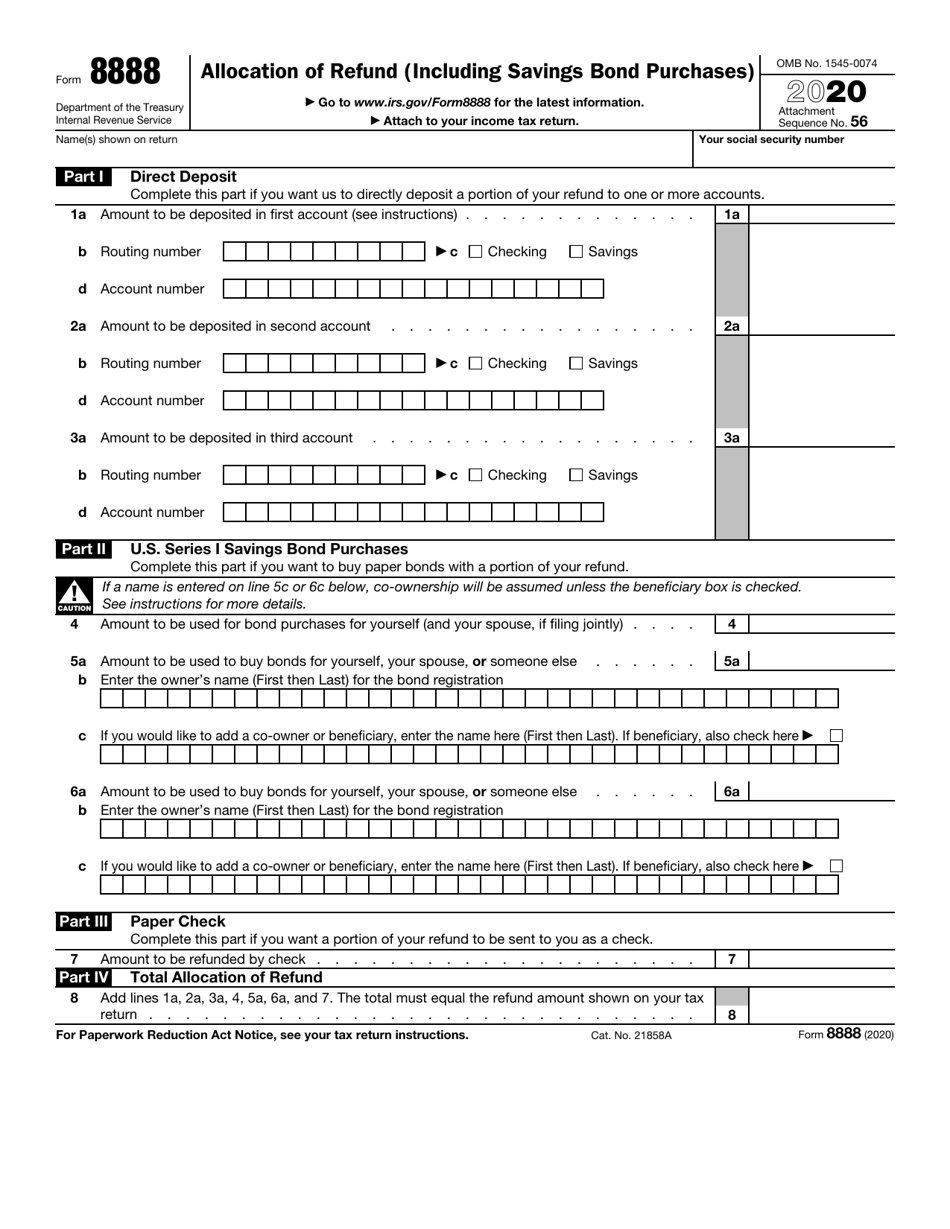

Form 8888 For 2021

Form 8888 For 2021 - Web to buy paper savings bonds, you use irs form 8888 to specify how much of your refund should go to savings bonds and how much to you directly (by check or by. Web the way to submit the irs 8888 on the internet: Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Ad access irs tax forms. Web information about form 8888, allocation of refund (including savings bond purchases), including recent updates, related forms and instructions on how to file. November 2021) department of the treasury internal revenue service. Edit, sign and save allocation of refund form. Try it for free now! Continue to use the november 2021 revision of form 8888 for tax years beginning after.

