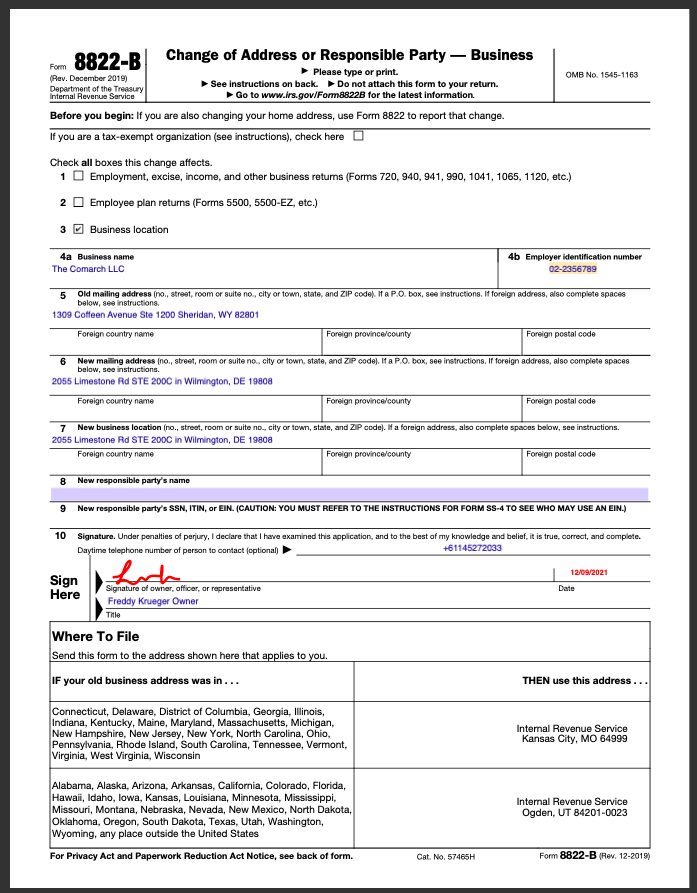

Form 8822 B Mailing Address

Form 8822 B Mailing Address - Identity of your responsible party. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. If you checked the box on line 2, send form 8822 to:. Use form 8822 to notify the internal. Web new mailing address: We use form 8822 to notify the internal revenue service (irs). Web form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs of. From the left of the screen, select miscellaneous forms and choose change of address (8822, 8822. Web if you’re a business owner trying to notify the irs of an address change, or you’ve recently changed the responsible party of an entity, you may need to file irs.

