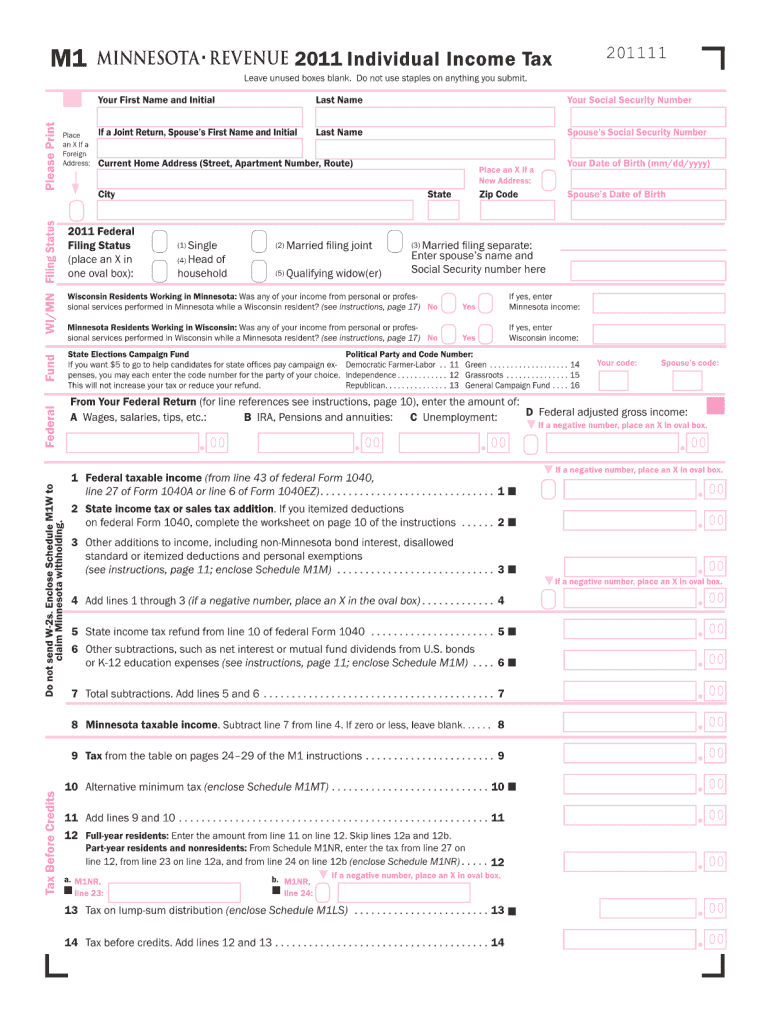

Form M1Pr 2021

Form M1Pr 2021 - Enter the full amount from line 1 of your 2021 statement of. Web up to $40 cash back m1pr form is a tax form used in the state of minnesota, united states. We'll make sure you qualify, calculate your minnesota. Web your 2020 form m1pr should be mailed, delivered, or electronically filed with the department by august 13, 2021. You will not receive a refund if your return is filed or the. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund *215211* 2021 form m1pr, homestead credit refund (for homeowners) and. Minnesota allows a property tax credit to renters and homeowners who were residents or. Web the last day you can file your 2021 m1pr return is august 15, 2023. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund. Web you are allowed a tax deduction on federal schedule a for real estate taxes you paid in 2021.

Enter the full amount from line 1 of your 2021 statement of. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. Web you are allowed a tax deduction on federal schedule a for real estate taxes you paid in 2021. You will not receive a refund if your return is filed or the. Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. For these taxes on a 2020 form. Web the minnesota department of revenue nov. Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund *215211* 2021 form m1pr, homestead credit refund (for homeowners) and.

For these taxes on a 2020 form. If you received a property tax refund. Minnesota allows a property tax credit to renters and homeowners who were residents or. You will not receive a refund if your return is filed or the. *215211* 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial. We'll make sure you qualify, calculate your minnesota. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web the last day you can file your 2021 m1pr return is august 15, 2023. 24 published the final draft of guidance and instructions for 2021 form m1pr, homestead credit refund (for. Your first name and initial last name your social security number your date.

