Form 8962 Instuctions

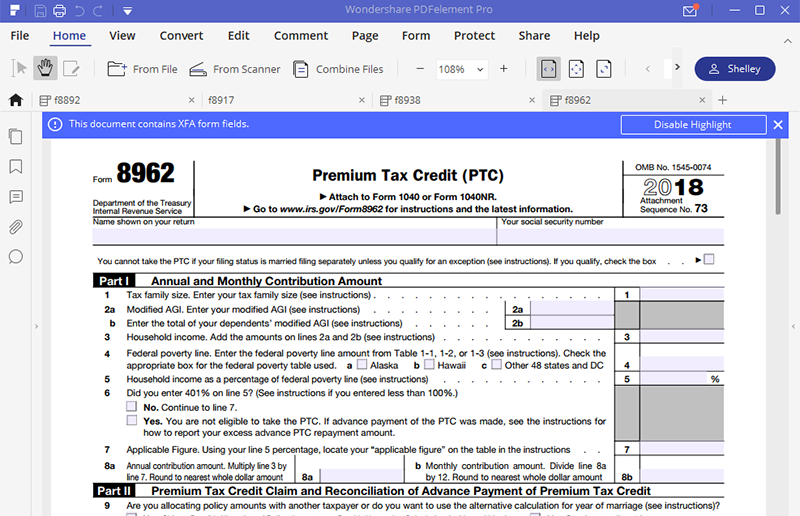

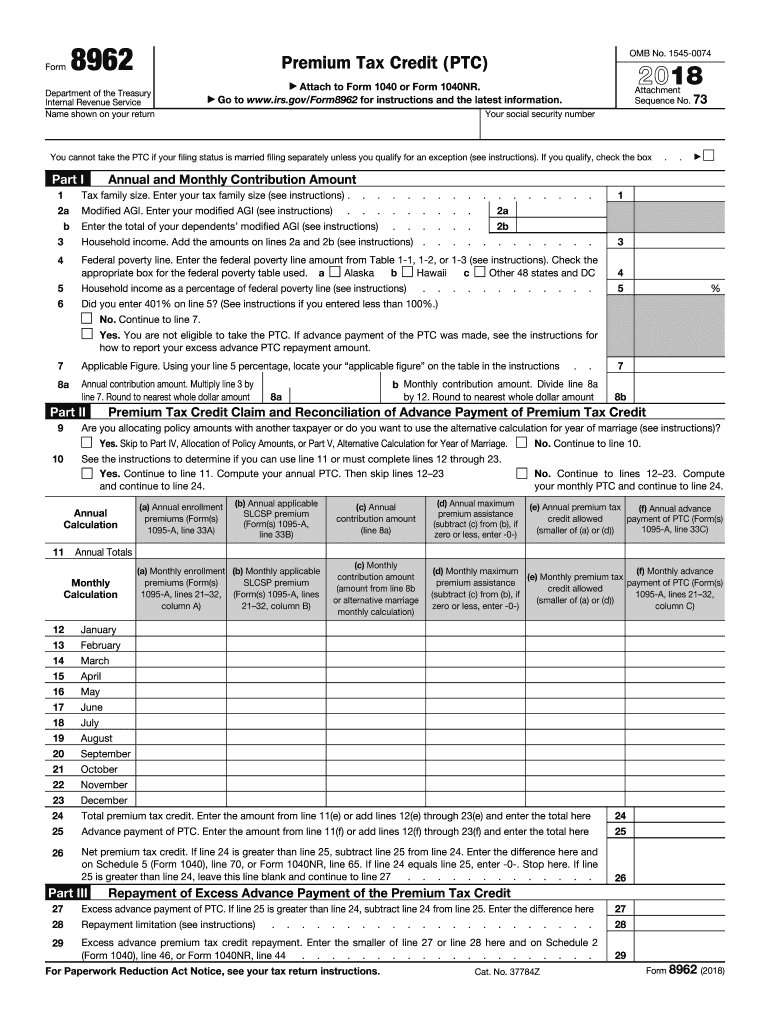

Form 8962 Instuctions - Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. How to fill out form 8962 step by step. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess. Complete, edit or print tax forms instantly. Web see the form 8962 instructions for more information. Who can use form 8962? Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. If your client (or their spouse, if married filing jointly) received unemployment compensation for any week of 2021, their. We’ll review magi, fpl, and adjusting credits.

