Form 966 Code Section Dissolution

Form 966 Code Section Dissolution - Not every corporation that is undergoing liquidation or dissolution must file the form 966. Web instructions section references are to the internal revenue code unless otherwise noted. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. Web the application uses this information to determine the due date for filing form 966. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Upload, modify or create forms. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Try it for free now! You can download or print. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to.

Web the application uses this information to determine the due date for filing form 966. As provided by the irs: Web within 30 days of the resolution adopted, an irs form 966 must be filed. The basic penalty for failing to file a form 966 within 30 days of. Web go to screen 57, dissolution/liquidation (966). Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. Web form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Along with the form, you must send in a certified copy of the director's resolution. Web within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation.

If the resolution or plan is amended or supplemented after form. Web the application uses this information to determine the due date for filing form 966. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. “a corporation (or a farmer’s. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to. Web who must file form 966? Web within 30 days after the adoption of any resolution or plan for or in respect of the dissolution of a corporation or the liquidation of the whole or any part of its capital stock,. Attach a copy of the dissolution plan for. Complete all other necessary entries for form 966. Web within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation.

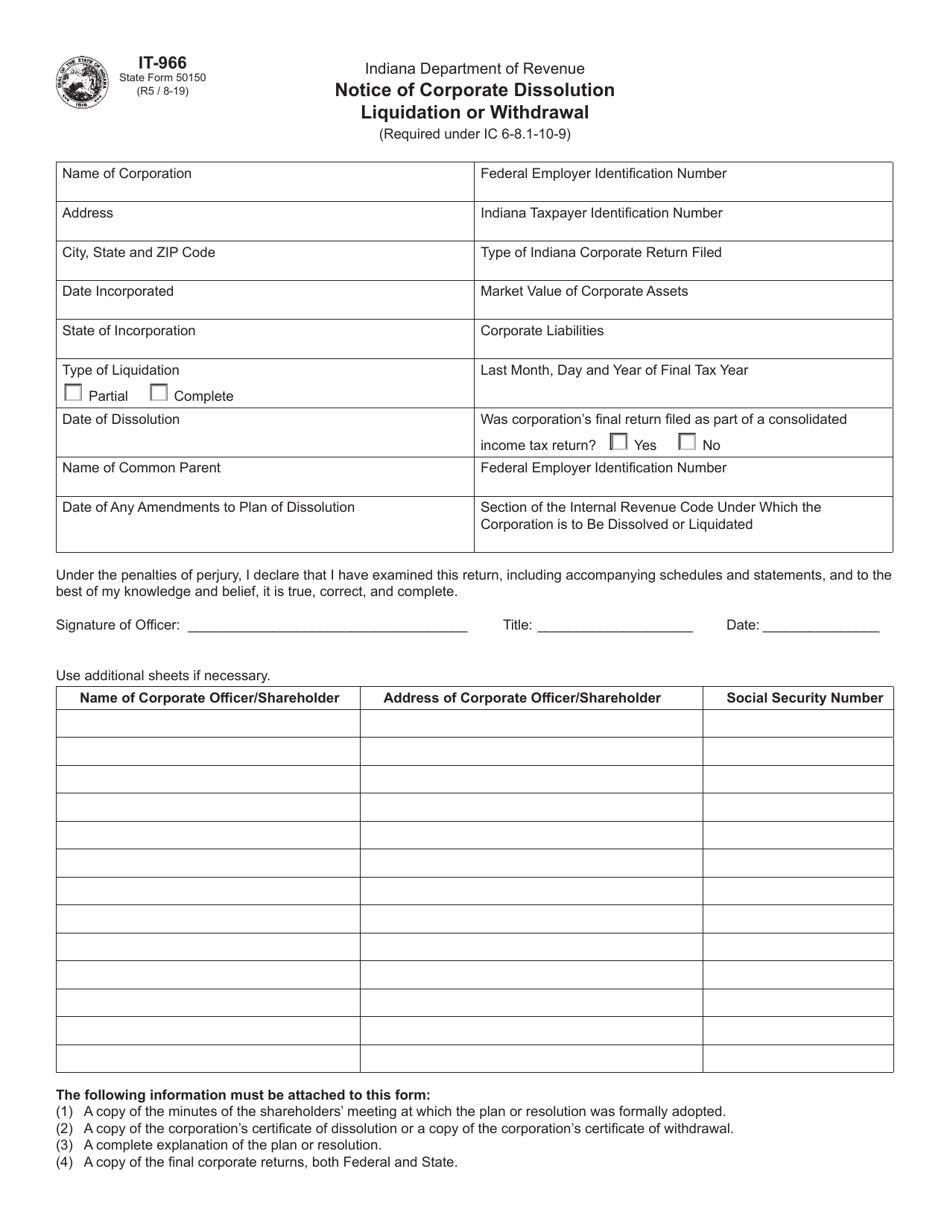

Form IT966 (State Form 50150) Download Fillable PDF or Fill Online

Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Not every corporation that is undergoing liquidation or dissolution must file the form 966. Web instructions section references are to the internal revenue code unless otherwise noted. Check the box labeled print form.

Code 960966 Global Diary

Upload, modify or create forms. Web form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web within 30 days of the resolution adopted, an irs form 966 must be filed. Section under which the corporation is to be dissolved or liquidated enter the internal revenue. Web they.

