Form 7200 For 2021

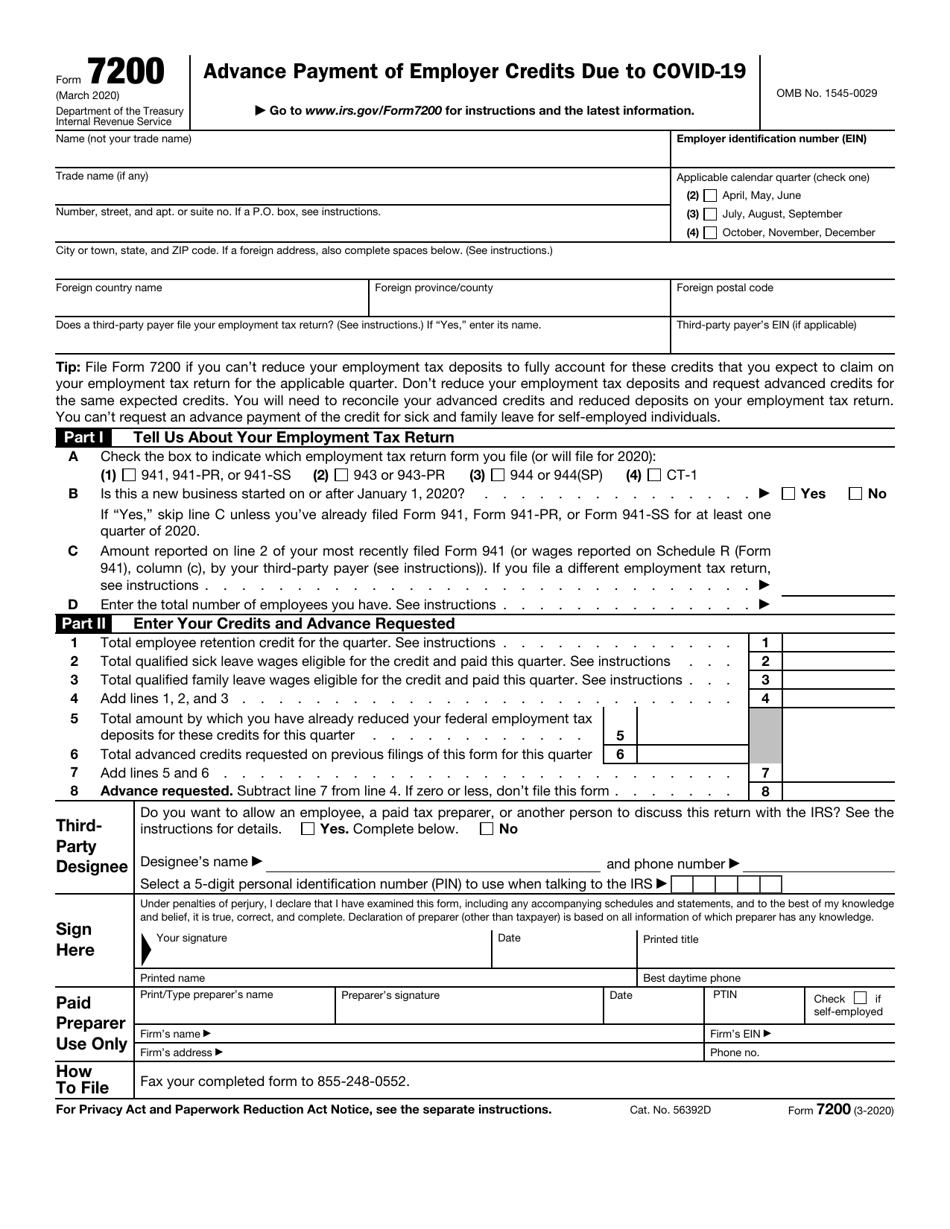

Form 7200 For 2021 - File form 7200 if you. Department of the treasury internal revenue service. Web learn how to fill out the new form 7200 for 2021. Web for more information about this credit, see the instructions for line 4, later. This document is used for individuals who. Name, ein, and address 2. Web the irs has made some changes to the form 7200 for 2021. Complete, edit or print tax forms instantly. Web what information is required to complete covid19 form 7200 for 2021? Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to.

Web learn how to fill out the new form 7200 for 2021. Department of the treasury internal revenue service. For 2021, with respect to the employee retention credit,. Name, ein, and address 2. Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving advance payments of credits claimed on. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Ad register and subscribe now to work on your advance payment of employer credits. Complete, edit or print tax forms instantly. Web form 7200 instructions 2021: This document is used for individuals who.

