Form 8606 Backdoor Roth Turbotax

Form 8606 Backdoor Roth Turbotax - How to enter correct total basis of prior year. The key to doing it right is to recognize. Hi, request quick help please. I am having issues completing form 8606 on turbotax. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. If you made a backdoor roth. Also, if an individual is converting additional traditional ira funds to a roth, this. Web sureshr returning member form 8606: Nondeductible contributions you made to traditional iras; Web form 8606 (2022) page.

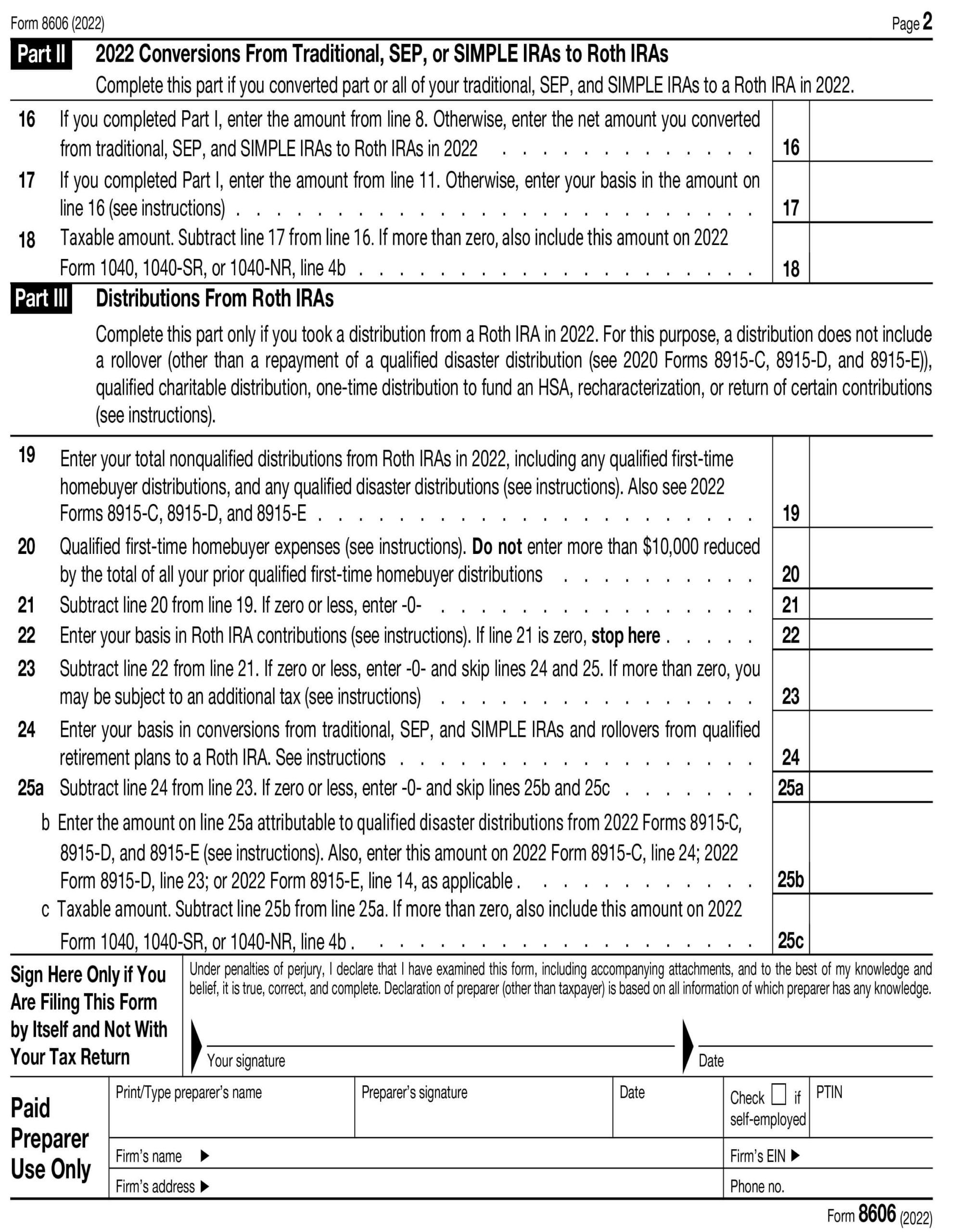

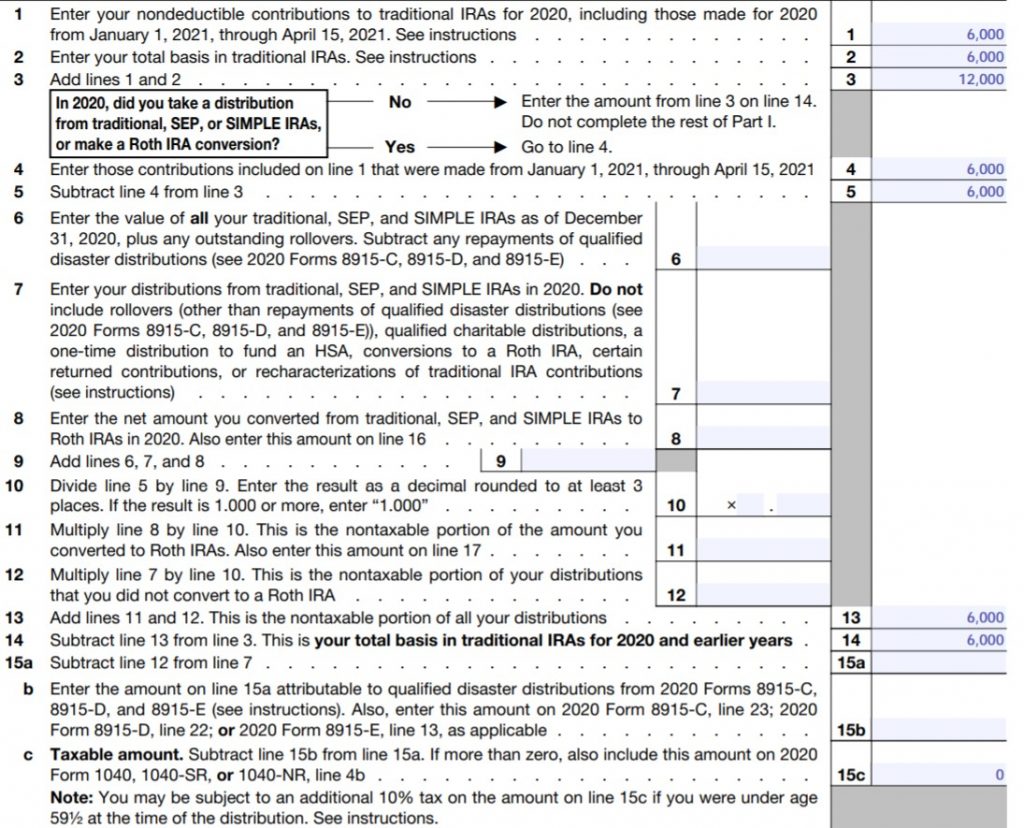

How to enter correct total basis of prior year. If you made a backdoor roth. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. Also, if an individual is converting additional traditional ira funds to a roth, this. The key to doing it right is to recognize. Distributions from traditional, sep, or simple iras, if you have ever made. Hi, request quick help please. Nondeductible contributions you made to traditional iras. Web use form 8606 for calculating the taxable amount from the conversion if you had any earnings in the traditional ira. Web use form 8606 to report:

See is form 8606 tira basis lost after. Web use form 8606 to report: Web this tutorial video walks you through how to report a late backdoor roth ira on turbotax, step by step, with a correct example of form 8606 shown. Web use form 8606 for calculating the taxable amount from the conversion if you had any earnings in the traditional ira. Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web this tutorial video walks you through how to report a backdoor roth ira on turbotax, step by step, with a correct example of form 8606 shown. Nondeductible contributions you made to traditional iras; To file taxes for your backdoor roth ira, fill out and file irs. If you made a backdoor roth. Hi, request quick help please.

Backdoor IRA Gillingham CPA

See is form 8606 tira basis lost after. Hi, request quick help please. Web turbotax, please assist. Also, if an individual is converting additional traditional ira funds to a roth, this. If you made a backdoor roth.

HOW TO FILL OUT FORM 8606 BACKDOOR ROTH IRA YouTube

If you made a backdoor roth. Web how do i pay taxes on my roth backdoor? Distributions from traditional, sep, or simple iras, if you have ever made. Web this tutorial video walks you through how to report a late backdoor roth ira on turbotax, step by step, with a correct example of form 8606 shown. See is form 8606.

How the ProRata Rule Impacts Your Backdoor Roth Contributions

Distributions from traditional, sep, or simple iras, if you have ever made. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. Nondeductible contributions you made to traditional iras; Form 8606 is not filled out correctly for backdoor roths. Web turbotax, please assist.

Make Backdoor Roth Easy On Your Tax Return

Web reporting the taxable contribution to an ira or conversion to roth on form 8606 explains the transactions that occurred to the irs. In some cases, you can transfer. If you made a backdoor roth. Web this tutorial video walks you through how to report a late backdoor roth ira on turbotax, step by step, with a correct example of.

