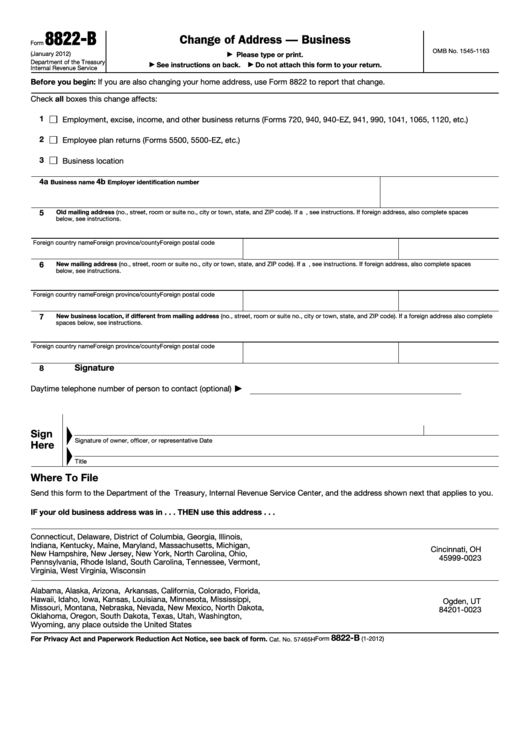

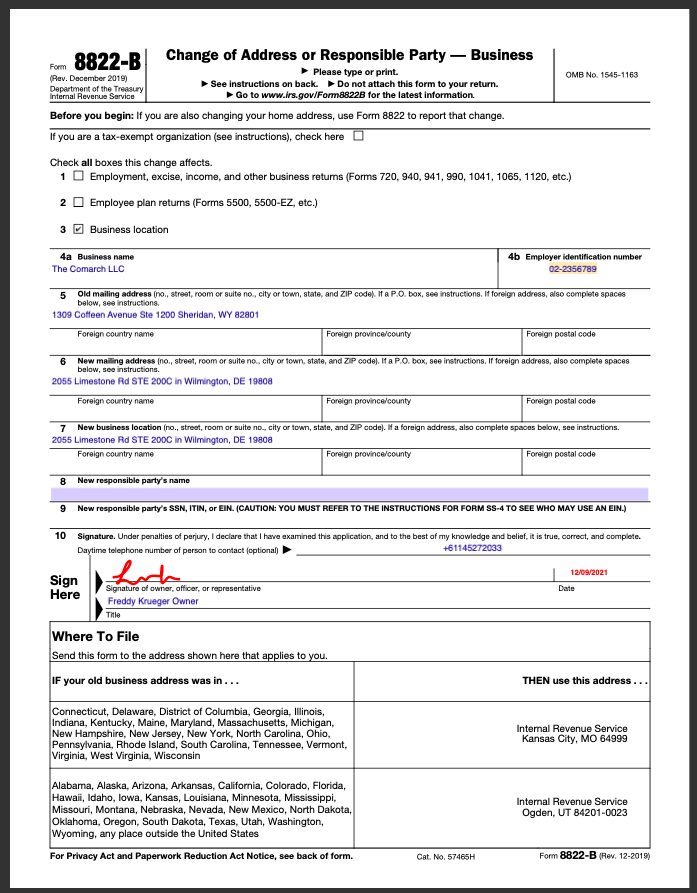

Form 8822-B-Change Of Address

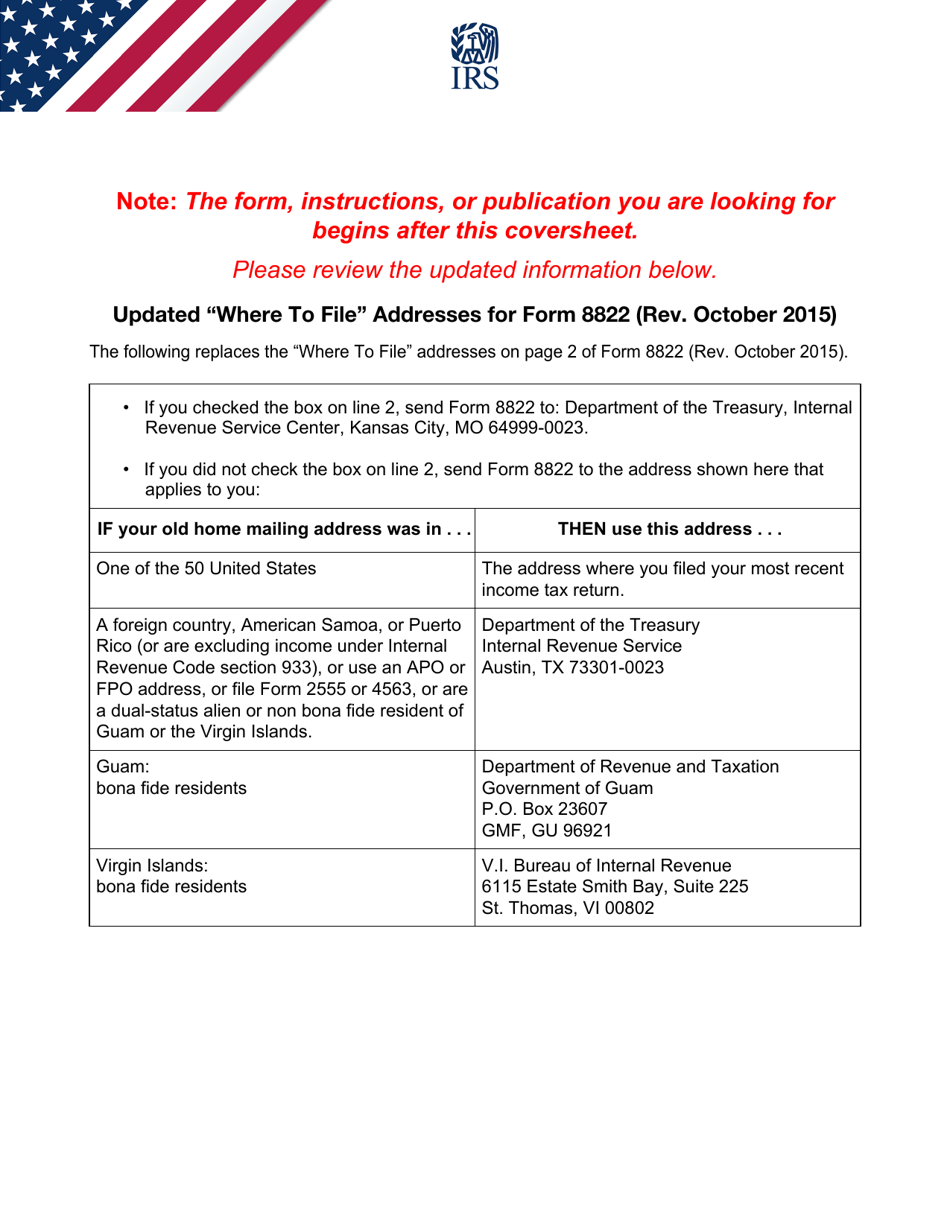

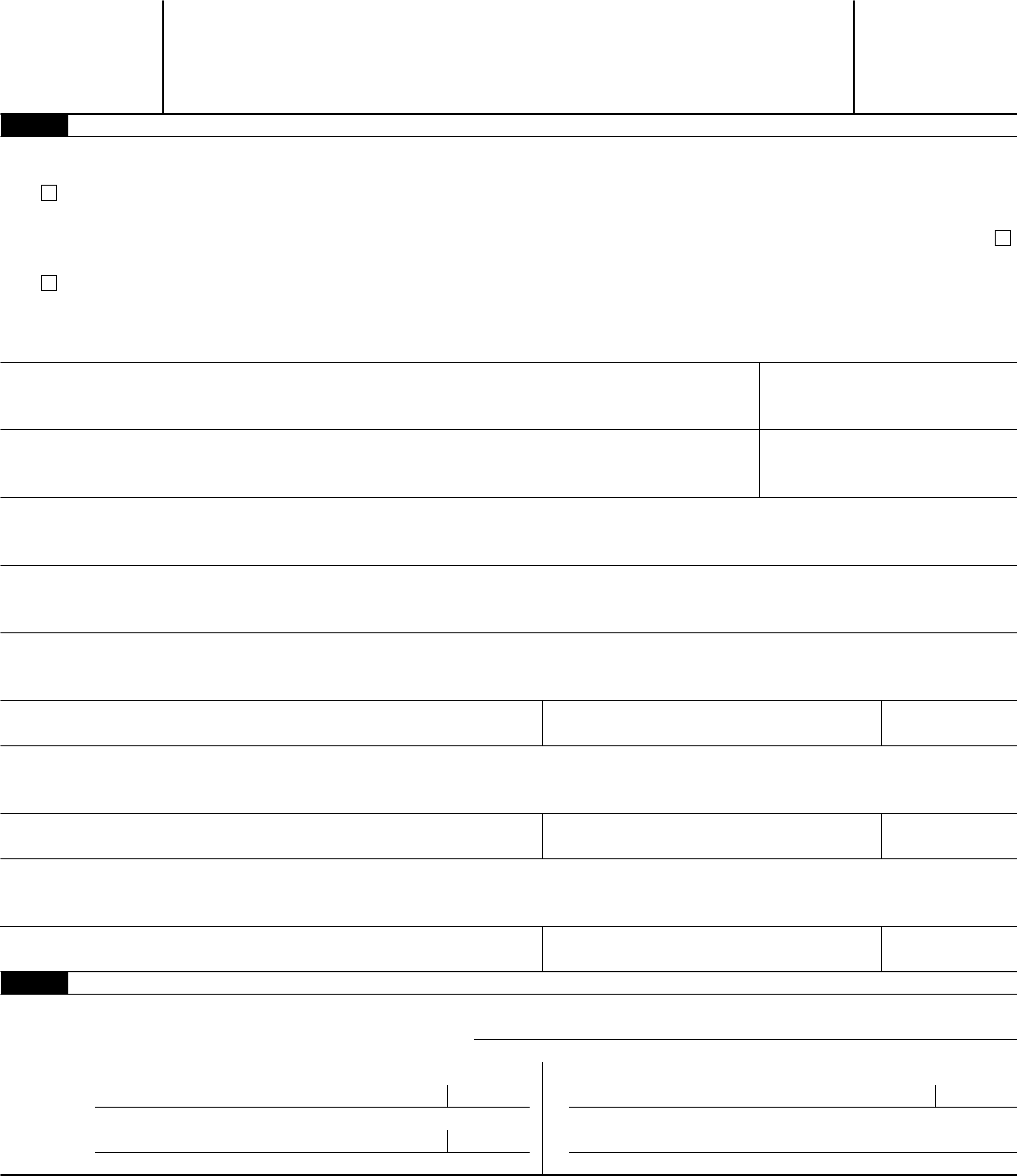

Form 8822-B-Change Of Address - Web separate form 8822 for each child. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process your change of address. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Identity of your responsible party. Changing both home and business addresses? Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Filling out form 8822 form 8822 requires only basic information,. Changes in responsible parties must be reported to the irs within 60 days.

Changing both home and business addresses? Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Generally, it takes 4 to 6 weeks to process a change of address. Web separate form 8822 for each child. Generally, it takes 4 to 6 weeks to process your change of address. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web report error it appears you don't have a pdf plugin for this browser. Changes in responsible parties must be reported to the irs within 60 days. Check all boxes this change affects:

Web report error it appears you don't have a pdf plugin for this browser. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Changing both home and business addresses? Identity of your responsible party. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Generally, it takes 4 to 6 weeks to process your change of address. Check all boxes this change affects: If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process a change of address. Changes in responsible parties must be reported to the irs within 60 days.

Change of Address or Responsible Party Business Free Download

Changing both home and business addresses? Identity of your responsible party. Check all boxes this change affects: Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Filling out form 8822 form 8822 requires only basic information,.

