Form 8938 Penalties

Form 8938 Penalties - Web the penalty for failing to file form 8938 is $10,000, and an additional penalty of up to $50,000 or 5 percent of the total balance may be imposed. Web 1 who is a specified individual? Form 8938 is one of the newest additions to the internal revenue service’s. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Use form 8938 to report your. Or, if you have an understatement of tax relating to an undisclosed specified.

Taxpayers who hold foreign assets beyond a certain threshold. Web form 8938 penalties (new) 2022 form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal. Web failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a penalty up to $50,000 for continued failure after irs notification). 3 what is the form 8938 reporting threshold? Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. Web in general, form 8938 penalties will be $10,000 per year. How to avoid late fines form 8938 penalties under 6038d (fatca). Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Or, if you have an understatement of tax relating to an undisclosed specified.

3 what is the form 8938 reporting threshold? Web 1 who is a specified individual? Form 8938 is one of the newest additions to the internal revenue service’s. Web failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a penalty up to $50,000 for continued failure after irs notification). Web there are several ways to submit form 4868. Web form 8938 is used by some u.s. Use form 8938 to report your. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web in general, form 8938 penalties will be $10,000 per year. Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”.

Spain’s Version of IRS Form 8938 Sanctions Struck Down—Part I

How to avoid late fines form 8938 penalties under 6038d (fatca). Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web if you do not file a correct and complete form.

Form 8938 Penalty How to Avoid Late Filed IRS Penalties

Web form 8938 penalties (new) 2022 form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an.

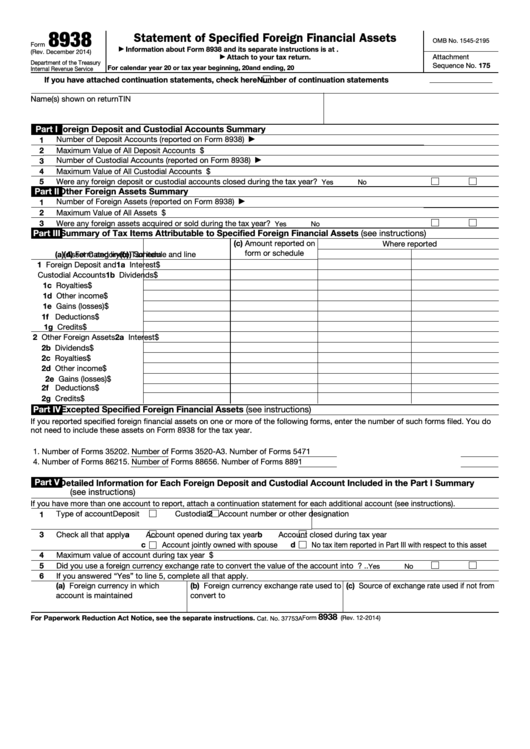

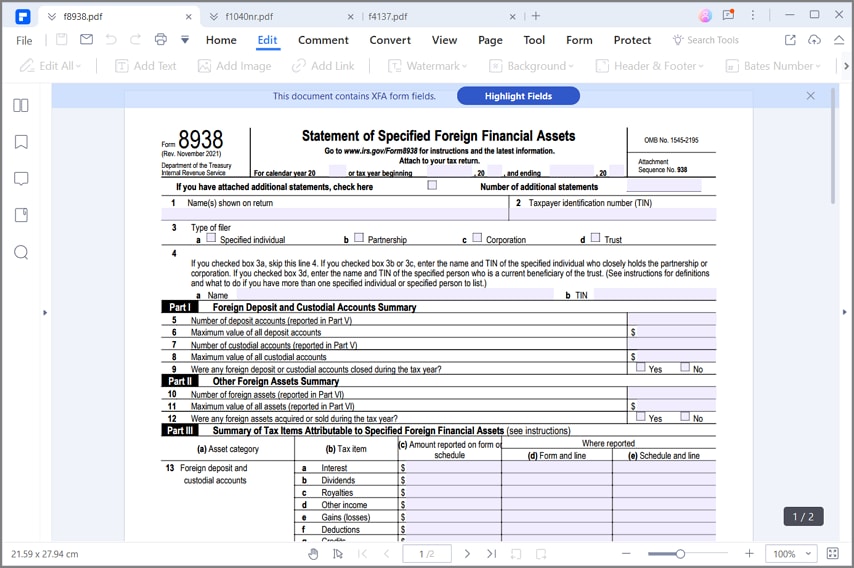

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Or, if you have an understatement of tax relating to an undisclosed specified. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web if you do not file a correct and.

Form 8938 Blank Sample to Fill out Online in PDF

Web there are several ways to submit form 4868. Form 8938 is one of the newest additions to the internal revenue service’s. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. 3 what is the form 8938.

