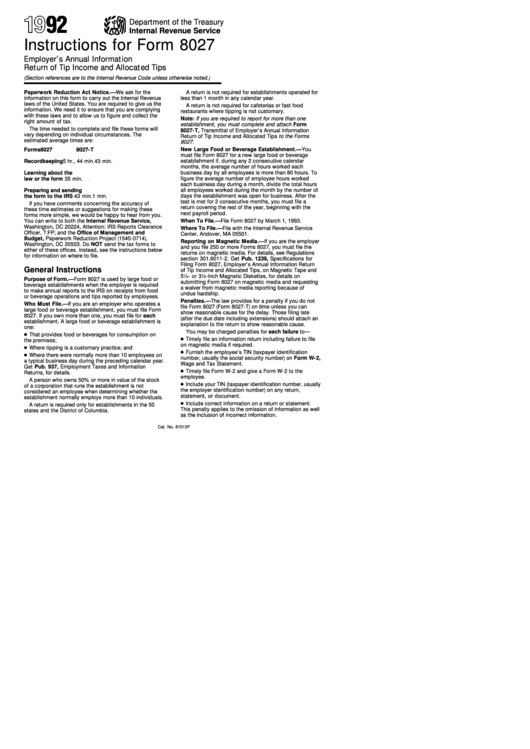

Form 8027 Instructions

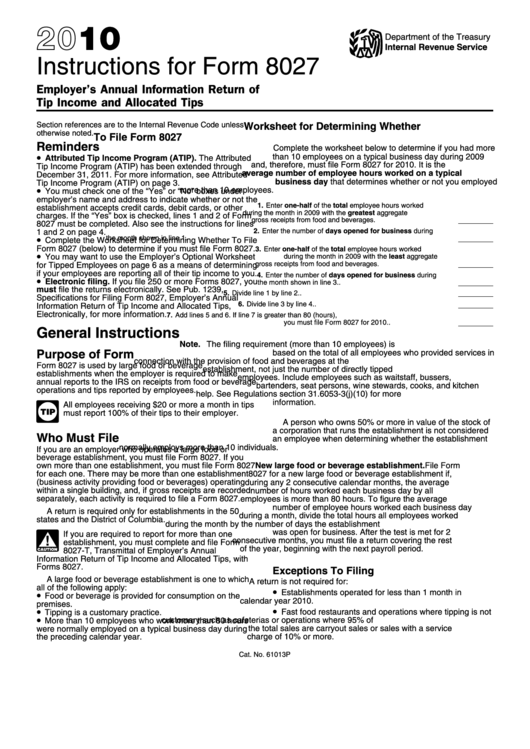

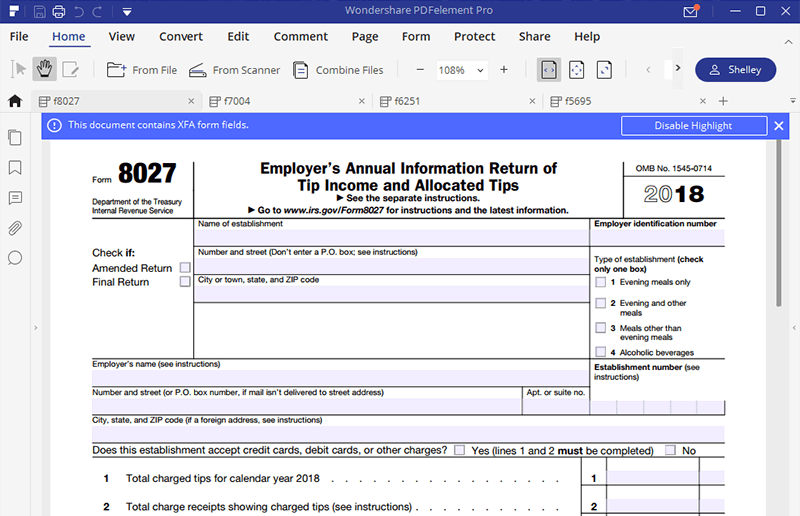

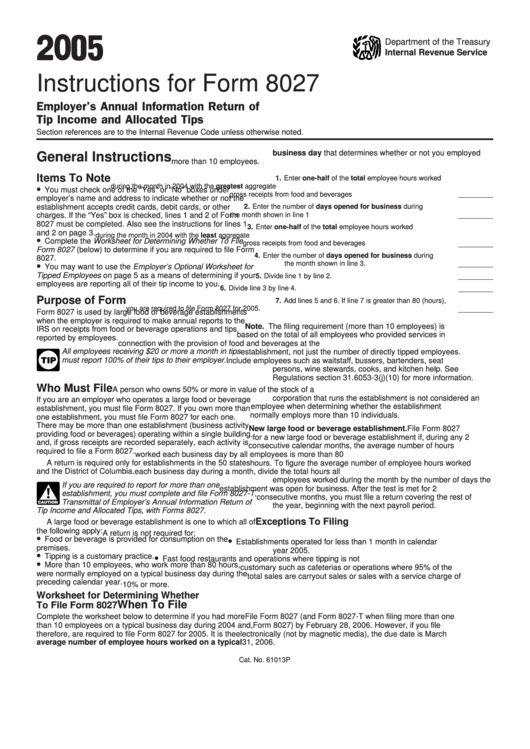

Form 8027 Instructions - Lines 1 and 2 : Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and instructions on how to file. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Web form 8027 instructions have really good guidance on requesting a lower tip rate. Web form 8027 instructions. Employers use form 8027 to annually report to the irs receipts and tips from their large food or beverage establishments and to determine allocated tips for tipped employees. Go to www.irs.gov/form8027 for instructions and the latest information. Web employers use form 8027 to report that information. These instructions give you some background information about form 8027. The business name, address, and employer identification number.

In the main section of the form, you must report the total tips your business brought in. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Web see the separate instructions. Web here’s an overview of the process. Follow the steps for your method of choice (outlined in the irs tax form instructions ), check the box next to the method you used in line 7 of form 8027, and add any details from your calculations to the document if needed. They tell you who must file form 8027, when and where to file it, and how to fill it out line by