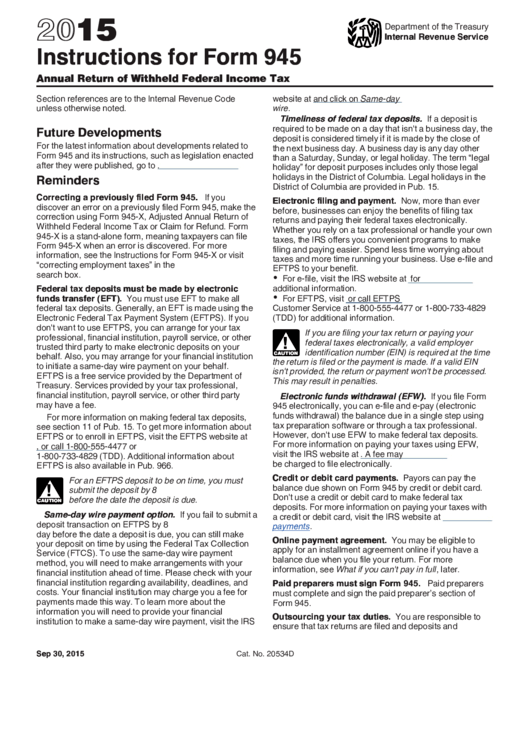

Form 945 Instructions 2022

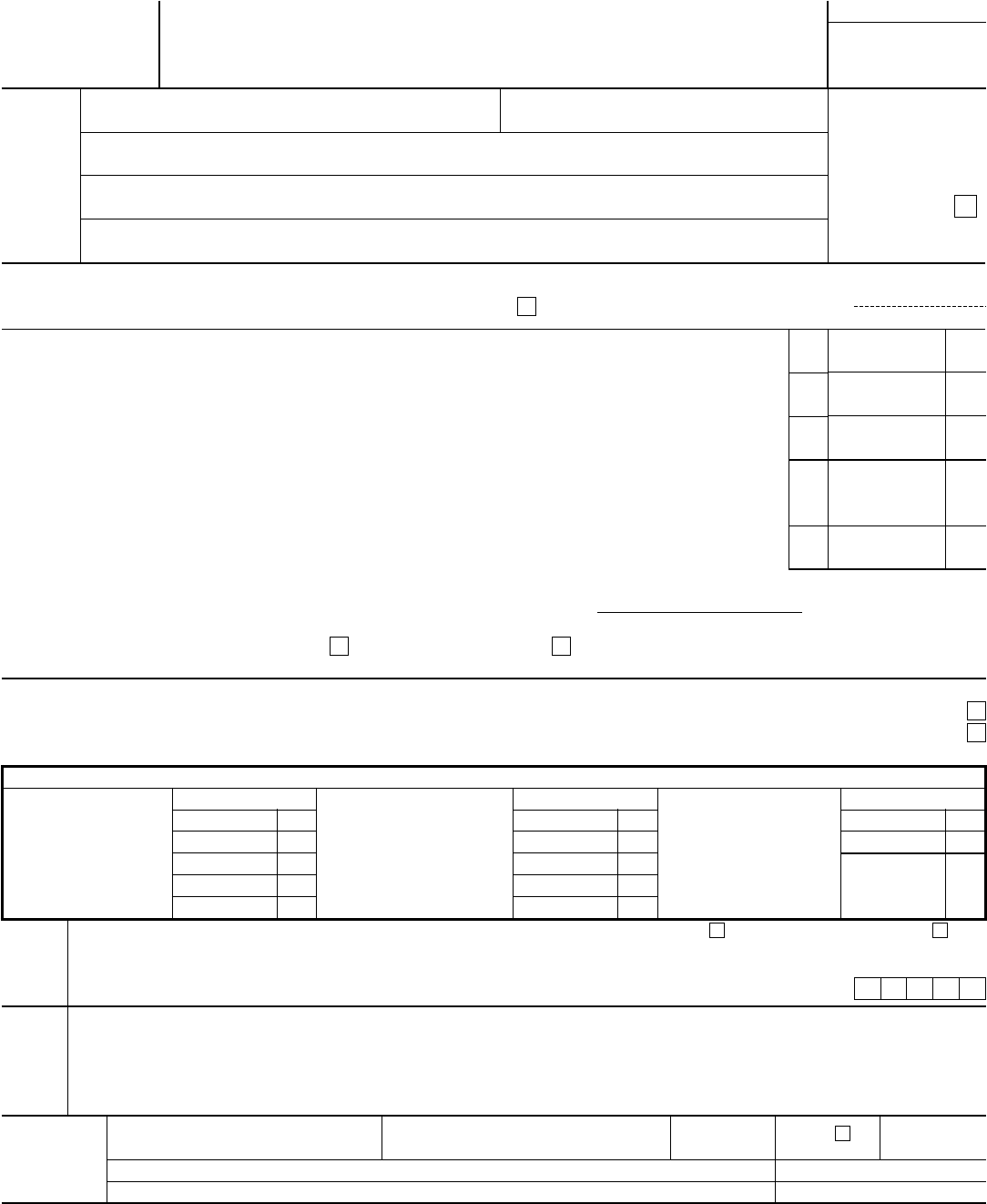

Form 945 Instructions 2022 - If you made deposits on time, in full. This form is used to report withheld federal income tax. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. Form 945 is an irs tax form that is required to be filed by business. Use this form to report your federal tax liability (based on the dates payments were made or wages were. Ad access irs tax forms. Annual record of federal tax liability 1220. Form 945 has a total of seven lines. Upload, modify or create forms. Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax.

After entering the basic business information such as the. Annual record of federal tax liability 1220. Fill out your company information. Complete, edit or print tax forms instantly. Web form 945 instructions for 2022 1. These instructions give you some background information about form 945. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. As a major exception, if you withheld these taxes from the income of a foreign. They tell you who must file form 945, how to. Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020, and before april 1, 2021, that is remaining at the end of the year because it.

The checklist for the 2023 form 945 will be posted on the thomson reuters tax & accounting customer help center website at. Complete, edit or print tax forms instantly. What is irs form 945 and who should file them? This form is used to report withheld federal income tax. The due date to file form 945 for the tax year 2022 is january 31, 2023. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. Annual record of federal tax liability 1220. Web address as shown on form 945. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web what are the requirements and instructions for filing 945 form?

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

This form is used to report withheld federal income tax. Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest version of form 945, fully updated for tax year 2022. They tell you who must file form 945, how to. As a major exception, if you withheld these taxes from.

FORM 945 Instructions On How To File Form 945

Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. If you made deposits on time, in full. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. Web form 945 is somewhat uncommon, so.

Form 945 Annual Return of Withheld Federal Tax Form (2015

Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax. The checklist for the 2023 form 945 will be posted on the thomson reuters tax & accounting customer help center website at. Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest.

File Form 945 Online Efile 945 Form 945 2020 945 Schedule A

Web address as shown on form 945. This form is used to report withheld federal income tax. Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax. The checklist for the 2023 form 945 will be posted on the thomson reuters tax & accounting customer help center website at. As a major.

