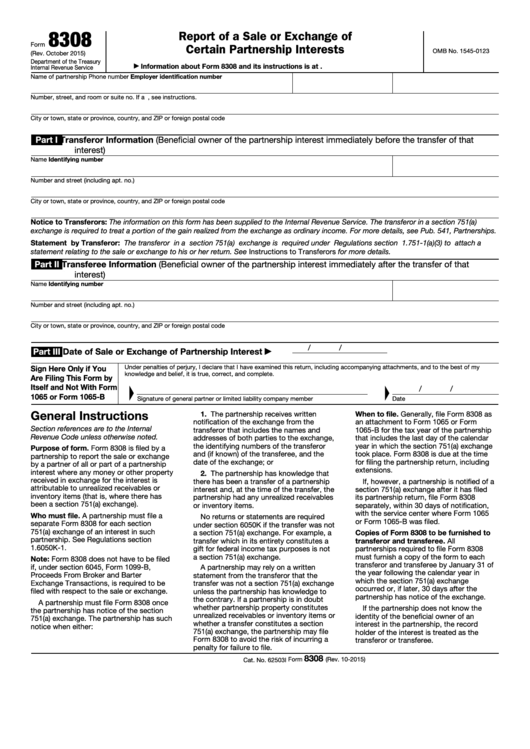

Form 8308 Instructions

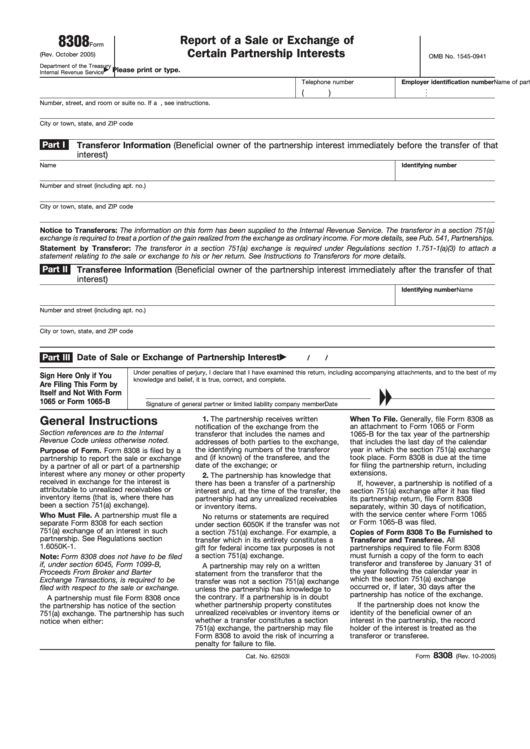

Form 8308 Instructions - Web purpose of form 8308 under the old regulatory scheme prior to the new regulations being finalized, a transferor partner and the partnership had to work together in determining the. Web form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange). Web form 8308 must generally be prepared prior to the time it must be attached to the partnership return and sent to the irs. Form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section. Under transferor information (part i) , enter the applicable partner in partner number of transferor. Except as otherwise provided in this paragraph (a), a partnership shall make a separate return on form 8308 with respect to each section 751 (a) exchange (as defined in paragraph (a) (4) (i) of this section) of an interest in such partnership which occurs after december 31, 1984. Report of a sale or exchange of certain partnership interests 0918 10/04/2018 form 8330: This will allow the timely furnishing of forms 8308 to the transferor and transferee. What is the form used for? Issuer's quarterly information return for mortgage credit certificates (mccs) 1021 10/15/2021 form 8404:

Web information about form 8308, report of a sale or exchange of certain partnership interests, including recent updates, related forms, and instructions on how to file. This will allow the timely furnishing of forms 8308 to the transferor and transferee. Web follow these steps to enter form 8308 in the program: Under transferor information (part i) , enter the applicable partner in partner number of transferor. Web updated 1 month ago. Web we last updated the report of a sale or exchange of certain partnership interests in february 2023, so this is the latest version of form 8308, fully updated for tax year 2022. What is the form used for? Go to screen 51, report of sale of partnership interests (8308). Web form 8308 must generally be prepared prior to the time it must be attached to the partnership return and sent to the irs. Web form 8308, report of a sale or exchange of certain partnership interests is completed only if there was a sale or exchange of partnership interest when any money or other property received in exchange for that interest is attributable to unrealized receivables or inventory items (also known as a section 751 (a) exchange).

