Form 8995-A Instructions

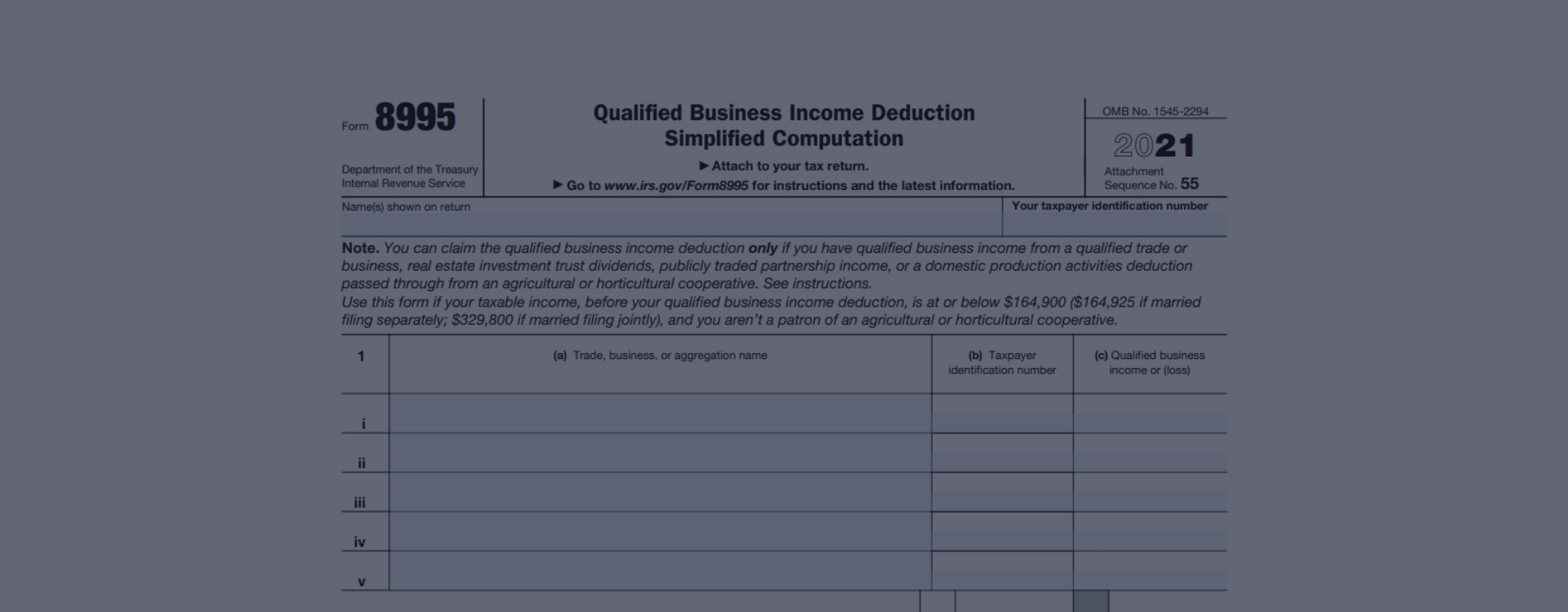

Form 8995-A Instructions - Use this form to figure your qualified business income deduction. Click to expand the qualified business deduction (qbi) Department of the treasury internal revenue service. The instructions state that these items are not automatically included in qbi. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Attach to your tax return. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or horticultural cooperative. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that must be included as qualified ptp losses or deductions in subsequent years when allowed in calculating your taxable income.

Click to expand the qualified business deduction (qbi) For instructions and the latest information. Complete schedule a only if your trade or business is a specified service trade or business (see instructions) and your taxable income is more Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Go to www.irs.gov/form8995a for instructions and the latest information. Use this form to figure your qualified business income deduction. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that must be included as qualified ptp losses or deductions in subsequent years when allowed in calculating your taxable income. Include the following schedules (their specific instructions are shown later), as appropriate: Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction.

Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or horticultural cooperative. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. There are two ways to calculate the qbi deduction: Don’t worry about which form your return needs to use. Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Use this form to figure your qualified business income deduction. Go to www.irs.gov/form8995a for instructions and the latest information. When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that must be included as qualified ptp losses or deductions in subsequent years when allowed in calculating your taxable income. For instructions and the latest information.

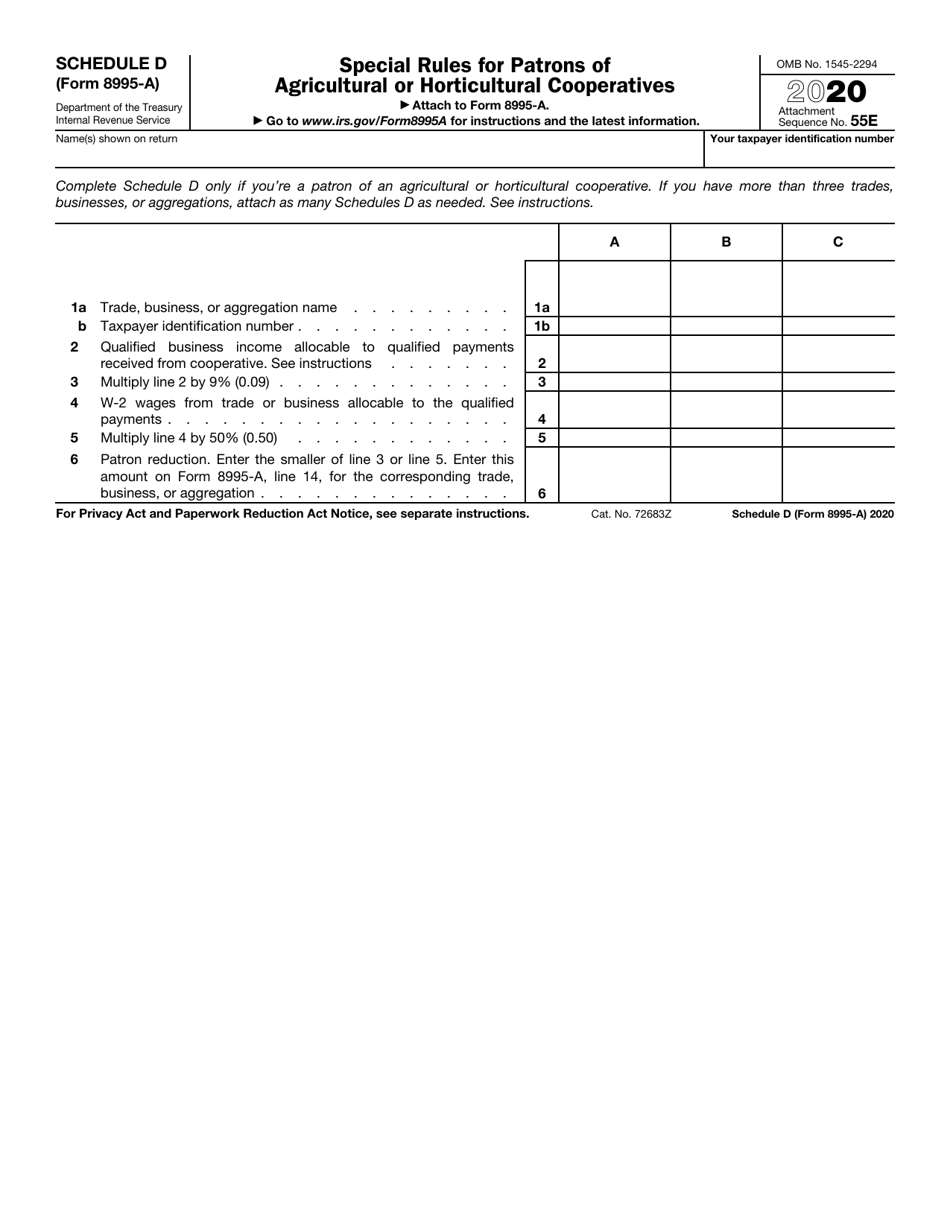

IRS Form 8995A Schedule D Download Fillable PDF or Fill Online Special

Department of the treasury internal revenue service. There are two ways to calculate the qbi deduction: Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Use this form if your.

