Form 6251 Instructions

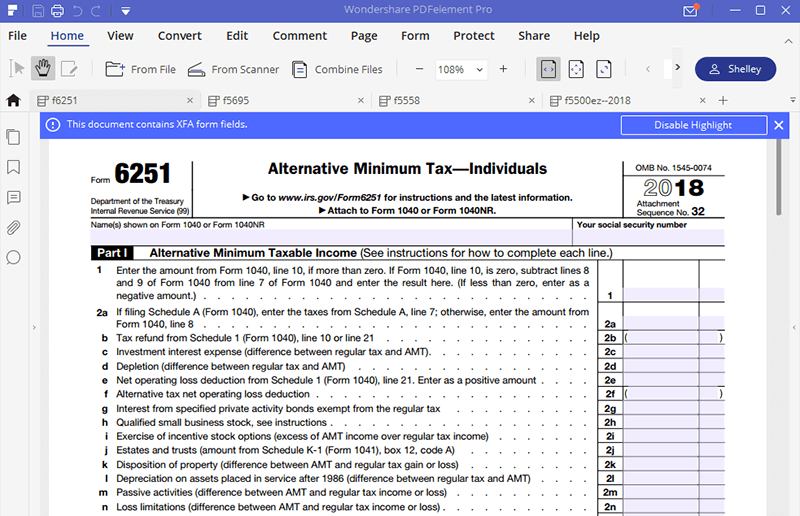

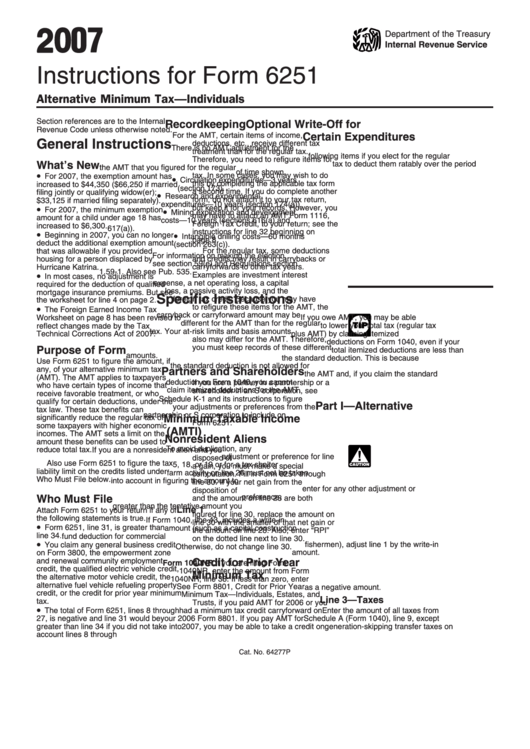

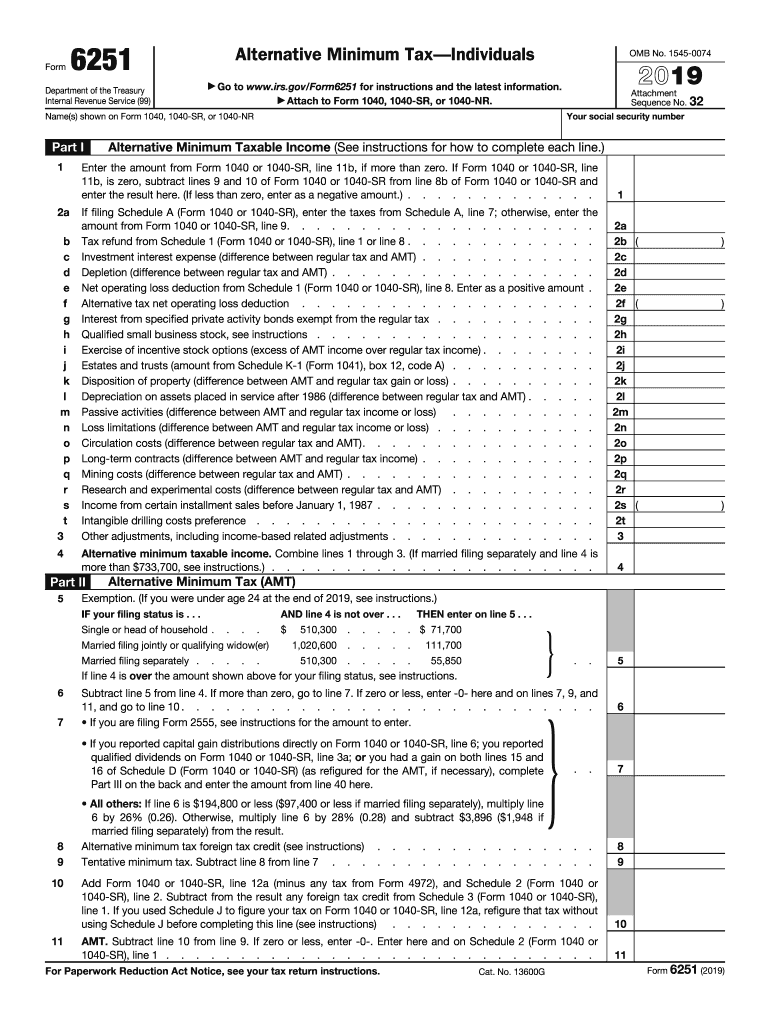

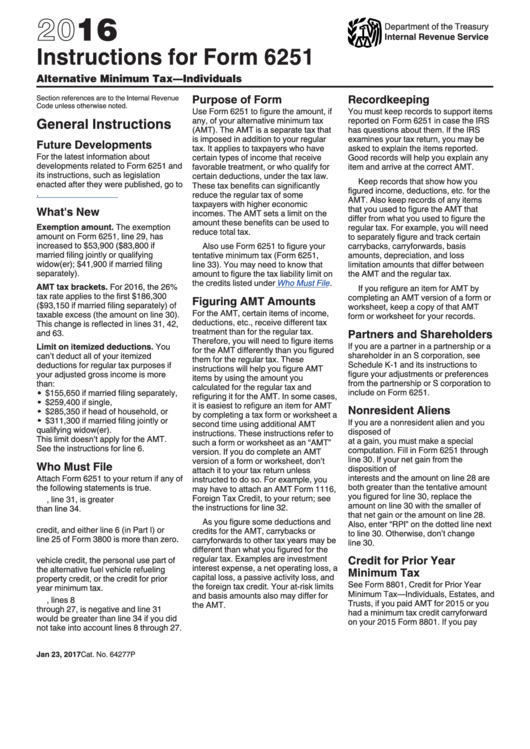

Form 6251 Instructions - Department of the treasury internal revenue service. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. Use this form to figure the amount, if any, of your alternative minimum tax (amt). The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. Use the clues to complete the pertinent fields. How tax planning can help you avoid amt and lower your total tax bill. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). For instructions and the latest information. $59,050 if married filing separately). Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability.

Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. If you are filing form 2555, see instructions for the amount to enter. Department of the treasury internal revenue service. Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. Use this form to figure the amount, if any, of your alternative minimum tax (amt). The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; Use the clues to complete the pertinent fields. The amt was designed to ensure that the wealthy pay their fair share of taxes. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax.

It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. The amt was designed to ensure that the wealthy pay their fair share of taxes. Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. Use the clues to complete the pertinent fields. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not all, income from taxation using deductions and credits. Use this form to figure the amount, if any, of your alternative minimum tax (amt). $59,050 if married filing separately). For instructions and the latest information. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax.

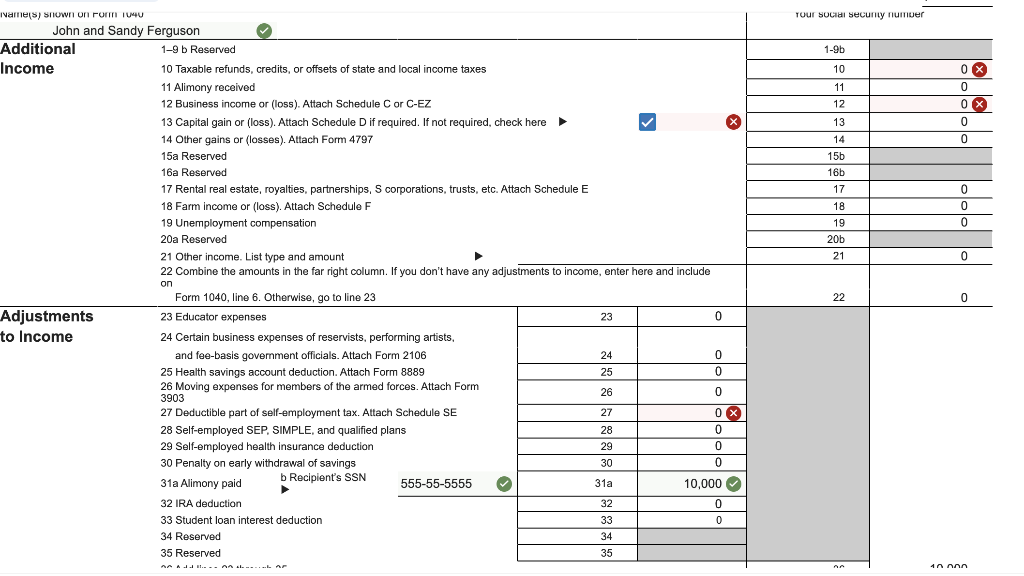

Worksheet to See if You Should Fill in Form 6251 Line 41

It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. Department of the treasury internal revenue service. For instructions and the latest information. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Make certain you enter correct details.