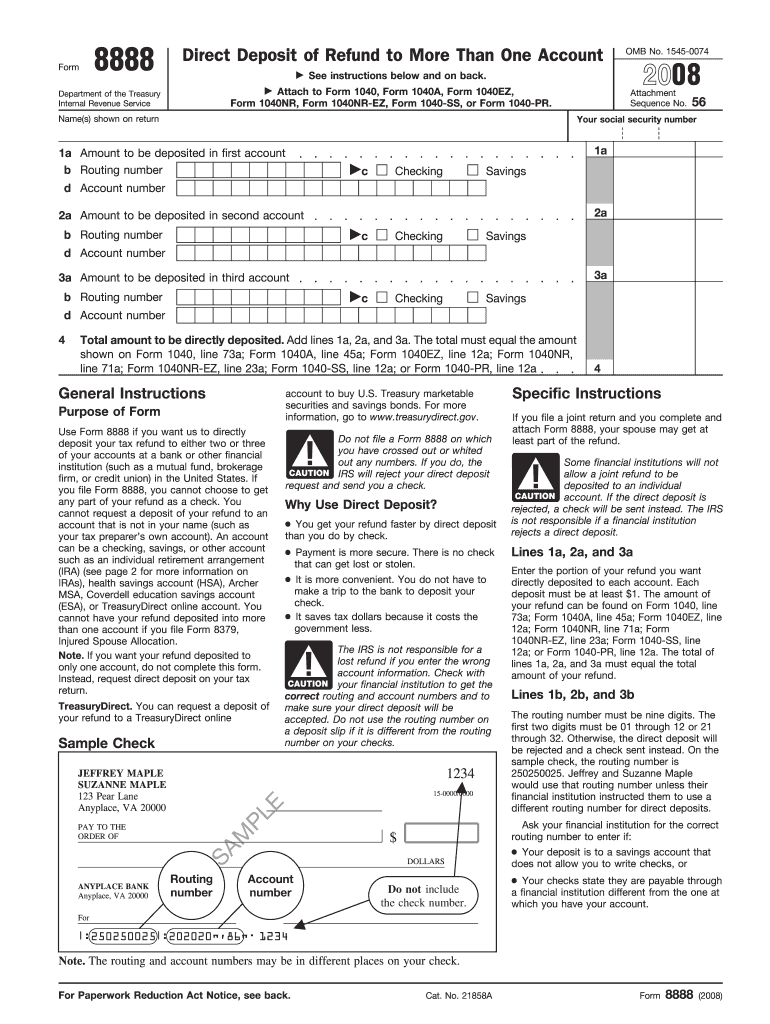

You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such. Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. The irs will revise form 8888 only when necessary. Web setting up direct deposit (one or multiple accounts) irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds to be. Try it for free now! Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. Start completing the fillable fields and carefully. Web on the following pages, please find the information on how to properly utilize form 8888, allocation of refund (including savings bond purchases) in the taxslayer software. Use get form or simply click on the template preview to open it in the editor. Web direct deposit information input the routing transit number (rtn), account number, and the type of account.

Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year 2022. Web future revisions of form 8888. Web to buy paper savings bonds, you use irs form 8888 to specify how much of your refund should go to savings bonds and how much to you directly (by check or by. Continue to use the november 2021 revision of form 8888 for tax years beginning after. You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such. Select the button get form to open it and start modifying. November 2021) department of the treasury internal revenue service allocation of refund (including savings bond purchases) a go to www.irs.gov/form8888. Web information about form 8888, allocation of refund (including savings bond purchases), including recent updates, related forms and instructions on how to file. What’s new personal protective equipment. Web the way to submit the irs 8888 on the internet:

Oven Baked Yummy Pulled Pork for Food Travelers Newspaper 10

Web the way to submit the irs 8888 on the internet: Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web direct deposit information input the routing transit number (rtn), account number, and the type of account. Complete, edit or print tax forms instantly. Continue to use the november 2021 revision of form 8888 for.

IRS Form 8888 Download Fillable PDF or Fill Online Allocation of Refund

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year 2022. Edit, sign and save allocation of refund form. Web the way to submit the irs 8888.

Form 8888 Edit, Fill, Sign Online Handypdf

Web setting up direct deposit (one or multiple accounts) irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds to be. Use get form or simply click on the template preview to open it in the editor. Fill out all necessary lines in the doc making use of our powerful pdf. Web.