Other Version Form 8995A 8995 Form Product Blog

Use separate schedules a, b, c, and/or d, as appropriate, to help calculate the deduction. For instructions and the latest information. The instructions state that these items are not automatically included in qbi. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new.

IRS Form 8995a Instructions PDF Jay J Holmes Page 1 Flip PDF

When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that must be included as qualified ptp losses or deductions in subsequent years when allowed in calculating your taxable income. Department of the treasury internal revenue service. Complete schedule a only if your trade or business.

Fill Free fillable F8995 2019 Form 8995 PDF form

Attach to your tax return. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. For instructions and the latest information. Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married.

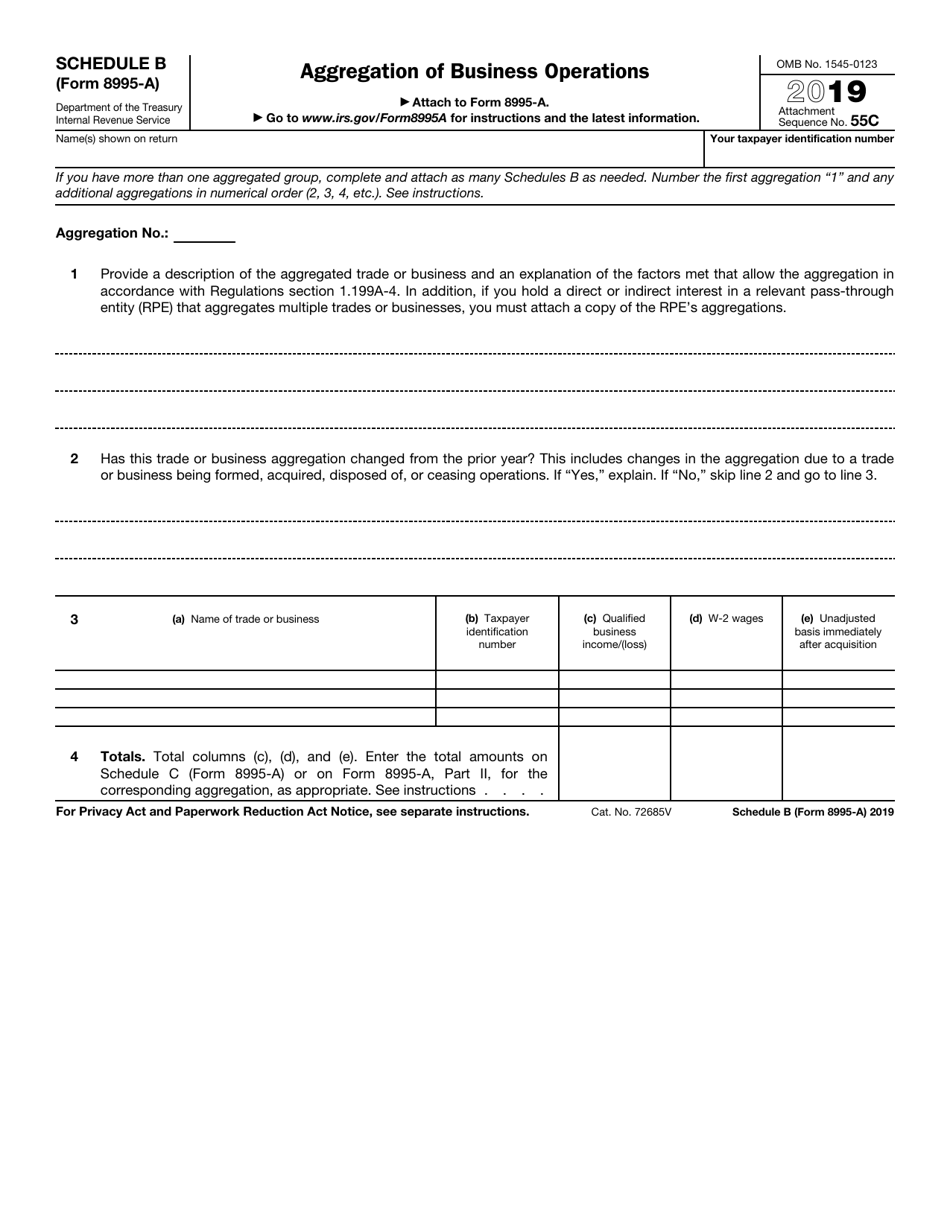

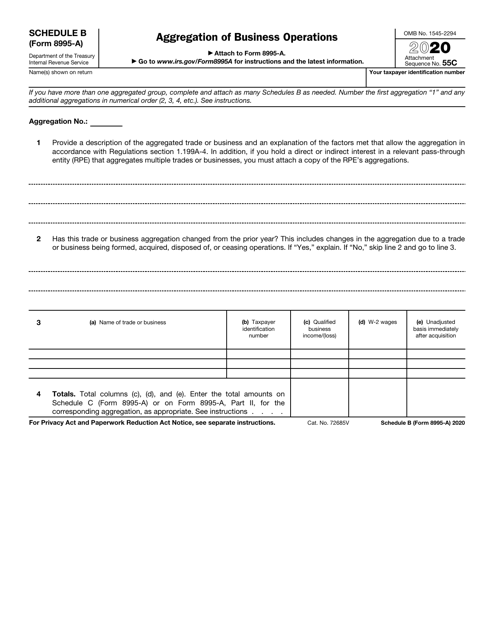

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

The instructions state that these items are not automatically included in qbi. Don’t worry about which form your return needs to use. Complete schedule a only if your trade or business is a specified service trade or business (see instructions) and your taxable income is more Department of the treasury internal revenue service. Include the following schedules (their specific instructions.

2020 Form IRS Instructions 8995 Fill Online, Printable, Fillable, Blank

Click to expand the qualified business deduction (qbi) Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or horticultural cooperative. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Complete schedule a only if your trade or business is a specified service trade or business (see instructions) and your taxable income is more There are two ways to calculate the qbi deduction: Attach to your tax return. Use separate schedules a,.

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

Go to www.irs.gov/form8995a for instructions and the latest information. There are two ways to calculate the qbi deduction: Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or horticultural cooperative. Use this form to figure your qualified business income deduction. Web.

Fill Free fillable F8995a 2019 Form 8995A PDF form