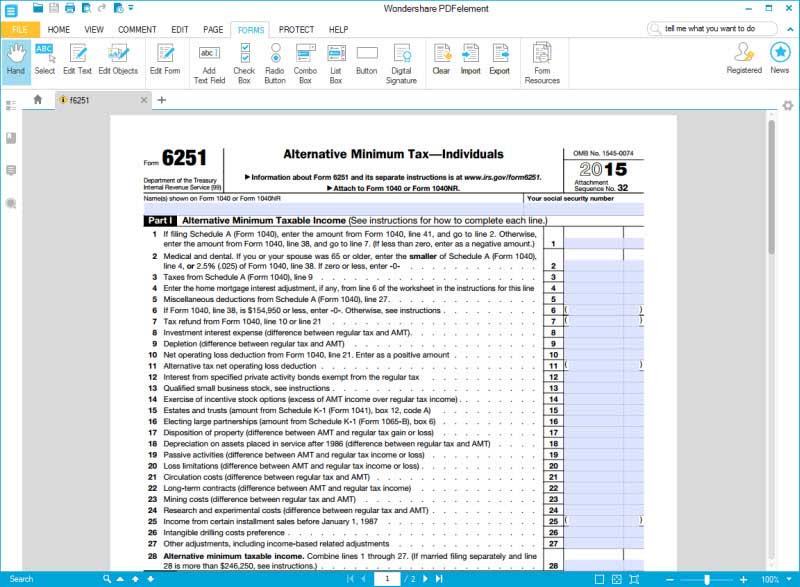

for How to Fill in IRS Form 6251

Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. On the website hosting the form, click on start now and.

Instructions For Form 6251 Alternative Minimum Tax Individuals

On the website hosting the form, click on start now and pass for the editor. Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. Web how to fill out a form 6251 instructions? The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount.

Tax Form 6251 Fill Out and Sign Printable PDF Template signNow

On the website hosting the form, click on start now and pass for the editor. Web today, over 50 years later, there exists a lot of confusion over amt, and how to minimize tax liability. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. How tax planning can.

IRS Form 6251 A Guide to Alternative Minimum Tax For Individuals

How tax planning can help you avoid amt and lower your total tax bill. Include your individual details and contact information. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines.

Form 6251 Fill and Sign Printable Template Online US Legal Forms

Use the clues to complete the pertinent fields. On the website hosting the form, click on start now and pass for the editor. The amt applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law. The exemption amount on form 6251, line 5, has increased to $75,900.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

Form 6251 is used by individuals to figure alternative minimum tax. Web form 6251, “alternative minimum tax—individuals,” is a tax form that calculates whether you’re liable for paying the alternative minimum tax and if so, how much you should pay. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are.

Instructions for How to Fill in IRS Form 6251

If you are filing form 2555, see instructions for the amount to enter. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. On the website hosting the form, click on start now and pass for the editor. Use this form to figure the amount, if any, of your.

for How to Fill in IRS Form 6251

The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; If you are filing form 2555, see instructions for the amount to enter. The irs imposes the alternative minimum tax (amt) on certain taxpayers who earn a significant amount of income, but are able to eliminate most, if not.

Instructions For Form 6251 2016 printable pdf download

For instructions and the latest information. Make certain you enter correct details and numbers in appropriate fields. Use this form to figure the amount, if any, of your alternative minimum tax (amt). On the website hosting the form, click on start now and pass for the editor. If you are filing form 2555, see instructions for the amount to enter.

Use Form 6251 To Figure The Amount, If Any, Of Your Alternative Minimum Tax (Amt).

If you are filing form 2555, see instructions for the amount to enter. The amt was designed to ensure that the wealthy pay their fair share of taxes. Use the clues to complete the pertinent fields. Use this form to figure the amount, if any, of your alternative minimum tax (amt).

Web Today, Over 50 Years Later, There Exists A Lot Of Confusion Over Amt, And How To Minimize Tax Liability.

The exemption amount on form 6251, line 5, has increased to $75,900 ($118,100 if married filing jointly or qualifying surviving spouse; Web how to fill out a form 6251 instructions? On the website hosting the form, click on start now and pass for the editor. Make certain you enter correct details and numbers in appropriate fields.

Web Form 6251, “Alternative Minimum Tax—Individuals,” Is A Tax Form That Calculates Whether You’re Liable For Paying The Alternative Minimum Tax And If So, How Much You Should Pay.

It adds back various tax breaks you might have claimed on your form 1040 tax return, then determines your taxes owed. Although reducing your taxable income to zero is perfectly legal, the irs uses amt to insure everyone pays their fair share. $59,050 if married filing separately). Form 6251 is used by individuals to figure alternative minimum tax.

The Irs Imposes The Alternative Minimum Tax (Amt) On Certain Taxpayers Who Earn A Significant Amount Of Income, But Are Able To Eliminate Most, If Not All, Income From Taxation Using Deductions And Credits.

Department of the treasury internal revenue service. Web developments related to form 6251 and its instructions, such as legislation enacted after they were published, go to irs.gov/form6251. Web form 6251 is used to determine if taxpayers owe alternative minimum tax instead of standard income tax. Include your individual details and contact information.