Form 801 Texas

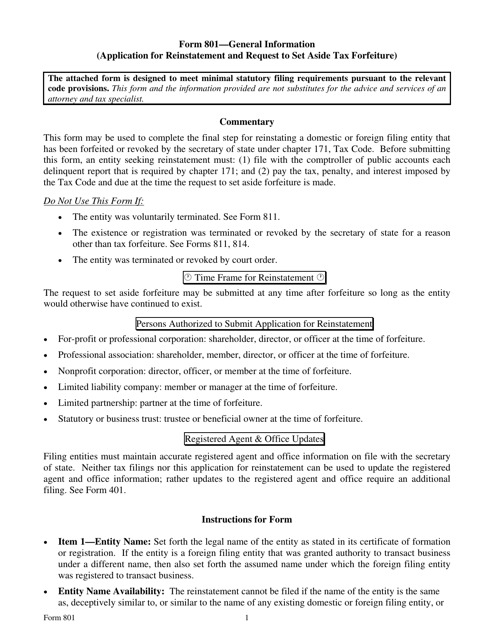

Form 801 Texas - The office strongly encourages electronic filing through. Web information about form 851, affiliations schedule, including recent updates, related forms and instructions on how to file. Web this is a texas form and can be use in general business secretary of state. Web texas form 801 is a state form that is used to report and remit sales and use tax. Registration of a texas limited liability partnership;. Web an entity forfeited under the tax code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all. Try it for free now! Web books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. The parent corporation of an affiliated. The advanced tools of the editor will.

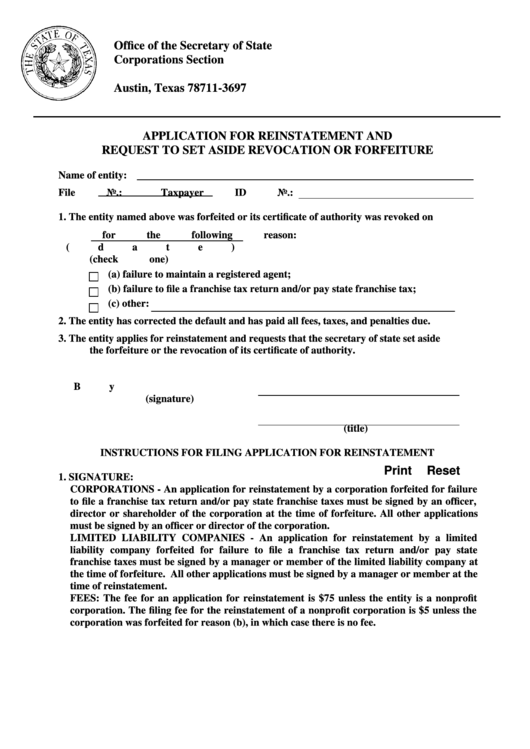

Sign online button or tick the preview image of the document. Web texas (forms 502, 505) $40. Web an entity forfeited under the tax code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax report, (2) paying all. Web this is a texas form and can be use in general business secretary of state. This form must be filed on a monthly basis, and the due date for the return is the 20th day of. Registration of a texas limited liability partnership;. Web if your llc was terminated for failing to pay the texas franchise tax, you’ll need to file the application for reinstatement and request to set aside tax forfeiture (form 801). And (2) pay the tax,. Try it for free now! (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171;

Application for reinstatement and request to set aside tax forfeiture,. Web this is a texas form and can be use in general business secretary of state. Periodic report of a nonprofit corporation 804: The advanced tools of the editor will. (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171; Web texas form 801 is a state form that is used to report and remit sales and use tax. Web if your llc was terminated for failing to pay the texas franchise tax, you’ll need to file the application for reinstatement and request to set aside tax forfeiture (form 801). Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code; Web 10 rows index of report forms filed by professional. Sexually oriented business fee forms.