Web form 8308, report of a sale or exchange of certain partnership interests is completed only if there was a sale or exchange of partnership interest when any money or other property received in exchange for that interest is attributable to unrealized receivables or inventory items (also known as a section 751 (a) exchange). Web information about form 8308, report of a sale or exchange of certain partnership interests, including recent updates, related forms, and instructions on how to file. Web form 8308 must generally be prepared prior to the time it must be attached to the partnership return and sent to the irs. Report of a sale or exchange of certain partnership interests 0918 10/04/2018 form 8330: Go to screen 51, report of sale of partnership interests (8308). This will allow the timely furnishing of forms 8308 to the transferor and transferee. Web purpose of form 8308 under the old regulatory scheme prior to the new regulations being finalized, a transferor partner and the partnership had to work together in determining the. Under transferor information (part i) , enter the applicable partner in partner number of transferor. Web form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange). Except as otherwise provided in this paragraph (a), a partnership shall make a separate return on form 8308 with respect to each section 751 (a) exchange (as defined in paragraph (a) (4) (i) of this section) of an interest in such partnership which occurs after december 31, 1984.

Mississippi Public Records Act Request Form

Form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section. Go to screen 51, report of sale of.

Form 8308 Report of a Sale or Exchange of Certain Partnership

Web updated 1 month ago. Web form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange)..

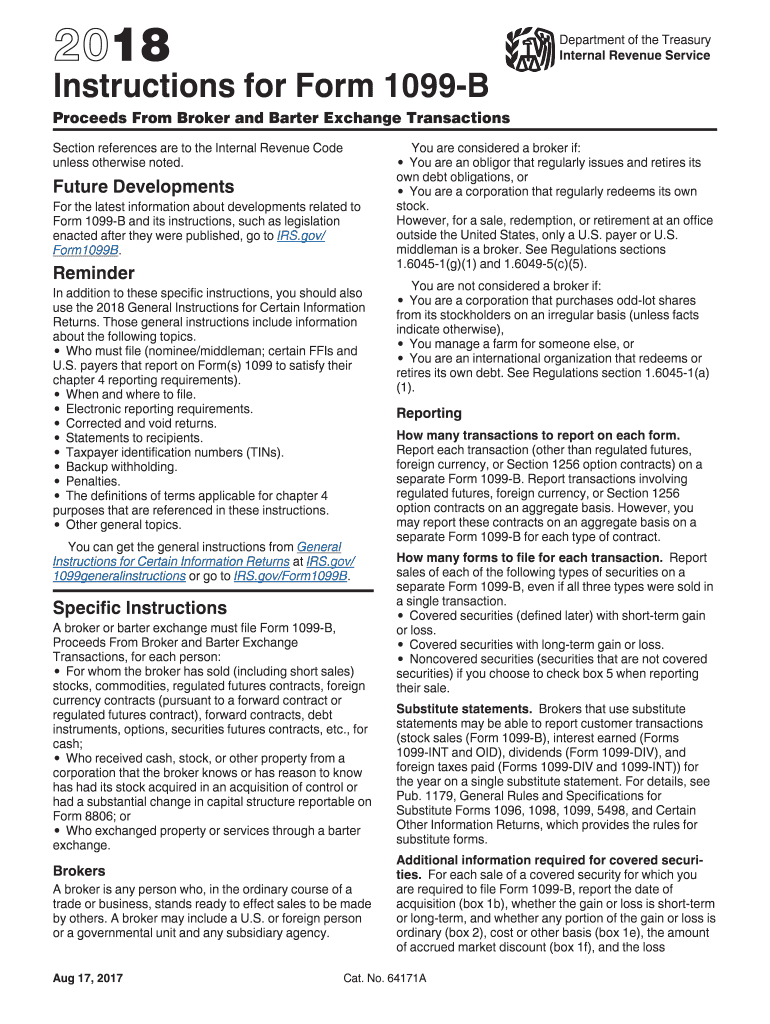

Filing A Past Due 1099B Fill Out and Sign Printable PDF Template

What is the form used for? Web purpose of form 8308 under the old regulatory scheme prior to the new regulations being finalized, a transferor partner and the partnership had to work together in determining the. Under transferor information (part i) , enter the applicable partner in partner number of transferor. Web form 8308 is filed by a partnership to.

Form 12 Filing Instructions Ten Great Lessons You Can Learn From Form

Form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section. Report of a sale or exchange of certain.

IBM 8308 6Slot SAS 3.5" DASD Media Backplane 28A8 8203E4A 8204E8A

Web form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange). Web updated 1 month ago..