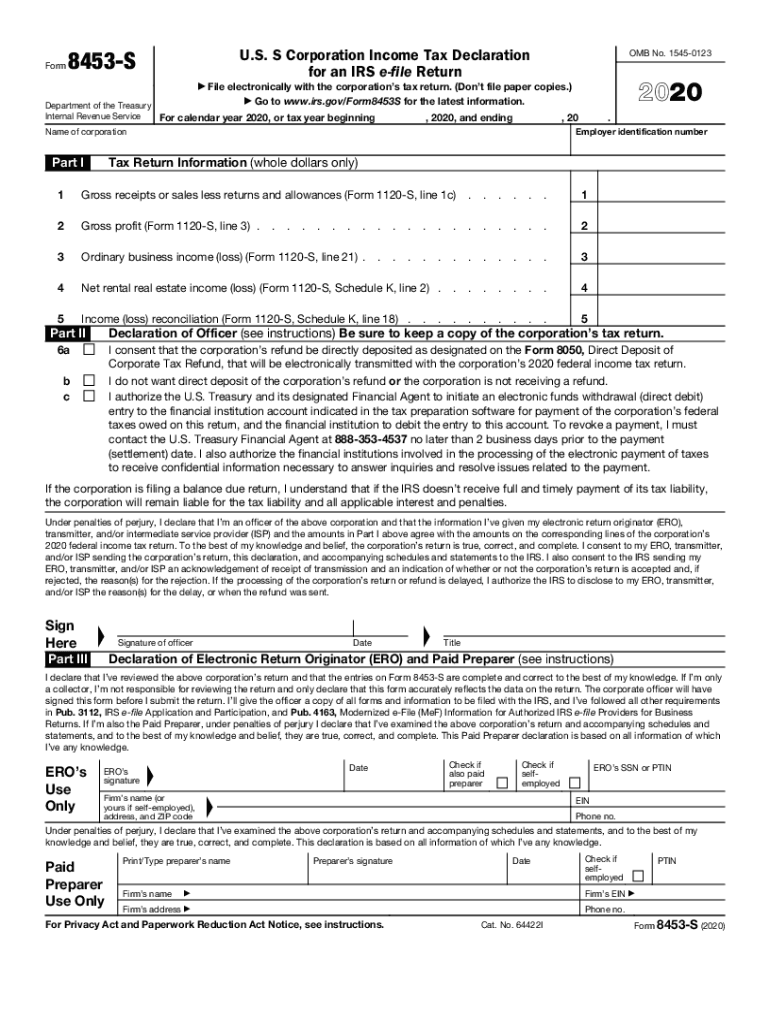

Form 8453 S Internal Revenue Service Fill Out and Sign Printable PDF

Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. Continue to use the november 2021 revision of form 8888 for tax years beginning after. Try it for free now! Allocation of refund (including savings bond purchases). Web the way to submit the irs 8888 on the.

Form Fillable Electronic Irs Forms Printable Forms Free Online

Ad access irs tax forms. Select the button get form to open it and start modifying. The irs will revise form 8888 only when necessary. Web form 8888 department of the treasury internal revenue service allocation of refund (including savings bond purchases) go to www.irs.gov/form8888 for the latest. Web future revisions of form 8888.

Treasury FS 1048 20192022 Fill and Sign Printable Template Online

Allocation of refund \(including savings bond purchases\) keywords: Ad access irs tax forms. Select the button get form to open it and start modifying. Edit, sign and save allocation of refund form. What’s new personal protective equipment.

Form 4562 Accounting for Depreciation and Amortization Silver Tax Group

Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year 2022. Try it for free now! Web direct deposit information input the routing transit number (rtn), account number, and the type of account. Web on the following pages, please find the.

