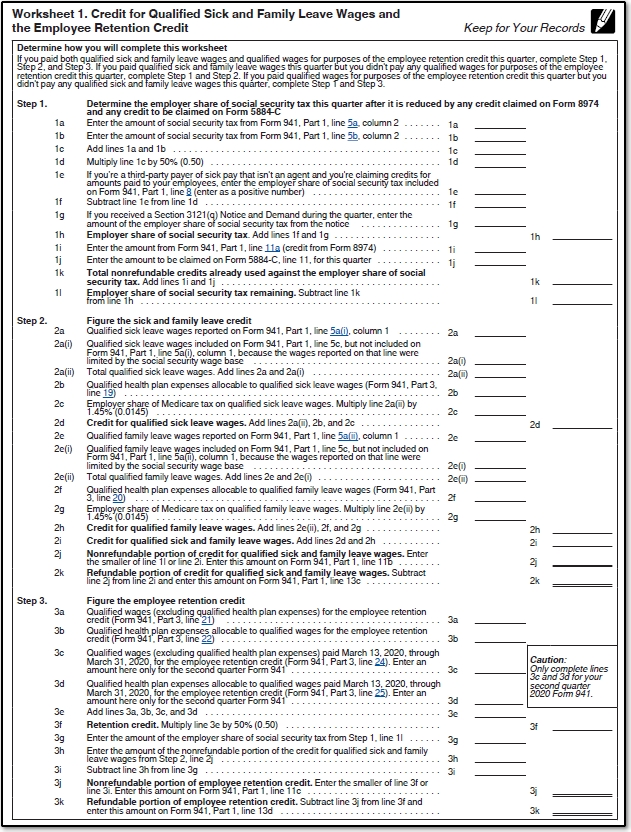

Form 941 X Worksheet 1

Form 941 X Worksheet 1 - This amount is originally found on form 941, like 13d. Web what is the purpose of worksheet 1? Worksheet 1 is not an official attachment to form 941, therefore you won’t have to worry about submitting it to the irs. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. The nonrefundable portion of the erc (as calculated on worksheet 1) is the amount that applies against the employer’s 6.2% share of social security tax. In das 2021, a different version of the worksheet is specific to quarter 2021. You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that apply to qualified wages paid after march 12, 2020, and before july 1, 2021. For more information about a Web basically, form 941 worksheet 1 consists of 3 steps. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023;

See the instructions for line 42. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. At this time, the irs expects the march 2023 revision of form 941 and these instructions to also be used for the second, third, and fourth quarters of 2023. About form 941 worksheet 2 A second version of the worksheet in das 2020 was released to calculate the credit for quarters 3 and 4. Worksheet 1 is not an official attachment to form 941, therefore you won’t have to worry about submitting it to the irs. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; The nonrefundable portion of the erc (as calculated on worksheet 1) is the amount that applies against the employer’s 6.2% share of social security tax. Type or print within the boxes. You must complete all five pages.

About form 941 worksheet 2 Web basically, form 941 worksheet 1 consists of 3 steps. Web cpeos must generally file form 941 and schedule r (form 941), allocation schedule for aggregate form 941 filers, electronically. The nonrefundable portion of the erc (as calculated on worksheet 1) is the amount that applies against the employer’s 6.2% share of social security tax. See the instructions for line 42. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. This amount is originally found on form 941, like 13d. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses.

