Form 7004 S Corporation

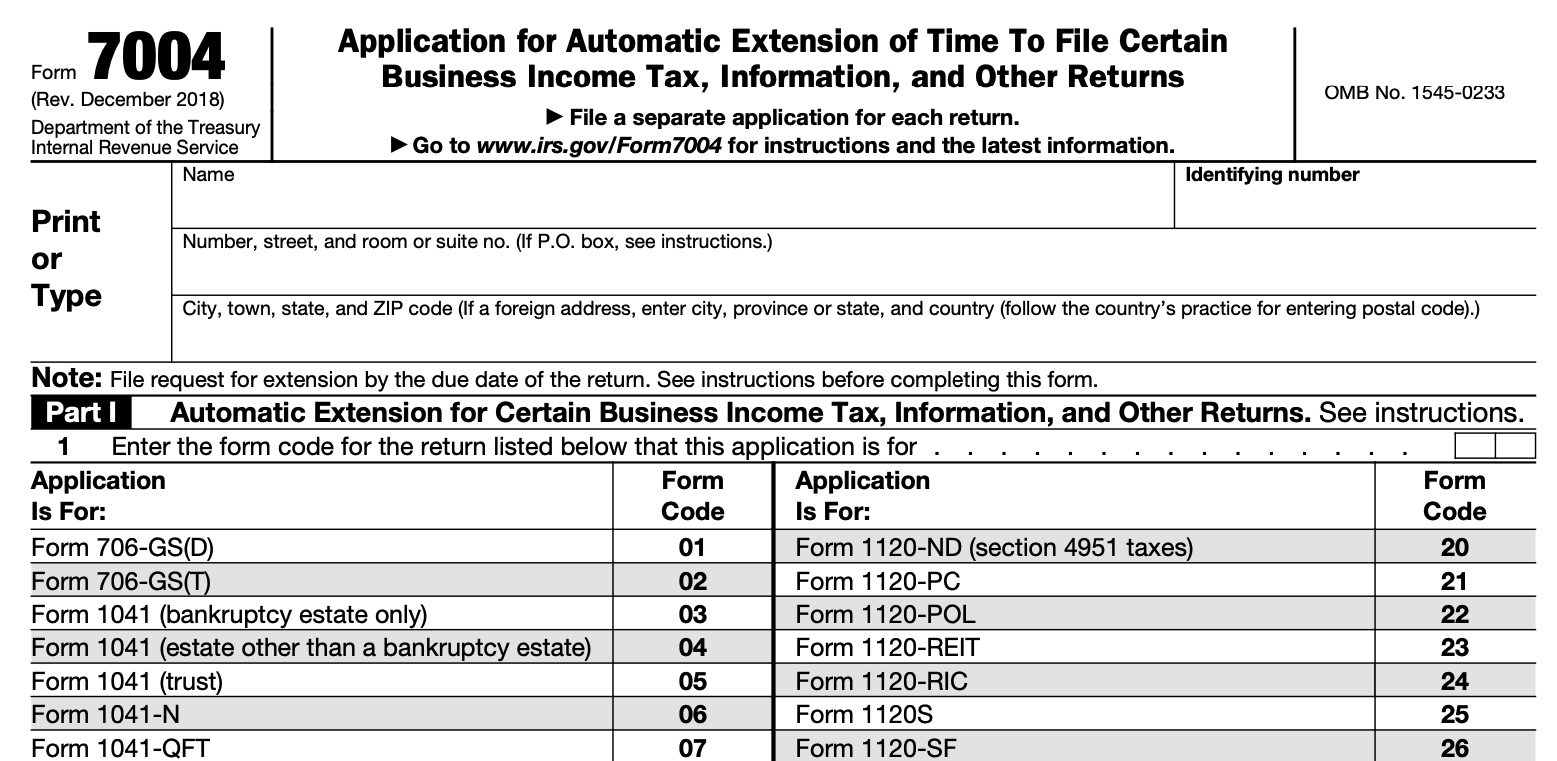

Form 7004 S Corporation - What is irs form 7004? Web where to file form 7004. Instead, attach a statement to the. Web what is the deadline for filing a 7004? In the case of an 1120, this is the 15 th day of the 4th. Web form 7004 covers every business entity type except for sole proprietorships, which file their taxes using form 1040 and use form 4868 to apply for an extension. Ultratax cs marks form 7004, line 3 if the organization is a corporation and the common parent of a group that intends to file a consolidated return. Web purpose of form. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more.

