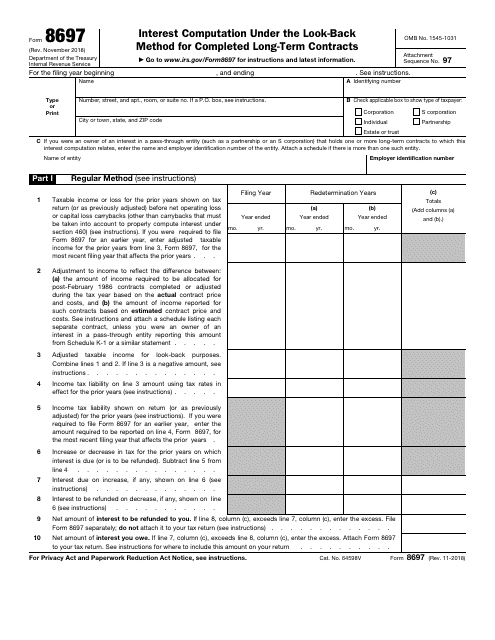

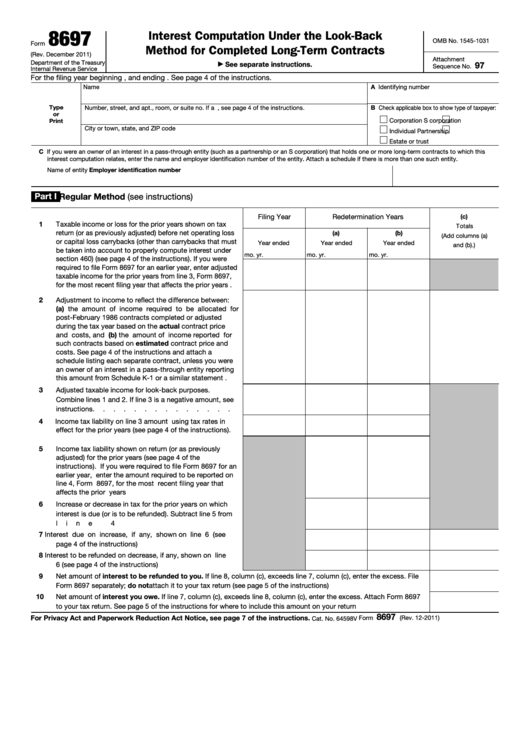

Form 8697 Instructions

Form 8697 Instructions - See page 2 of the instructions. Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: For the filing year beginning , and ending. When completing part i, line 1, of the corrected form 8697, follow the instructions on the form but do not enter For the filing year beginning , and ending. General instructions if the taxpayer reporting income from a contract price and costs instead of Internal revenue service please print or type. For instructions and latest information. November 2018) department of the treasury internal revenue service. November 2002) department of the treasury see separate instructions.

For instructions and latest information. That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s average annual Web developments related to form 8697 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8697. Web you must file a corrected form 8697 only if the amount shown on part i, line 6, or part ii, line 7, for any prior year changes as a result of an error you made, an income tax examination, or the filing of an amended tax return. Internal revenue service please print or type. Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: Name identifying number fill in your number, street, and apt., room, or. General instructions if the taxpayer reporting income from a contract price and costs instead of November 2018) department of the treasury internal revenue service. For the filing year beginning , and ending.

For instructions and latest information. Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: For the filing year beginning , and ending. Web you must file a corrected form 8697 only if the amount shown on part i, line 6, or part ii, line 7, for any prior year changes as a result of an error you made, an income tax examination, or the filing of an amended tax return. When completing part i, line 1, of the corrected form 8697, follow the instructions on the form but do not enter Name identifying number fill in your number, street, and apt., room, or. See page 2 of the instructions. That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s average annual For the filing year beginning , and ending. See the instructions for part ii, line 2, later.

