Form 965-B

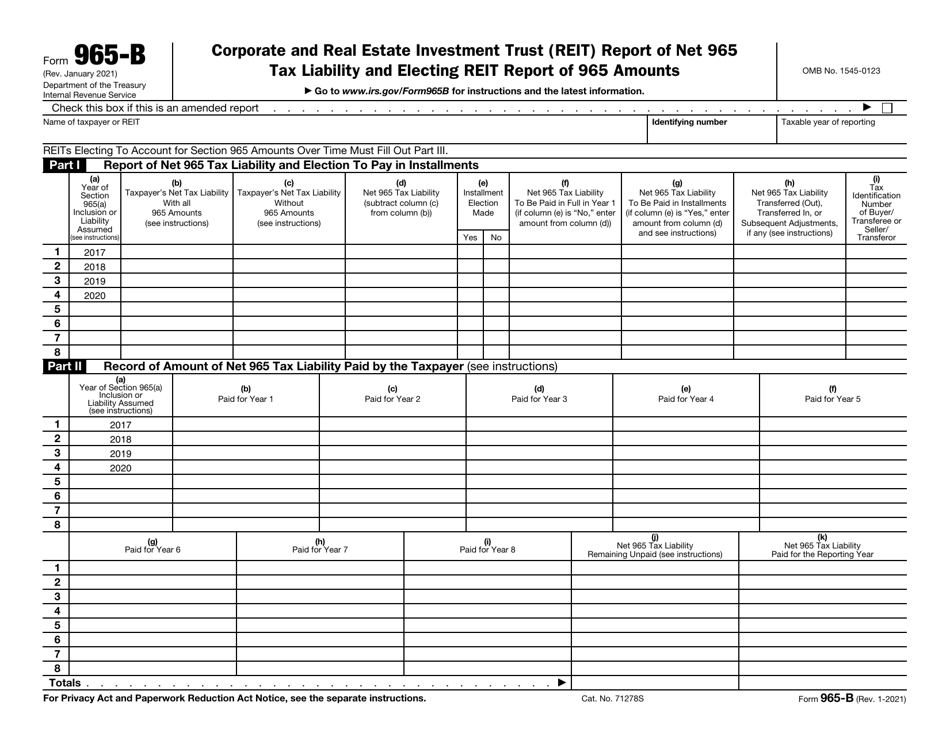

Form 965-B - If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. These and other forms and schedules are available on the irs website. In addition, this form is used to report the Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. The each tax year in which a taxpayer must pay or include section coronavirus aid, relief, and economic security act (cares 965 amounts. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. • section 965(a) inclusions (schedules a, b, and c). January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. A detailed description of the acceleration or triggering event;

These and other forms and schedules are available on the irs website. See the instructions for your income tax return for general information about electronic filing. If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. • section 965(a) inclusions (schedules a, b, and c). Web allocated in accordance with section 965(b) should file form 965. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. The each tax year in which a taxpayer must pay or include section coronavirus aid, relief, and economic security act (cares 965 amounts. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. A detailed description of the acceleration or triggering event;

Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. A detailed description of the acceleration or triggering event; Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. These and other forms and schedules are available on the irs website. Web electronic filing of form 965. See the instructions for your income tax return for general information about electronic filing. In addition, this form is used to report the

