Form 990 Ez 2019

Form 990 Ez 2019 - Department of the treasury internal revenue service. Ad access irs tax forms. Short form return of organization exempt from income tax. Form 990 (2019) sign here paid preparer use only under penalties of perjury, i declare that i. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. This form is commonly used by eligible organizations to file an. Under section 501(c), 527, or 4947(a)(1) of the. Form 4562 (2017) (a) classification of property (e). Short form return of organization exempt from income tax.

For tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. Web solved • by intuit • 66 • updated 1 year ago. M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,. Get ready for tax season deadlines by completing any required tax forms today. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7),. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Department of the treasury internal revenue service. Form 4562 (2017) (a) classification of property (e). This form is commonly used by eligible organizations to file an. Short form return of organization exempt from income tax.

Short form return of organization exempt from income tax. Department of the treasury internal revenue service. Form 4562 (2017) (a) classification of property (e). Ad access irs tax forms. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Get ready for tax season deadlines by completing any required tax forms today. Short form return of organization exempt from income tax. This form is commonly used by eligible organizations to file an. Department of the treasury internal revenue service. Form 990 (2019) sign here paid preparer use only under penalties of perjury, i declare that i.

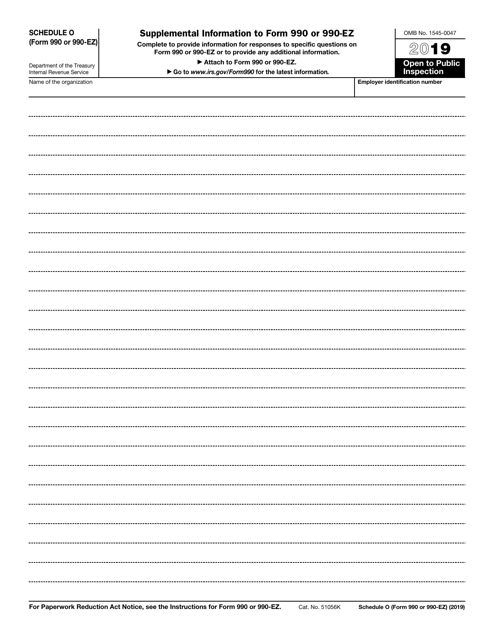

IRS Form 990 (990EZ) Schedule O Download Fillable PDF or Fill Online

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Under section 501(c), 527, or 4947(a)(1) of the. This form is commonly used by eligible organizations to file an. If gross receipts are $200,000 or more, or if total assets (part il, column.