941x Worksheet 2 Excel

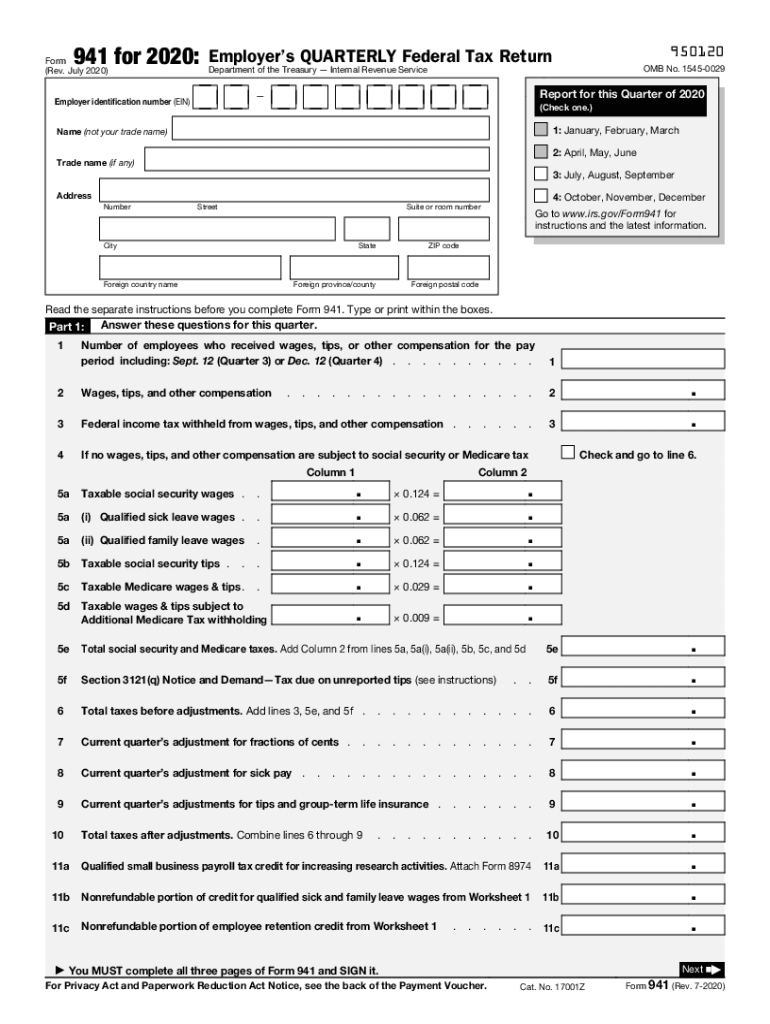

Web home forms and instructions about form 941, employer's quarterly federal tax return employers use form 941 to: Web form 941 worksheet 1 is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. Type or print within the boxes. See the instructions for line 42. Web what is the purpose of worksheet 1?

941 Form Printable & Fillable Sample in PDF

Subtract line 1g from line 1f. You'll also use this worksheet to Web what is the purpose of worksheet 1? Web basically, form 941 worksheet 1 consists of 3 steps. Who will find worksheet 1 helpful?

