Form 8868 Due Date

Form 8868 Due Date - Extending the time for filing a return does not extend the time for paying tax. An organization will only be allowed an extension of 6 months for a return for a tax year. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. For the calendar tax year filers, extension form 8868 is due by july 15, 2022. Service in a combat zone Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. | go to www.irs.gov/form8868 for the latest information. The extension doesn’t extend the time to pay any tax due. Web form 8870, information return for transfers associated with certain personal benefit contracts pdf; Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period.

Extending the time for filing a return does not extend the time for paying tax. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. For the calendar tax year filers, extension form 8868 is due by july 15, 2022. The extension doesn’t extend the time to pay any tax due. An organization will only be allowed an extension of 6 months for a return for a tax year. Service in a combat zone Web form 8870, information return for transfers associated with certain personal benefit contracts pdf; Do not file for an extension of time by attaching form 8868 to the exempt

An organization will only be allowed an extension of 6 months for a return for a tax year. Service in a combat zone The extension doesn’t extend the time to pay any tax due. | go to www.irs.gov/form8868 for the latest information. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile. However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. For the calendar tax year filers, extension form 8868 is due by july 15, 2022. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period.

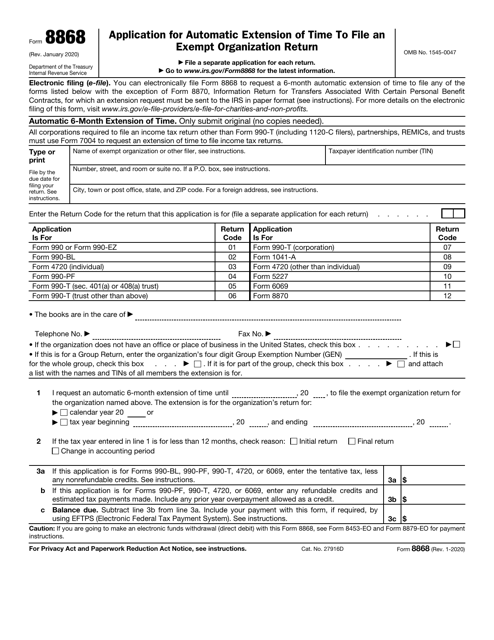

Form 8868 Fillable and Editable PDF Template

The extension doesn’t extend the time to pay any tax due. However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. Do not file for an extension of time by attaching form 8868 to the exempt An organization will only be allowed an.

IRS Form 8868 Download Fillable PDF or Fill Online Application for

Do not file for an extension of time by attaching form 8868 to the exempt | go to www.irs.gov/form8868 for the latest information. Service in a combat zone The extension doesn’t extend the time to pay any tax due. For the calendar tax year filers, extension form 8868 is due by july 15, 2022.

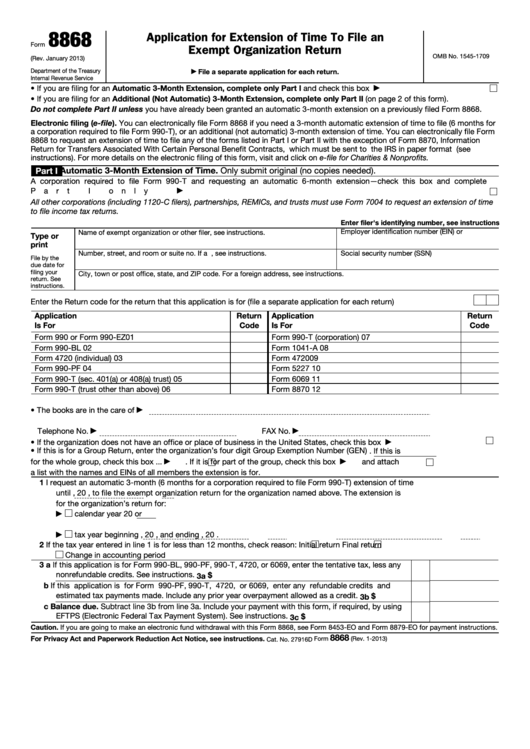

Fillable Form 8868 Application For Extension Of Time To File An

The extension doesn’t extend the time to pay any tax due. Do not file for an extension of time by attaching form 8868 to the exempt The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile. An organization will only be allowed an extension of 6 months for.

Form 8868 Application for Extension of Time to File an Exempt

Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021. Extending the time for filing a return does not extend the time for paying tax. The extension doesn’t extend the time to pay any tax due. Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury.

Form 8868 Application for Extension of Time to File an Exempt

Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. Extending the time for filing a return does not extend the time for paying tax. An organization will only be allowed an extension of 6 months for a return for.

Many taxexempt organizations must file information returns by May 15

Extending the time for filing a return does not extend the time for paying tax. An organization will only be allowed an extension of 6 months for a return for a tax year. Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021. Service in a combat zone The best way to file the.

