Form 886 Eic

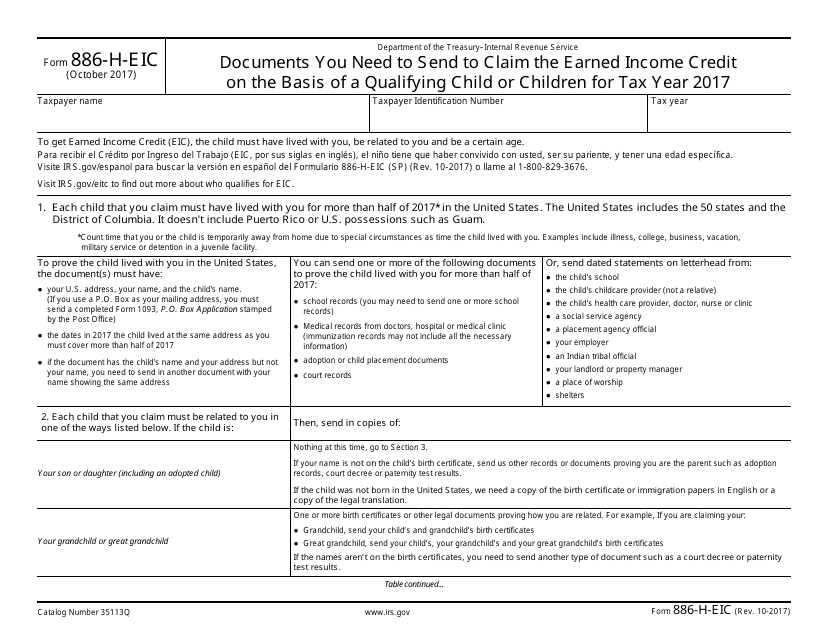

Form 886 Eic - • submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the earned income credit. Web earned income tax credit (eitc) child tax credit (ctc) additional child tax credit (actc) premium tax credit (ptc) american opportunity tax credit (aotc) follow the instructions on the letter or notice we sent you. We’ll ask you to send us copies of your documents to prove that you can claim credits such as: Contacting a low income taxpayer clinic. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. To claim a child as a qualifying child for eitc, you must show the child is. Web it is available for three tax years. The child (or children) must meet the three tests: A litc can help you with your audit. Review the document with your client, showing the client the legal requirements a qualifying child must meet.

Proof of relationship proof of. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. Contacting a low income taxpayer clinic. • submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the earned income credit. To claim a child as a qualifying child for eitc, you must show the child is. Web earned income tax credit (eitc) child tax credit (ctc) additional child tax credit (actc) premium tax credit (ptc) american opportunity tax credit (aotc) follow the instructions on the letter or notice we sent you. Review the document with your client, showing the client the legal requirements a qualifying child must meet. A litc can help you with your audit. Web this tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income tax credit (eitc) with a qualifying child (if you are not sure you are qualified,. Tax yearto get earned income credit (eic), the child must have lived with you,.

Review the document with your client, showing the client the legal requirements a qualifying child must meet. To claim a child as a qualifying child for eitc, you must show the child is. The child (or children) must meet the three tests: Contacting a low income taxpayer clinic. Web it is available for three tax years. Tax yearto get earned income credit (eic), the child must have lived with you,. Proof of relationship proof of. The assistant helps you find out your filing status, determine if your child is a qualifying child and if you are eligible for the eitc, and estimate the amount of the eitc you may claim. A litc can help you with your audit. • submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the earned income credit.

Fill Free fillable Form 886HEIC Documents You Need to Send to (IRS

Tax yearto get earned income credit (eic), the child must have lived with you,. Proof of relationship proof of. Web earned income tax credit (eitc) child tax credit (ctc) additional child tax credit (actc) premium tax credit (ptc) american opportunity tax credit (aotc) follow the instructions on the letter or notice we sent you. To claim a child as a.

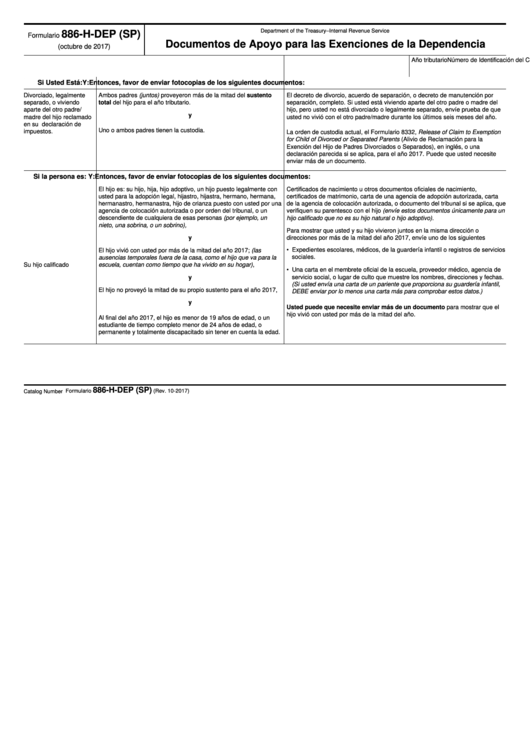

Fillable Form 886HDep (Sp) Supporting Documents For Dependency

Review the document with your client, showing the client the legal requirements a qualifying child must meet. Contacting a low income taxpayer clinic. Web this tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income tax credit (eitc) with a qualifying child (if.