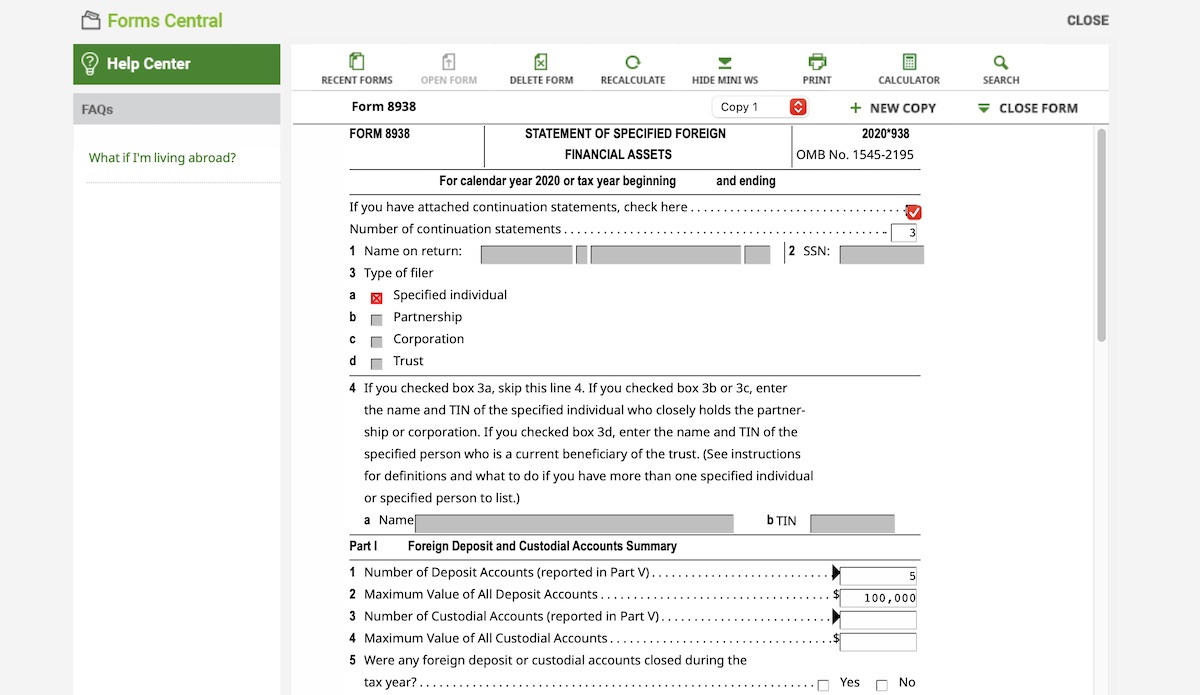

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Unlike the fbar penalties, there has been no indication that the internal revenue service plans on. Taxpayers who hold foreign assets beyond a certain threshold. 4 what exchange rate is used to convert maximum. Aggregate foreign assets of usd 200,000 on the last day of the year or usd 300,000 at any time during the year. Web there are several.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web 1 who is a specified individual? Web in general, form 8938 penalties will be $10,000 per year. 4 what exchange rate is used to convert maximum. Web form 8938 is used by some u.s. Form 8938 is one of the newest additions to the internal revenue service’s.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Taxpayers who hold foreign assets beyond a certain threshold. 2 what is a specified foreign financial asset? Web in general, form 8938 penalties will be $10,000 per year. Web failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a penalty up to $50,000 for continued failure after irs notification). Aggregate foreign assets.

Form 8938 Penalties & Statute of Limitations FATCA Tax Law Firm New

Web form 8938 penalties (new) 2022 form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal. You may be subject to penalties if you fail to timely file a correct form 8938. Web if you do not file a correct and complete form 8938 within 90 days after the.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. You may be subject to penalties if you fail to timely file a correct form 8938. Use form 8938 to report your. 4 what exchange rate is used to convert maximum. Web there are several ways to submit form 4868.

The Counting Thread v2 (Page 298) EVGA Forums

Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Form 8938 is one of the newest additions to the internal revenue service’s. Web in general, form 8938 penalties will be $10,000.

Taxpayers Can File Form 4868 By Mail, But Remember To Get Your Request In The Mail By Tax Day.

Aggregate foreign assets of usd 200,000 on the last day of the year or usd 300,000 at any time during the year. You may be subject to penalties if you fail to timely file a correct form 8938. Web failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a penalty up to $50,000 for continued failure after irs notification). Unlike the fbar penalties, there has been no indication that the internal revenue service plans on.

Person” Must File Annually A Form 893 8 Reporting Their Ownership Of Most “Specified Foreign Financial Assets.”.

In general, form 893 8 reporting is required if. Or, if you have an understatement of tax relating to an undisclosed specified. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Web 1 who is a specified individual?

Taxpayers Who Hold Foreign Assets Beyond A Certain Threshold.

Web there are several ways to submit form 4868. Use form 8938 to report your. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. How to avoid late fines form 8938 penalties under 6038d (fatca).

Web Form 8938 Penalties (New) 2022 Form 8938 Is An Irs International Reporting Form Used To Disclose Overseas Accounts, Assets, Investments, And Income To The Irs (Internal.

Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. 3 what is the form 8938 reporting threshold? 2 what is a specified foreign financial asset? Form 8938 is one of the newest additions to the internal revenue service’s.