Form 945 Annual Return of Withheld Federal Tax Form (2015

These instructions give you some background information about form 945. Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Annual record of federal tax.

Instructions For Form 945 Annual Return Of Withheld Federal

The due date to file form 945 for the tax year 2022 is january 31, 2023. Use this form to report your federal tax liability (based on the dates payments were made or wages were. Upload, modify or create forms. This checklist applies to the 2022 form 945. These instructions give you some background information about form 945.

Form 945 Edit, Fill, Sign Online Handypdf

Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. Web when is form 945 due date for 2022 tax year? Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Web form 945 instructions for 2022 1. Complete, edit or.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

Fill out your company information. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 945,” and “2021” on your. Upload, modify or create forms. Web when is form 945 due date for 2022 tax year? After entering the basic business information such as the.

Form 945 Instructions Fill online, Printable, Fillable Blank

What is irs form 945 and who should file them? Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. Web form 945 instructions for 2022 1. These.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Web address as shown on form 945. Web if you withheld federal income tax from nonpayroll payments, you must file form 945. Complete, edit or print tax forms instantly. Upload, modify or create forms. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you.

Web What Are The Requirements And Instructions For Filing 945 Form?

Upload, modify or create forms. Web any credit for qualified sick and family leave wages paid in 2022 for leave taken after march 31, 2020, and before april 1, 2021, that is remaining at the end of the year because it. Web the irs has made available a draft 2022 form 945 annual return of withheld federal income tax. Web if you withheld federal income tax from nonpayroll payments, you must file form 945.

They Tell You Who Must File Form 945, How To.

Web 2022 12/07/2022 inst 945: Form 945 is an irs tax form that is required to be filed by business. Web form 945 is somewhat uncommon, so your payroll and tax software might not be able to file it for you. This form is used to report withheld federal income tax.

Annual Record Of Federal Tax Liability 1220.

If you made deposits on time, in full. What is irs form 945 and who should file them? The due date to file form 945 for the tax year 2022 is january 31, 2023. Web when is form 945 due date for 2022 tax year?

Use This Form To Report Your Federal Tax Liability (Based On The Dates Payments Were Made Or Wages Were.

After entering the basic business information such as the. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. Easily add and highlight text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or remove pages from. Web address as shown on form 945.