13 8822 Forms And Templates free to download in PDF

If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Generally, it takes 4 to 6 weeks to process a change of address. Identity of your responsible party. Filling out form 8822 form 8822 requires only basic information,. Web report error it appears you don't have a pdf plugin for.

Fill Free fillable Form 8822 Change of Address Part I Complete (IRS

Check all boxes this change affects: Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. If you are managing an estate, trust, gift, or other.

IRS Form 8822 Fill Out, Sign Online and Download Fillable PDF

Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Identity of your responsible party. Changes in responsible parties must be reported to the irs within.

Form 8822 Change of Address (2014) Edit, Fill, Sign Online Handypdf

Changes in responsible parties must be reported to the irs within 60 days. Check all boxes this change affects: Web separate form 8822 for each child. Changing both home and business addresses? Identity of your responsible party.

Fill Free fillable form 8822b change of address or responsible party

Web separate form 8822 for each child. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney. If you are a representative signing for the taxpayer, attach to form.

How to Change Your Address with the IRS 7 Steps (with Pictures)

Check all boxes this change affects: Generally, it takes 4 to 6 weeks to process your change of address. Web separate form 8822 for each child. Identity of your responsible party. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file,.

Irs Business Name Change Form 8822b Armando Friend's Template

Check all boxes this change affects: Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Changing both home and business addresses? Generally, it takes 4 to 6 weeks to process a change of address. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use.

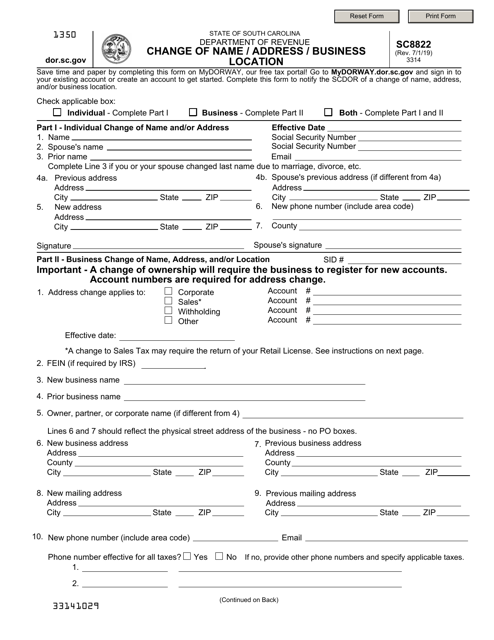

Form SC8822 Download Fillable PDF or Fill Online Change of Name

Check all boxes this change affects: Changing both home and business addresses? Changes in responsible parties must be reported to the irs within 60 days. If you are a representative signing for the taxpayer, attach to form 8822 a copy of your power of attorney. Web form 8822 is used to change your mailing address—the place where you receive your.

How to fill out the 8822b form Firstbase.io

Generally, it takes 4 to 6 weeks to process a change of address. Web form 8822 is used to change your mailing address—the place where you receive your mail—which can be different than the address of your permanent home. Changes in responsible parties must be reported to the irs within 60 days. Check all boxes this change affects: Generally, it.

Web Form 8822 Is Used To Change Your Mailing Address—The Place Where You Receive Your Mail—Which Can Be Different Than The Address Of Your Permanent Home.

Identity of your responsible party. Changes in responsible parties must be reported to the irs within 60 days. Changing both home and business addresses? Web form 8822 is used to report changes to your home address to the irs when you’ve moved.

Web Separate Form 8822 For Each Child.

Web report error it appears you don't have a pdf plugin for this browser. Filling out form 8822 form 8822 requires only basic information,. Generally, it takes 4 to 6 weeks to process a change of address. Check all boxes this change affects:

If You Are A Representative Signing For The Taxpayer, Attach To Form 8822 A Copy Of Your Power Of Attorney.

Generally, it takes 4 to 6 weeks to process your change of address. If you are managing an estate, trust, gift, or other fiduciary tax matter, you can also use form 8822 to update the mailing address the irs has on file, which will need to include a copy of your power of attorney.