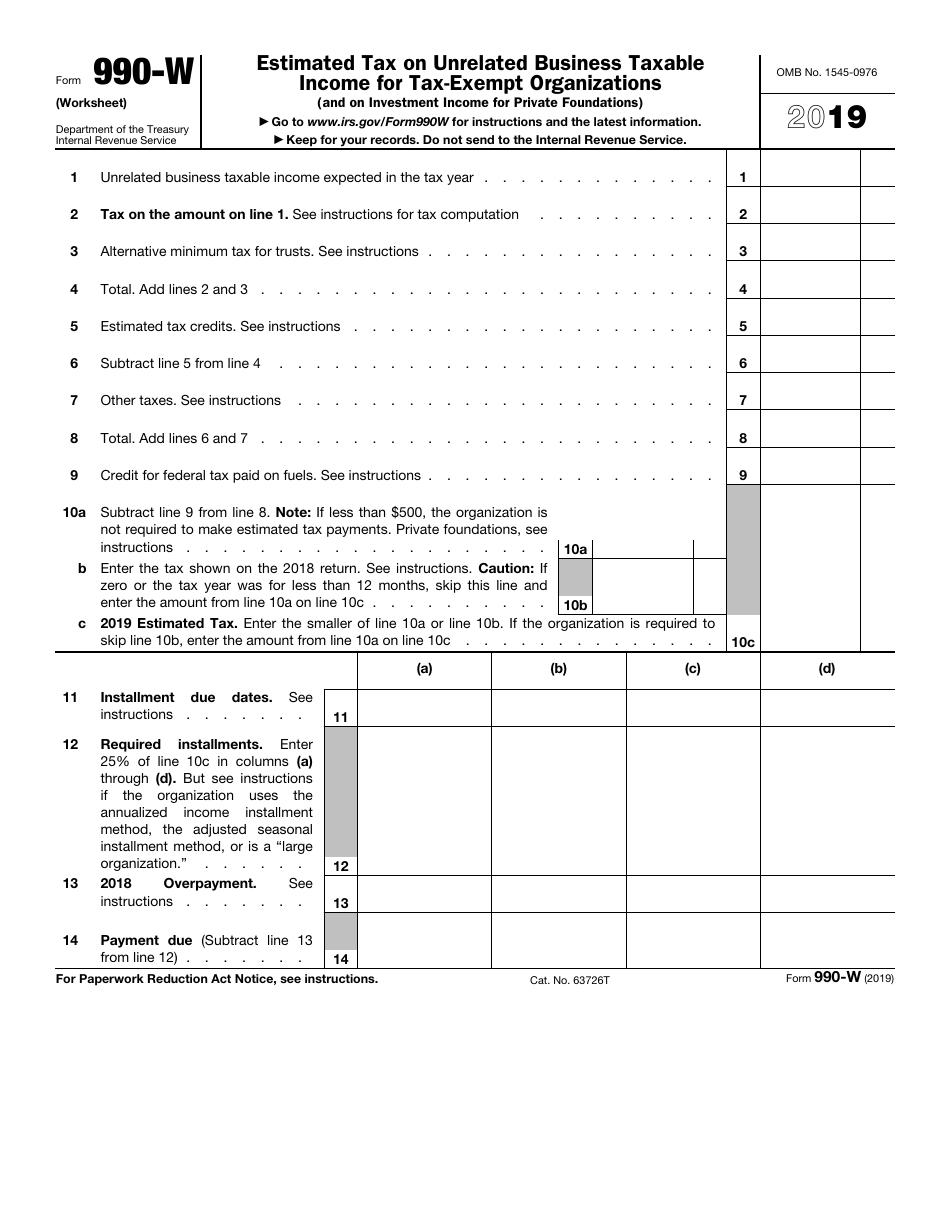

IRS Form 990W Download Fillable PDF or Fill Online Estimated Tax on

Under section 501(c), 527, or 4947(a)(1) of the. Web solved • by intuit • 66 • updated 1 year ago. Get ready for tax season deadlines by completing any required tax forms today. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Department of the treasury internal revenue service.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. Department of the treasury internal revenue service. Web solved • by intuit • 66 • updated 1 year ago. Form 990 (2019) sign here paid preparer use only under penalties of perjury, i declare that i. From part i exclusively.