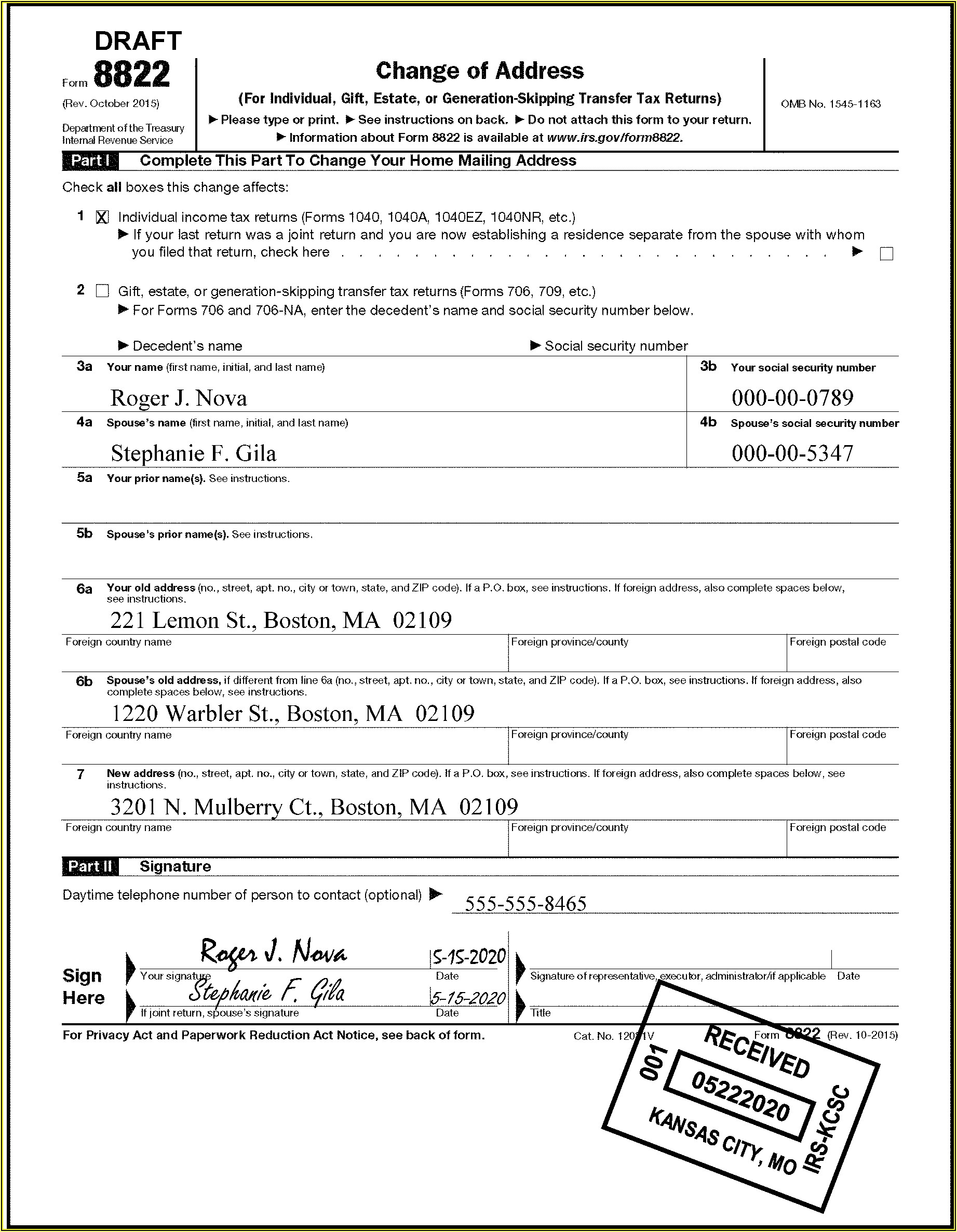

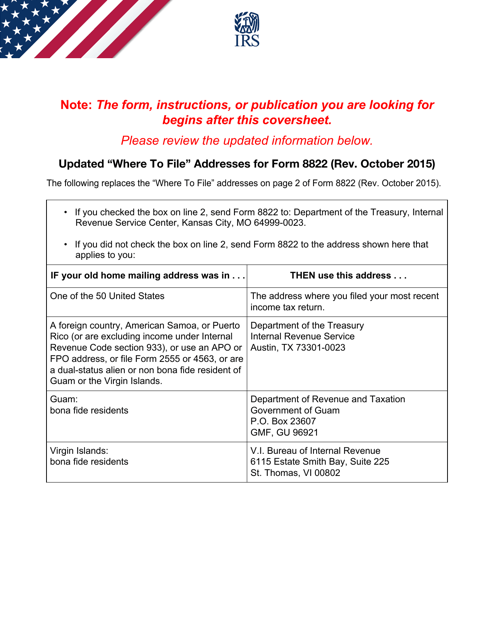

Web form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Identity of your responsible party. Web this form is used to change the address of your mail, the location where you get to receive your mail. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web to enter a change of address on form 8822 in proconnect: Web new mailing address: And this can vary from your permanent home address. If you checked the box on line 2, send form 8822 to:. From the left of the screen, select miscellaneous forms and choose change of address (8822, 8822. Web if you’re a business owner trying to notify the irs of an address change, or you’ve recently changed the responsible party of an entity, you may need to file irs.