Ad 3m+ customers have trusted us with their business formations. Extensions must be filed by midnight local time on the normal due date of the return. Form 7004 can be filed on. In the case of an 1120, this is the 15 th day of the 4th. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. Get started on yours today. Web what is the deadline for filing a 7004? • an s corporation that pays wages to employees typically files irs form 941 for. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. There is no penalty or negative.

Web what is the deadline for filing a 7004? Form 7004 can be filed on. Ultratax cs marks form 7004, line 3 if the organization is a corporation and the common parent of a group that intends to file a consolidated return. Complete, edit or print tax forms instantly. For form 1065 enter the code 25. Web form 7004 is an extension form that can be used to get an automatic extension of up to 6 months from the irs for filing your business tax returns. Extensions must be filed by midnight local time on the normal due date of the return. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web where to file form 7004. Download or email irs 7004 & more fillable forms, register and subscribe now!

Form 7004 S Corporation Tax Extensions Bette Hochberger, CPA, CGMA

We're ready when you are. Web purpose of form. Extensions must be filed by midnight local time on the normal due date of the return. Web form 7004 can be filed electronically for most returns. For form 1065 enter the code 25.

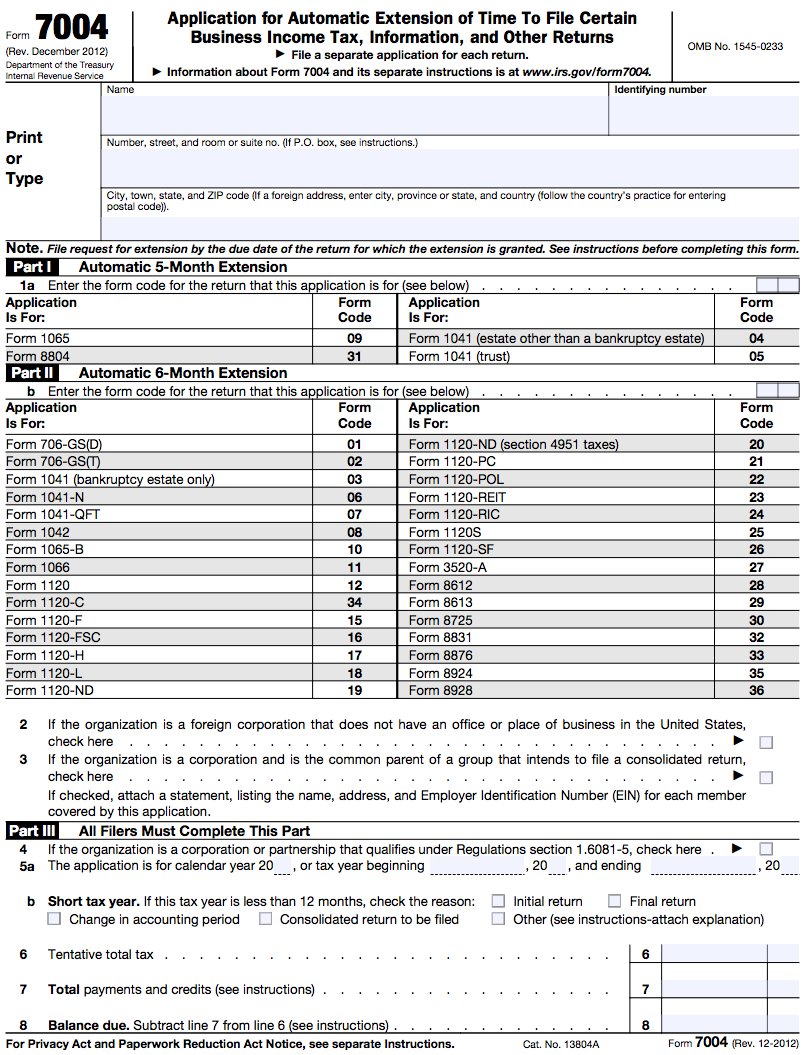

2016 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Download or email irs 7004 & more fillable forms, register and subscribe now! For form 1065 enter the code 25. • an s corporation that pays wages to employees typically files irs form 941 for. Web •.

What Is The Purpose Of Form 7004? Blog ExpressExtension

Get started on yours today. Web what is the deadline for filing a 7004? Web form 7004 is an extension form that can be used to get an automatic extension of up to 6 months from the irs for filing your business tax returns. Ultratax cs marks form 7004, line 3 if the organization is a corporation and the common.

