Form 590 California

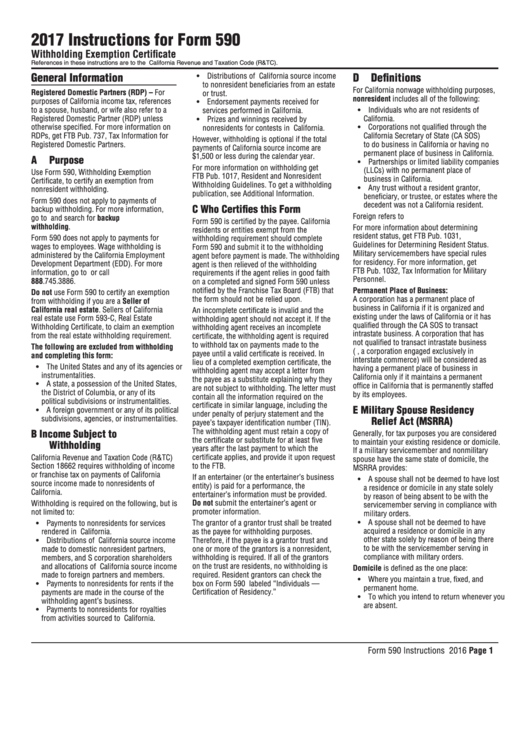

Form 590 California - Web form 590 does not apply to payments for wages to employees. Wage withholding is administered by the california employment development department (edd). The payee completes this form and submits it to the withholding agent. Wage withholding is administered by the california employment development department (edd). California residents or entities should complete and present. Web we last updated california form 590 in february 2023 from the california franchise tax board. Web form 590 does not apply to payments for wages to employees. The withholding agent keeps this form with their records. 590 the payee completes this form and submits it to the withholding. The trust will file a california fiduciary tax return.

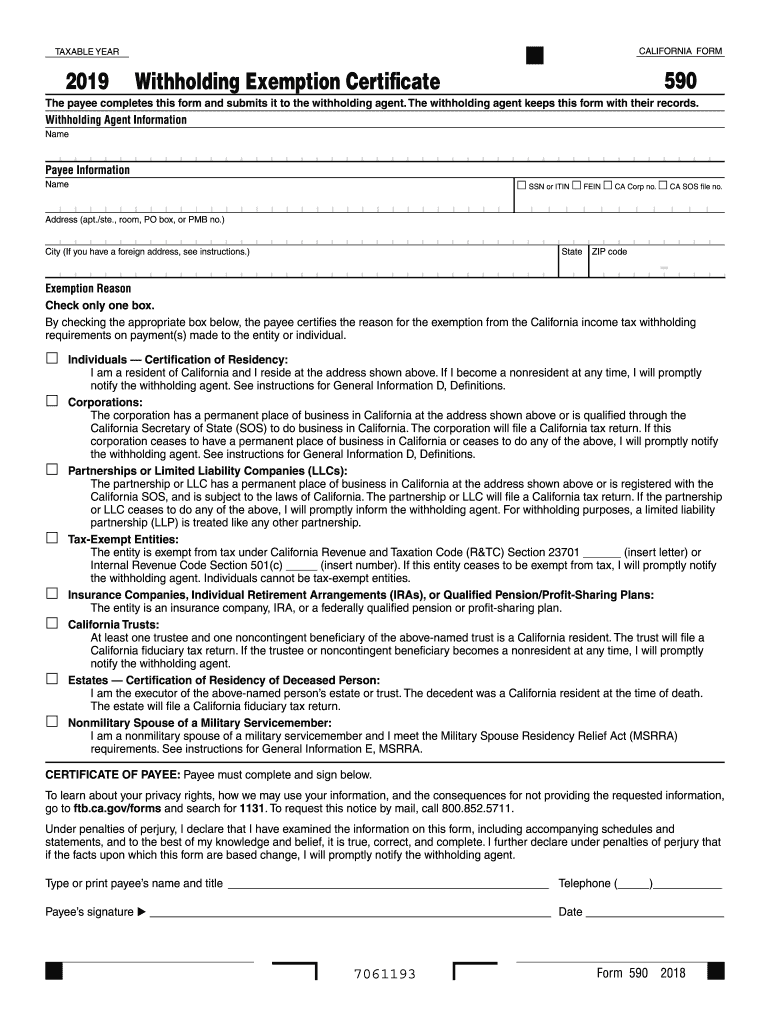

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Payee who is a california resident or a business with resident status can use form 590 to certify exemption from nonresident. The withholding agent keeps this form with their records. Web form 590, general information e, for the definition of permanent place of business. The trust will file a california fiduciary tax return. The withholding agent keeps this form with their records. 2003) file this form with your withholding agent. Web taxable year 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. This form is for income earned in tax year 2022, with tax returns due in april. Web form 590 does not apply to payments for wages to employees.