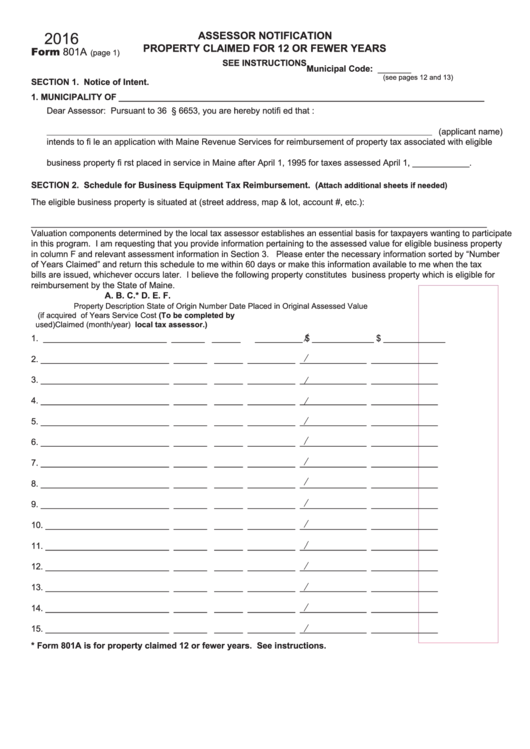

Form 801a Assessor Notification Property Claimed For 12 Or Fewer

Certificate of termination of a domestic nonprofit corporation pursuant to the texas business organizations code; The administrative rules adopted for determining entity name availability (texas. Try it for free now! Web books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law..

801 Form Oregon Fill Online, Printable, Fillable, Blank pdfFiller

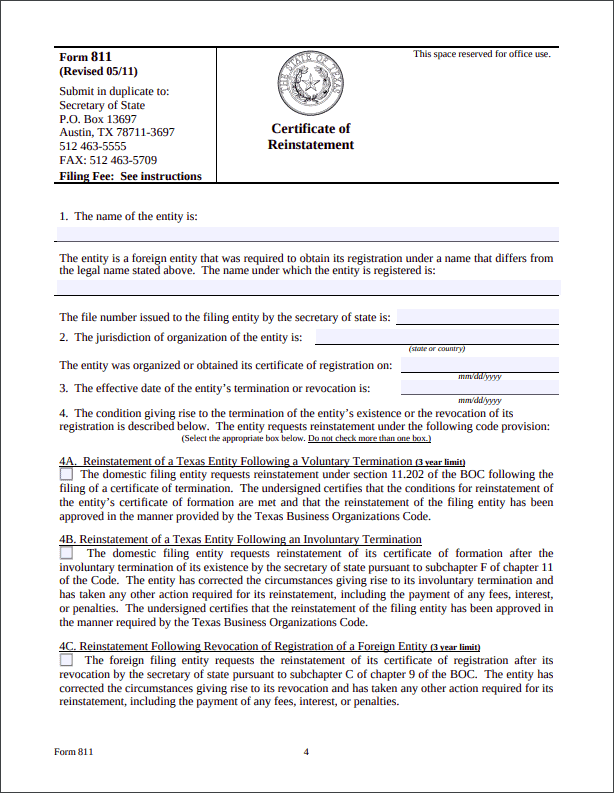

Application for reinstatement and request to set aside revocation or forfeiture 802: Sign online button or tick the preview image of the document. Web books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Web information about form 851, affiliations schedule,.

Fillable Form 801 Application For Reinstatement And Request To Set

Web this is a texas form and can be use in general business secretary of state. Web information about form 851, affiliations schedule, including recent updates, related forms and instructions on how to file. Ad download or email tx form 801 & more fillable forms, register and subscribe now! The parent corporation of an affiliated. Try it for free now!

Form 801 Download Fillable PDF or Fill Online Application for

The office strongly encourages electronic filing through. The secretary of state is aware that many transactions in the business and financial world are time sensitive. Ad download or email tx form 801 & more fillable forms, register and subscribe now! Web form 801 requirements instructions for filing a reinstatement of a domestic or foreign filing entity following a tax forfeiture.

Free guide to reinstate or revive a Texas Limited Liability Company

Application for reinstatement and request to set aside tax forfeiture,. The secretary of state is aware that many transactions in the business and financial world are time sensitive. Web mixed beverage tax forms. Withdrawal of name registration of foreign entity not qualified to transact business in texas (form 508) $15. The administrative rules adopted for determining entity name availability (texas.

Saif 801 Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

The parent corporation of an affiliated. Web texas (forms 502, 505) $40. Sexually oriented business fee forms. Web this is a texas form and can be use in general business secretary of state. The secretary of state is aware that many transactions in the business and financial world are time sensitive.

We're moving. Should I worry?

Withdrawal of name registration of foreign entity not qualified to transact business in texas (form 508) $15. Sexually oriented business fee forms. Application for reinstatement and request to set aside revocation or forfeiture 802: The parent corporation of an affiliated. The document has moved here.

