Form 8855 Instructions

Form 8855 Instructions - Use your indications to submit established track record areas. Web instructions for form 8885 health coverage tax credit department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Name of estate (or the filing trust, if applicable (see instructions)) Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate. Customize your document by using the toolbar on the top. At first, seek the “get form” button and tap it. Web becauseform 8855 is a freestanding form with signature lines under the penalties of perjury and not any type of schedule, it appears that filing of the form separately is the suggested manner of making the 645 election, particularly because the instructions to form 8855 do not mention the need to file it or a copy with the form 1041. The hctc can't be claimed for coverage months beginning in. Wait until form 8855 instructions is appeared.

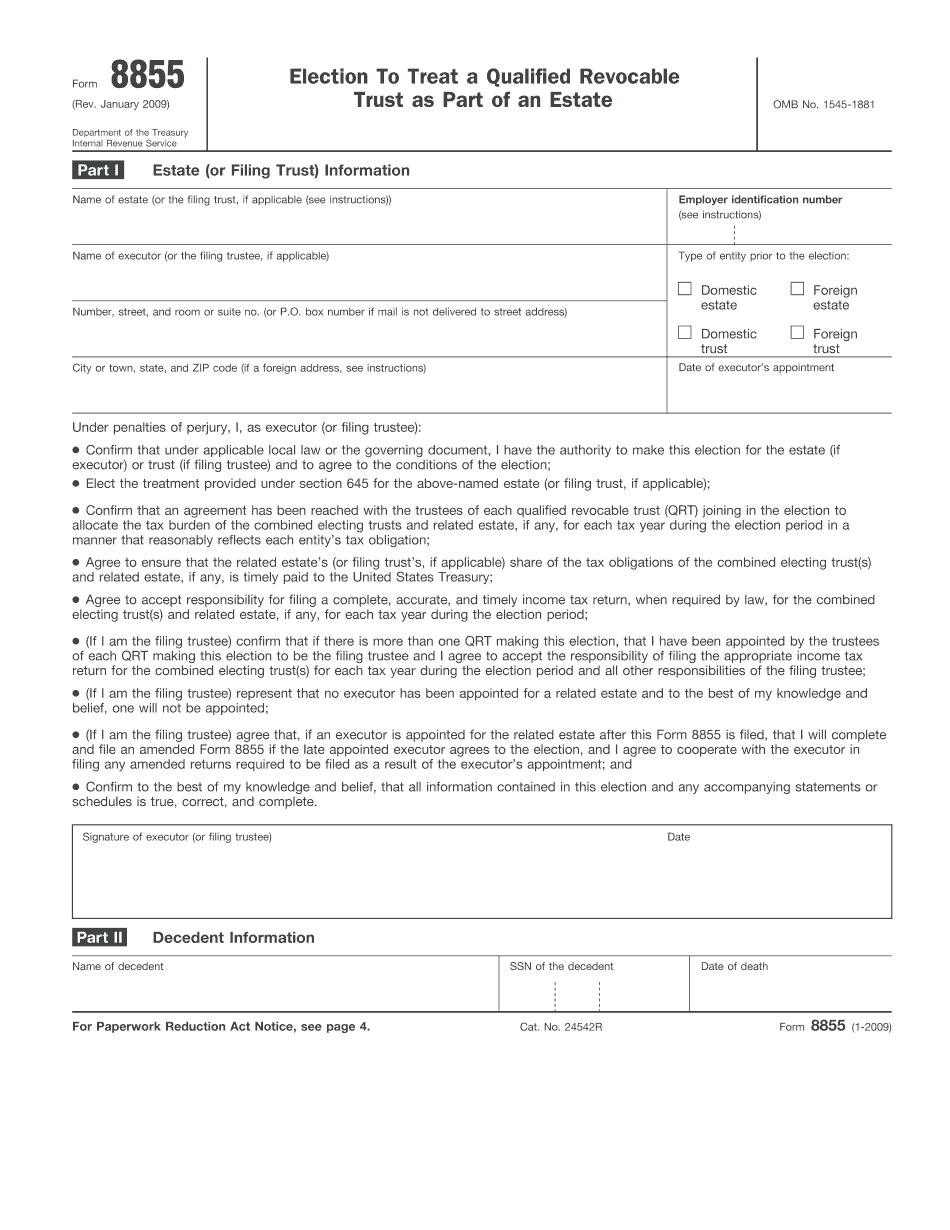

You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). Web how to edit and fill out form 8855 instructions online. Web where to file your taxes (for form 8855) if you are located in. What’s new expiration of the health coverage tax credit (hctc). On the site with all the document, click on begin immediately along with complete for the editor. Add your own info and speak to data. Select the template you require in the collection of legal form samples. Make sure that you enter correct details and numbers throughout suitable areas. Web form 8855 is used to make a section 645 election, which election allows a qualified revocable trust to be treated and taxed (for income tax purposes) as part of its related estate during the election period. Part i estate (or filing trust) information.

Fill out all the requested fields (they are marked in yellow). Web form 8855 is used to make a section 645 election, which election allows a qualified revocable trust to be treated and taxed (for income tax purposes) as part of its related estate during the election period. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Wait until form 8855 instructions is appeared. Customize your document by using the toolbar on the top. Web fill out form 8855 instructions in a few moments by simply following the recommendations listed below: On the site with all the document, click on begin immediately along with complete for the editor. Part i estate (or filing trust) information. Web where to file your taxes (for form 8855) if you are located in. Make sure that you enter correct details and numbers throughout suitable areas.