Property Tax Refund State Of Minnesota WOPROFERTY

Web the minnesota department of revenue nov. Web the last day you can file your 2021 m1pr return is august 15, 2023. Web 2023 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *235211* your code spouse’s code state elections campaign fund: Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund.

Mn Tax Forms 2021 Printable Printable Form 2022

Enter the full amount from line 1 of your 2021 statement of. If you are filing as a renter, include any certificates of. Web the minnesota department of revenue nov. We'll make sure you qualify, calculate your minnesota. Web 2023 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *235211* your code spouse’s code state elections.

Fill Free fillable 2020 Form M1PR, Homestead Credit Refund (for

Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner for the home. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund *215211* 2021 form m1pr, homestead credit refund (for homeowners) and. This form is filed by minnesota residents. Web your 2020 form m1pr should.

Fill Free fillable M1pr 19 2019 M1PR, Property Tax Refund Return PDF form

If you received a property tax refund. Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. Yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code.

Fill Free fillable American Immigration Lawyers Association PDF forms

Web 2022 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund. Web 2023 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *235211* your code spouse’s code state elections campaign fund: The refund is not shown within the refund calculator on the main screen. Web ssi 10 political party code numbers: Enter the.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Web the last day you can file your 2021 m1pr return is august 15, 2023. Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. We'll make sure you qualify, calculate your minnesota. Web up to $40 cash back m1pr form is a tax form used in the state of minnesota, united states. Web.

M1Pr Form 2014 Fill Out and Sign Printable PDF Template signNow

You will not receive a refund if your return is filed or the. Web you are allowed a tax deduction on federal schedule a for real estate taxes you paid in 2021. Your first name and initial last name your social security number your date. Web the last day you can file your 2021 m1pr return is august 15, 2023..

Fillable Form M1pr Homestead Credit Refund (For Homeowners) And

You will not receive a refund if your return is filed or the. This form is for income earned in tax year 2022, with tax returns. If you are filing as a renter, include any certificates of. It stands for minnesota property tax refund form. *215211* 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your.

Fill Free fillable M1pr 19 2019 M1PR, Property Tax Refund Return PDF form

Web fill online, printable, fillable, blank 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form. Web ssi 10 political party code numbers: Web up to $40 cash back m1pr form is a tax form used in the state of minnesota, united states. Web 2021 form m1prx, amended homestead credit refund (for homeowners) and renter's property tax.

Fill Free fillable Minnesota Department of Revenue PDF forms

We'll make sure you qualify, calculate your minnesota. Web 2020 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund 9995 *205211* your code spouse’s code state elections campaign fund: Web you are allowed a tax deduction on federal schedule a for real estate taxes you paid in 2021. You will not receive a refund if your return.

It Stands For Minnesota Property Tax Refund Form.

The refund is not shown within the refund calculator on the main screen. Web ssi 10 political party code numbers: Web up to $40 cash back m1pr form is a tax form used in the state of minnesota, united states. For these taxes on a 2020 form.

Web 2020 Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter’s Property Tax Refund 9995 *205211* Your Code Spouse’s Code State Elections Campaign Fund:

Web the last day you can file your 2021 m1pr return is august 15, 2023. Web we last updated minnesota form m1pr in december 2022 from the minnesota department of revenue. We'll make sure you qualify, calculate your minnesota. This form is filed by minnesota residents.

Web 2022 Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter’s Property Tax Refund.

Enter the full amount from line 1 of your 2021 statement of. If you are filing as a renter, include any certificates of. This form is for income earned in tax year 2022, with tax returns. If you received a property tax refund.

Your First Name And Initial Last Name Your Social Security Number Your Date.

*215211* 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial. Minnesota allows a property tax credit to renters and homeowners who were residents or. Web 2021 form m1prx, amended homestead credit refund (for homeowners) and renter's property tax refund *215811* you will need the 2021 form m1pr instructions, including. You will not receive a refund if your return is filed or the.