Wage withholding is administered by the california employment development department (edd). Web 59003103 form 590 c2 (rev. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web taxable year 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. 590 the payee completes this form and submits it to the withholding. The payee completes this form and submits it to the withholding agent. Web form 590 does not apply to payments for wages to employees. Web we last updated california form 590 in february 2023 from the california franchise tax board. Web form 590, general information e, for the definition of permanent place of business. Wage withholding is administered by the california employment development department (edd).

Fill Free fillable OAK023308 2002 Form 590 Withholding Exemption

Form 590 does not apply to payments of backup. The withholding agent keeps this form with their records. Payee who is a california resident or a business with resident status can use form 590 to certify exemption from nonresident. Web form 590 does not apply to payments for wages to employees. The trust will file a california fiduciary tax return.

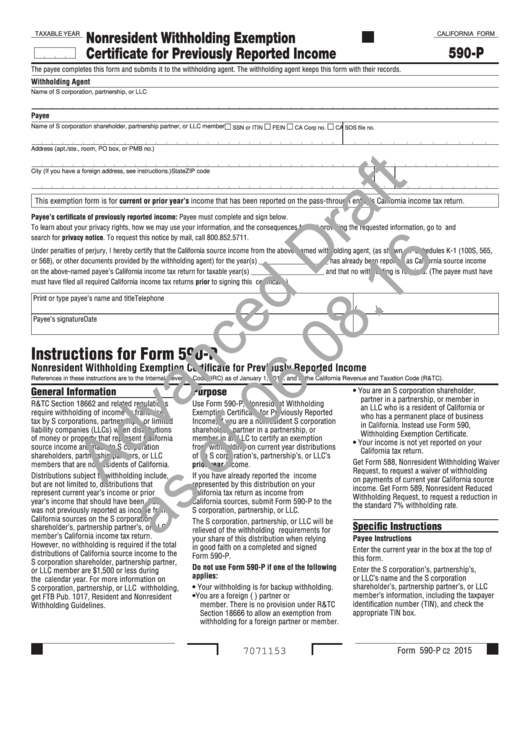

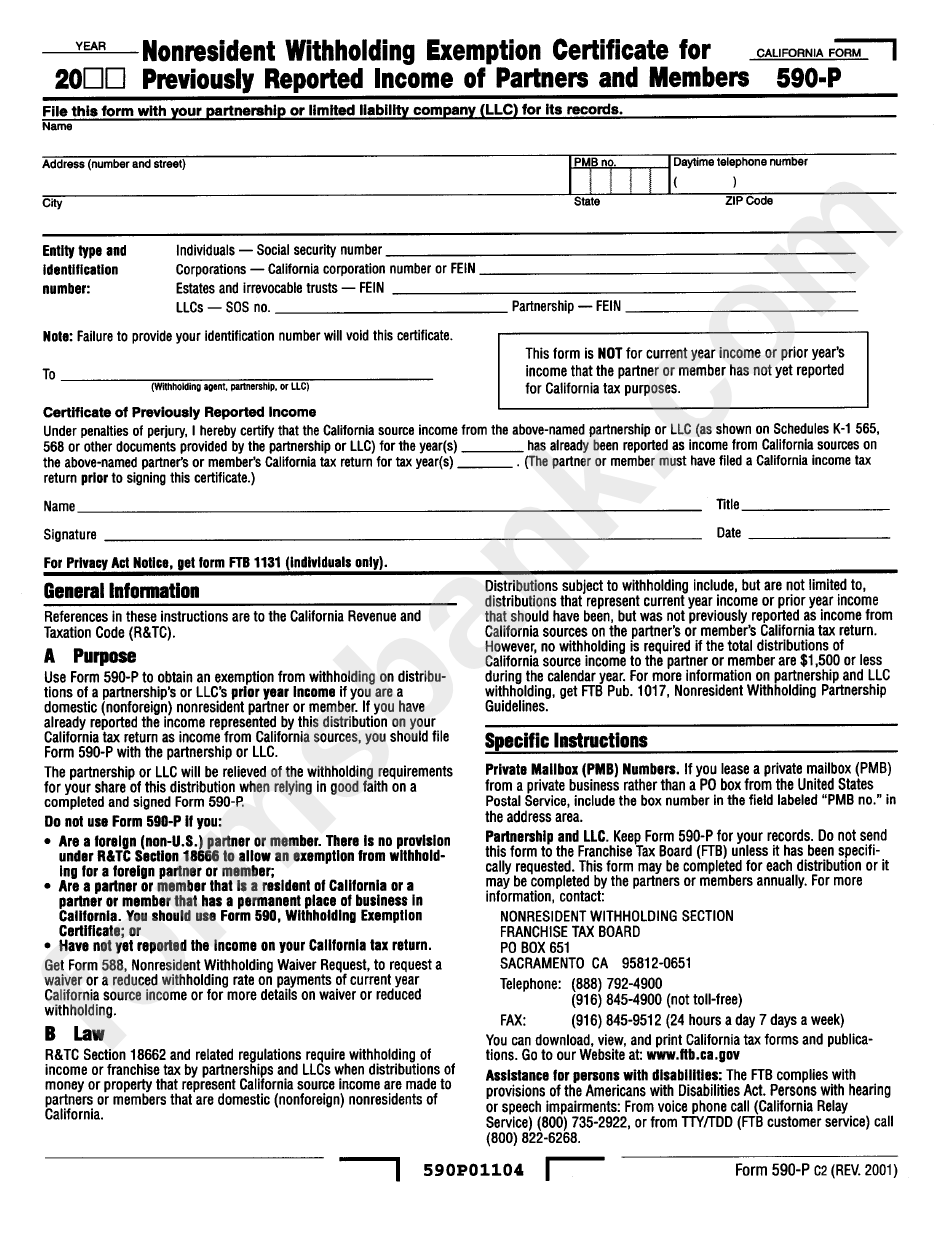

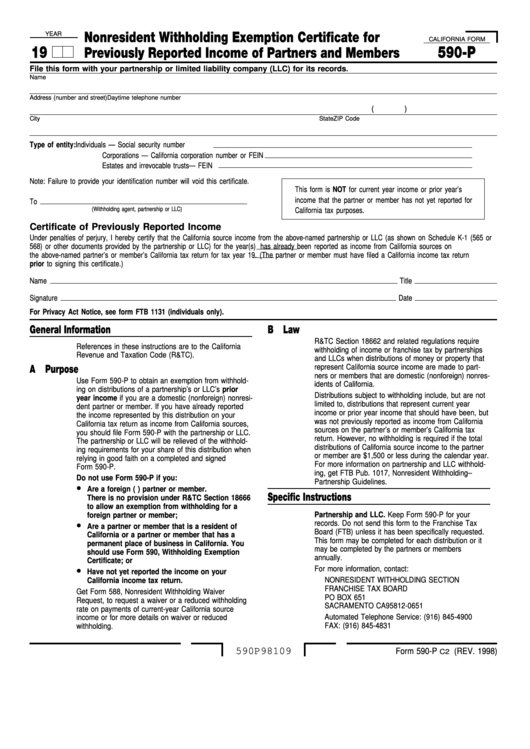

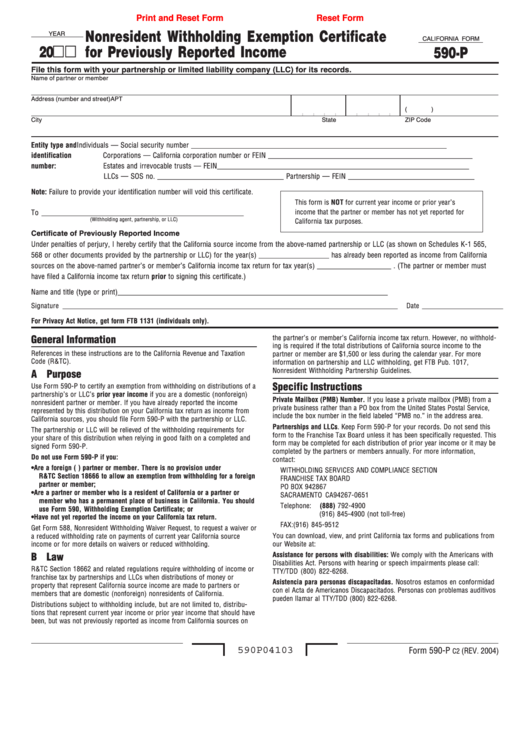

California Form 590P Draft Nonresident Withholding Exemption

Web form 590 does not apply to payments for wages to employees. Web reg 590, request for commercial registration of a passenger vehicle author: 590 the payee completes this form and submits it to the withholding. California residents or entities should complete and present. Web form 590, general information e, for the definition of permanent place of business.

Instructions For Form 590 Withholding Exemption Certificate 2017

The trust will file a california fiduciary tax return. The withholding agent keeps this form with their records. Payee who is a california resident or a business with resident status can use form 590 to certify exemption from nonresident. Web form 590, general information e, for the definition of permanent place of business. Wage withholding is administered by the california.