LEGO Propeller Plane Instructions 8855, Technic

Select the template you require in the collection of legal form samples. Fill out all the requested fields (they are marked in yellow). Click on the get form key to open it and begin editing. Part i estate (or filing trust) information. Web fill out form 8855 instructions in a few moments by simply following the recommendations listed below:

form 8855 instructions 2022 Fill Online, Printable, Fillable Blank

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee,. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Web where to file your taxes (for form 8855) if.

Fillable IRS Form 8855 2017 Online PDF Template

Use your indications to submit established track record areas. Click on the get form key to open it and begin editing. Address to mail form to irs. Web becauseform 8855 is a freestanding form with signature lines under the penalties of perjury and not any type of schedule, it appears that filing of the form separately is the suggested manner.

LEGO 8855 Prop Plane Set Parts Inventory and Instructions LEGO

At first, seek the “get form” button and tap it. Web form 8855 is used to make a section 645 election, which election allows a qualified revocable trust to be treated and taxed (for income tax purposes) as part of its related estate during the election period. December 2020) election to treat a qualified revocable trust as part of an.

Form 8855Election to Treat a Qualified Revocable Trust as Part of an…

Web where to file your taxes (for form 8855) if you are located in. Make sure that you enter correct details and numbers throughout suitable areas. The hctc expires at the end of 2021. Wait until form 8855 instructions is appeared. Name of estate (or the filing trust, if applicable (see instructions))

Fill Free fillable Form 8855 Election To Treat Qualified Revocable

Part i estate (or filing trust) information. December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855 for the latest information. Add your own info and speak to data. Make sure that you enter correct details and numbers throughout suitable areas. Web how to edit and.

LEGO 8855 INSTRUCTIONS PDF

Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). On the site with all the document, click on begin immediately along with complete for the editor. Web how to complete any form 8855 online: Add your own info and speak to data. The hctc can't be claimed.

LEGO 8855 Prop Plane Set Parts Inventory and Instructions LEGO

Customize your document by using the toolbar on the top. Web for specific instructions for form 8865, schedule b, use the instructions for form 1065, lines 1a through 21 (income and deductions). Fill out all the requested fields (they are marked in yellow). Name of estate (or the filing trust, if applicable (see instructions)) At first, seek the “get form”.

LEGO 8855 Prop Plane Set Parts Inventory and Instructions LEGO

Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate. Web how to edit and fill out form 8855 instructions online. Wait until form 8855 instructions is appeared. Web for specific instructions for form 8865, schedule b, use the instructions for form.

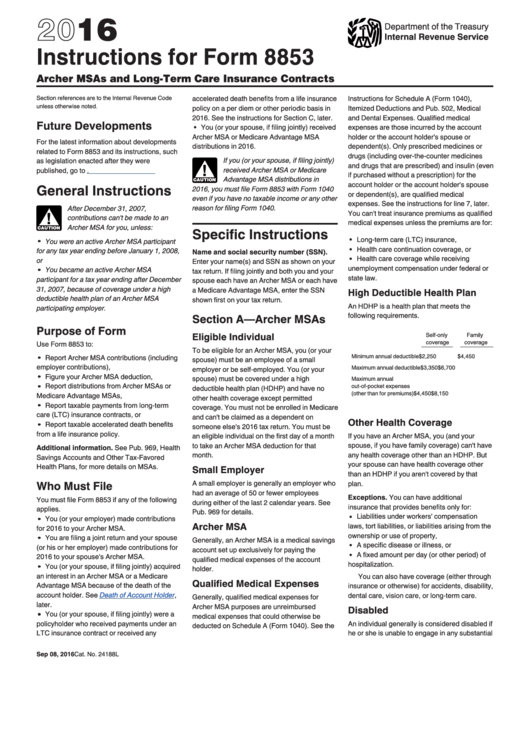

Instructions For Form 8853 2016 printable pdf download

December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855 for the latest information. Download your completed form and share it as you needed. Click on the get form key to open it and begin editing. Add your own info and speak to data. Web fill.

Web Essentially, Form 8855 Is What Makes It Possible To Combine A Trust And An Estate Into One Taxable Entity.

Select the template you require in the collection of legal form samples. Web how to complete any form 8855 online: On the site with all the document, click on begin immediately along with complete for the editor. At first, seek the “get form” button and tap it.

Customize Your Document By Using The Toolbar On The Top.

The hctc expires at the end of 2021. Add your own info and speak to data. Web how to edit and fill out form 8855 instructions online. Wait until form 8855 instructions is appeared.

Address To Mail Form To Irs.

The hctc can't be claimed for coverage months beginning in. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee,. December 2020) election to treat a qualified revocable trust as part of an estate department of the treasury internal revenue service go to www.irs.gov/form8855 for the latest information. Web where to file your taxes (for form 8855) if you are located in.

Web For Specific Instructions For Form 8865, Schedule B, Use The Instructions For Form 1065, Lines 1A Through 21 (Income And Deductions).

Web fill out form 8855 instructions in a few moments by simply following the recommendations listed below: You can view or download the instructions for form 1065 at irs.gov/scheduled(form1065). Use your indications to submit established track record areas. Without the election made, there would be two separate entities that would result in an irrevocable trust after the settler passes away as well as the decedent’s estate.