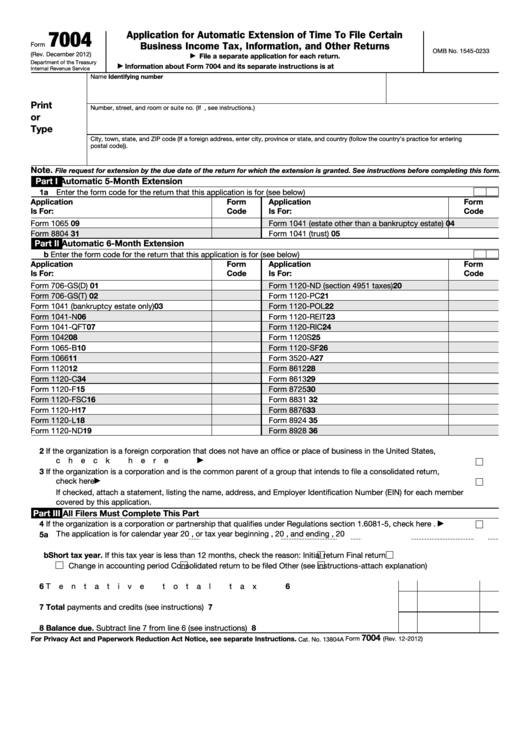

How to Fill Out Tax Form 7004 tax department of india

Complete, edit or print tax forms instantly. Ad 3m+ customers have trusted us with their business formations. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Enter code 25 in the box on form 7004, line 1. Download or email irs 7004.

Fillable Form 7004 Application For Automatic Extension Of Time To

Web form 7004 covers every business entity type except for sole proprietorships, which file their taxes using form 1040 and use form 4868 to apply for an extension. Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web where to file form.

Corporation return due date is March 16, 2015Cary NC CPA

Web form 7004 is an extension form that can be used to get an automatic extension of up to 6 months from the irs for filing your business tax returns. We know the irs from the inside out. Web purpose of form. Get started on yours today. Instead, attach a statement to the.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Instead, attach a statement to the. Web form 7004 is an extension form that can be used to get an automatic extension of up to 6 months from the irs for filing your business tax returns. Web form 7004 covers every business entity type except for sole proprietorships, which file their taxes using form 1040 and use form 4868 to.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Ad 3m+ customers have trusted us with their business formations. • an s corporation that pays wages to employees typically files irs form 941 for. Web where to file form 7004 for s corporation. Download or email irs 7004 & more fillable forms, register and subscribe now! Web where to file form 7004.

What Partnerships Need to Know About Form 7004 for Tax Year 2020 Blog

Web irs form 7004 is the application for automatic extension of time to file certain business income tax, information, and other returns. it's used to request more. Web to file a business tax extension, use form 7004, “application for automatic extension of time to file certain business income tax, information, and other. We know the irs from the inside out..