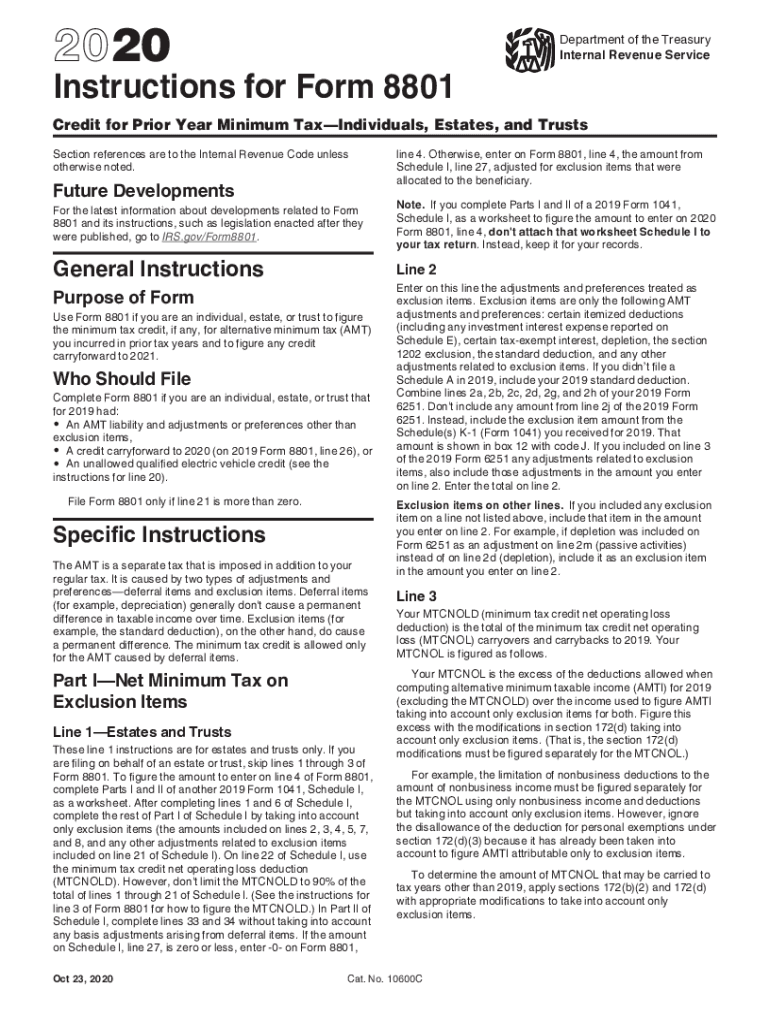

IRS 8801 Instructions 2020 Fill out Tax Template Online US Legal Forms

Web updated 1 month ago. Web form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange)..

Form 8308 Report of a Sale or Exchange of Certain Partnership

Form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section. Web follow these steps to enter form 8308.

Form 8308 Report of a Sale or Exchange of Certain Partnership

Under transferor information (part i) , enter the applicable partner in partner number of transferor. What is the form used for? Report of a sale or exchange of certain partnership interests 0918 10/04/2018 form 8330: Web follow these steps to enter form 8308 in the program: Go to screen 51, report of sale of partnership interests (8308).

Fillable Form 8308 (Rev. October 2015) printable pdf download

Web information about form 8308, report of a sale or exchange of certain partnership interests, including recent updates, related forms, and instructions on how to file. Report of a sale or exchange of certain partnership interests 0918 10/04/2018 form 8330: Except as otherwise provided in this paragraph (a), a partnership shall make a separate return on form 8308 with respect.

Fillable Form 8308 Report Of A Sale Or Exchange Of Certain

Go to screen 51, report of sale of partnership interests (8308). Web we last updated the report of a sale or exchange of certain partnership interests in february 2023, so this is the latest version of form 8308, fully updated for tax year 2022. Except as otherwise provided in this paragraph (a), a partnership shall make a separate return on.

This Will Allow The Timely Furnishing Of Forms 8308 To The Transferor And Transferee.

Report of a sale or exchange of certain partnership interests 0918 10/04/2018 form 8330: Web form 8308, report of a sale or exchange of certain partnership interests is completed only if there was a sale or exchange of partnership interest when any money or other property received in exchange for that interest is attributable to unrealized receivables or inventory items (also known as a section 751 (a) exchange). Web information about form 8308, report of a sale or exchange of certain partnership interests, including recent updates, related forms, and instructions on how to file. Web form 8308 must generally be prepared prior to the time it must be attached to the partnership return and sent to the irs.

Web Follow These Steps To Enter Form 8308 In The Program:

Web purpose of form 8308 under the old regulatory scheme prior to the new regulations being finalized, a transferor partner and the partnership had to work together in determining the. Go to screen 51, report of sale of partnership interests (8308). Issuer's quarterly information return for mortgage credit certificates (mccs) 1021 10/15/2021 form 8404: Except as otherwise provided in this paragraph (a), a partnership shall make a separate return on form 8308 with respect to each section 751 (a) exchange (as defined in paragraph (a) (4) (i) of this section) of an interest in such partnership which occurs after december 31, 1984.

What Is The Form Used For?

Web updated 1 month ago. Form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section. Under transferor information (part i) , enter the applicable partner in partner number of transferor. Web form 8308 is filed by a partnership to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).