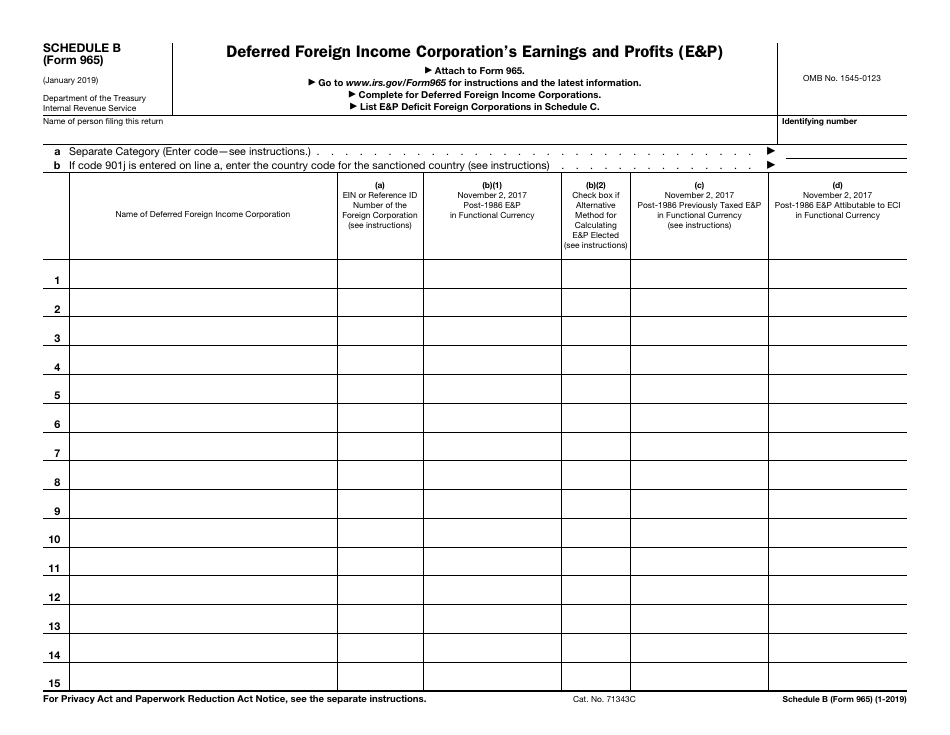

IRS Form 965 Schedule B Download Fillable PDF or Fill Online Deferred

In addition, this form is used to report the Web allocated in accordance with section 965(b) should file form 965. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until.

IRS Form 965B Download Fillable PDF or Fill Online Corporate and Real

These and other forms and schedules are available on the irs website. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information. See the instructions for your income tax return for general.