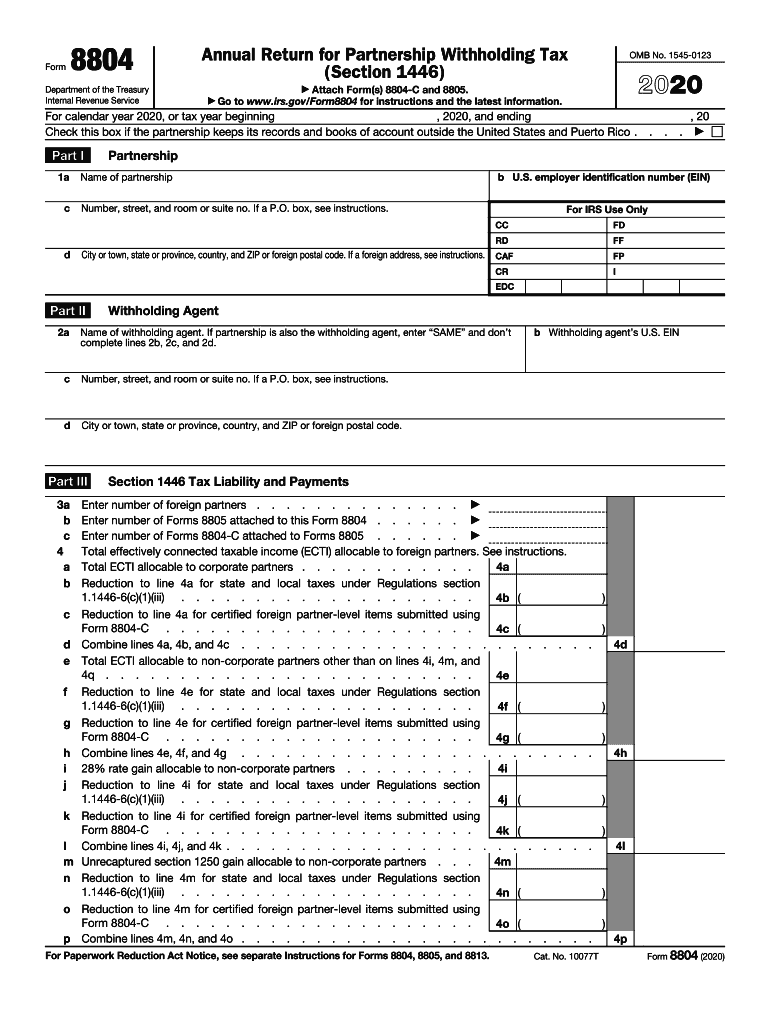

Form 8804 PDF Internal Revenue Service Fill Out and Sign Printable

November 2021) department of the treasury internal revenue service. You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such. Start completing the fillable fields and carefully. Web direct deposit information input the routing transit number (rtn), account number, and the type of account. You.

Fill Free fillable F8888 2019 Form 8888 PDF form

Web future revisions of form 8888. You can generally get information. Web setting up direct deposit (one or multiple accounts) irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds to be. Try it for free now! Web form 8888 department of the treasury internal revenue service allocation of refund (including savings.

Form 8888 Irs Fill Out and Sign Printable PDF Template signNow

Web to buy paper savings bonds, you use irs form 8888 to specify how much of your refund should go to savings bonds and how much to you directly (by check or by. Web setting up direct deposit (one or multiple accounts) irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds.

Allocation Of Refund (Including Savings Bond Purchases).

Web if you were under age 55 at the end of 2021 and, on the first day of every month during 2021, you were, or were considered, an eligible individual with the same coverage, enter. Try it for free now! Ad access irs tax forms. You can generally get information.

Upload, Modify Or Create Forms.

Amounts paid for personal protective equipment (ppe), such as masks, hand sanitizer, and sanitizing wipes, for use. Web to buy paper savings bonds, you use irs form 8888 to specify how much of your refund should go to savings bonds and how much to you directly (by check or by. The irs will revise form 8888 only when necessary. Edit, sign and save allocation of refund form.

Web Direct Deposit Information Input The Routing Transit Number (Rtn), Account Number, And The Type Of Account.

Web if you file a paper tax return, complete and attach form 8888, allocation of refund (including savings bond purchases) to your federal income tax return to tell irs how much and to. Start completing the fillable fields and carefully. You want us to directly deposit your refund (or part of it) to either two or three accounts at a bank or other financial institution (such. Web we last updated the allocation of refund (including savings bond purchases) in december 2022, so this is the latest version of form 8888, fully updated for tax year 2022.

Web Future Revisions Of Form 8888.

Web information about form 8888, allocation of refund (including savings bond purchases), including recent updates, related forms and instructions on how to file. Web setting up direct deposit (one or multiple accounts) irs form 8888 allocation of refund (including savings bond purchases) is used by taxpayers who want their refunds to be. Allocation of refund \(including savings bond purchases\) keywords: November 2021) department of the treasury internal revenue service.