line. Web form 8027 instructions have really good guidance on requesting a lower tip rate. Tipping of food or beverage employees by customers is customary. Web form 8027 instructions. These are for use if your establishment accepts credit cards, debit cards, or other types of charges.

Web see the separate instructions. In the main section of the form, you must report the total tips your business brought in. Follow the steps for your method of choice (outlined in the irs tax form instructions ), check the box next to the method you used in line 7 of form 8027, and add any details from your calculations to the document if needed. Lines 1 and 2 : Tipping of food or beverage employees by customers is customary. Web employers use form 8027 to report that information. In addition, employers use form 8027 to determine allocated tips for tipped employees. Web form 8027 instructions have really good guidance on requesting a lower tip rate. Go to www.irs.gov/form8027 for instructions and the latest information. Number and street (don’t enter a p.o.

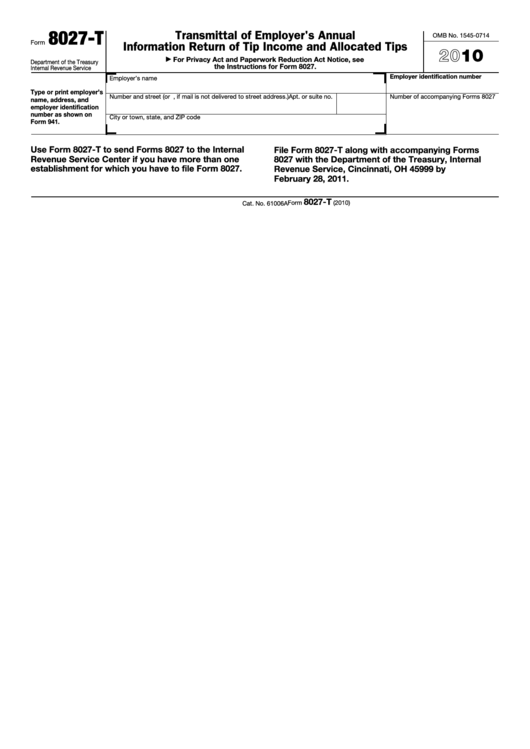

Fillable Form 8027T Transmittal Of Employer'S Annual Information

At the top of form 8027, you enter information about your business, including: Enter any service charges of less than 10% that you paid to your employees. These instructions give you some background information about form 8027. City or town, state, and zip code. Web here’s an overview of the process.

