Form 7200 2022

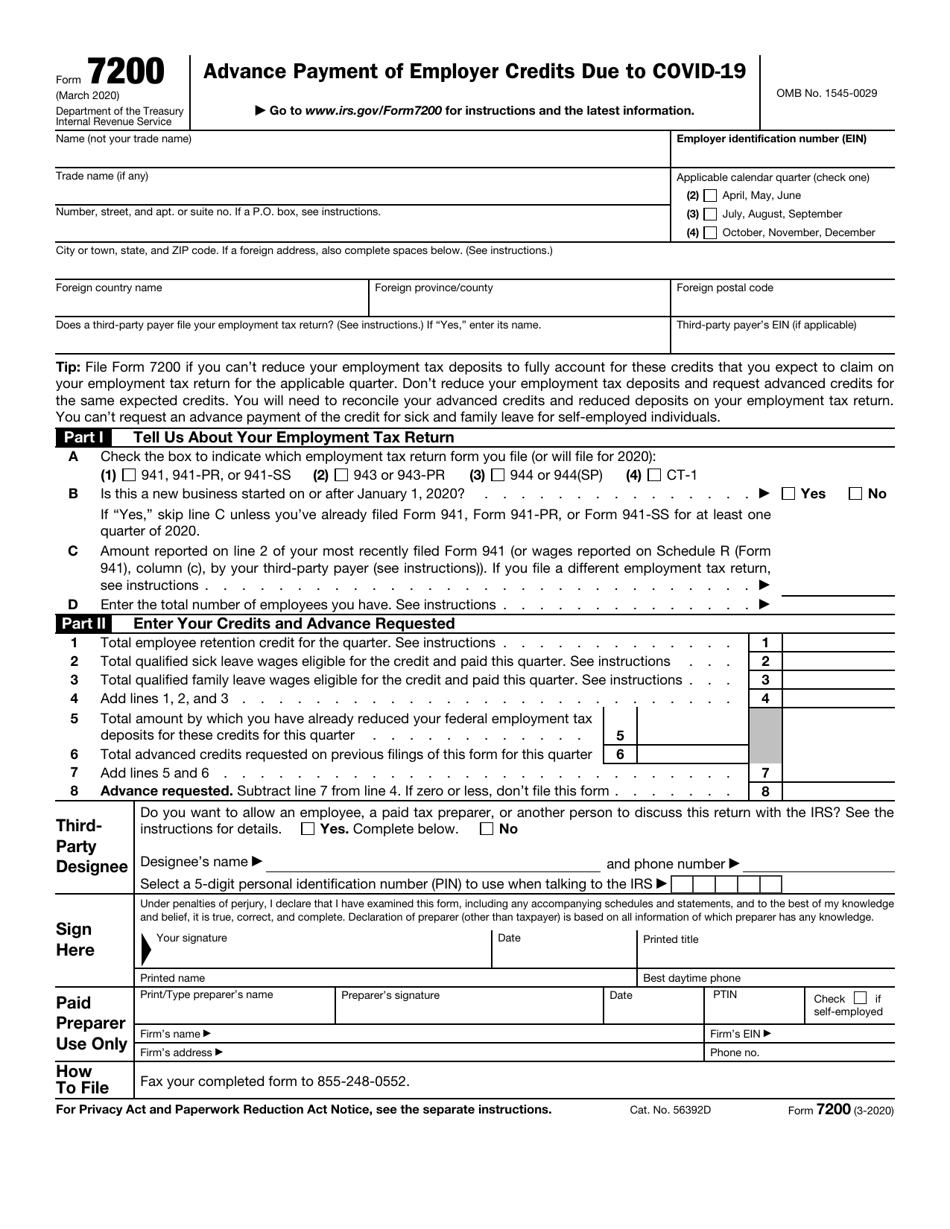

Form 7200 2022 - Stephanie glanville | august 6, 2021 | read time: Form 7200, advance payment of employer credits due to. Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. Web if you have requested or received funds previously, report it on the form 7200. The advance and credits must be reported on the employment tax return and remember to provide a. Web 7/26/2022 new updates changes in printable form the printable 7200 is used to report a deceased individual's final income tax return. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of. Form 7200 remains on irs.gov only as a historical item at. How to fill out the employee retention tax credit? Web do not file form 7200 after january 31, 2022.

