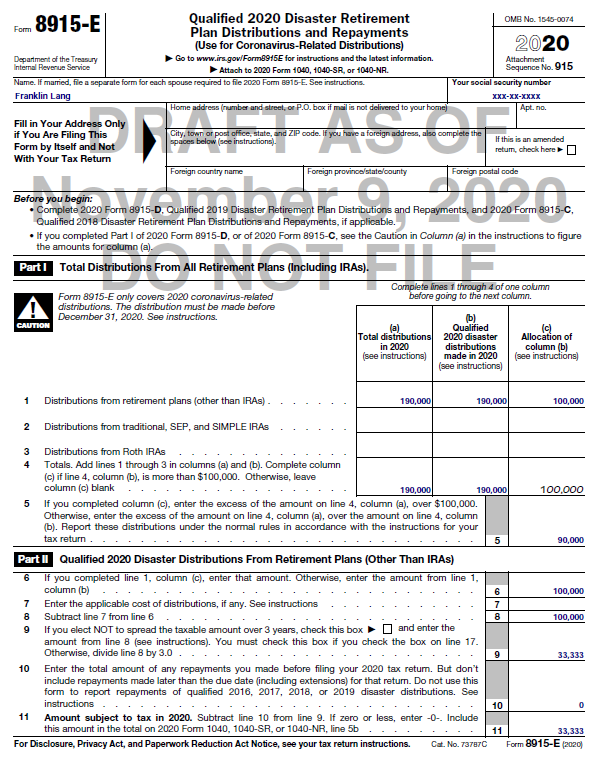

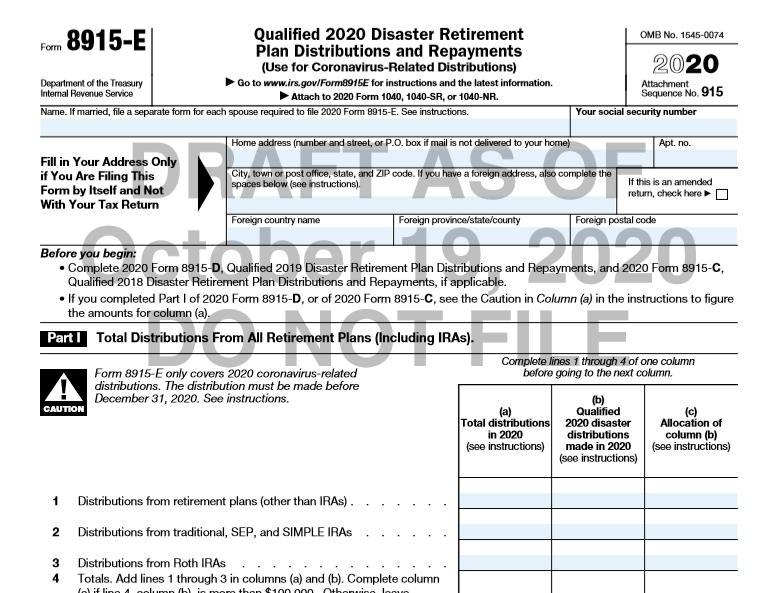

Form 8915-E Instructions

Form 8915-E Instructions - Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions. This will also include any coronavirus relate d distributions as taxable income. Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. Any distributions you took within the 2021 tax year will be taxable on your federal return. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Web go to www.irs.gov/form8915e for instructions and the latest information. 2022 general instructions future developments

Any distributions you took within the 2021 tax year will be taxable on your federal return. 2022 general instructions future developments Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. Web go to www.irs.gov/form8915e for instructions and the latest information. This will also include any coronavirus relate d distributions as taxable income. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions.

Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. 2022 general instructions future developments Web go to www.irs.gov/form8915e for instructions and the latest information. Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus relate d distributions as taxable income. Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions.

Form 8915 Qualified Hurricane Retirement Plan Distributions and

Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions. Web go to www.irs.gov/form8915e for instructions and the latest information. Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. 2022 general instructions future.