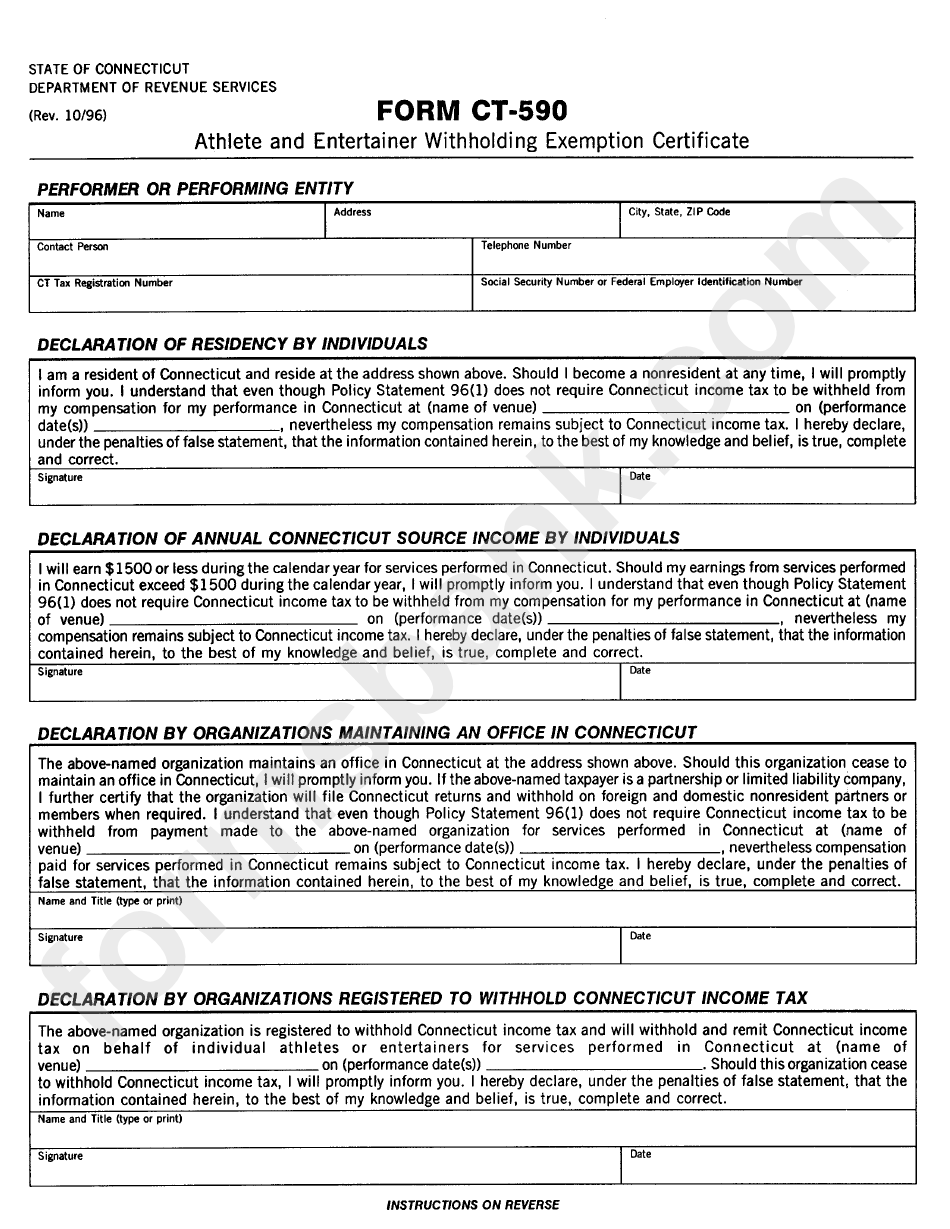

Fillable Form Ct590 Athlete And Entertainer Withholding Exemption

The payee completes this form and submits it to the withholding agent. Web 59003103 form 590 c2 (rev. This form is for income earned in tax year 2022, with tax returns due in april. Web form 590, general information e, for the definition of permanent place of business. Web use form 590, withholding exemption certificate, to certify an exemption from.

2019 Form CA FTB 590 Fill Online, Printable, Fillable, Blank PDFfiller

Form 590 does not apply to payments of backup. Web form 590 does not apply to payments for wages to employees. Web taxable year 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Payee who is a california resident or a business with resident status can use form 590 to.