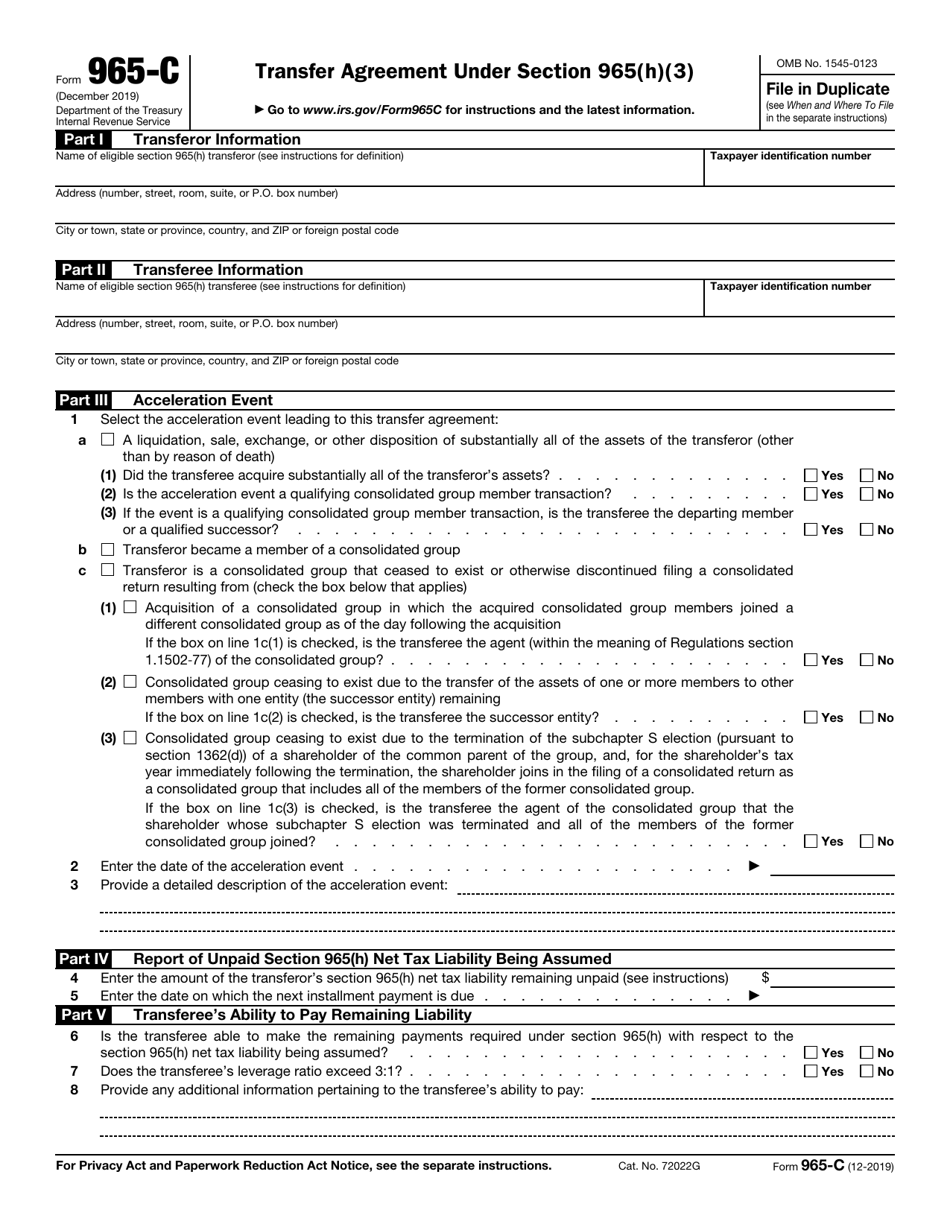

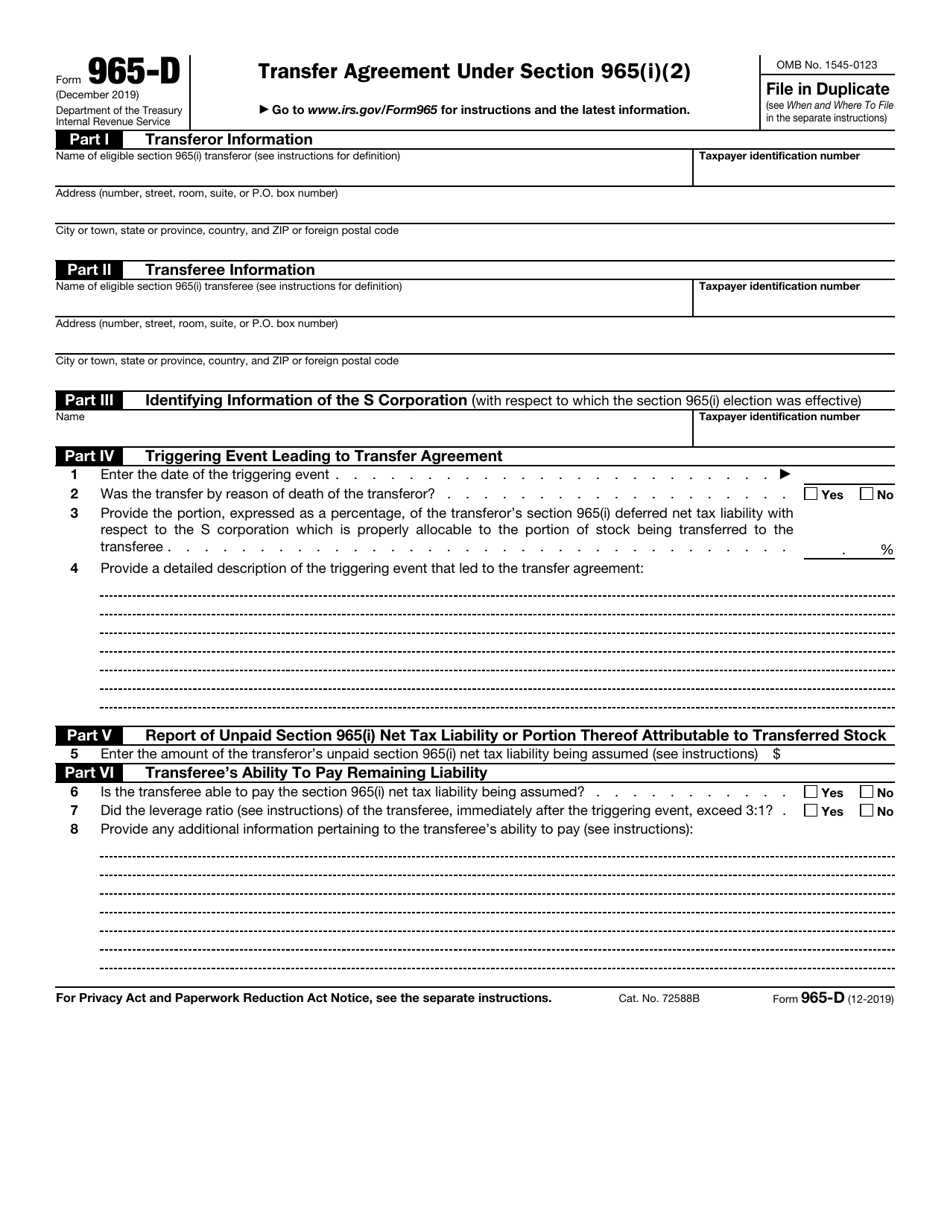

IRS Form 965C Download Fillable PDF or Fill Online Transfer Agreement

Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. A detailed description of the acceleration or triggering event; These and other forms.