Form 8962 isn’t for everyone. Web see the form 8962 instructions for more information. Complete, edit or print tax forms instantly. Web why is the tax year 2021 form 8962, line 5 showing 133%? You may take ptc (and aptc may. Web instructions for form 8962 premium tax credit (ptc) department of the treasury internal revenue service section references are to the internal revenue code unless otherwise. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Taxpayers complete form 8862 and attach it to their tax return if: Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Complete form 8962 only for health insurance coverage in a qualified health plan (described later) purchased through a health.

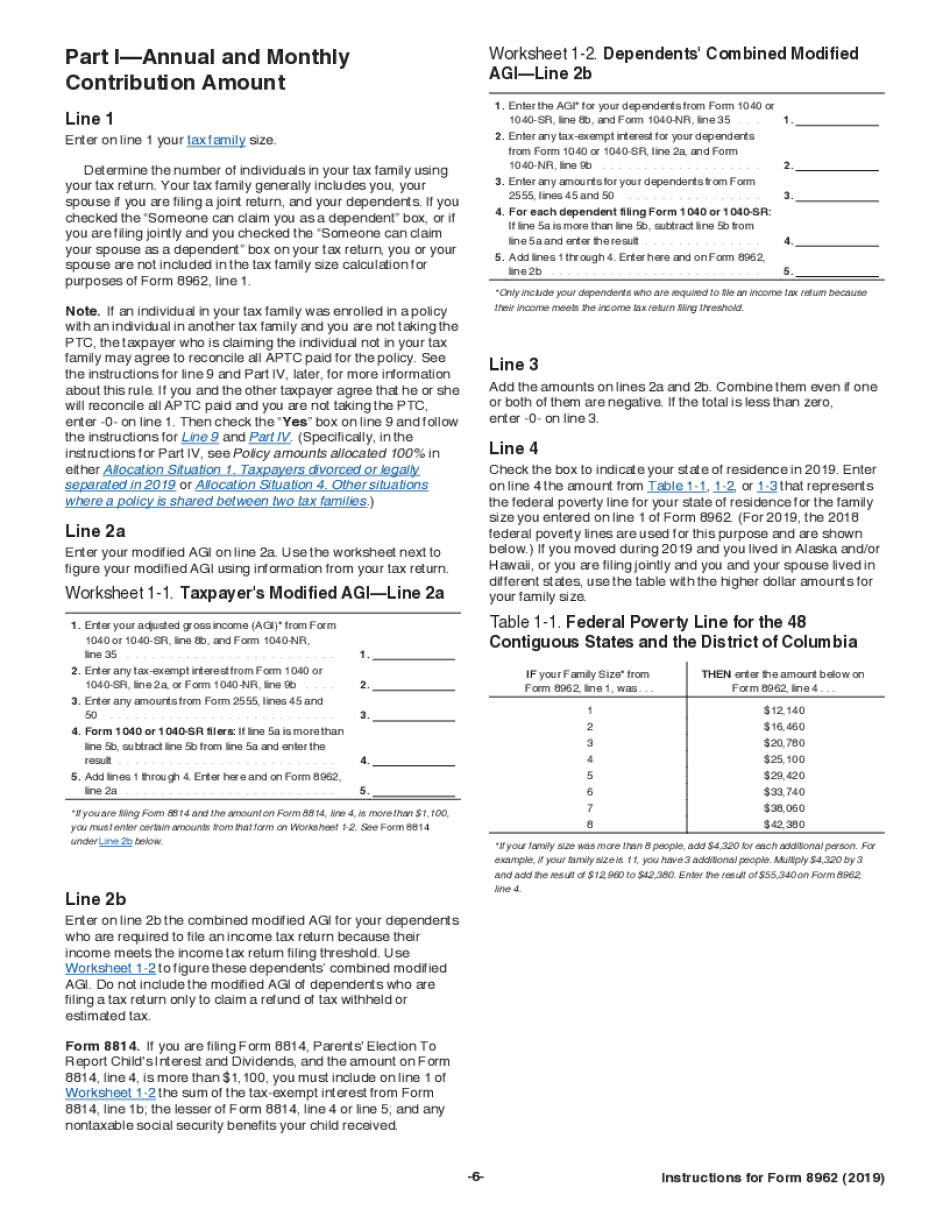

If your client (or their spouse, if married filing jointly) received unemployment compensation for any week of 2021, their. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Web about form 8862, information to claim certain credits after disallowance. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during that year. Web why is the tax year 2021 form 8962, line 5 showing 133%? Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. To be eligible for this tax credit, you. By aotax | feb 12, 2022 | health insurance premiums | 0 comments. Complete form 8962 only for health insurance coverage in a qualified health plan (described later) purchased through a health.