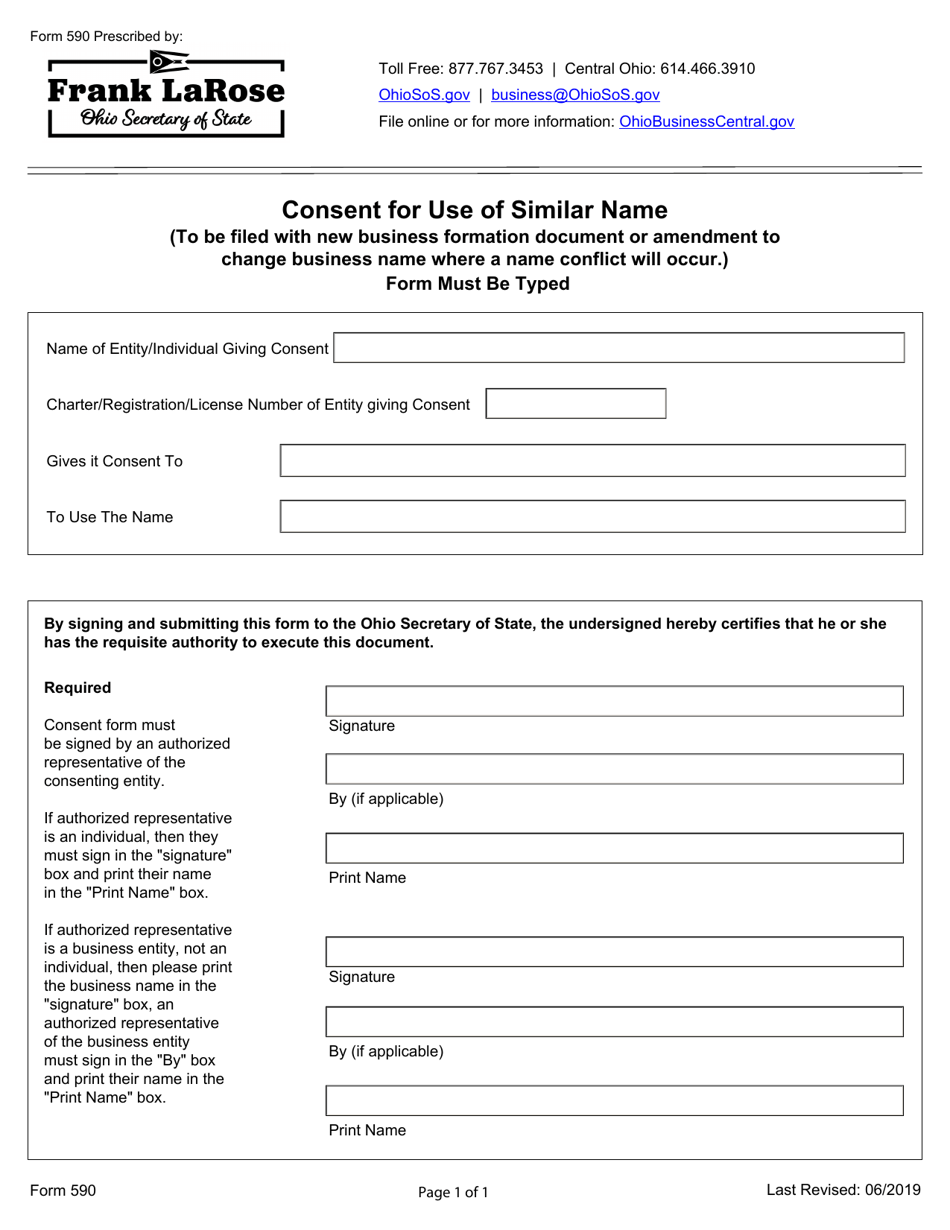

Form 590 Download Fillable PDF or Fill Online Consent for Use of

The trust will file a california fiduciary tax return. Web form 590, general information e, for the definition of permanent place of business. Web form 590 does not apply to payments for wages to employees. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments..

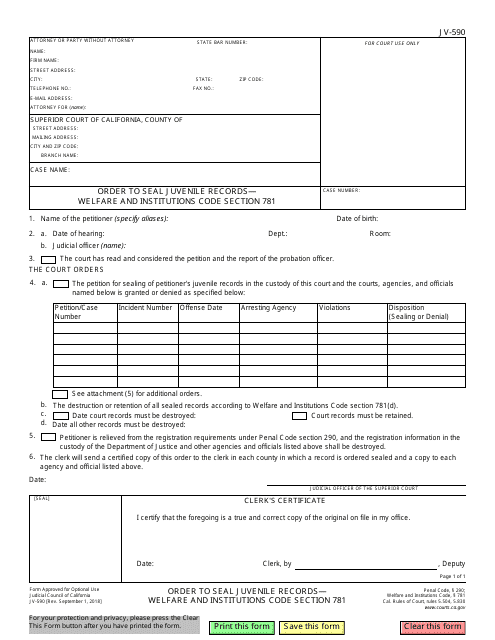

Form JV590 Download Fillable PDF or Fill Online Order to Seal Juvenile

Wage withholding is administered by the california employment development department (edd). This form is for income earned in tax year 2022, with tax returns due in april. The trust will file a california fiduciary tax return. Wage withholding is administered by the california employment development department (edd). Web we last updated california form 590 in february 2023 from the california.

Form 590P Nonresident Withholding Exemption Certificate For

Web form 590 does not apply to payments for wages to employees. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web california form 590 the payee completes this form and submits it to the withholding agent. Failure to furnish your identification. The trust will file a california fiduciary tax return.

Fillable California Form 590P Nonresident Witholding Exemption

The withholding agent keeps this form with their records. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Payee who is a california resident or a business with resident status can use form 590 to certify exemption from nonresident. This form is for.

Fillable California Form 590P Nonresident Withholding Exemption

The payee completes this form and submits it to the withholding agent. 2003) file this form with your withholding agent. Web taxable year 2022 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web form 590 does not apply to payments for wages to employees. Form 590 does not apply to.

Web 59003103 Form 590 C2 (Rev.

Form 590 does not apply to payments of backup. Web we last updated california form 590 in february 2023 from the california franchise tax board. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Wage withholding is administered by the california employment development department (edd).

The Withholding Agent Keeps This Form With Their Records.

590 the payee completes this form and submits it to the withholding. Web form 590 does not apply to payments for wages to employees. California residents or entities should complete and present. Web reg 590, request for commercial registration of a passenger vehicle author:

Failure To Furnish Your Identification.

Payee who is a california resident or a business with resident status can use form 590 to certify exemption from nonresident. Web form 50 201 taxable year 2020 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Web we last updated the withholding exemption certificate in february 2023, so this is the latest version of form 590, fully updated for tax year 2022. Web form 590 does not apply to payments for wages to employees.

2003) File This Form With Your Withholding Agent.

Wage withholding is administered by the california employment development department (edd). Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee completes this form and submits it to the withholding agent. Web california form 590 the payee completes this form and submits it to the withholding agent.