Backdoor Roth IRA, How to Report a Gain in Traditional IRA on the Form

How do you file taxes for a backdoor roth ira? Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. To file taxes for your backdoor roth ira, fill out and file irs. Nondeductible contributions you made to traditional iras. I am having issues completing form 8606 on turbotax.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web reporting the taxable contribution to an ira or conversion to roth on form 8606 explains the transactions that occurred to the irs. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. To file taxes for your backdoor roth ira, fill out and file irs. In some cases,.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

If you made a backdoor roth. Also, if an individual is converting additional traditional ira funds to a roth, this. Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. The key to doing it right is to recognize. Web form 8606 (2022) page.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web this tutorial video walks you through how to report a late backdoor roth ira on turbotax, step by step, with a correct example of form 8606 shown. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. Nondeductible contributions you made to traditional iras. Web use form 8606.

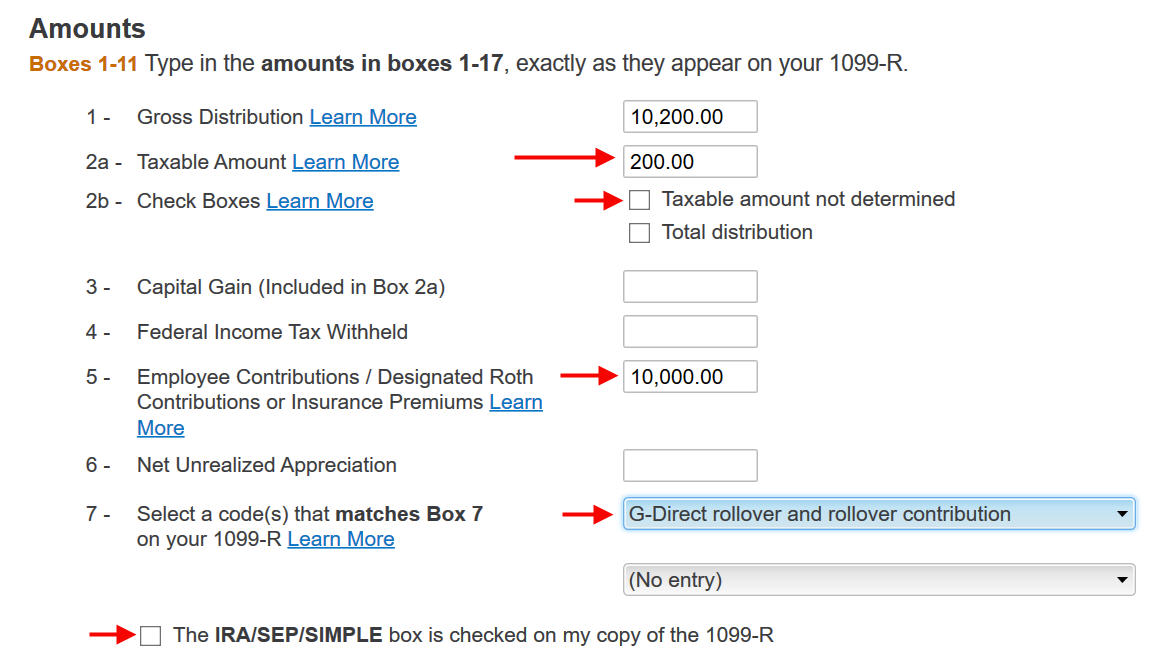

How To Enter 2022 Mega Backdoor Roth in TurboTax (Updated)

The key to doing it right is to recognize. To file taxes for your backdoor roth ira, fill out and file irs. How to enter correct total basis of prior year. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,. Web the.

BACKDOOR ROTH IRA TurboTax Tutorial How to report BACKDOOR ROTH IRA

Hi, request quick help please. How to enter correct total basis of prior year. Web use form 8606 to report: Distributions from traditional, sep, or simple iras, if you have a basis in these iras;. Web this tutorial video walks you through how to report a late backdoor roth ira on turbotax, step by step, with a correct example of.

The Key To Doing It Right Is To Recognize.

Web notice that on form 8606, you're not required to include 401 (k) money in the calculation of taxable income from a conversion. Web sureshr returning member form 8606: Hi, request quick help please. Web form 8606 (2022) page.

Web Use Form 8606 To Report:

See is form 8606 tira basis lost after. Web this tutorial video walks you through how to report a late backdoor roth ira on turbotax, step by step, with a correct example of form 8606 shown. Web reporting the taxable contribution to an ira or conversion to roth on form 8606 explains the transactions that occurred to the irs. 2 part ii 2022 conversions from traditional, sep, or simple iras to roth iras complete this part if you converted part or all of your traditional, sep,.

Nondeductible Contributions You Made To Traditional Iras.

Web turbotax, please assist. In some cases, you can transfer. I am having issues completing form 8606 on turbotax. Distributions from traditional, sep, or simple iras, if you have a basis in these iras;.

Nondeductible Contributions You Made To Traditional Iras;

How to enter correct total basis of prior year. If you made a backdoor roth. Web reporting the backdoor roth ira properly on turbotax is unfortunately even more complicated than filling out form 8606 by hand. Also, if an individual is converting additional traditional ira funds to a roth, this.