Instructions For Form 8027 printable pdf download

Web here’s an overview of the process. City or town, state, and zip code. At the top of form 8027, you enter information about your business, including: These instructions give you some background information about form 8027. Web see the separate instructions.

Form 8027 Employer's Annual Information Return of Tip and

Now, if you operate an establishment whose employees consistently receive less than 8% of sales, a lower rate may be requested by submitting a petition to the irs. Web see the separate instructions. Tipping of food or beverage employees by customers is customary. Go to www.irs.gov/form8027 for instructions and the latest information. City or town, state, and zip code.

IRS Form 8027 Work it Right the First Time

The business name, address, and employer identification number. Go to www.irs.gov/form8027 for instructions and the latest information. Web here’s an overview of the process. City or town, state, and zip code. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and instructions on how to file.

Instructions For Form 8027 printable pdf download

Employers use form 8027 to annually report to the irs receipts and tips from their large food or beverage establishments and to determine allocated tips for tipped employees. Lines 1 and 2 : However, you cannot request a rate less than 2%two percent. The business name, address, and employer identification number. Web see the separate instructions.

Form 8027T Transmittal of Employer's Annual Information Return (2015

City or town, state, and zip code. Go to www.irs.gov/form8027 for instructions and the latest information. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Now, if you operate an establishment whose employees consistently receive less than 8% of.

How To Fill Out Verification Of Employment/Loss Of Form Florida

Tipping of food or beverage employees by customers is customary. Web see the separate instructions. In the main section of the form, you must report the total tips your business brought in. Now, if you operate an establishment whose employees consistently receive less than 8% of sales, a lower rate may be requested by submitting a petition to the irs..

Instructions For Form 8027 printable pdf download

Web see the separate instructions. At the top of form 8027, you enter information about your business, including: Web form 8027 instructions have really good guidance on requesting a lower tip rate. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g.,.

