Form Of Business Organization

Form Of Business Organization - Corporations are formed under the laws of each state and are subject to corporate income tax. Register in system for award management (sam) once you have an understanding of the process from the ptac counselor, you must register to do business with the federal government through the system for award management (sam). Web business organization, an entity formed for the purpose of carrying on commercial enterprise. Cyber threats are increasing across all business sectors, with health care being a prominent domain. Organisations from which one can choose the right one include: (a) sole proprietorship, (b) joint hindu family business, (c) partnership, (d) cooperative societies, and (e) joint stock company. Business is sometimes called a “taxable corporation” 2. Web whether your business or organization was fully or partially suspended depends on your specific situation. Business enterprises customarily take one of three forms: While not difficult, there are certain steps you must take and.

Business is sometimes called a “taxable corporation” 2. Web to find out what you need to do to form a corporation in your state, choose your state from the list below. Therefore, you may need to. Corporations are formed under the laws of each state and are subject to corporate income tax. It requires complying with more regulations and tax requirements. Cyber threats are increasing across all business sectors, with health care being a prominent domain. Sole proprietorship — the simplest form of business organisation, and then Business is an unincorporated hybrid entity with traits of a corporation and a general partnership c. Web what are the five forms of business organizations? Web business organization, an entity formed for the purpose of carrying on commercial enterprise.

