Form 8826 Instructions

Form 8826 Instructions - Web i need to fill out form 8826. See the instructions for the tax return with which this form is filed. Go to input return ⮕ credits ⮕ general bus. Web small business tax credit. Web generating form 8826, disabled access credit in lacerte. Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Section references are to the internal revenue code unless otherwise noted. Disqualified corporate interest expense disallowed under section 163(j) and. For the latest information about developments.

Web i need to fill out form 8826. Web complying with the americans with disabilities act may require a financial investment on your part. If you are a shareholder or partner claiming a credit, attach a copy of the shareholder listing or federal schedule k. Learning about the law or the form 24 min. Enter the corporation's taxable income or (loss) before the nol deduction,. Section references are to the internal revenue code unless otherwise noted. Disqualified corporate interest expense disallowed under section 163(j) and. Web generating form 8826, disabled access credit in lacerte. Follow the simple instructions below: Enjoy smart fillable fields and interactivity.

Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. Irs form 8826 has instructions on how to take this credit. Learning about the law or the form 24 min. Web small business tax credit. The prep of legal documents can. June 6, 2019 11:17 am. Web get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Web generating form 8826, disabled access credit in lacerte. Web complying with the americans with disabilities act may require a financial investment on your part.

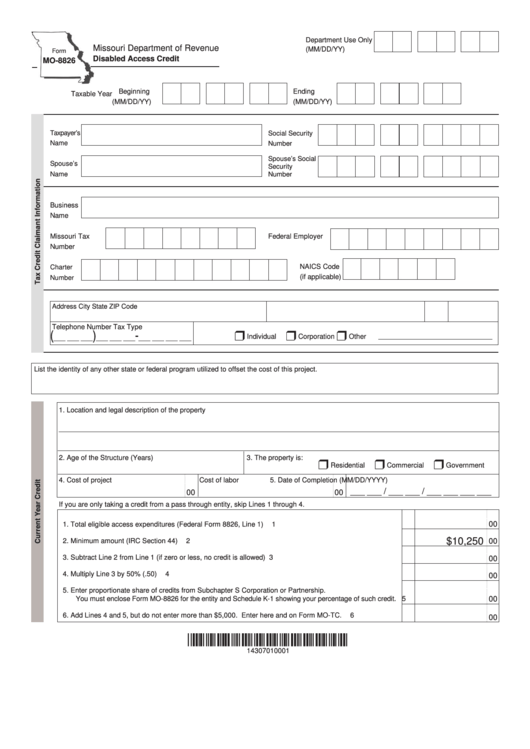

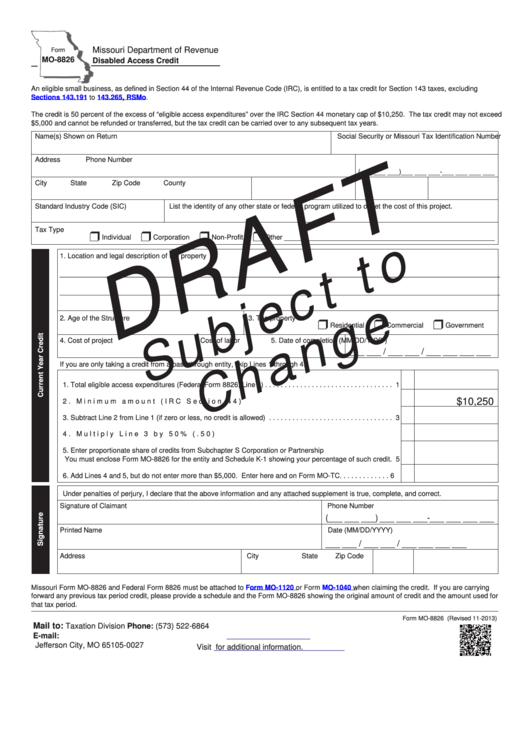

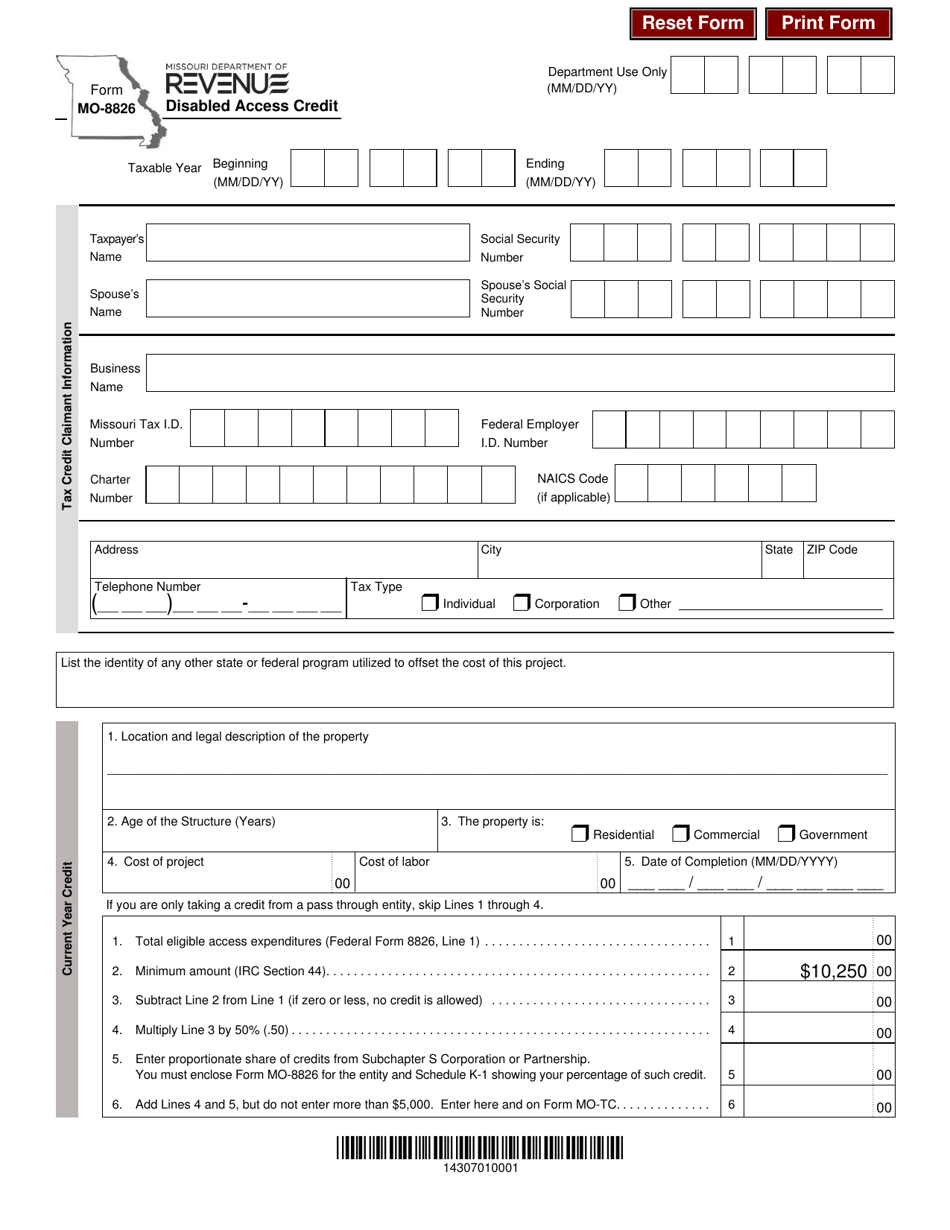

Fillable Form Mo8826 Disabled Access Credit 2016 printable pdf

Recordkeeping 1 hr., 54 min. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Web get your online template and fill it in using progressive features. Web small business tax credit. Web instructions • a corporation income tax or fiduciary return.