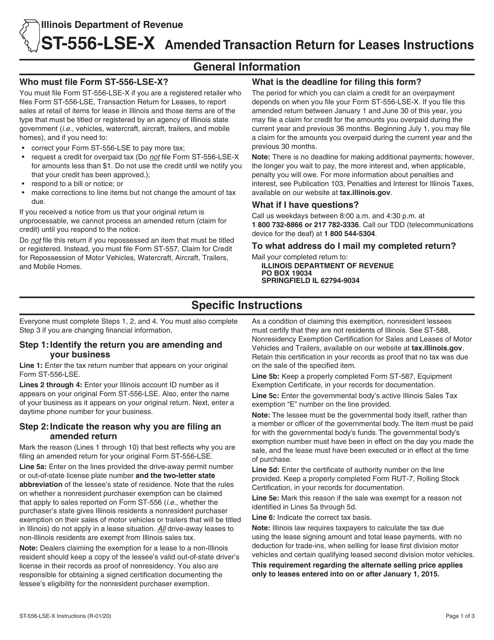

Download Instructions for Form ST556LSEX, 966 Amended Transaction

Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to. Web the application uses this information to determine the due date for filing form 966. Form 966 is filed with the internal. Web they must file form.

Business Concept about Form 966 Corporate Dissolution or Liquidation

Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. “a corporation (or a farmer’s. Along with the form, you must send in a certified copy of the director's resolution. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a. Section under which the corporation is to.

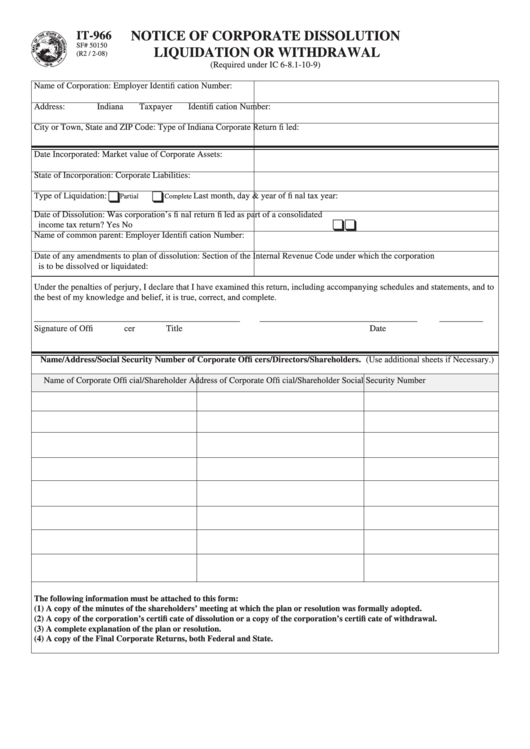

Fillable Form It966 Notice Of Corporate Dissolution Liquidation Or

You can download or print. Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. Section under which the corporation is to be dissolved or liquidated enter the internal revenue. Check the box labeled print form 966 with complete return. Web in addition, the corporation must attach to the form 966 a certified.

Revised Corporation Code Dissolution YouTube

Web we last updated the corporate dissolution or liquidation in february 2023, so this is the latest version of form 966, fully updated for tax year 2022. Along with the form, you must send in a certified copy of the director's resolution. Web are you going to dissolve your corporation during the tax year? Section under which the corporation is.

Form 12.901b2 Dissolution of Marriage with Property But No Children

Along with the form, you must send in a certified copy of the director's resolution. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Attach a copy of the dissolution plan for. Web go to screen 57, dissolution/liquidation (966). Upload, modify or create.

Form 966 (Rev PDF Tax Return (United States) S Corporation

Complete all other necessary entries for form 966. Web within 30 days of the resolution adopted, an irs form 966 must be filed. Check the box labeled print form 966 with complete return. Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. Web form 966 must be filed within 30 days after.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Attach a copy of the dissolution plan for. Web who must file form 966? The basic penalty for failing to file a form 966 within 30 days of. Complete all other necessary entries for form 966. If the resolution or plan is amended or supplemented after form.

Form 966 Corporate Dissolution or Liquidation (2010) Free Download

Attach a copy of the dissolution plan for. Form 966 is filed with the internal. Web within 30 days of the vote to dissolve an s corporation, you must submit a completed form 966 corporation dissolution or liquidation. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or.

Not Every Corporation That Is Undergoing Liquidation Or Dissolution Must File The Form 966.

Web who must file form 966? Web section 6653(c) of the internal revenue code defines the penalties for failing to file form 966. Web form 966 corporate dissolution or liquidation can be generated by checking the box, print form 966 with complete return in screen 51, corporate. Web are you going to dissolve your corporation during the tax year?

Form 966 Is Filed With The Internal.

Attach a copy of the dissolution plan for. Web in addition, the corporation must attach to the form 966 a certified copy of the “resolution or plan.” all states have procedures that must be followed when a decision is made to. Web form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. As provided by the irs:

Make Sure To File Irs Form 966 After You Adopt A Plan Of Dissolution For The Corporation.

Complete all other necessary entries for form 966. If the resolution or plan is amended or supplemented after form. The basic penalty for failing to file a form 966 within 30 days of. Who must file corporation (or a farmer’s cooperative) must file form 966 if it adopts a.

“A Corporation (Or A Farmer’s.

Upload, modify or create forms. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web the application uses this information to determine the due date for filing form 966. Check the box labeled print form 966 with complete return.