Form 8814 2022

Form 8814 2022 - Complete, edit or print tax forms instantly. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest. Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form(s) 8814 to your tax return and file your return by the. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web common questions about using form 8615 and form 8814 in lacerte solved • by intuit • 58 • updated march 02, 2023 this article will assist you with. Web instructions for form 8814 (2022) | internal. Learn more about form 8814,. From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Complete line 7b if applicable.

Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web common questions about using form 8615 and form 8814 in lacerte solved • by intuit • 58 • updated march 02, 2023 this article will assist you with. A separate form 8814 must be filed for. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Web to enter information for the parents' return (form 8814): Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form(s) 8814 to your tax return and file your return by the. However, the federal income tax on the child’s income, including qualified dividends and. Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest.

Complete, edit or print tax forms instantly. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's. Complete, edit or print tax forms instantly. Complete line 7b if applicable. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Ad access irs tax forms. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? Try it for free now! Web to make the election, complete and attach form(s) 8814 to your tax return and file your return by the due date (including extensions). Web it means that if your child has unearned income more than $2,200, some of it will be taxed at estate and trust tax rates (for tax years 2018 and 2019) or at the parent’s highest.

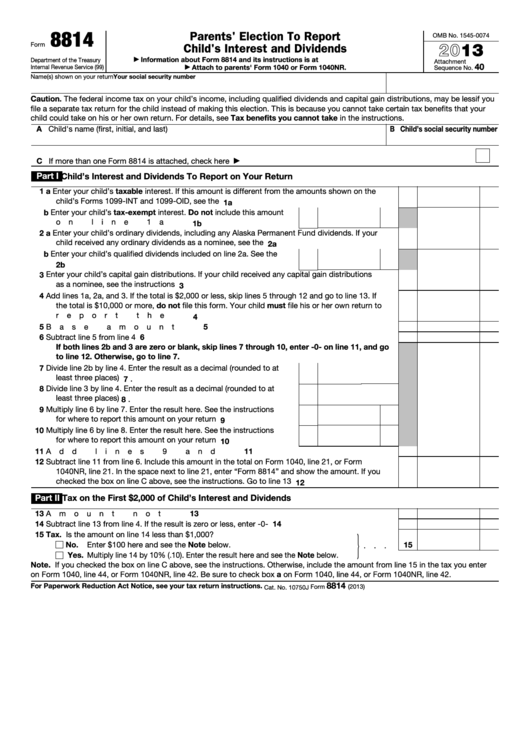

Fill Free fillable Parents’ Election To Report Child’s Interest and

Web instructions for form 8814 (2022) | internal revenue service nov 21, 2022 — to make the election, complete and attach form(s) 8814 to your tax return and file your return by the. Upload, modify or create forms. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible.

8814 form Fill out & sign online DocHub

From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Upload, modify or create forms. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web taxslayer support what is form 8814, parent's election to.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Web to enter information for the parents' return (form 8814): Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. Web instructions for form 8814 (2022) | internal. If you file form 8814 with your income tax return to report your. A separate form 8814 must be filed for.

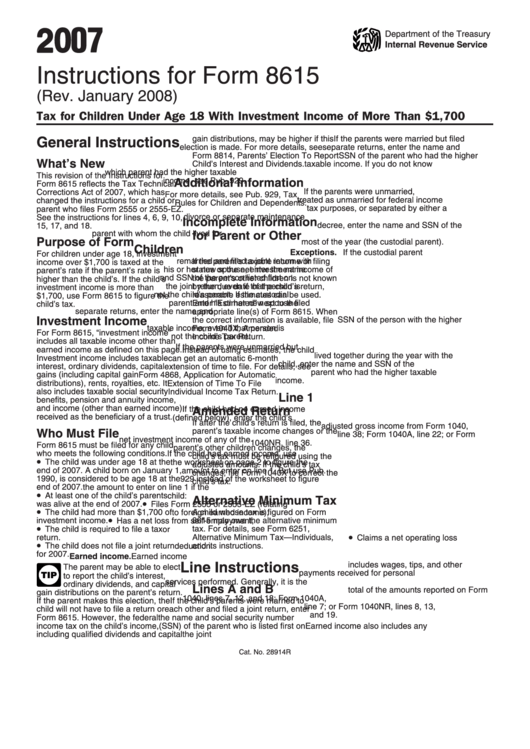

Instructions For Form 8615 Tax For Children Under Age 18 With

Learn more about form 8814,. Try it for free now! Web taxslayer pro desktop tax computation menu desktop: Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Upload, modify or create forms.

INTERESTING STUFF 21 February 2020 TIME GOES BY

From within your taxact return (online or desktop), click federal (on smaller devices, click in the top left corner of your. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web instructions for form 8814 (2022) | internal. However, the federal income tax on the.