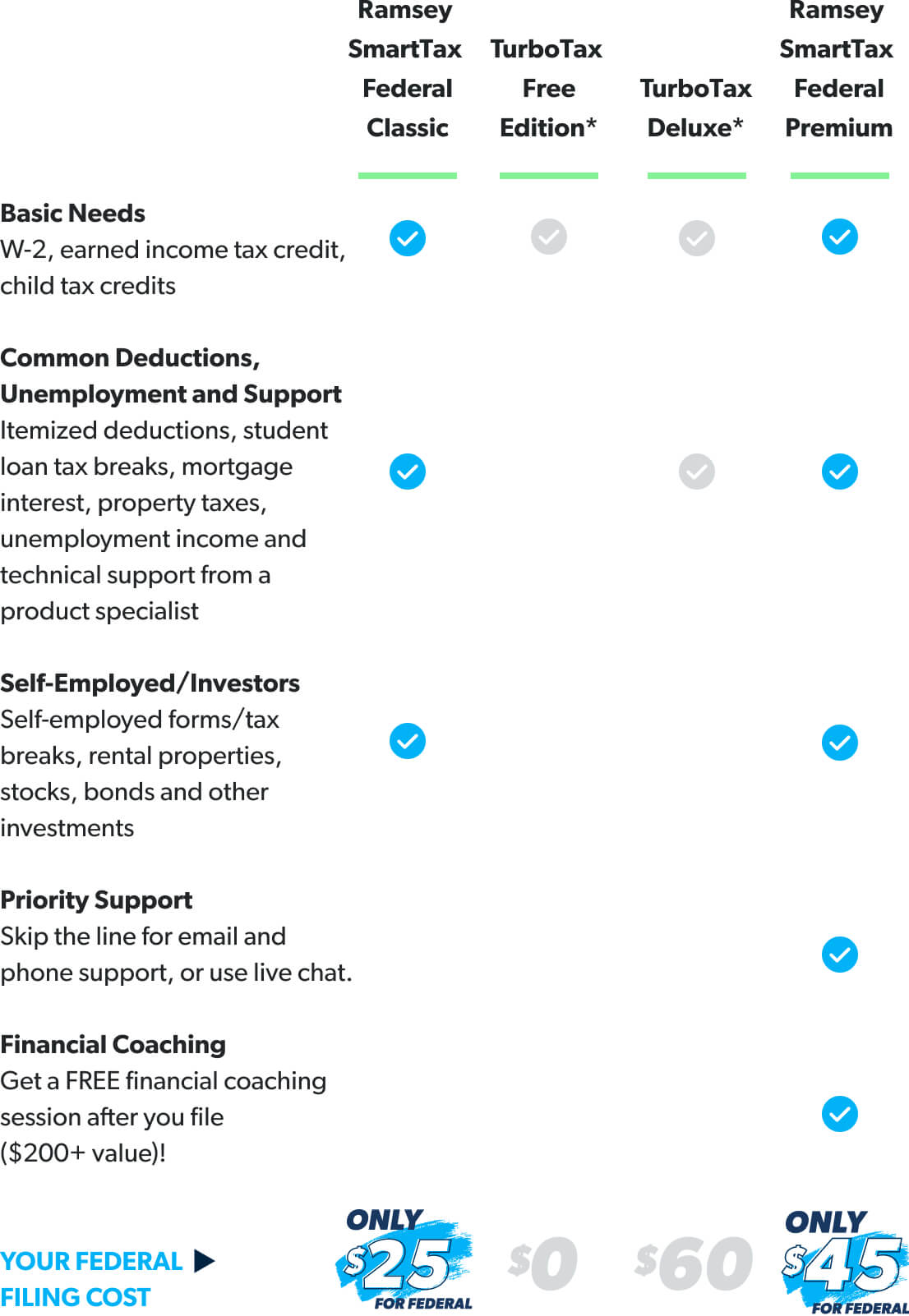

PPT Form 8915e TurboTax Updates On QDRP Online & Instructions To

Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. This will also include any coronavirus relate d distributions as taxable income. Additionally, the form will also be filed in 2021 and 2022 to.

Generating Form 8915E in ProSeries Intuit Accountants Community

Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions. Web go to www.irs.gov/form8915e for instructions and the latest information. This will.

Wordly Account Gallery Of Photos

This will also include any coronavirus relate d distributions as taxable income. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. Any distributions you took within the 2021 tax year will be taxable.

Publication 4492A (7/2008), Information for Taxpayers Affected by the

This will also include any coronavirus relate d distributions as taxable income. 2022 general instructions future developments Any distributions you took within the 2021 tax year will be taxable on your federal return. Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. Any repayments you make will reduce the amount of qualified.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

Web the relief allows taxpayers to access retirement savings earlier than they normally would be able to. Any distributions you took within the 2021 tax year will be taxable on your federal return. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. 2022 general instructions future developments Additionally, the form.

form 8915 e instructions turbotax Renita Wimberly

2022 general instructions future developments Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions. Any distributions you took within the 2021 tax year will be taxable on your federal return. Web go to www.irs.gov/form8915e for instructions and the latest information..

Kandy Snell

Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus relate d distributions as taxable income. Web go to www.irs.gov/form8915e for instructions and the latest information. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. 2022 general instructions.

form 8915 e instructions turbotax Renita Wimberly

Web go to www.irs.gov/form8915e for instructions and the latest information. 2022 general instructions future developments This will also include any coronavirus relate d distributions as taxable income. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Any distributions you took within the 2021 tax year will be taxable on your.

8915e tax form instructions Somer Langley

Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020. Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions. Web the relief allows taxpayers to access retirement savings earlier than they.

Web The Relief Allows Taxpayers To Access Retirement Savings Earlier Than They Normally Would Be Able To.

Additionally, the form will also be filed in 2021 and 2022 to report the 1/3 taxable portions of the 2020 distributions net of any repayments of the 2020 distributions. Web go to www.irs.gov/form8915e for instructions and the latest information. This will also include any coronavirus relate d distributions as taxable income. Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020.

2022 General Instructions Future Developments

Any distributions you took within the 2021 tax year will be taxable on your federal return.

.jpeg)