Form 8849 Schedule 6

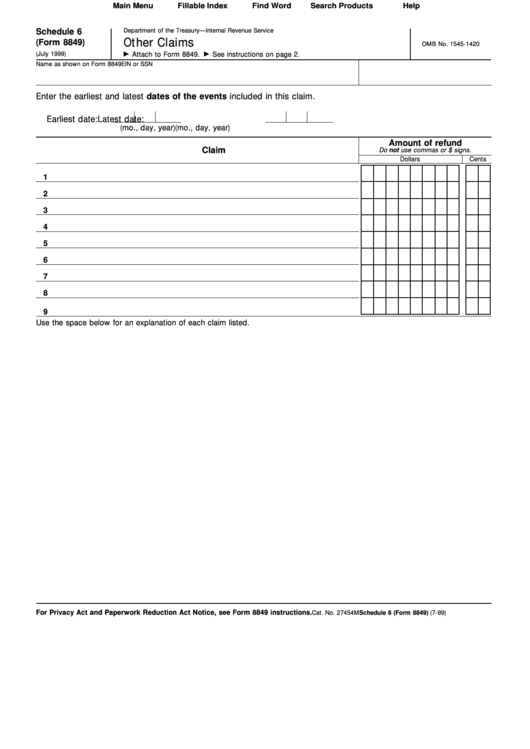

Form 8849 Schedule 6 - Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Mail it to the irs at the address under where to file in the form 8849 instructions. Web what is schedule 6 (form 8849)? Web what are the different schedules of form 8849? Web to make a claim for a vehicle that was sold, destroyed, or stolen, the following information must be attached to schedule 6. Information about schedule 6 (form 8849) and its instructions, is at. August 2013) department of the treasury internal revenue service. For amending sales by registered ultimate vendors. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. For claiming alternative fuel credits.

Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes? See form 2290, crn 365, later. Attach schedule 6 to form 8849. Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. The vehicle identification number (vin). Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Use this form to claim a refund of excise taxes on certain fuel related sales. The taxable gross weight category. Web what is schedule 6 (form 8849)?

Web to make a claim for a vehicle that was sold, destroyed, or stolen, the following information must be attached to schedule 6. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. Schedules 1, 5, and 6 are also available. Use this form to claim a refund of excise taxes on certain fuel related sales. The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen. The taxable gross weight category. Web what is schedule 6 (form 8849)? If you attach additional sheets, write your name and taxpayer identification number on each sheet. Web why is irs offering electronic filing of form 8849, claim for refund of excise taxes?