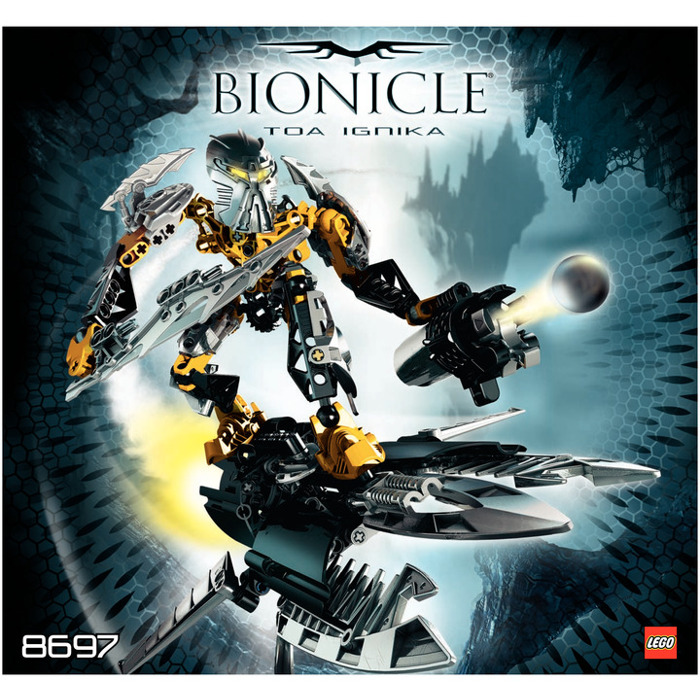

LEGO 8697 Toa Ignika Set Parts Inventory and Instructions LEGO

See the instructions for part ii, line 2, later. November 2002) department of the treasury see separate instructions. See page 2 of the instructions. Internal revenue service please print or type. Web you must file a corrected form 8697 only if the amount shown on part i, line 6, or part ii, line 7, for any prior year changes as.

LEGO instructions Bionicle 8697 Toa Ignika YouTube

See the instructions for part ii, line 2, later. November 2002) department of the treasury see separate instructions. That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s average annual General instructions if the taxpayer reporting income from a contract price and costs instead of When.

IRS Form 8697 Download Fillable PDF or Fill Online Interest Computation

November 2002) department of the treasury see separate instructions. For the filing year beginning , and ending. That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s average annual When completing part i, line 1, of the corrected form 8697, follow the instructions on the form.