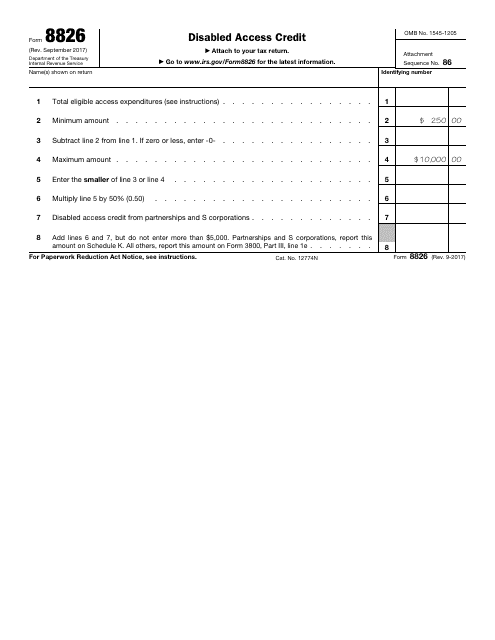

Fill Free fillable F8826 Accessible Form 8826 (Rev. September 2017

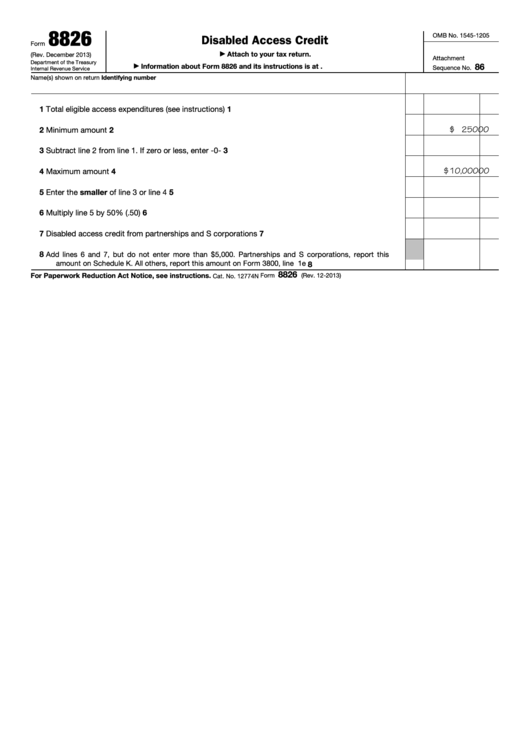

Section references are to the internal revenue code unless otherwise noted. See the instructions for the tax return with which this form is filed. Web the expenses must enable the small business to comply with the americans with disabilities act (ada). September 2017) department of the treasury internal revenue service. Web get your online template and fill it in using.

Form Mo8826 Disabled Access Credit 2013 printable pdf download

Attach to your tax return. Learning about the law or the form 24 min. Irs form 8826 has instructions on how to take this credit. Web instructions for form 8886 available on irs.gov. Recordkeeping 1 hr., 54 min.

Tax Forms Teach Me! Personal Finance

Web instructions • a corporation income tax or fiduciary return. Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. Enter the corporation's taxable income or (loss) before the nol deduction,. However, small business owners may claim a tax credit for this. Web get.

Form 8826 Disabled Access Credit Stock Image Image of financial

Attach to your tax return. Taxable income or (loss) before net operating loss deduction. June 6, 2019 11:17 am. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a. However, small business owners may claim a tax credit for this.

Form 8826 Disabled Access Credit Department Of The Treasury

Select the applicable module below for instructions on entering form 8826, disabled access credit. Web i need to fill out form 8826. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Enter the corporation's taxable income or (loss) before the nol deduction,. For the latest information about developments.

IRS Form 8826 Instructions Claiming the Disabled Access Credit

Web instructions for form 8886 available on irs.gov. Section references are to the internal revenue code unless otherwise noted. Web follow these steps to generate form 8826 in the individual module: For the latest information about developments. Taxable income or (loss) before net operating loss deduction.