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

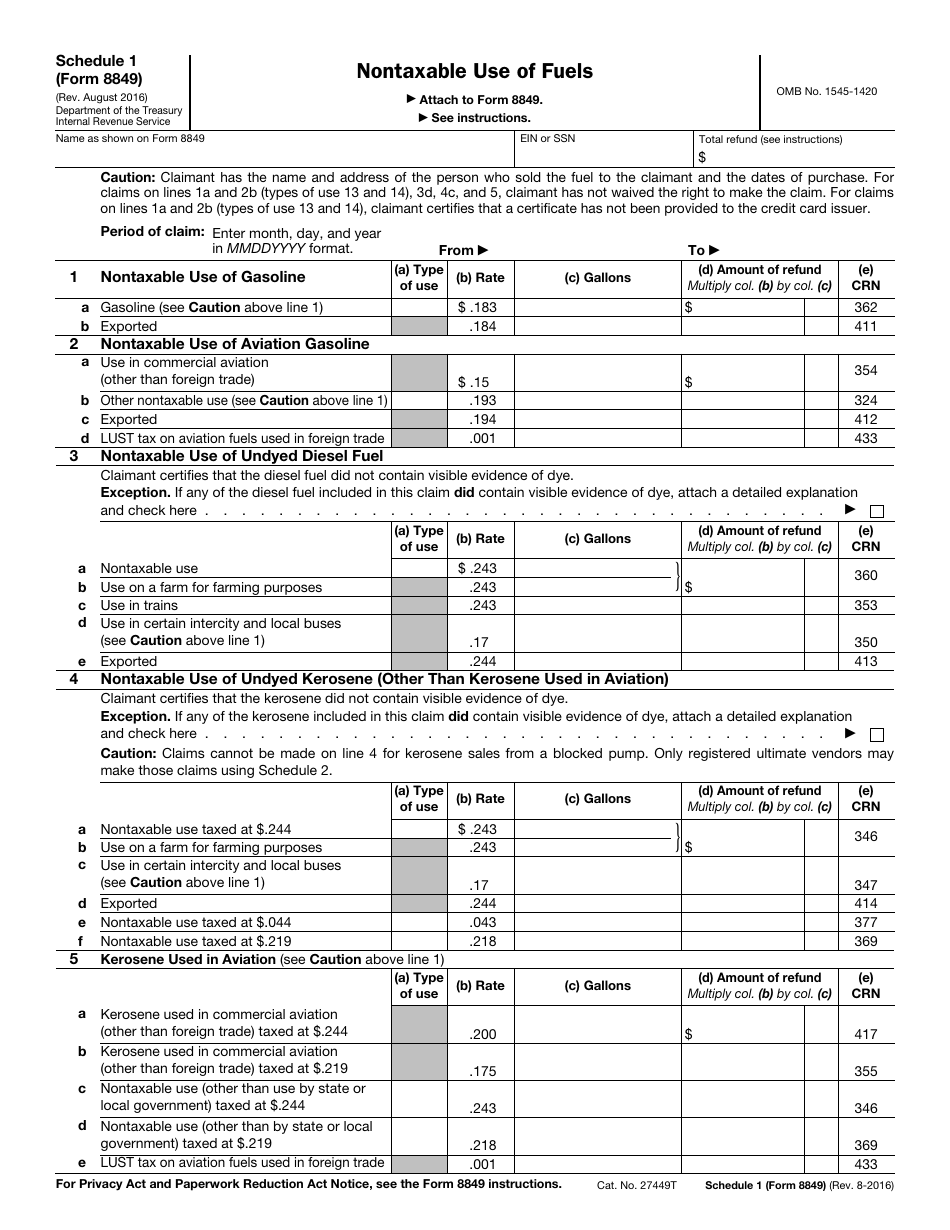

Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. Schedules 1, 5, and 6 are also available. Web schedule 6 (form 8849) (rev. To claim refunds on nontaxable use of fuels. Mail it to the irs at the address under where to file in the form 8849 instructions.

IRS Form 8849 Form 8849 Schedule 6 Claim for Refund

Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Other claims including the credit claim of form 2290. Web schedule 6 (form 8849) (rev. Offering electronic filing of form 8849 satisfies the congressional mandate to provide filers an electronic option for filing form 8849 with schedules 2, 3, or 8. You.

IRS Form 8849 Schedule 1 Download Fillable PDF or Fill Online

Other claims including the credit claim of form 2290. Information about schedule 6 (form 8849) and its instructions, is at. Attach schedule 6 to form 8849. Web what is schedule 6 (form 8849)? Web • for schedules 1 and 6, send form 8849 to:

Fillable Schedule 6 (Form 8849) Other Claims printable pdf download

For amending sales by registered ultimate vendors. What's new for dispositions of vehicles on or after july 1, 2015, treasury decision 9698 changed the information to be submitted for credit or refund claims for vehicles sold. Web form 8849 (schedule 8) registered credit card issuers 1006 07/17/2012 inst 8849 (schedule 6) instructions for schedule 6 (form 8849), other claims 0715.

The IRS Form 8849 Schedule 6 Claim for Refund Fill Online, Printable

What's new for dispositions of vehicles on or after july 1, 2015, treasury decision 9698 changed the information to be submitted for credit or refund claims for vehicles sold. The vehicle identification number (vin). The taxable gross weight category. Web what is schedule 6 (form 8849)? Do not use schedule 6 to make adjustments to liability reported on forms 720.

Fill Free fillable F8849s6 Schedule 6 (Form 8849) (Rev. August 2013

Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Attach schedule 6 to form 8849. The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen. If you attach additional sheets, write your name and taxpayer identification number on each sheet. Use this.

Form 8849 (Schedule 6) Other Claims of Taxes IRS Form (2014) Free

See form 2290, crn 365, later. Use this form to claim a refund of excise taxes on certain fuel related sales. You can also use schedule 6 to claim credit for low mileage vehicles. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. The irs form 8849.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

If you attach additional sheets, write your name and taxpayer identification number on each sheet. Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. For amending sales by registered ultimate vendors. Web form 8849 (schedule 8) registered credit card issuers 1006 07/17/2012 inst 8849 (schedule 6) instructions.

Form 8849 (Schedule 1) Nontaxable Use of Fuels (2012) Free Download

The vehicle identification number (vin). See form 2290, crn 365, later. Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. If you attach additional sheets, write your name and taxpayer identification number.

Form 2848 Example

Web information about form 8849, claim for refund of excise taxes, including recent updates, related forms and instructions on how to file. Mail it to the irs at the address under where to file in the form 8849 instructions. Web schedule 6 (form 8849) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8849. Do not.

Web What Are The Different Schedules Of Form 8849?

Do not use schedule 6 to make adjustments to liability reported on forms 720 filed for prior quarters. You can also use schedule 6 to claim credit for low mileage vehicles. Private delivery services designated by the irs cannot deliver items to p.o. Other claims including the credit claim of form 2290.

August 2013) Department Of The Treasury Internal Revenue Service.

For claiming alternative fuel credits. If you attach additional sheets, write your name and taxpayer identification number on each sheet. Information about schedule 6 (form 8849) and its instructions, is at. Web schedule 6 (form 8849) (rev.

Offering Electronic Filing Of Form 8849 Satisfies The Congressional Mandate To Provide Filers An Electronic Option For Filing Form 8849 With Schedules 2, 3, Or 8.

Use this form to claim a refund of excise taxes on certain fuel related sales. Attach schedule 6 to form 8849. The vehicle identification number (vin). To claim refunds on nontaxable use of fuels.

Web Information About Form 8849, Claim For Refund Of Excise Taxes, Including Recent Updates, Related Forms And Instructions On How To File.

What's new for dispositions of vehicles on or after july 1, 2015, treasury decision 9698 changed the information to be submitted for credit or refund claims for vehicles sold. Mail it to the irs at the address under where to file in the form 8849 instructions. The taxable gross weight category. The irs form 8849 (schedule 6) helps you claim tax refund for vehicles that were sold, destroyed, or stolen.