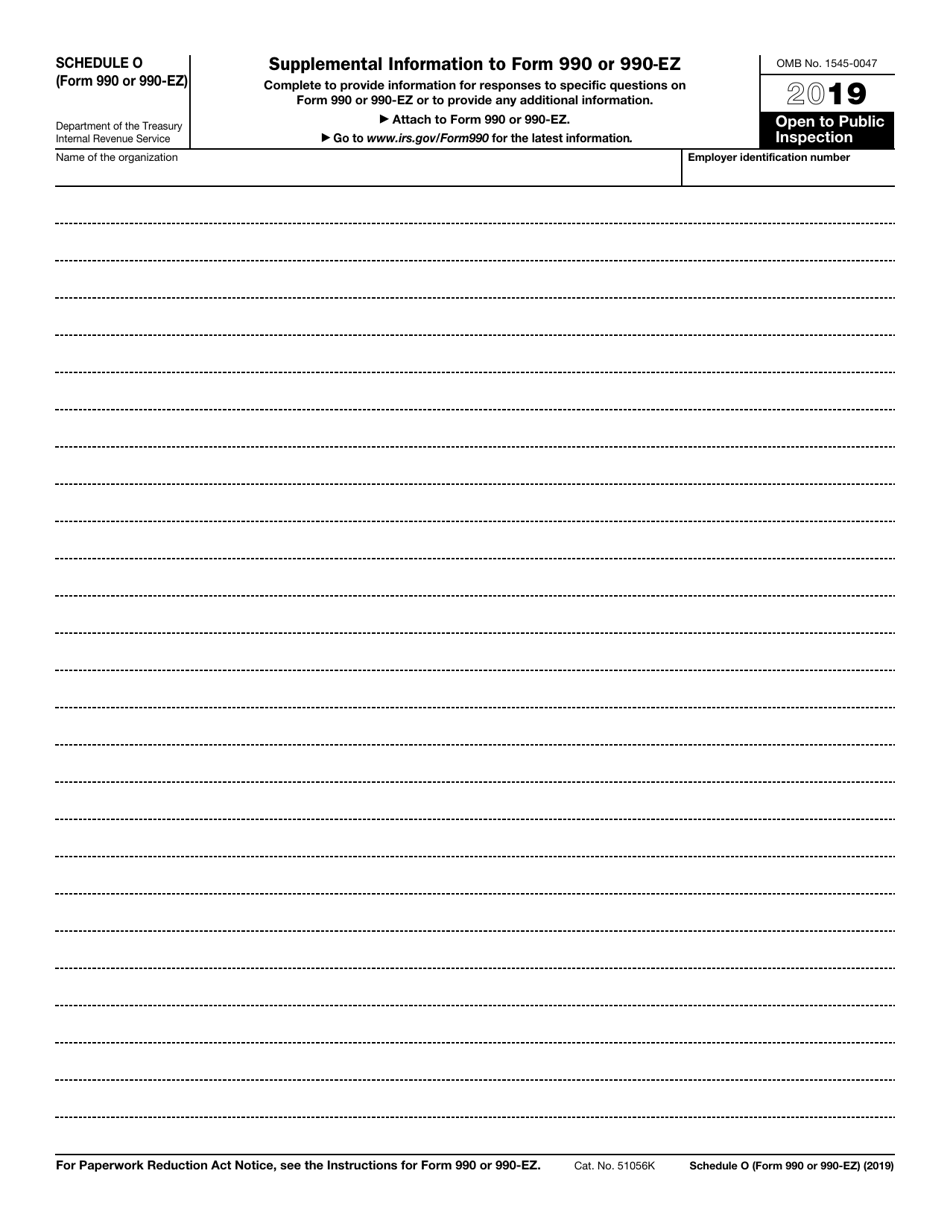

IRS Form 990 (990EZ) Schedule O Download Fillable PDF or Fill Online

Get ready for tax season deadlines by completing any required tax forms today. Under section 501(c), 527, or 4947(a)(1) of the. Department of the treasury internal revenue service. For tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine.

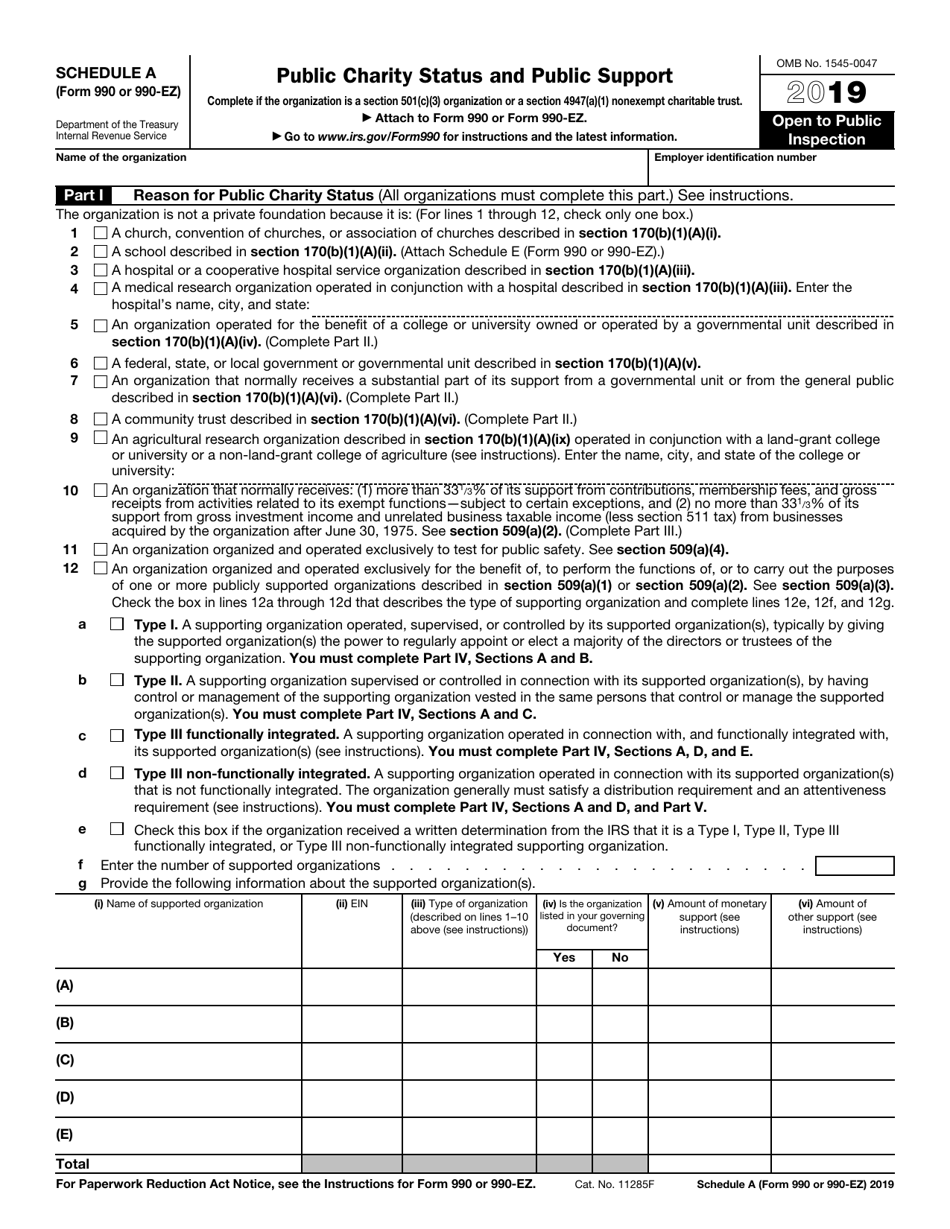

IRS Form 990 (990EZ) Schedule A Download Fillable PDF or Fill Online

Under section 501(c), 527, or 4947(a)(1) of the. This form is commonly used by eligible organizations to file an. Short form return of organization exempt from income tax. Form 990 (2019) sign here paid preparer use only under penalties of perjury, i declare that i. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine.