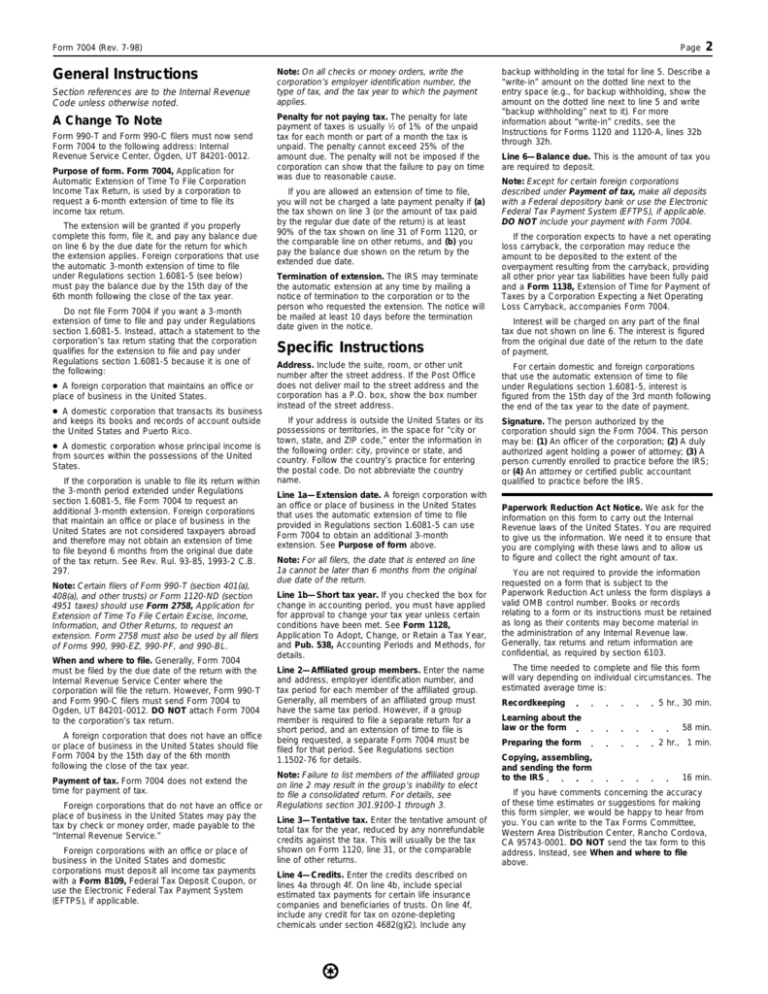

Form 7004 (Rev. July 1998)

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to. Web form 7004 covers every business entity type except for sole proprietorships, which file their taxes using form 1040 and use form 4868 to apply for an extension. Web to file a business tax extension, use form.

Extensions Must Be Filed By Midnight Local Time On The Normal Due Date Of The Return.

Web form 7004 covers every business entity type except for sole proprietorships, which file their taxes using form 1040 and use form 4868 to apply for an extension. Enter code 25 in the box on form 7004, line 1. Start your corporation with us. Download or email irs 7004 & more fillable forms, register and subscribe now!

We Know The Irs From The Inside Out.

Web where to file form 7004 for s corporation. Instead, attach a statement to the. Web • an s corporation can obtain an extension of time to file by filing irs form 7004. • an s corporation that pays wages to employees typically files irs form 941 for.

Web How Do I File Form 7004, Application For Automatic Extension Of Time To File Certain Business Income Tax, Information, And Other Returns?

Get started on yours today. Ad 3m+ customers have trusted us with their business formations. There is no penalty or negative. Web you can extend filing form 1120s when you file form 7004.

Web Form 7004 Is An Extension Form That Can Be Used To Get An Automatic Extension Of Up To 6 Months From The Irs For Filing Your Business Tax Returns.

For form 1065 enter the code 25. In the case of an 1120, this is the 15 th day of the 4th. Web where to file form 7004. Complete, edit or print tax forms instantly.