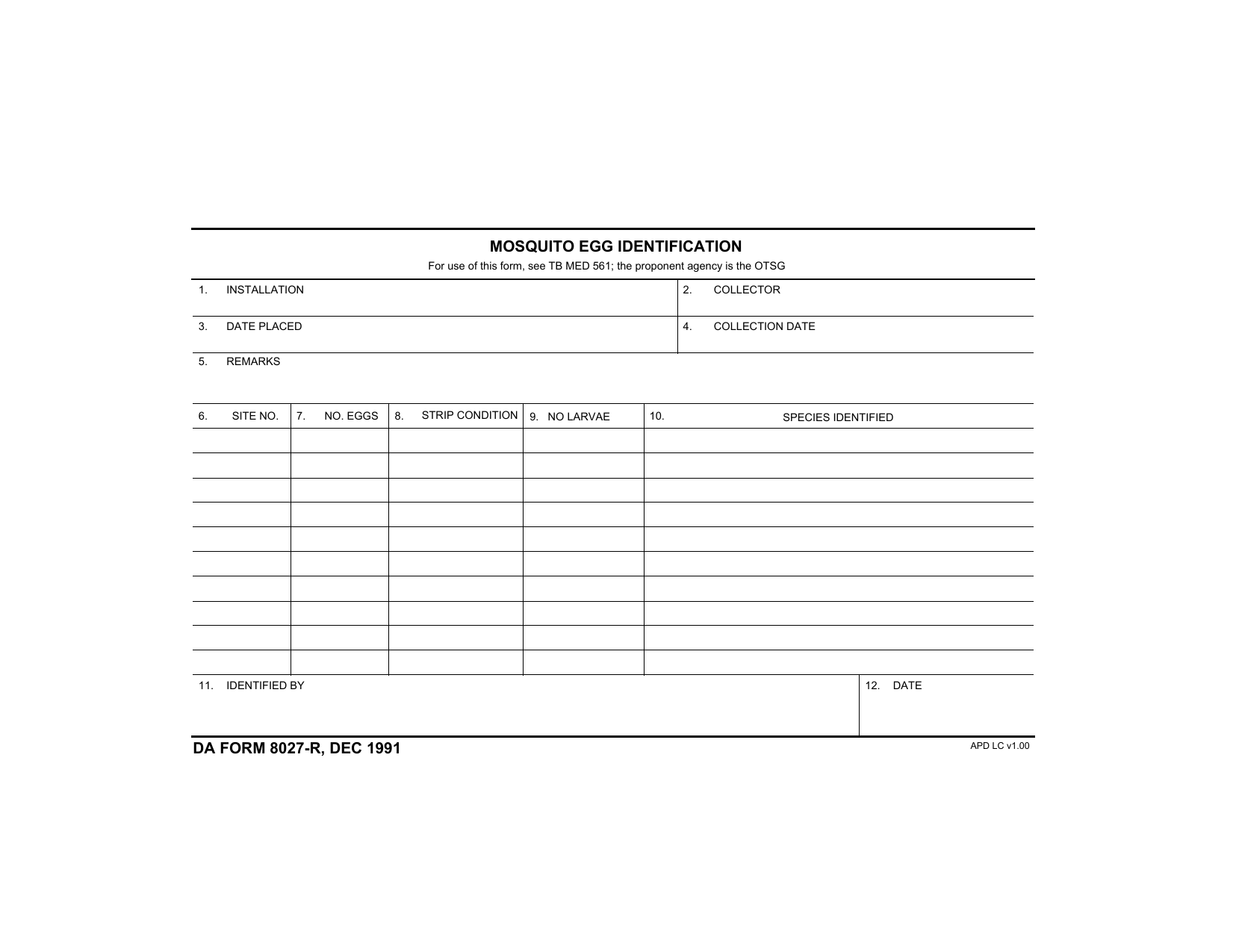

Download DA Form 8027R Mosquito Egg Identification PDF

Lines 1 and 2 : Tipping of food or beverage employees by customers is customary. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals). Web employers use form 8027 to report that information. City or town, state, and zip.

3.11.180 Allocated Tips Internal Revenue Service

However, you cannot request a rate less than 2%two percent. Web see the separate instructions. Web form 8027 instructions have really good guidance on requesting a lower tip rate. Go to www.irs.gov/form8027 for instructions and the latest information. They tell you who must file form 8027, when and where to file it, and how to fill it out line by.

These Are For Use If Your Establishment Accepts Credit Cards, Debit Cards, Or Other Types Of Charges.

Tipping of food or beverage employees by customers is customary. However, you cannot request a rate less than 2%two percent. City or town, state, and zip code. Number and street (don’t enter a p.o.

Follow The Steps For Your Method Of Choice (Outlined In The Irs Tax Form Instructions ), Check The Box Next To The Method You Used In Line 7 Of Form 8027, And Add Any Details From Your Calculations To The Document If Needed.

Web see the separate instructions. Web here’s an overview of the process. Web information about form 8027, employer's annual information return of tip income and allocated tips, including recent updates, related forms, and instructions on how to file. City or town, state, and zip code.

Web Employers Use Form 8027 To Report That Information.

Enter any service charges of less than 10% that you paid to your employees. They tell you who must file form 8027, when and where to file it, and how to fill it out line by line. Number and street (don’t enter a p.o. When filling out form 8027, you need to provide information about your business, like your ein, whether you accept credit card payments, and what products you serve (e.g., evening meals).

Now, If You Operate An Establishment Whose Employees Consistently Receive Less Than 8% Of Sales, A Lower Rate May Be Requested By Submitting A Petition To The Irs.

The business name, address, and employer identification number. In addition, employers use form 8027 to determine allocated tips for tipped employees. Lines 1 and 2 : Web see the separate instructions.