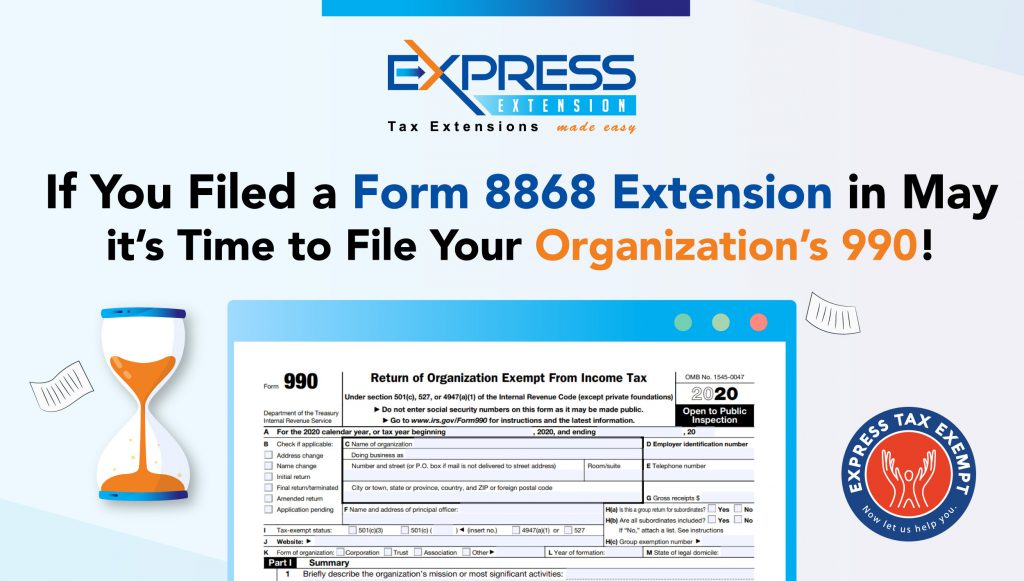

If You Filed a Form 8868 Extension in May, it’s Time to File Your

Web 8868 application for automatic extension of time to file an exempt organization return department of the treasury internal revenue service file by the due date for filing your return. Service in a combat zone An organization will only be allowed an extension of 6 months for a return for a tax year. Extending the time for filing a return.

File Form 8868 Online Efile 990 Extension with the IRS

Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. An organization will only be allowed an extension of 6 months for a return for a tax year. The best way to file the form before the deadline to avoid penalties is to.

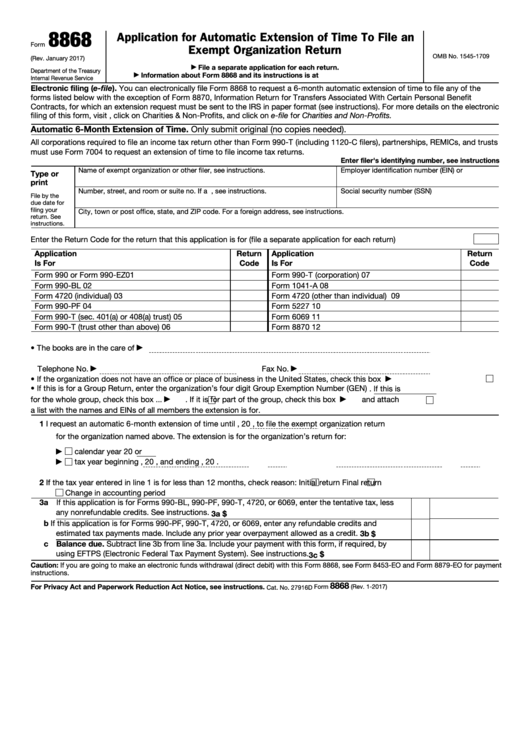

Fillable Form 8868 Application For Automatic Extension Of Time To

Extending the time for filing a return does not extend the time for paying tax. Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. The best way to file the form before the deadline to avoid penalties is to fill it with online portals like tax2efile..

Women Truckers 2290 tax efiling ThinkTrade Inc Blog

| go to www.irs.gov/form8868 for the latest information. An organization will only be allowed an extension of 6 months for a return for a tax year. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Do not file for an extension of.

The Best Way To File The Form Before The Deadline To Avoid Penalties Is To Fill It With Online Portals Like Tax2Efile.

If they follow a different fiscal year, their due date is the fifteenth day of the fifth month. Web information about form 8868, application for extension of time to file an exempt organization return, including recent updates, related forms, and instructions on how to file. Web if a nonprofit follows the calendar year, its taxes are due by may 17, 2021. | go to www.irs.gov/form8868 for the latest information.

Web Form 8870, Information Return For Transfers Associated With Certain Personal Benefit Contracts Pdf;

The extension doesn’t extend the time to pay any tax due. Extending the time for filing a return does not extend the time for paying tax. An organization will only be allowed an extension of 6 months for a return for a tax year. Service in a combat zone

Web 8868 Application For Automatic Extension Of Time To File An Exempt Organization Return Department Of The Treasury Internal Revenue Service File By The Due Date For Filing Your Return.

However, if the 15th day of the 5th month falls between april 15 and june 15, the due date to file the extension is july 15, 2022. Do not file for an extension of time by attaching form 8868 to the exempt Web the due date to file form 8868 is the 15th day of the fifth month after the end of your accounting period. For the calendar tax year filers, extension form 8868 is due by july 15, 2022.