Online form 7200 is a federal income tax form. Web the irs has released a revised draft version of form 7200 to be used to obtain a refundable payment of the employee retention credit and the qualified sick pay. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. File form 7200 if you. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Form 7200 remains on irs.gov only as a historical item at. The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided. Web learn how to fill out the new form 7200 for 2021. The last day to file form 7200 to request an advance payment for the second quarter of 2021 is august. For 2021, with respect to the employee retention credit,.

IRS Form 7200 Instructions A Detailed Explanation Guide

Web for more information about this credit, see the instructions for line 4, later. Department of the treasury internal revenue service. The last day to file form 7200 to request an advance payment for the second quarter of 2021 is august. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2,.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

For 2021, with respect to the employee retention credit,. Web what information is required to complete covid19 form 7200 for 2021? File form 7200 if you. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Ad register and subscribe now to work.

What is IRS Form 7200 for 2021? TaxBandits YouTube

Online form 7200 is a federal income tax form. Ad register and subscribe now to work on your irs form 7200 & more fillable forms. Name, ein, and address 2. Taxpayers filing a form 941, employer's quarterly federal tax return, may submit a form 7200, advance payment of employer credits due to. This document is used for individuals who.

2021 Form IRS Instructions 7200 Fill Online, Printable, Fillable, Blank

Web the irs has released a revised draft version of form 7200 to be used to obtain a refundable payment of the employee retention credit and the qualified sick pay. Complete, edit or print tax forms instantly. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the.

The IRS Released An Updated Form 7200 for Tax Year 2021 Blog TaxBandits

This document is used for individuals who. Web form 7200 may be filed to request an advance payment for the employee retention credit through august 2, 2021. Web form 7200 instructions 2021: The following lines are introduced for the 2021 tax year, enter the total number of employees who are provided. Web learn how to fill out the new form.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

Department of the treasury internal revenue service. Online form 7200 is a federal income tax form. Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your advance payment of employer credits. Ad register and subscribe now to work on your irs form 7200 & more fillable forms.

EMPLOYEE RETENTION TAX CREDIT IRS UPDATE FOR 2021. HOW TO FILE FORM

Department of the treasury internal revenue service. Web the irs has made some changes to the form 7200 for 2021. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Department of the treasury internal revenue service. Web for more information about this.

Learn How to Calculate Form 7200 for 2021 (New Form) Advanced Payroll

Department of the treasury internal revenue service. This document is used for individuals who. Web what information is required to complete covid19 form 7200 for 2021? Department of the treasury internal revenue service. For 2021, with respect to the employee retention credit,.

What Is The Form 7200, How Do I File It? Blog TaxBandits

Web what information is required to complete covid19 form 7200 for 2021? Form 7200 remains on irs.gov only as a historical item at. For 2021, with respect to the employee retention credit,. Ad register and subscribe now to work on your irs form 7200 & more fillable forms. Web in a december 4 statement posted on its website, the irs.

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

The last day to file form 7200 to request an advance payment for the second quarter of 2021 is august. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Web what information is required to complete covid19 form 7200 for 2021? Department.

Web The Irs Has Released A Revised Draft Version Of Form 7200 To Be Used To Obtain A Refundable Payment Of The Employee Retention Credit And The Qualified Sick Pay.

Complete, edit or print tax forms instantly. The last day to file form 7200 to request an advance payment for the second quarter of 2021 is august. Web therefore, employers can file form 7200 to request advance payments of employee retention credit on or before august 2, 2021, for the qualified wages paid until. Online form 7200 is a federal income tax form.

Ad Register And Subscribe Now To Work On Your Irs Form 7200 & More Fillable Forms.

Department of the treasury internal revenue service. For 2021, with respect to the employee retention credit,. Web last day to file form 7200. Web what information is required to complete covid19 form 7200 for 2021?

Web Form 7200 May Be Filed To Request An Advance Payment For The Employee Retention Credit Through August 2, 2021.

Web learn how to fill out the new form 7200 for 2021. Name, ein, and address 2. This document is used for individuals who. Web form 7200 instructions 2021:

File Form 7200 If You.

Form 7200 remains on irs.gov only as a historical item at. Complete, edit or print tax forms instantly. Web for more information about this credit, see the instructions for line 4, later. Web in a december 4 statement posted on its website, the irs said that employers will experience a delay in receiving advance payments of credits claimed on.