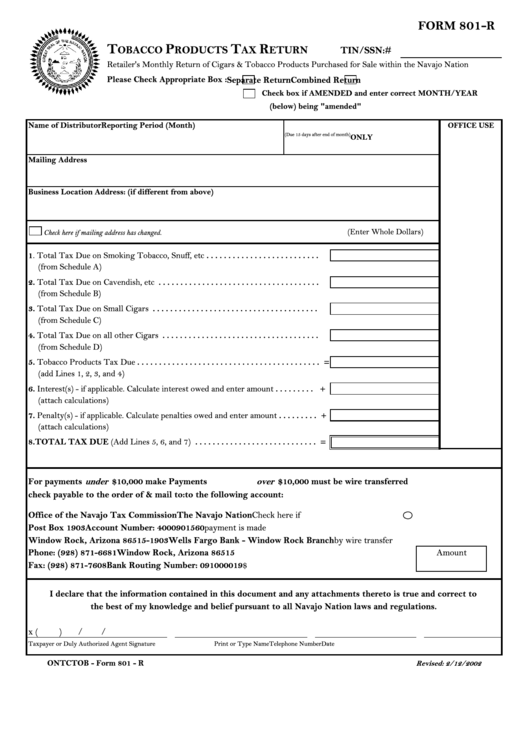

Form 801R Tobacco Products Tax Return Form printable pdf download

Upload, modify or create forms. This agreement remains in effect for all subsequent tax bills pursuant to tax code section 31.01 until the earlier of the. The advanced tools of the editor will. Web an entity forfeited under the tax code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the.

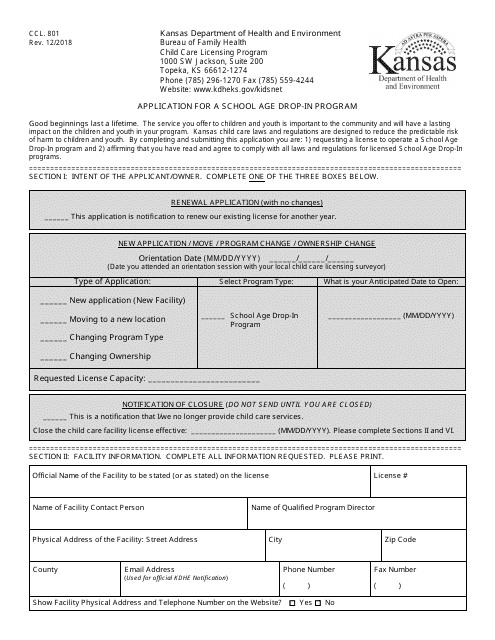

Form CCL.801 Download Printable PDF or Fill Online Application for a

Web this form, an entity seeking reinstatement must: The advanced tools of the editor will. Ad download or email tx form 801 & more fillable forms, register and subscribe now! Web an entity forfeited under the tax code can reinstate at any time (so long as the entity would otherwise continue to exist) by (1) filing the required franchise tax.

Workers Comp Exempt Form California Universal Network

Web texas form 801 is a state form that is used to report and remit sales and use tax. Web 10 rows index of report forms filed by professional. Try it for free now! The office strongly encourages electronic filing through. The administrative rules adopted for determining entity name availability (texas.

The Secretary Of State Is Aware That Many Transactions In The Business And Financial World Are Time Sensitive.

Ad download or email tx form 801 & more fillable forms, register and subscribe now! Try it for free now! This form must be filed on a monthly basis, and the due date for the return is the 20th day of. Periodic report of a nonprofit corporation 804:

Application For Reinstatement And Request To Set Aside Revocation Or Forfeiture 802:

The administrative rules adopted for determining entity name availability (texas. The document has moved here. Web form 801 1 any name reservation or registration filed with the secretary of state. Web this form, an entity seeking reinstatement must:

Sign Online Button Or Tick The Preview Image Of The Document.

Registration of a texas limited liability partnership;. Web texas (forms 502, 505) $40. To begin the document, utilize the fill camp; (1) file with the comptroller of public accounts each delinquent report that is required by chapter 171;

This Agreement Remains In Effect For All Subsequent Tax Bills Pursuant To Tax Code Section 31.01 Until The Earlier Of The.

The advanced tools of the editor will. And (2) pay the tax,. The office strongly encourages electronic filing through. Web 10 rows index of report forms filed by professional.