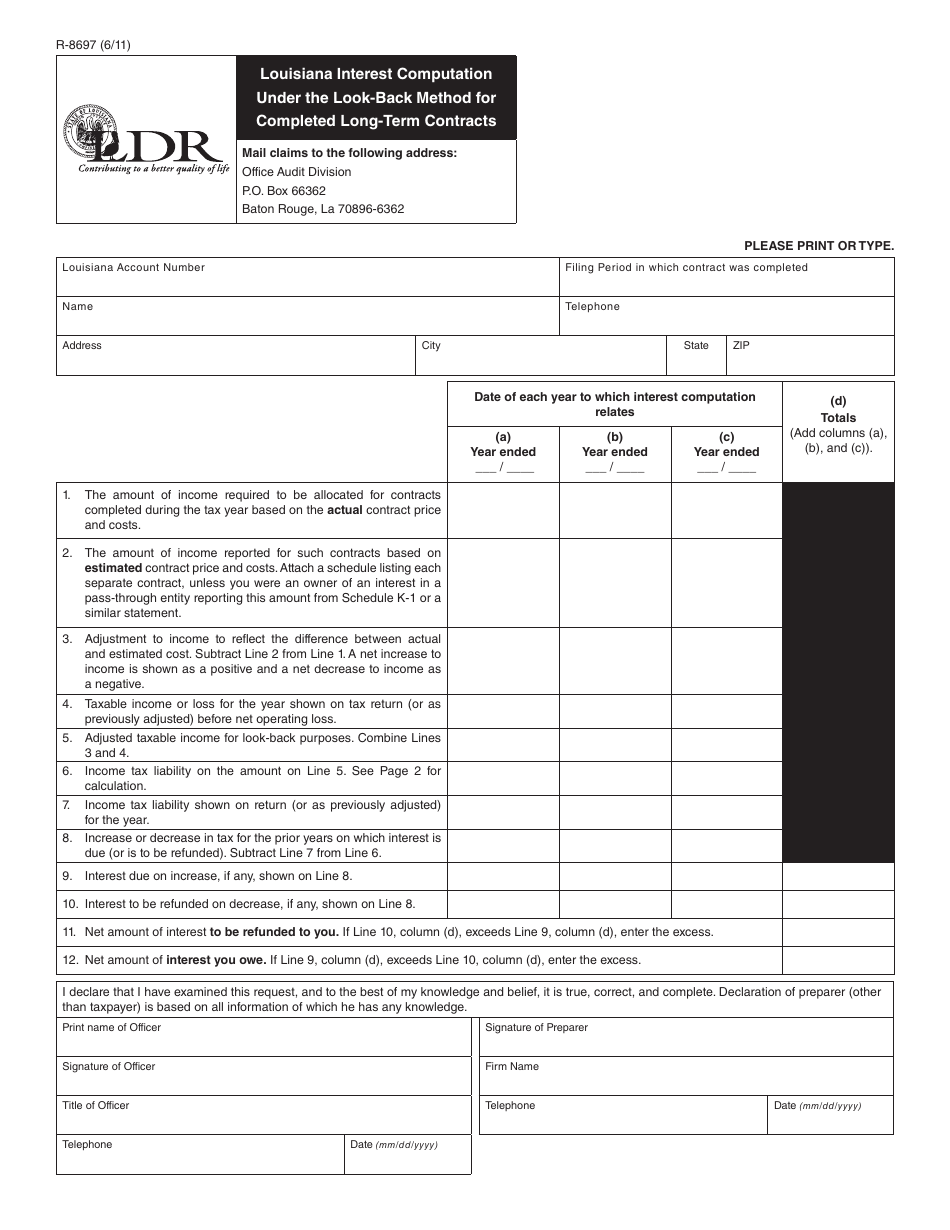

Form R8697 Download Fillable PDF or Fill Online Louisiana Interest

For the filing year beginning , and ending. Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: General instructions if the taxpayer reporting income from a contract price and costs instead of Web developments related to form 8697 and its instructions, such as legislation enacted after they were published,.

LEGO 8697 Toa Ignika Set Parts Inventory and Instructions LEGO

When completing part i, line 1, of the corrected form 8697, follow the instructions on the form but do not enter November 2002) department of the treasury see separate instructions. General instructions if the taxpayer reporting income from a contract price and costs instead of See the instructions for part ii, line 2, later. November 2018) department of the treasury.

Form 8697 Interest Computation under the LookBack Method for

Web you must file a corrected form 8697 only if the amount shown on part i, line 6, or part ii, line 7, for any prior year changes as a result of an error you made, an income tax examination, or the filing of an amended tax return. See page 2 of the instructions. For the filing year beginning ,.

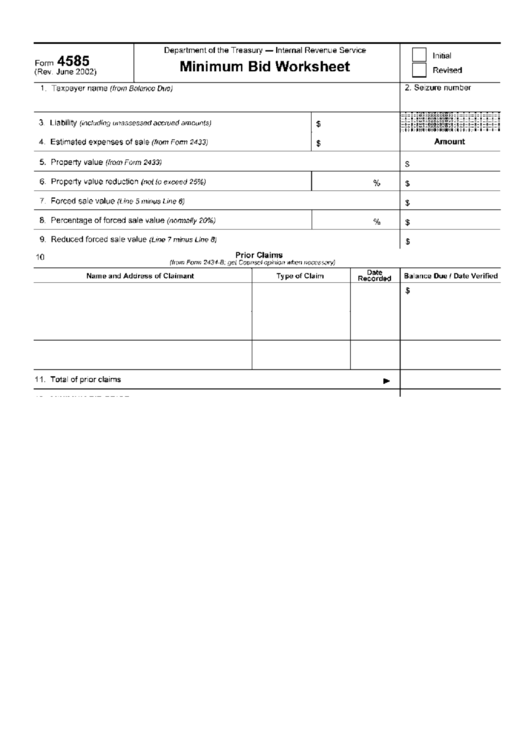

Form 4585 Minimum Bid Worksheet Department Of The Treasury

For the filing year beginning , and ending. See page 2 of the instructions. For the filing year beginning , and ending. Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: See the instructions for part ii, line 2, later.

Fillable Form 8697 Interest Computation Under The LookBack Method

General instructions if the taxpayer reporting income from a contract price and costs instead of Name identifying number fill in your number, street, and apt., room, or. November 2018) department of the treasury internal revenue service. That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s.

LEGO Toa Ignika Set 8697 Instructions Brick Owl LEGO Marketplace

Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s average annual When completing part i, line 1, of the corrected form 8697, follow the instructions.

Fill Free fillable Interest Computation Under the LookBack Method

General instructions if the taxpayer reporting income from a contract price and costs instead of November 2002) department of the treasury see separate instructions. For the filing year beginning , and ending. Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: For the filing year beginning , and ending.

For Instructions And Latest Information.

When completing part i, line 1, of the corrected form 8697, follow the instructions on the form but do not enter Web you must file a corrected form 8697 only if the amount shown on part i, line 6, or part ii, line 7, for any prior year changes as a result of an error you made, an income tax examination, or the filing of an amended tax return. Web developments related to form 8697 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8697. See page 2 of the instructions.

Web Instructions For Form 8697 Internal Revenue Service (Rev.

November 2018) department of the treasury internal revenue service. That ends with or includes the end of • $1 million or due or to be refunded under the • 1% of the taxpayer’s average annual General instructions if the taxpayer reporting income from a contract price and costs instead of For the filing year beginning , and ending.

November 2002) Department Of The Treasury See Separate Instructions.

Web use form 8697 to figure the interest you must file this form for your tax year the smaller of: For the filing year beginning , and ending. Internal revenue service please print or type. See the instructions for part ii, line 2, later.