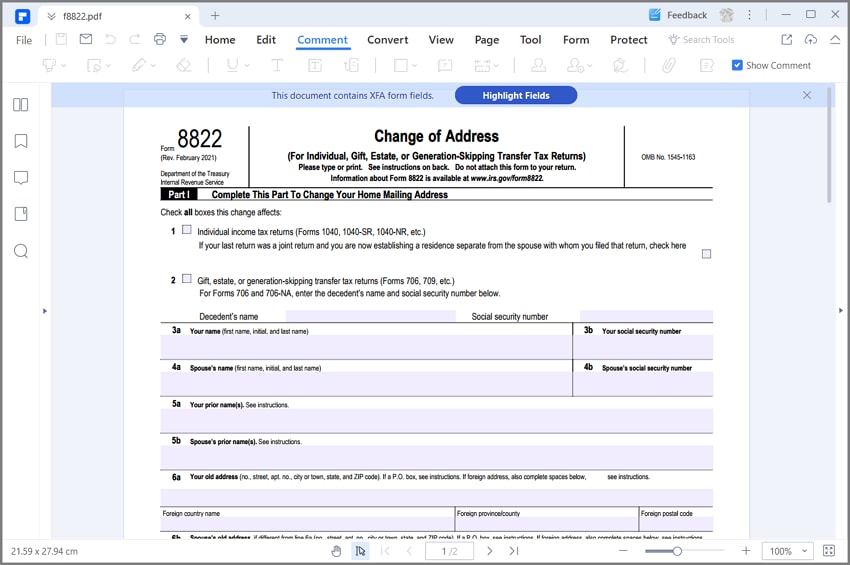

Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web you will use form 8822 to change your mailing address, which might be different from the address of your permanent residence. Web to enter a change of address on form 8822 in proconnect: Web form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. Web new mailing address: Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs of. From the left of the screen, select miscellaneous forms and choose change of address (8822, 8822. Web if you’re a business owner trying to notify the irs of an address change, or you’ve recently changed the responsible party of an entity, you may need to file irs. If you checked the box on line 2, send form 8822 to:.

Form 8822Change of Address

If you are managing an estate, trust, gift, or other fiduciary tax matter, you. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. Web this form is used to change the address of your mail, the location where you get to receive your mail. Web if you’re a business owner trying to notify.

How to Change a Business Address With the IRS eHow

Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web you will use form 8822 to change your mailing address, which might be different from the address of your permanent residence. Web if you’re a business owner trying to notify the irs of an address change, or you’ve recently changed the.

Form 8822 Change of Address (2014) Free Download

Web you will use form 8822 to change your mailing address, which might be different from the address of your permanent residence. And this can vary from your permanent home address. We use form 8822 to notify the internal revenue service (irs). Identity of your responsible party. If you checked the box on line 2, send form 8822 to:.

Fill Free fillable form 8822b change of address or responsible party

If you checked the box on line 2, send form 8822 to:. Web this form is used to change the address of your mail, the location where you get to receive your mail. If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs of. Web if you’re a business.

How to fill out the 8822b form Firstbase.io

Web this form is used to change the address of your mail, the location where you get to receive your mail. Web form 8822 is used by taxpayers to notify the irs of changes in home or business mailing addresses or business location. We use form 8822 to notify the internal revenue service (irs). If the change in the identity.

Receive your tax correspondence without delays by filing IRS Form 8822B

If you checked the box on line 2, send form 8822 to:. Web you will use form 8822 to change your mailing address, which might be different from the address of your permanent residence. Web to enter a change of address on form 8822 in proconnect: Use form 8822 to notify the internal. If you are managing an estate, trust,.

Downloadable Irs Form 8822 Form Resume Examples WjYDkqk9KB

If you checked the box on line 2, send form 8822 to:. Web form 8822 is used to report changes to your home address to the irs when you’ve moved. Web the following replaces the “where to file” addresses on page 2 of form 8822 (rev. If the change in the identity of your responsible party occurred before 2014, and.

IRS Form 8822 The Best Way to Fill it

Web to enter a change of address on form 8822 in proconnect: And this can vary from your permanent home address. We use form 8822 to notify the internal revenue service (irs). Use form 8822 to notify the internal. If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs.

Letter To Suppliers Change Of Address / SupplierChange Management for

If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs of. Identity of your responsible party. Web you will use form 8822 to change your mailing address, which might be different from the address of your permanent residence. Use form 8822 to notify the internal. Web form 8822 is.

IRS Form 8822 Download Fillable PDF or Fill Online Change of Address

If you are managing an estate, trust, gift, or other fiduciary tax matter, you. If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs of. Web to enter a change of address on form 8822 in proconnect: Web the following replaces the “where to file” addresses on page 2.

Web New Mailing Address:

Web this form is used to change the address of your mail, the location where you get to receive your mail. Identity of your responsible party. If you are managing an estate, trust, gift, or other fiduciary tax matter, you. Web form 8822 is used to report changes to your home address to the irs when you’ve moved.

Web You Will Use Form 8822 To Change Your Mailing Address, Which Might Be Different From The Address Of Your Permanent Residence.

From the left of the screen, select miscellaneous forms and choose change of address (8822, 8822. Use form 8822 to notify the internal. If you checked the box on line 2, send form 8822 to:. We use form 8822 to notify the internal revenue service (irs).

Web Form 8822 Is Used By Taxpayers To Notify The Irs Of Changes In Home Or Business Mailing Addresses Or Business Location.

Web to enter a change of address on form 8822 in proconnect: If the change in the identity of your responsible party occurred before 2014, and you have not previously notified the irs of. Web if you’re a business owner trying to notify the irs of an address change, or you’ve recently changed the responsible party of an entity, you may need to file irs. And this can vary from your permanent home address.