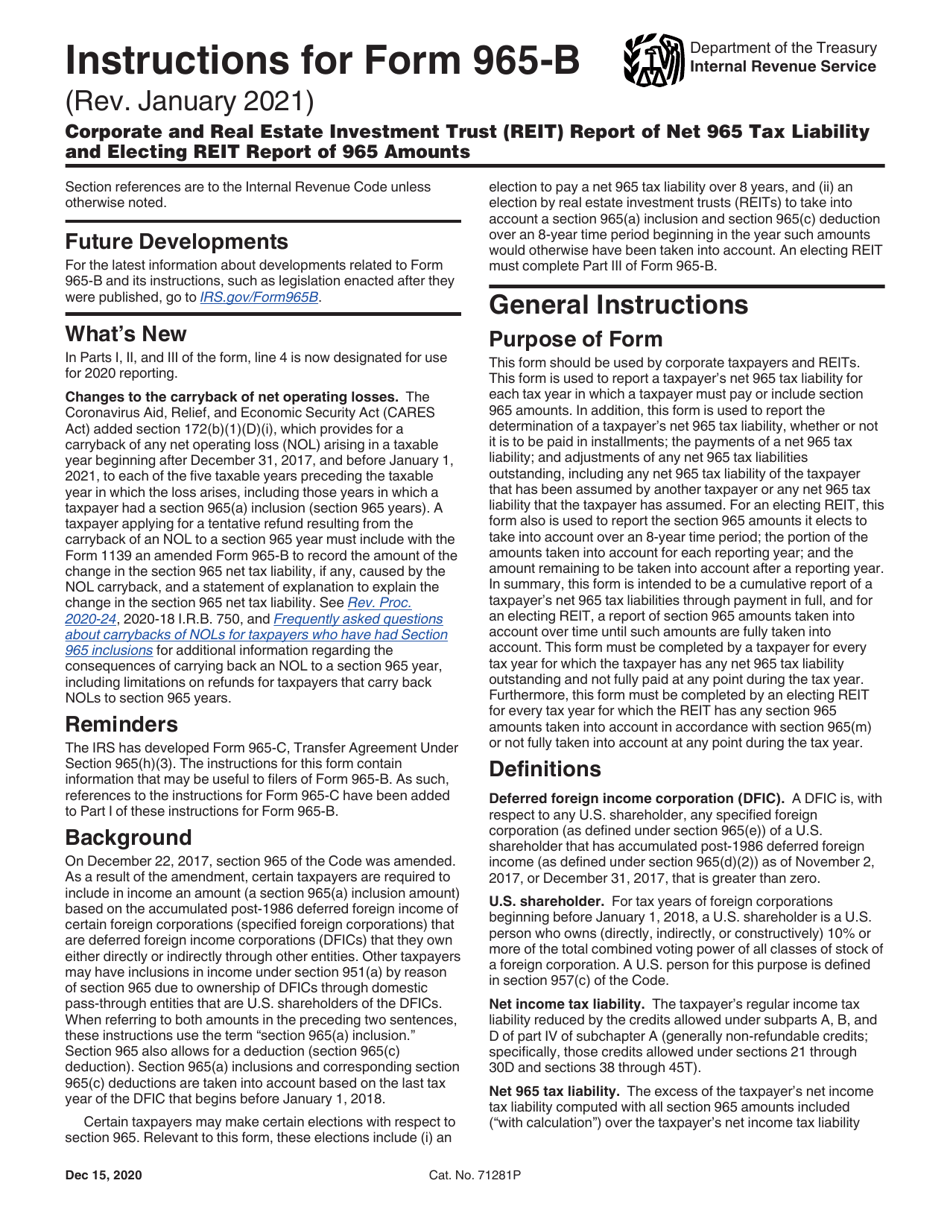

Download Instructions for IRS Form 965B Corporate and Real Estate

Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. In addition, this form is used to report the January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions.

IRS 3520A 2020 Fill out Tax Template Online US Legal Forms

If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities.

286 Real Estate Investment Trust Reit Stock Photos Free & Royalty

See the instructions for your income tax return for general information about electronic filing. In addition, this form is used to report the Web allocated in accordance with section 965(b) should file form 965. Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an.

IRS Form 965D Download Fillable PDF or Fill Online Transfer Agreement

A detailed description of the acceleration or triggering event; Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. In addition, this form is used to report the Web electronic filing of form 965. Web in summary, this form is intended to be a cumulative report of a.

Form 965 Instrument Flight Rules Pilot (Aeronautics)

• section 965(a) inclusions (schedules a, b, and c). These and other forms and schedules are available on the irs website. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts. In addition, this form is used to report the Web allocated in accordance with section 965(b) should file form 965.

Form 11b Five New Thoughts About Form 11b That Will Turn Your World

Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses. If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. Web in summary, this form is intended to be a cumulative report of a.

Form 11 Worksheet Five Things You Should Know Before Embarking On Form

The each tax year in which a taxpayer must pay or include section coronavirus aid, relief, and economic security act (cares 965 amounts. Web electronic filing of form 965. These and other forms and schedules are available on the irs website. Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of.

See The Instructions For Your Income Tax Return For General Information About Electronic Filing.

In addition, this form is used to report the Web in summary, this form is intended to be a cumulative report of a taxpayer’s net 965 tax liabilities through payment in full, and for an electing reit, a report of section 965 amounts taken into account over time until such amounts are fully taken into account. Web allocated in accordance with section 965(b) should file form 965. Shareholders of a dfic should use schedules a, b, and c to calculate section 965(a) inclusion amounts.

A Detailed Description Of The Acceleration Or Triggering Event;

• section 965(a) inclusions (schedules a, b, and c). If you file your income tax return electronically, form 965 and separate schedules f and h are filed with the electronic income tax return. These and other forms and schedules are available on the irs website. January 2021) corporate and real estate investment trust (reit) report of net 965 tax liability and electing reit report of 965 amounts department of the treasury internal revenue service go to www.irs.gov/form965b for instructions and the latest information.

The Each Tax Year In Which A Taxpayer Must Pay Or Include Section Coronavirus Aid, Relief, And Economic Security Act (Cares 965 Amounts.

Web electronic filing of form 965. Web this form is used to report a taxpayer’s net 965 tax liability for changes to the carryback of net operating losses.