Form 8843 Deadline

Form 8843 Deadline - Web who should complete only form 8843? Income in 2017 this was the deadline for your federal and state tax returns if you had income. This guide has been created to assist you in completing the form 8843. How do i complete form 8843? Form 8843 for 2022 must be completed and mailed to the irs by june 15, 2023. Web number should be included on form 8843. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. For the prior calendar year is april 15th of the current year.” this is a general guide to the completion of form 8843, needed for any. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Source income in 2022 you only need complete the irs form.

Web should i file form 8843 if i missed the filing deadline for previous years? Web the deadline for mailing your 8843: How should i prepare form. How do i complete form. Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. How do i complete form 8843? Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. Web form 8843 department of the treasury internal revenue service statement for exempt individuals. You must file form 8843 by june 15, 2023. Web number should be included on form 8843.

For the prior calendar year is april 15th of the current year.” this is a general guide to the completion of form 8843, needed for any. Web april 18, 2023 is the deadline for a tax return if you had us income. How do i complete form. Form 8843 for 2022 must be completed and mailed to the irs by june 15, 2023. You must file form 8843 by june 15, 2022. If you are a nonresident tax filer, and have no u.s. Income in 2017 this was the deadline for your federal and state tax returns if you had income. Web the deadline for the form filed without a tax return is june 15, 2023, although we recommend you complete and send the form before the end of tax season on april 15,. Ad register and subscribe now to work on your irs 8843 & more fillable forms. Web number should be included on form 8843.

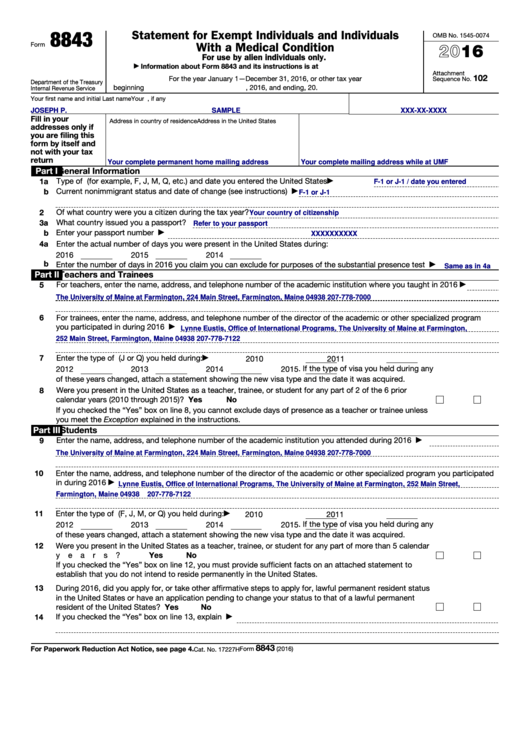

Form 8843 Statement for Exempt Individuals and Individuals with a

Ad register and subscribe now to work on your irs 8843 & more fillable forms. Income in 2017 this was the deadline for your federal and state tax returns if you had income. Web if you are filing the form 8843 by itself because you did not have any u.s. Due date for your tax return if you had u.s..

form 8843 example Fill Online, Printable, Fillable Blank

Source income in 2022 you only need complete the irs form. I am leaving the country before i can file my. How do i complete form. Web should i file form 8843 if i missed the filing deadline for previous years? Taxpayer identification number to file form 8843?

[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone

Web if you are filing the form 8843 by itself because you did not have any u.s. Ad register and subscribe now to work on your irs 8843 & more fillable forms. Web should i file form 8843 if i missed the filing deadline for previous years? Who is required to file form 8843? Income in 2017 this was the.

FAQ for Tax Filing Harvard International Office

How do i complete form 8843? This guide has been created to assist you in completing the form 8843. Web the federal income tax filing due date for individuals for the 2022 tax year is april 18, 2023. You must file form 8843 by june 15, 2022. I am leaving the country before i can file my.

Should those on F1 OPT submit both Form 8843 and Form 1040NR? Quora

Due date for your tax return if you had u.s. Web who should complete only form 8843? For the prior calendar year is april 15th of the current year.” this is a general guide to the completion of form 8843, needed for any. All nonresident aliens for tax purposes who spent any portion of 2022 in f or j status.

