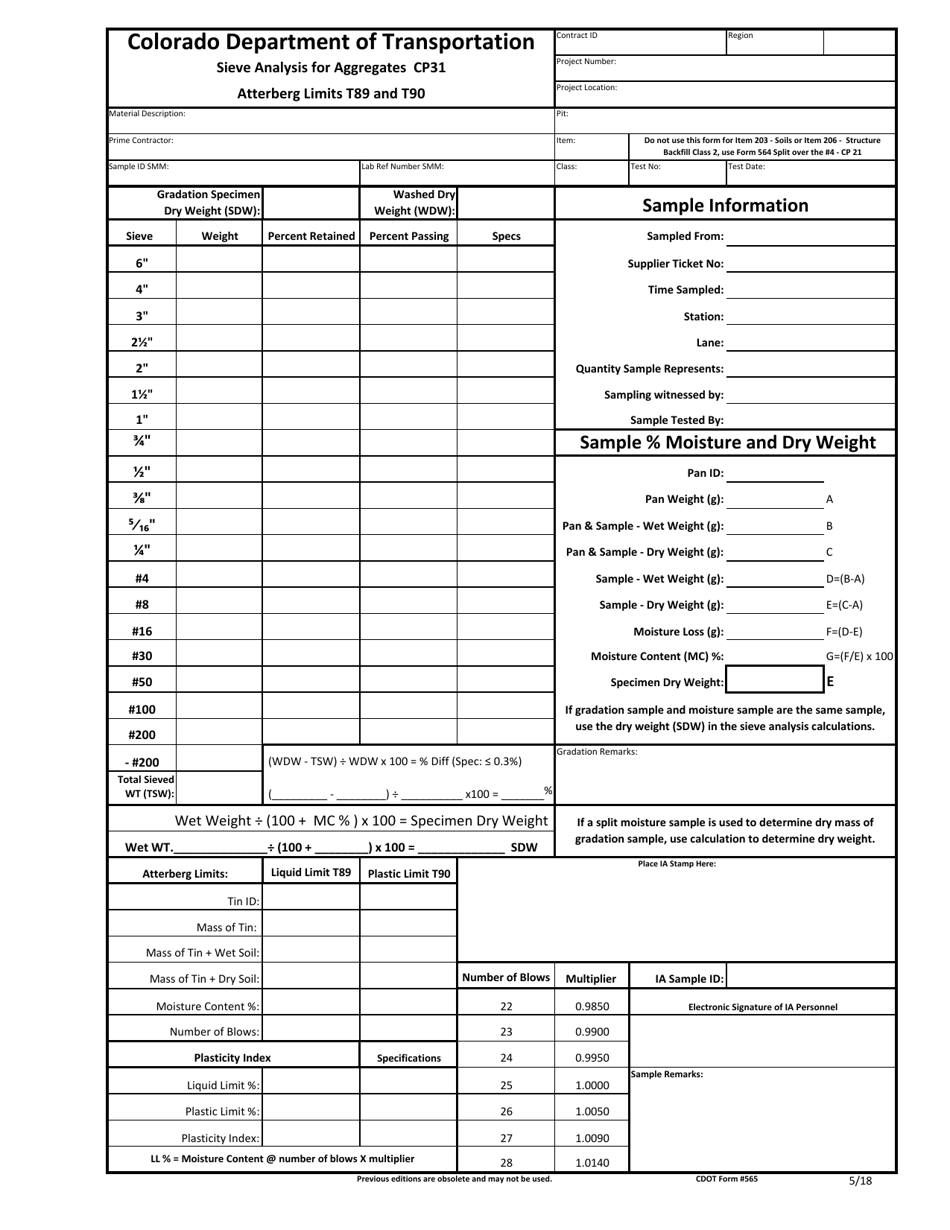

CDOT Form 565 Download Fillable PDF or Fill Online Sieve Analysis for

Use form 565 to report income, deductions, gains, losses, etc., from the. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Spent almost one and a half hours with. Web 1 best answer gloriah5200 expert alumni however, did the person you spoke.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Llcs can determine which form they should file based on how they file their. Llcs classified as a disregarded entity or. Use form 565 to report income, deductions, gains, losses, etc., from the. Web 3 years ago california how do i amend a ca 565 (partnership) or a ca 568 (llc) return? A smllc is still subject to the annual.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Form 565 or 568 is produced for a short period. In 2010 we correctly filed form 565, because we were general partnership. Use form 565 to report income, deductions, gains, losses, etc., from the. Limited liability company return of income (includes schedule t and llc income worksheet) x: Web the notice provides that the 2022 california forms 565 and form.

Fillable California Form 565 Partnership Return Of 2004

Web aside from a few exceptions, llcs categorized as partnerships should file form 568, not form 565. Enter the $800 annual tax here. Spent almost one and a half hours with. Web form 565 is an information return for calendar year 2022 or fiscal years beginning in 2022. Per the ca ftb limited liability company.

La Form It 565 Instructions 2020 Fill Online, Printable, Fillable

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Spent almost one and a half hours with. Web 1 best answer gloriah5200 expert alumni however, did the person you spoke to at the ca ftb tell you both conditions that must be met in order to.

Exquisite Form 565 Bras and Women's Lingerie aBra4Me

However, in 2011 we filed by mistake form 568 (the llc form). Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Enter the $800 annual tax here. There is a way to cancel the filing of form 565, to get the $800 back and then to.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

There is a way to cancel the filing of form 565, to get the $800 back and then to file the. Llcs can determine which form they should file based on how they file their. Web 1 best answer gloriah5200 expert alumni however, did the person you spoke to at the ca ftb tell you both conditions that must be.

Llcs Classified As A Disregarded Entity Or.

Use form 565 to report income, deductions, gains, losses, etc., from the. Form 565 or 568 is produced for a short period. Use form 565 to report income, deductions, gains, losses, etc., from the. Web form 565 is an information return for calendar year 2021 or fiscal years beginning in 2021.

Web While A Single Member Llc Does Not File California Form 565, They Must File California Form 568 Which Provides Details About The Llc.

Llcs can determine which form they should file based on how they file their. Web form 565 is an information return for calendar year 2022 or fiscal years beginning in 2022. Before you amend, you may want to archive the return as it currently exists so that the. Limited liability company return of income (includes schedule t and llc income worksheet) x:

Web How Do You Generate Ca Form 565 Instead Of Form 568?

Enter the $800 annual tax here. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web aside from a few exceptions, llcs categorized as partnerships should file form 568, not form 565.

Web 1 Best Answer Gloriah5200 Expert Alumni However, Did The Person You Spoke To At The Ca Ftb Tell You Both Conditions That Must Be Met In Order To Not File The Ca 568.

Per franchise tax board instructions, please write short period in red ink at the top of form 565 or 568, side 1.. Per the ca ftb limited liability company. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. In 2010 we correctly filed form 565, because we were general partnership.