IRS Form 886HEIC Download Fillable PDF or Fill Online Documents You

The assistant helps you find out your filing status, determine if your child is a qualifying child and if you are eligible for the eitc, and estimate the amount of the eitc you may claim. A litc can help you with your audit. Web earned income tax credit (eitc) child tax credit (ctc) additional child tax credit (actc) premium tax.

2018 IRS Form 886HEIC Fill Online, Printable, Fillable, Blank PDFfiller

Web it is available for three tax years. We’ll ask you to send us copies of your documents to prove that you can claim credits such as: Documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. Contacting a low income taxpayer clinic. To claim a.

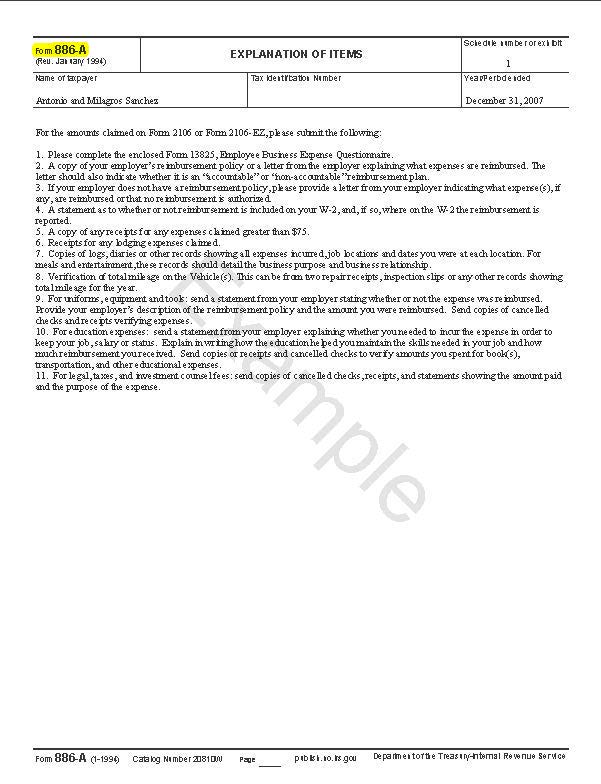

Irs Form 886 A Worksheet Ivuyteq

• submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the earned income credit. The child (or children) must meet the three tests: Tax yearto get earned income credit (eic), the child must have lived with you,. Proof of relationship proof of. Web this tool is to help you identify.

Form 886 A Worksheet Worksheet List

The assistant helps you find out your filing status, determine if your child is a qualifying child and if you are eligible for the eitc, and estimate the amount of the eitc you may claim. A litc can help you with your audit. Review the document with your client, showing the client the legal requirements a qualifying child must meet..

Audit Form 886A Tax Lawyer Answer & Response to IRS

The child (or children) must meet the three tests: Tax yearto get earned income credit (eic), the child must have lived with you,. Web earned income tax credit (eitc) child tax credit (ctc) additional child tax credit (actc) premium tax credit (ptc) american opportunity tax credit (aotc) follow the instructions on the letter or notice we sent you. We’ll ask.

Form 886 A Worksheet Worksheet List

Web this tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income tax credit (eitc) with a qualifying child (if you are not sure you are qualified,. Tax yearto get earned income credit (eic), the child must have lived with you,. Contacting a.

Form EIA886 Download Printable PDF or Fill Online Annual Survey of

Documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. Web it is available for three tax years. Review the document with your client, showing the client the legal requirements a qualifying child must meet. A litc can help you with your audit. To claim a.

Form 886 H Eic ≡ Fill Out Printable PDF Forms Online

• submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the earned income credit. A litc can help you with your audit. Tax yearto get earned income credit (eic), the child must have lived with you,. Contacting a low income taxpayer clinic. Web this tool is to help you identify.

The Assistant Helps You Find Out Your Filing Status, Determine If Your Child Is A Qualifying Child And If You Are Eligible For The Eitc, And Estimate The Amount Of The Eitc You May Claim.

Contacting a low income taxpayer clinic. Tax yearto get earned income credit (eic), the child must have lived with you,. We’ll ask you to send us copies of your documents to prove that you can claim credits such as: A litc can help you with your audit.

Web It Is Available For Three Tax Years.

Web earned income tax credit (eitc) child tax credit (ctc) additional child tax credit (actc) premium tax credit (ptc) american opportunity tax credit (aotc) follow the instructions on the letter or notice we sent you. Proof of relationship proof of. Documents you need to send to claim the earned income credit on the basis of a qualifying child or children for tax year 2022. Web this tool is to help you identify what documents you need to provide to the irs, if you are audited, to prove you can claim the earned income tax credit (eitc) with a qualifying child (if you are not sure you are qualified,.

Review The Document With Your Client, Showing The Client The Legal Requirements A Qualifying Child Must Meet.

The child (or children) must meet the three tests: • submit the documentation requested to show your child met the relationship, age and residency tests to qualify you for the earned income credit. To claim a child as a qualifying child for eitc, you must show the child is.