Ad register and subscribe now to work on your advance payment of employer credits. The advance and credits must be reported on the employment tax return and remember to provide a. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. The last date to file form 7200 is the same whether you file. Watch now and see more below. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. Form 7200 remains on irs.gov only as a historical item at. Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for which. Stephanie glanville | august 6, 2021 | read time:

Web if you have requested or received funds previously, report it on the form 7200. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: The advance and credits must be reported on the employment tax return and remember to provide a. Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for which. A guide to the 7200 for the rest of 2021. Form 7200 remains on irs.gov only as a historical item at. Web 7.0k views | last modified 3/22/2022 1:33:16 am est |. 5 minute (s) | form 7200, tax tips | no comments the. Watch now and see more below. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee.

Form 7200 Instructions 2022 StepbyStep TaxRobot

Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Qualified sick and family leave wages. Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal.

Form 7200 Instructions 2022 StepbyStep TaxRobot

Web form 7200 guidelines in 2022. Web 7.0k views | last modified 3/22/2022 1:33:16 am est |. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Qualified sick and family leave wages. Web do not file form 7200 after january 31, 2022.

Why File Form 7200? How Does This Form Work? Blog TaxBandits

Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of. Watch now and see more below. Web do not file form 7200 after january 31, 2022. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on your employment.

ERTC Form 7200 Alternative ERC Advance Instructions Late Deadline

Web last day to file form 7200. A guide to the 7200 for the rest of 2021. The last date to file form 7200 is the same whether you file. Stephanie glanville | august 6, 2021 | read time: Web 7.0k views | last modified 3/22/2022 1:33:16 am est |.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

A guide to the 7200 for the rest of 2021. Complete, edit or print tax forms instantly. Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. Web if you have requested or received funds previously, report it on the form.

77a. Who Can Sign A Form 7200? Should A Taxpayer Submit Additional

Web form 7200 guidelines in 2022. Watch now and see more below. 5 minute (s) | form 7200, tax tips | no comments the. How to fill out the employee retention tax credit? Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of.

Form 7200 Instructions 2022 StepbyStep TaxRobot

Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Web last day to file form 7200. Ad register and subscribe now to work on your advance payment of employer credits. Qualified sick and family leave wages..

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

A guide to the 7200 for the rest of 2021. Web do not file form 7200 after january 31, 2022. Web if you have requested or received funds previously, report it on the form 7200. Watch now and see more below. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family.

IRS Form 7200 2022 IRS Forms

Qualified sick and family leave wages. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Web last day to file form 7200. Web do not file form 7200 after january 31, 2022. The advance and credits.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Web employers were able to take the credit by filing irs form 7200 to request a payment, or by reducing federal employment tax deposits by any erc amount for which. Watch now and see more below. Web 7.0k views | last modified 3/22/2022 1:33:16 am est |. Web 7/26/2022 new updates changes in printable form the printable 7200 is used.

Check Out 100+ Free Tutorials In The.

Web 7.0k views | last modified 3/22/2022 1:33:16 am est |. Watch now and see more below. Web form 7200 may be used to request an advance payment of employer credits if the employer's share of social security taxes isn't high enough to immediately use the. Qualified sick and family leave wages.

Stephanie Glanville | August 6, 2021 | Read Time:

Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of. The advance and credits must be reported on the employment tax return and remember to provide a. Web the last day to file form 7200 to request an advance payment for the fourth quarter of 2021 is january 31, 2022. Web do not file form 7200 after january 31, 2022.

How To Fill Out The Employee Retention Tax Credit?

The document is a final tax return for an. Web yes, you can! Web form 7200 guidelines in 2022. Complete, edit or print tax forms instantly.

Form 7200 Remains On Irs.gov Only As A Historical Item At.

The last date to file form 7200 is the same whether you file. 5 minute (s) | form 7200, tax tips | no comments the. Web at the time form 7200 and these instructions went to print, the credit for qualified sick and family leave wages is available for leave taken before october 1, 2021, and the employee. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: