Form 990 Schedule C

Form 990 Schedule C - Web c d e total. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Web organizations that are exempt under irc § 501(c)(4), (c)(5), and (c)(6) may lobby or engage in political activities without losing their exempt status, however, they. Public charity status and public support. Extracted financial data is not available for this tax period, but form 990 documents are. • section 501(c) organizations, and • section 527 organizations. Complete, edit or print tax forms instantly. As you can tell from its title, profit or loss from business, it´s used to report both income and losses. Read the irs instructions for 990 forms. Web what is the purpose of form 990 schedule c?

Web instructions for form 990. Schedule d (form 990) 2021 (continued) (column (d) must equal form 990, part x, column (b), line 10c.) two years back three years back four years back. Web organizations that are exempt under irc § 501(c)(4), (c)(5), and (c)(6) may lobby or engage in political activities without losing their exempt status, however, they. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. If you checked 12d of part i, complete sections a and d, and complete part v.). Ad get ready for tax season deadlines by completing any required tax forms today. Read the irs instructions for 990 forms. Section 501 (c) (4) and 501 (c) (6) organizations will not have. Web review a list of form 990 schedules with instructions. This schedule is to provide required information about public charity status and public support.

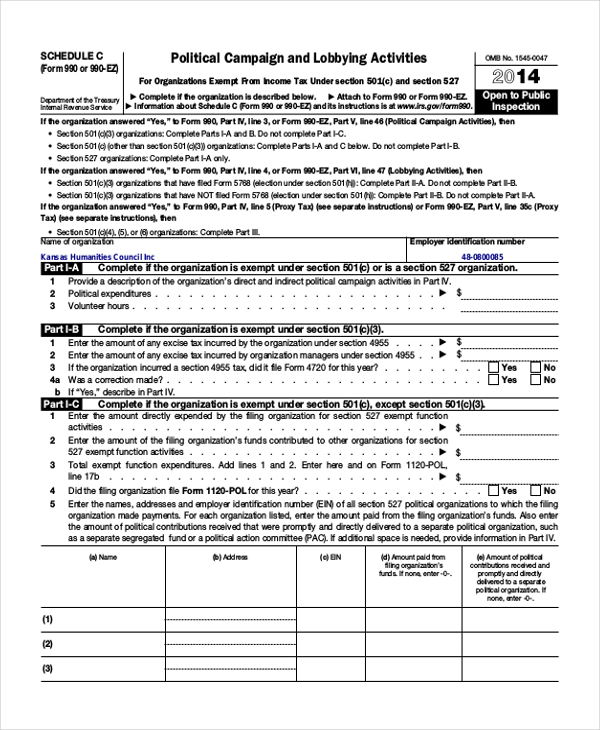

Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. Schedule c is used by certain nonprofit organizations to report additional information about their political campaign. Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. The following schedules to form 990, return of organization exempt from income tax, do not have separate. • section 501(c) organizations, and • section 527 organizations. Ad get ready for tax season deadlines by completing any required tax forms today. If you checked 12d of part i, complete sections a and d, and complete part v.). Section 501 (c) (4) and 501 (c) (6) organizations will not have. Complete, edit or print tax forms instantly.

Electronic IRS Form 990 (Schedule K) 2018 2019 Printable PDF Sample

Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Web 990 (filed on nov. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Web c d e total. Web schedule c is.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Ad get ready for tax season deadlines by completing any required tax forms today. Schedule c is used by certain nonprofit organizations to report additional information about their political campaign. Read the irs instructions for 990 forms. If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule a (form 990).

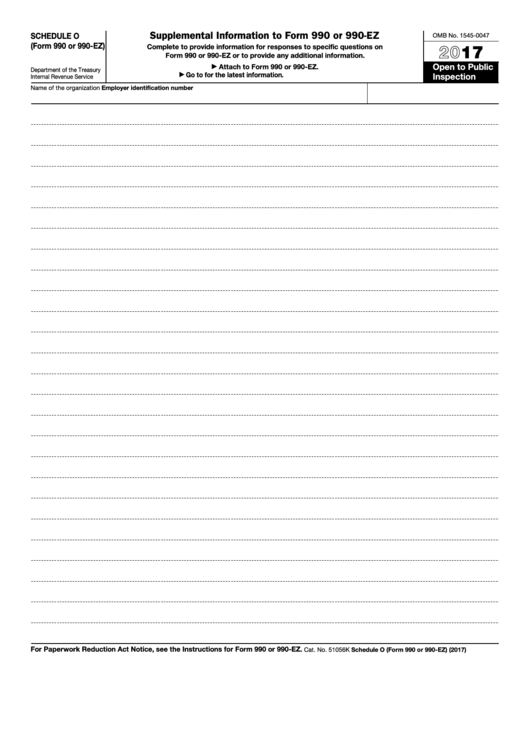

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or. This schedule is to provide required information about public charity status and public support. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web.

Online IRS Form 990 (Schedule I) 2018 2019 Fillable and Editable

(column (b) must equal form 990, part x, col. Web organizations that are exempt under irc § 501(c)(4), (c)(5), and (c)(6) may lobby or engage in political activities without losing their exempt status, however, they. Ad get ready for tax season deadlines by completing any required tax forms today. Web nonprofit explorer has organizations claiming tax exemption in each of.

IRS Form 990 (Schedule J) 2018 2019 Fill out and Edit Online PDF

Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. Web c d e total. Web schedule a.

Form 990 (Schedule R) 2019 Blank Sample to Fill out Online in PDF

Web schedule a (form 990). Web schedule c (form 990) 2022 page check if the filing organization belongs to an affiliated group (and list in part iv each affiliated group member’s name, address, ein, expenses,. Complete, edit or print tax forms instantly. Web instructions for form 990. Web nonprofit explorer has organizations claiming tax exemption in each of the 27.

Nonprofit Tax Tidbits Form 990 Schedule C Hawkins Ash CPAs

Read the irs instructions for 990 forms. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. This schedule is to provide required information about public charity status and public support. Section 501 (c) (4) and 501 (c) (6) organizations will not have. Web after a.

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Web instructions for form 990. Extracted financial data is not available for this tax period, but form 990 documents are. If you checked 12d of part i, complete sections a and d, and complete part v.). Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under..

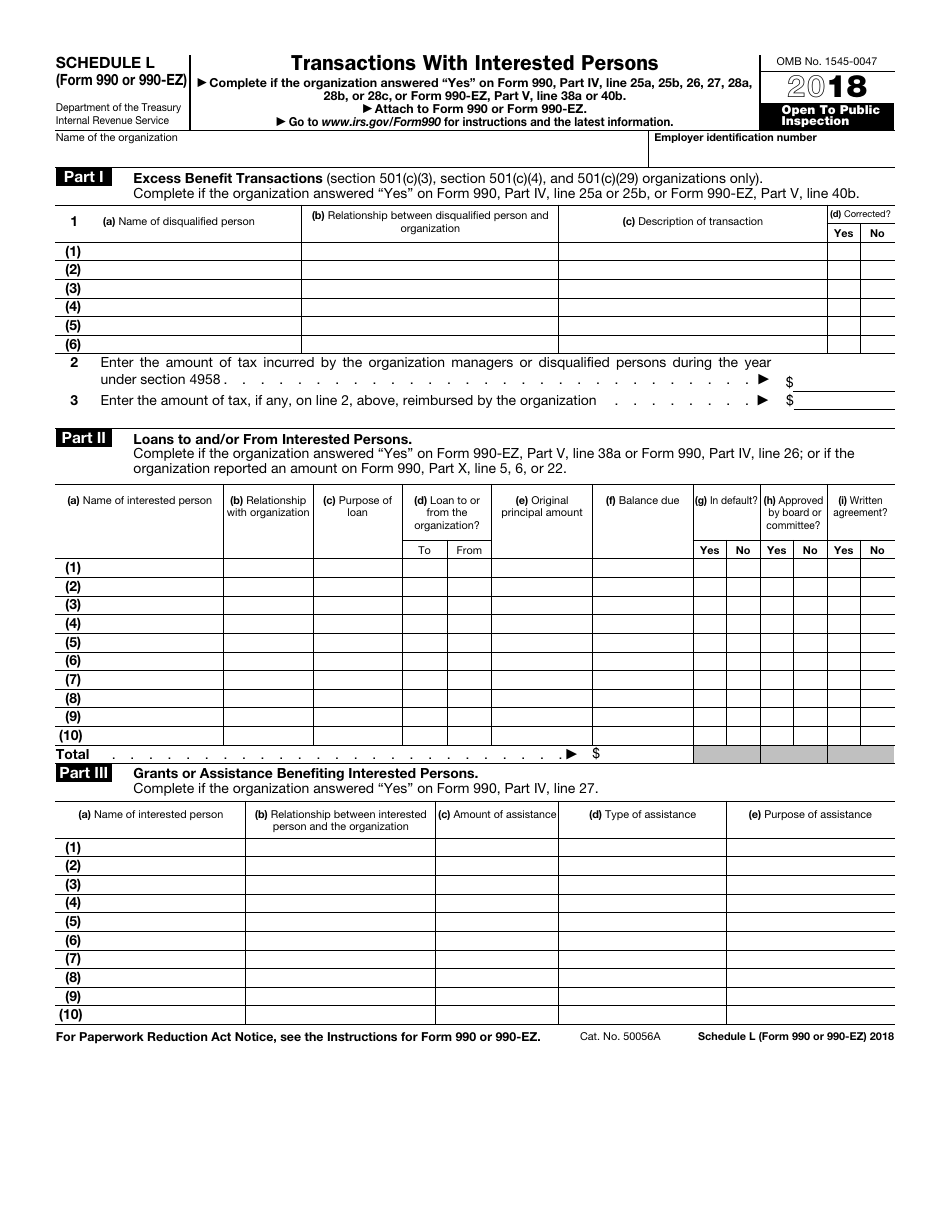

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Public charity status and public support. Web instructions for form 990. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Web nonprofit.

Download Instructions for IRS Form 990, 990EZ Schedule C Political

Web instructions for form 990. Section 501 (c) (4) and 501 (c) (6) organizations will not have. • section 501(c) organizations, and • section 527 organizations. Read the irs instructions for 990 forms. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total.

As You Can Tell From Its Title, Profit Or Loss From Business, It´s Used To Report Both Income And Losses.

Web schedule c is used by section 501 (c) organizations and section 527 organizations to furnish additional information on political campaign activities or. Web schedule r (form 990) 2022 related organizations and unrelated partnerships department of the treasury internal revenue service complete if the organization. The following schedules to form 990, return of organization exempt from income tax, do not have separate. Web schedule c is the tax form filed by most sole proprietors.

Web Schedule C (Form 990) 2022 Page Check If The Filing Organization Belongs To An Affiliated Group (And List In Part Iv Each Affiliated Group Member’s Name, Address, Ein, Expenses,.

• section 501(c) organizations, and • section 527 organizations. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Extracted financial data is not available for this tax period, but form 990 documents are. Purpose of schedule schedule c (form 990) is used by:

Read The Irs Instructions For 990 Forms.

Complete, edit or print tax forms instantly. Web schedule c (form 990) department of the treasury internal revenue service political campaign and lobbying activities for organizations exempt from income tax under. Ad get ready for tax season deadlines by completing any required tax forms today. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or.

Web Instructions For Form 990.

Schedule c is used by certain nonprofit organizations to report additional information about their political campaign. Public charity status and public support. Section 501 (c) (4) and 501 (c) (6) organizations will not have. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or.