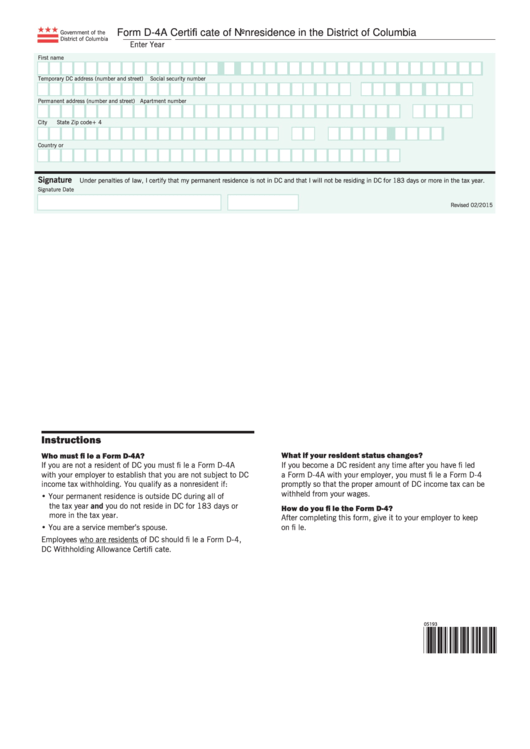

Form D-4A

Form D-4A - Show details we are not affiliated with any brand or entity on this form. Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: Signature date revised 12/2016 instructions Web office of tax and revenue. The irs uses this form to notify the district of columbia (d.c.) to not deduct taxes from your wages because you do not live in d.c. Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. I have never live in dc, i live in va, but currently i am working in dc. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. My question is what do i have to put in the question that say, temporary dc address in that form if i have never live in dc. You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases.

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Ask the chief financial officer. Signature date revised 12/2016 instructions You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases. Web office of tax and revenue. I have never live in dc, i live in va, but currently i am working in dc. Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. 1101 4th street, sw, suite 270 west, washington, dc 20024.

1101 4th street, sw, suite 270 west, washington, dc 20024. Once filed with your employer, it will remain in effect until you file a new certificate. Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to: Monday to friday, 9 am to 4 pm, except district holidays. How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Ask the chief financial officer. I have never live in dc, i live in va, but currently i am working in dc. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s.

Form 4A YouTube

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Monday to friday, 9 am to 4 pm, except district holidays. You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases. The irs.

Form 4A, Form 4C, Form 4D, Form 5, Form 5/TS, Form 6, Form Form

I have never live in dc, i live in va, but currently i am working in dc. Web office of tax and revenue. 1101 4th street, sw, suite 270 west, washington, dc 20024. The irs uses this form to notify the district of columbia (d.c.) to not deduct taxes from your wages because you do not live in d.c. Once.

20162022 Form DC D4A Fill Online, Printable, Fillable, Blank pdfFiller

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Monday to friday, 9 am to 4 pm, except district holidays. Show details we are not affiliated with any brand or entity on this form. I have never live in dc, i live.

FORM_4A Public Law Justice

The irs uses this form to notify the district of columbia (d.c.) to not deduct taxes from your wages because you do not live in d.c. Show details we are not affiliated with any brand or entity on this form. Ask the chief financial officer. Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: You may.

4A Notice of Unsatisfactory Work Padded Forms

Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. Web office of tax and revenue. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state.

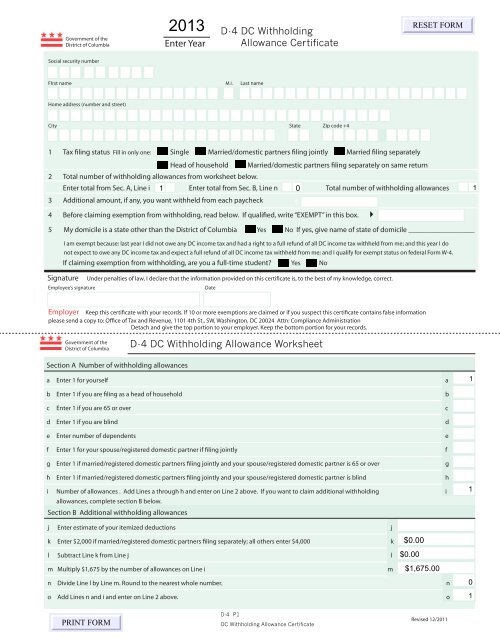

State Tax Forms 2013

Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. Once filed with your employer, it will remain in effect until you file a new certificate. Web office of tax and revenue. Last name temporary dc.