There are two ways to calculate the qbi deduction: Include the following schedules (their specific instructions are shown later), as appropriate: Go to www.irs.gov/form8995a for instructions and the latest information. Attach to your tax return. When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that.

8995 Form 📝 IRS Form 8995 for Instructions Printable Sample With PDF

When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that must be included as qualified ptp losses or deductions in subsequent years when allowed in calculating your taxable income. Click to expand the qualified business deduction (qbi) Don’t worry about which form your return needs.

Click To Expand The Qualified Business Deduction (Qbi)

Department of the treasury internal revenue service. Complete schedule a only if your trade or business is a specified service trade or business (see instructions) and your taxable income is more Use this form if your taxable income, before your qualified business income deduction, is above $163,300 ($326,600 if married filing jointly), or you’re a patron of an agricultural or horticultural cooperative. For instructions and the latest information.

Use Separate Schedules A, B, C, And/Or D, As Appropriate, To Help Calculate The Deduction.

There are two ways to calculate the qbi deduction: When losses or deductions from a ptp are suspended in the year incurred, you must determine the qualified portion of the losses or deductions that must be included as qualified ptp losses or deductions in subsequent years when allowed in calculating your taxable income. Use this form to figure your qualified business income deduction. Don’t worry about which form your return needs to use.

Include The Following Schedules (Their Specific Instructions Are Shown Later), As Appropriate:

Web overview if your work qualifies you for certain business deductions on your taxes, you may need to use form 8995. The instructions state that these items are not automatically included in qbi. Attach to your tax return. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï

Web The Qualified Business Income Deduction (Qbi) Is Intended To Reduce The Tax Rate On Qualified Business Income To A Rate That Is Closer To The New Corporate Tax Rate.

Go to www.irs.gov/form8995a for instructions and the latest information.