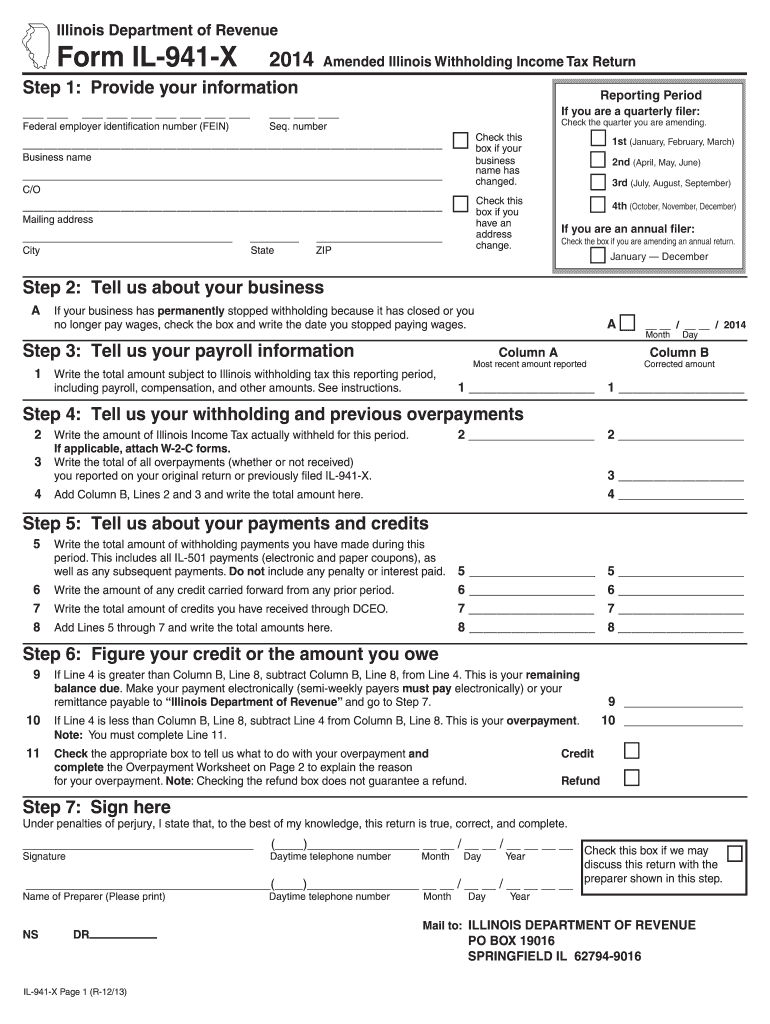

2016 Form IL DoR IL941X Fill Online, Printable, Fillable, Blank

Subtract line 1g from line 1f. You'll also use this worksheet to Checkout this video to know how to complete the 941 worksheet 1. It has a series of steps that enable the employer to determine the employer’s share of social security tax and the. Don't use an earlier revision to report taxes for 2023.

941x Worksheet 1 Excel

Subtract line 1g from line 1f. However, cpeos are permitted to file a paper form 941 and its accompanying schedules in lieu of electronic submissions for the second, third, and fourth quarters of calendar year 2020. You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that apply to qualified wages paid after.

941 Worksheet 1 Credit for Qualified Sick and Family Leave Wages and

However, cpeos are permitted to file a paper form 941 and its accompanying schedules in lieu of electronic submissions for the second, third, and fourth quarters of calendar year 2020. Don't use an earlier revision to report taxes for 2023. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service.

IL DoR IL941X 2014 Fill out Tax Template Online US Legal Forms

Pay the employer's portion of social security or medicare tax. Type or print within the boxes. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

You will use worksheet 2 to make changes to the refundable portion of the employee tax credit that apply to qualified wages paid after march 12, 2020, and before july 1, 2021. Web what is form 941 worksheet 1? Web basically, form 941 worksheet 1 consists of 3 steps. Web home forms and instructions about form 941, employer's quarterly federal.

Worksheet 1 Can Help You Complete The Revised Form 941 Blog TaxBandits

This worksheet is for your records and to assist you in completing the new data fields of form 941. Web basically, form 941 worksheet 1 consists of 3 steps. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. In das 2021, a different version of the worksheet is specific to quarter 2021..

941x Worksheet 1 Excel

Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. Subtract line 1g from line 1f. Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting quarter. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. However, cpeos are permitted to file a.

Irs Forms 2020 Printable Fill Out and Sign Printable PDF Template

Subtract line 1g from line 1f. Web what is the purpose of worksheet 1? The nonrefundable portion of the erc (as calculated on worksheet 1) is the amount that applies against the employer’s 6.2% share of social security tax. Web basically, form 941 worksheet 1 consists of 3 steps. Before you begin to complete worksheet 1, you should know how.

Web Form 941 Worksheet 1 Is Designed To Accompany The Newly Revised Form 941 For The Second Quarter Of 2020 And Beyond.

Type or print within the boxes. Before you begin to complete worksheet 1, you should know how you paid your employees for the reporting quarter. Web what is form 941 worksheet 1? Checkout this video to know how to complete the 941 worksheet 1.

Web What Is The Purpose Of Worksheet 1?

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; This amount is originally found on form 941, like 13d. About form 941 worksheet 2 The nonrefundable portion of the erc (as calculated on worksheet 1) is the amount that applies against the employer’s 6.2% share of social security tax.

Report Income Taxes, Social Security Tax, Or Medicare Tax Withheld From Employee's Paychecks.

Current revision form 941 pdf instructions for form 941 ( print version. When reporting a negative amount in columns 3 and 4, use a minus sign instead of parentheses. Worksheet 1 (included in the instructions to form 941) is used to calculate the nonrefundable portion and refundable portion of the erc. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021.

Web Beginning With The Second Quarter 2020 Form 941, The Form Has Been Updated To Include Worksheet 1 (On Page 5) That Is Used To Calculate The Credits.

Web file your form 941 by completing the worksheet 1 through expressefile now for the lowest price in the industry, only $5.95/return. In das 2021, a different version of the worksheet is specific to quarter 2021. Thus, any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this worksheet. However, cpeos are permitted to file a paper form 941 and its accompanying schedules in lieu of electronic submissions for the second, third, and fourth quarters of calendar year 2020.