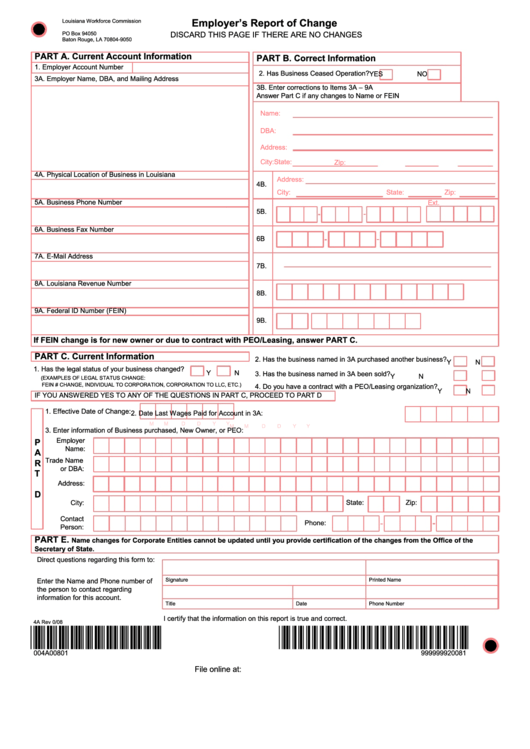

Form 4a Employer'S Report Of Change 2008 printable pdf download

Web office of tax and revenue. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. 1101 4th street, sw, suite 270 west, washington, dc 20024. Once filed with your employer, it will remain in effect until you file a new certificate. How.

P&D 4A YouTube

1101 4th street, sw, suite 270 west, washington, dc 20024. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Office of tax and revenue, 1101 4th st., sw, washington, dc 20024 attn: Monday to friday, 9 am to 4 pm, except district.

最炫民族风(蓝调版)钢琴谱 五线谱—凤凰传奇

I have never live in dc, i live in va, but currently i am working in dc. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Ask the chief financial officer. You may file a new withholding allowance certificate any time the.

Form D4a Certificate Of Nonresidence In The District Of Columbia

I have never live in dc, i live in va, but currently i am working in dc. How it works browse for the d 4a temporary dc address customize and esign d 4a send out signed dc d certificate or print it Show details we are not affiliated with any brand or entity on this form. Signature date revised 12/2016.

I Have Never Live In Dc, I Live In Va, But Currently I Am Working In Dc.

You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases. Once filed with your employer, it will remain in effect until you file a new certificate. 1101 4th street, sw, suite 270 west, washington, dc 20024. Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s.

Office Of Tax And Revenue, 1101 4Th St., Sw, Washington, Dc 20024 Attn:

Commonwealth signature under penalties of law, i certify that my permanent residence is not in dc and that i will not be residing in dc for 183 days or more in the tax year. Show details we are not affiliated with any brand or entity on this form. Signature date revised 12/2016 instructions If 10 or more exemptions are claimed or if you suspect this certificate contains false information please send a copy to:

How It Works Browse For The D 4A Temporary Dc Address Customize And Esign D 4A Send Out Signed Dc D Certificate Or Print It

Last name temporary dc address (number and street) social security number permanent address (number and street) apartment number city state zip code + 4 country or u.s. Web office of tax and revenue. The irs uses this form to notify the district of columbia (d.c.) to not deduct taxes from your wages because you do not live in d.c. Monday to friday, 9 am to 4 pm, except district holidays.

Ask The Chief Financial Officer.

My question is what do i have to put in the question that say, temporary dc address in that form if i have never live in dc.