IRS Form 8826 Download Fillable PDF or Fill Online Disabled Access

Select the applicable module below for instructions on entering form 8826, disabled access credit. See the instructions for the tax return with which this form is filed. Web generating form 8826, disabled access credit in lacerte. Recordkeeping 1 hr., 54 min. Web instructions for form 8886 available on irs.gov.

Form MO8826 Download Fillable PDF or Fill Online Disabled Access

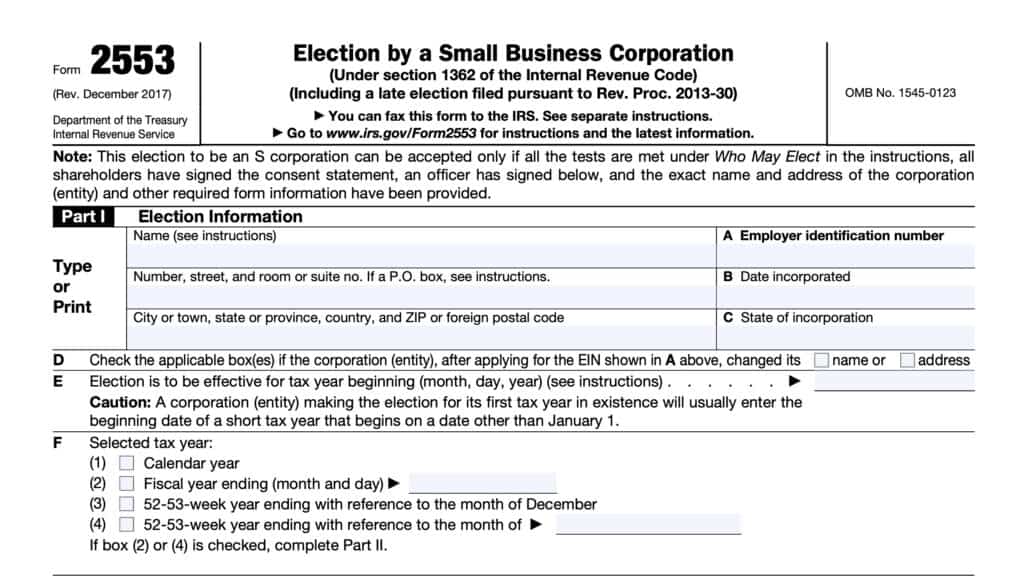

December 2017) department of the treasury internal revenue service. Most expenses to comply with the ada, including barrier. You can download or print current or past. Web i need to fill out form 8826. Web follow these steps to generate form 8826 in the individual module:

Form 8826 Disabled Access Credit Form (2013) Free Download

Web generating form 8826, disabled access credit in lacerte. Follow the simple instructions below: See the instructions for the tax return with which this form is filed. December 2017) department of the treasury internal revenue service. Taxable income or (loss) before net operating loss deduction.

However, Small Business Owners May Claim A Tax Credit For This.

Learning about the law or the form 24 min. Web we last updated the disabled access credit in february 2023, so this is the latest version of form 8826, fully updated for tax year 2022. For the latest information about developments. Recordkeeping 1 hr., 54 min.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Follow the simple instructions below: Taxable income or (loss) before net operating loss deduction. Web i need to fill out form 8826. Web complying with the americans with disabilities act may require a financial investment on your part.

Web Small Business Tax Credit.

September 2017) department of the treasury internal revenue service. Purpose of form use form 8886 to disclose information for each reportable transaction in which you participated. Disqualified corporate interest expense disallowed under section 163(j) and. See the instructions for the tax return with which this form is filed.

June 6, 2019 11:17 Am.

Go to input return ⮕ credits ⮕ general bus. Most expenses to comply with the ada, including barrier. If you are a shareholder or partner claiming a credit, attach a copy of the shareholder listing or federal schedule k. Web a corporation (other than an s corporation) must complete and file form 8926 if it paid or accrued disqualified interest during the current tax year or had a.