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Learn more about form 8814,. Complete line 7b if applicable. Web instructions for form 8814 (2022) | internal. However, the federal income tax on the child’s income, including qualified dividends and. Web taxslayer pro desktop tax computation menu desktop:

IRS 941 2022 Form Printable Blank PDF Online

A separate form 8814 must be filed for. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. This form is for income earned in tax year 2022, with tax returns due in april. Web instructions for form 8814 (2022).

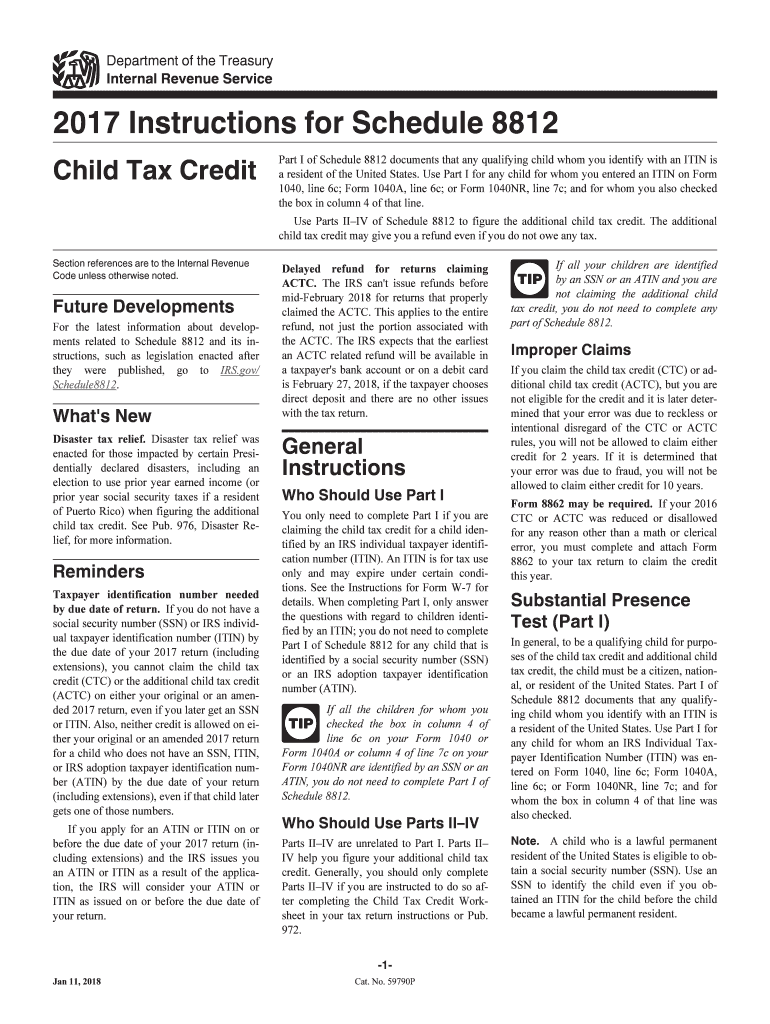

Irs Instructions Form 8812 Fill Out and Sign Printable PDF Template

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web if the parent makes this election, the child won’t have to file a return or form 8615. Web to make the election, complete and attach form(s) 8814 to your tax return and file your return.

Valley Joist Identity + Website Graphiti

Upload, modify or create forms. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? If you file form 8814 with your income tax return to report your. Web august 3, 2022 draft as of form 8814 department of the treasury internal revenue service parents’ election to report child’s interest and dividends go to. This form.

New Tax Forms for 2019 and 2020

Use this form if you elect to report your child's. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Web common questions about using form 8615 and form 8814 in lacerte solved • by intuit • 58 • updated.

For Paperwork Reduction Act Notice, See Your Tax Return.

This form is for income earned in tax year 2022, with tax returns due in april. Web if the parent makes this election, the child won’t have to file a return or form 8615. Web instructions for form 8814 (2022) | internal. Upload, modify or create forms.

Web It Means That If Your Child Has Unearned Income More Than $2,200, Some Of It Will Be Taxed At Estate And Trust Tax Rates (For Tax Years 2018 And 2019) Or At The Parent’s Highest.

Web taxslayer pro desktop tax computation menu desktop: Complete, edit or print tax forms instantly. Web enter “form 8814” on the dotted line next to line 7a or line 8, whichever applies. If you file form 8814 with your income tax return to report your.

Use This Form If You Elect To Report Your Child's.

Try it for free now! A separate form 8814 must be filed for. Ad access irs tax forms. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service.

Web To Make The Election, Complete And Attach Form(S) 8814 To Your Tax Return And File Your Return By The Due Date (Including Extensions).

Complete, edit or print tax forms instantly. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Nov 21, 2022 — purpose of form. Web using form 8814 or form 8615 to report a child's income this article will help determine if your client is eligible to use form 8814 or form 8615 to report a child's.