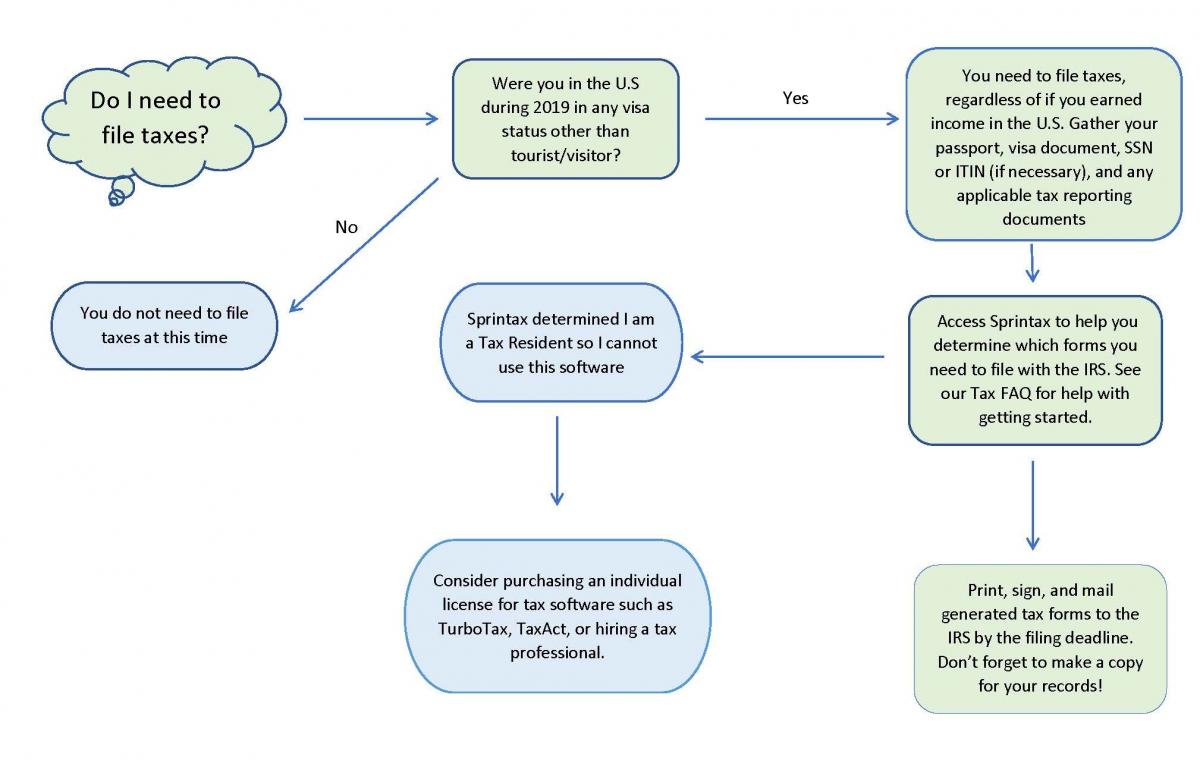

What is Form 8843 and How Do I File it? Sprintax Blog

Who is required to file form 8843? Web who should complete only form 8843? How do i complete form. Complete, edit or print tax forms instantly. Web all must file form 8843.

8843 Form 2021 IRS Forms Zrivo

Complete, edit or print tax forms instantly. How should i prepare form. How do i complete form 8843? Income in 2017 this was the deadline for your federal and state tax returns if you had income. Do i need a u.s.

Form 8843 Edit, Fill, Sign Online Handypdf

All nonresident aliens for tax purposes who spent any portion of 2022 in f or j status are required to complete form 8843 and send it to the. Irs form 8843 is a tax form used be foreign nationals to document the number of days spent outside of the u.s. Due date for your tax return if you had u.s..

Form 8843. What is it? And how do I file it? Official

Web all must file form 8843. Ad register and subscribe now to work on your irs 8843 & more fillable forms. Income in 2017 this was the deadline for your federal and state tax returns if you had income. Web if you are filing the form 8843 by itself because you did not have any u.s. Who is required to.

Fillable Form 8843 Statement For Exempt Individuals And Individuals

Web form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for use by alien individuals only. June 15, 2023 is the deadline if the 8843 is the only form you need to mail to the irs because. Web should i file form 8843 if i missed the filing deadline for.

You Must File Form 8843 By June 15, 2023.

June 15, 2023 is the deadline if the 8843 is the only form you need to mail to the irs because. Sourced income, then the filing deadline is june 15, 2019. This guide has been created to assist you in completing the form 8843. Due date for your tax return if you had u.s.

How Do I Complete Form 8843?

How do i complete form. If you are a nonresident tax filer, and have no u.s. Web when is the filing deadline? For the prior calendar year is april 15th of the current year.” this is a general guide to the completion of form 8843, needed for any.

Source Income In 2022 You Only Need Complete The Irs Form.

Ad register and subscribe now to work on your irs 8843 & more fillable forms. Web who should complete only form 8843? Web number should be included on form 8843. Web the federal income tax filing due date for individuals for the 2022 tax year is april 18, 2023.

How Do I Complete Form 8843?

How should i prepare form. Complete, edit or print tax forms instantly. Web should i file form 8843 if i missed the filing deadline for previous years? Web the deadline for mailing your 8843:

![[2016 버전] 미국 유학생 텍스 리턴 3편 (Form 8843 작성법) Bluemoneyzone](https://img1.daumcdn.net/thumb/R800x0/?scode=mtistory2&fname=https:%2F%2Ft1.daumcdn.net%2Fcfile%2Ftistory%2F2638E83958C218ED0B)