irs form 8962 instructions Fill Online, Printable, Fillable Blank

Taxpayers complete form 8862 and attach it to their tax return if: Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Web federal form 8962 instructions caution. Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web the purpose of form 8962 is to allow.

form 8962 2015 Irs forms, Form, Tax credits

Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). Taxpayers complete form 8862 and attach it to their tax return if: Web the purpose of form 8962 is to allow filers.

Download Instructions for IRS Form 8962 Premium Tax Credit (Ptc) PDF

By aotax | feb 12, 2022 | health insurance premiums | 0 comments. Complete form 8962 only for health insurance coverage in a qualified health plan (described later) purchased through a health. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. To be eligible for this tax credit, you. How.

IRS Form 8962 Instruction for How to Fill it Right

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. The american rescue plan act was signed into law on march 11, 2021, and eliminates the 2020 excess. Complete, edit or print tax forms instantly. Web why is the tax year 2021 form 8962, line 5 showing 133%? Web form 8962.

Form 8962 Edit, Fill, Sign Online Handypdf

Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any advance premium tax credit (aptc). Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). We’ll review magi, fpl,.

Irs form 8962 Fillable Brilliant form 8962 Instructions 2018 at Models

Web why is the tax year 2021 form 8962, line 5 showing 133%? To be eligible for this tax credit, you. How to fill out form 8962 step by step. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the marketplace during.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Complete form 8962 only for health insurance coverage in a qualified health plan (described later) purchased through a health. Complete, edit or print tax forms instantly. Web form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through.

how to fill out form 8962 step by step Fill Online, Printable

Web find out how to fill out premium tax credit form 8962, the form for reporting obamacare tax credits. Form 8962 is used either (1) to reconcile a premium tax. Web about form 8862, information to claim certain credits after disallowance. You may take ptc (and aptc may. Taxpayers complete form 8862 and attach it to their tax return if:

Form 8962 Fill Out and Sign Printable PDF Template signNow

Who can use form 8962? Complete form 8962 only for health insurance coverage in a qualified health plan (described later) purchased through a health. Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Complete, edit or print tax forms instantly. Web 406 rows instructions for form 8962 (2022).

Form 8962 Instructions 2018 Fresh 21 Unique Free Resume Creator

If your client (or their spouse, if married filing jointly) received unemployment compensation for any week of 2021, their. Complete, edit or print tax forms instantly. Web see the form 8962 instructions for more information. Web the purpose of form 8962 is to allow filers to calculate their premium tax credit (ptc) amount and to reconcile that amount with any.

Web See The Form 8962 Instructions For More Information.

You may take ptc (and aptc may. Ad get ready for tax season deadlines by completing any required tax forms today. Ad get ready for tax season deadlines by completing any required tax forms today. Complete form 8962 only for health insurance coverage in a qualified health plan (described later) purchased through a health.

To Be Eligible For This Tax Credit, You.

Web form 8962 department of the treasury internal revenue service premium tax credit (ptc) attach to form 1040, 1040a, or 1040nr. Web 406 rows instructions for form 8962 (2022) instructions for form 8962. Web find out how to fill out premium tax credit form 8962, the form for reporting obamacare tax credits. By aotax | feb 12, 2022 | health insurance premiums | 0 comments.

Web Instructions For Form 8962 Premium Tax Credit (Ptc) Department Of The Treasury Internal Revenue Service Section References Are To The Internal Revenue Code Unless Otherwise.

Taxpayers complete form 8862 and attach it to their tax return if: Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web use form 8962 to figure the amount of your premium tax credit (ptc) and reconcile it with advance payment of the premium tax credit (aptc). How to fill out form 8962 step by step.

Web The Purpose Of Form 8962 Is To Allow Filers To Calculate Their Premium Tax Credit (Ptc) Amount And To Reconcile That Amount With Any Advance Premium Tax Credit (Aptc).

Complete, edit or print tax forms instantly. Web federal form 8962 instructions caution. If your client (or their spouse, if married filing jointly) received unemployment compensation for any week of 2021, their. We’ll review magi, fpl, and adjusting credits.