Form 990EZ Instructions 2021 Form 990EZ Filing instructions

Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Under section 501(c), 527, or 4947(a)(1) of the. Form 990 (2019) sign here paid preparer use only under penalties of perjury, i declare that i. Department of the treasury internal revenue service. Web solved • by intuit • 66 • updated 1 year.

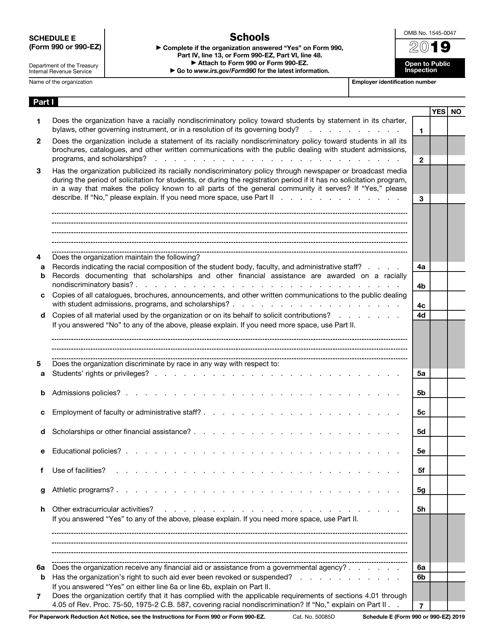

IRS Form 990 (990EZ) Schedule E Download Fillable PDF or Fill Online

M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,. Department of the treasury internal revenue service. Web ez.

Who Must File Form 990, 990EZ or 990N YouTube

If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. M m m m m m m m m m m m m m m m m m m.

Form 990 or 990EZ Schedule E 2019 2020 Blank Sample to Fill out

Short form return of organization exempt from income tax. Short form return of organization exempt from income tax. Ad download or email irs 990ez & more fillable forms, register and subscribe now! From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7),. Form 4562 (2017) (a) classification of property (e).

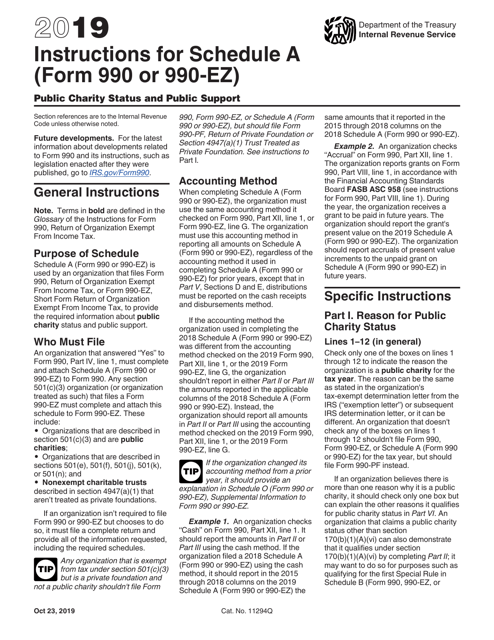

Download Instructions for IRS Form 990, 990EZ Schedule A Public

For tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7),. Department of the treasury internal revenue service. Department of the treasury internal revenue service. Form 4562 (2017) (a) classification of property (e).

Complete, Edit Or Print Tax Forms Instantly.

Form 990 (2019) sign here paid preparer use only under penalties of perjury, i declare that i. Department of the treasury internal revenue service. Ad download or email irs 990ez & more fillable forms, register and subscribe now! Short form return of organization exempt from income tax.

Web Solved • By Intuit • 66 • Updated 1 Year Ago.

If gross receipts are $200,000 or more, or if total assets (part il, column (b)) are $500,000 or more, file. Form 4562 (2017) (a) classification of property (e). This form is commonly used by eligible organizations to file an. M m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m m yes no if yes,.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Department of the treasury internal revenue service. Web ez (2019) l add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Short form return of organization exempt from income tax. From part i exclusively religious, charitable, etc., contributions to organizations described in section 501(c)(7),.

Ad Access Irs Tax Forms.

For tax years beginning on or after july 2, 2019, exempt organizations must electronically file their returns. Under section 501(c), 527, or 4947(a)(1) of the.