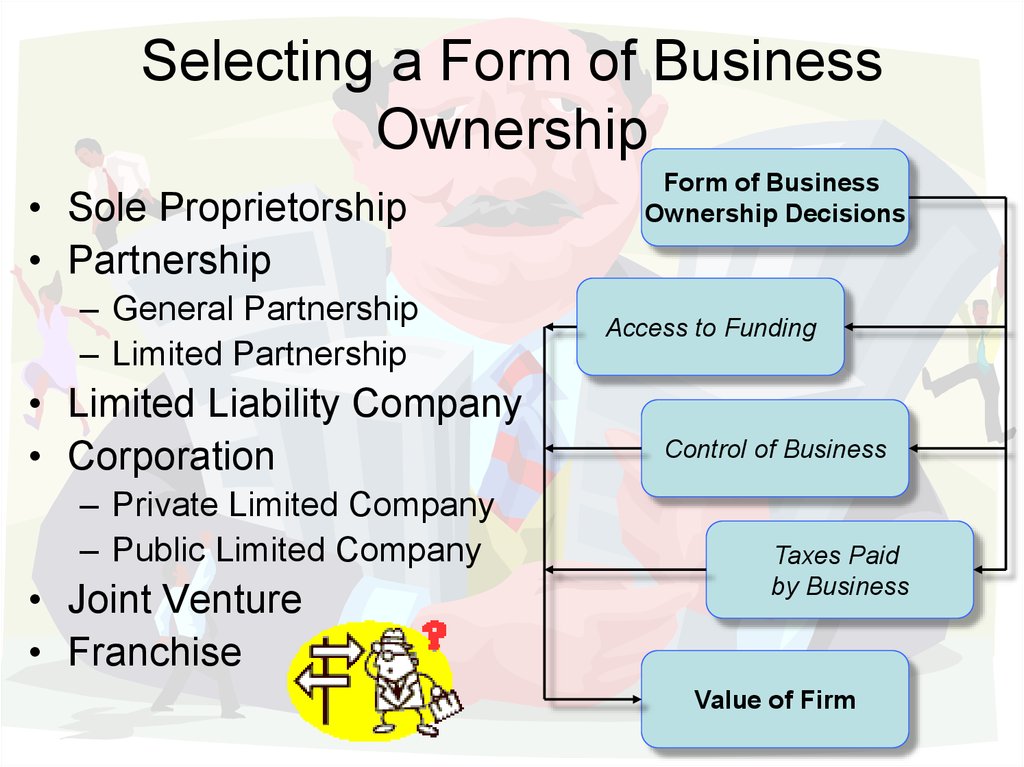

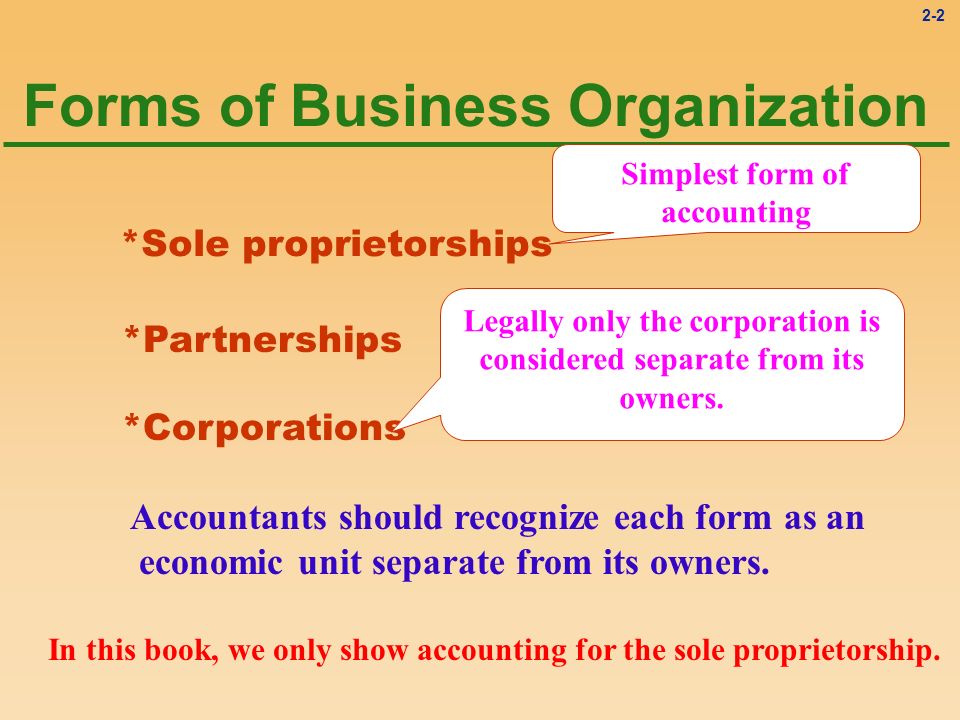

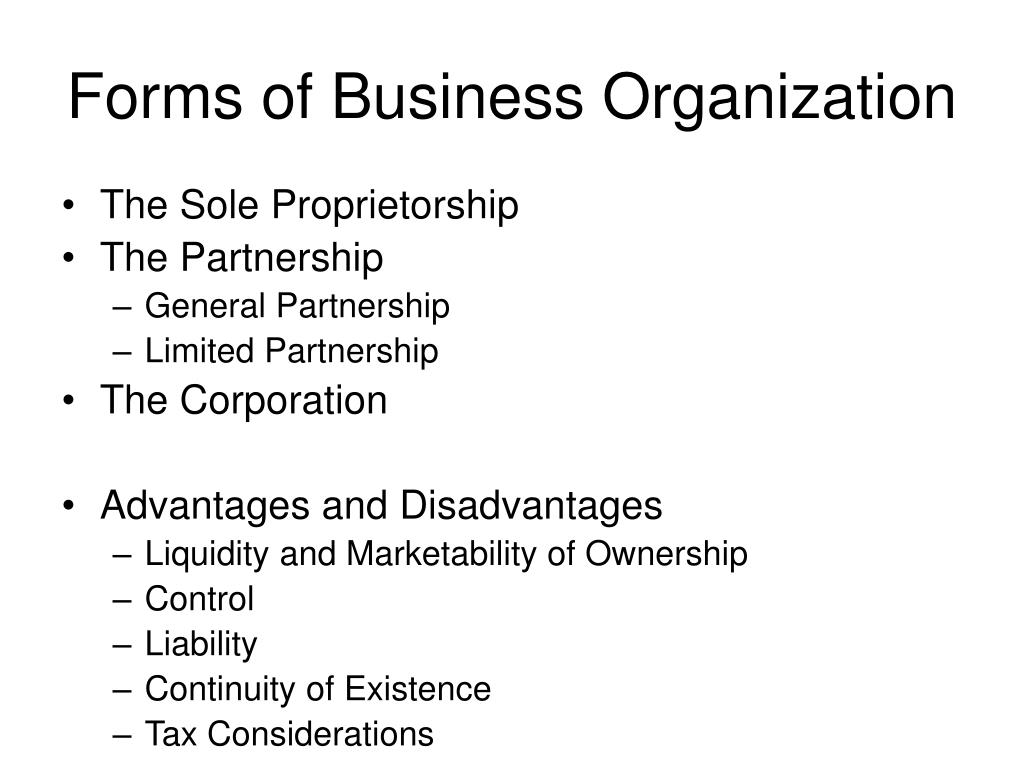

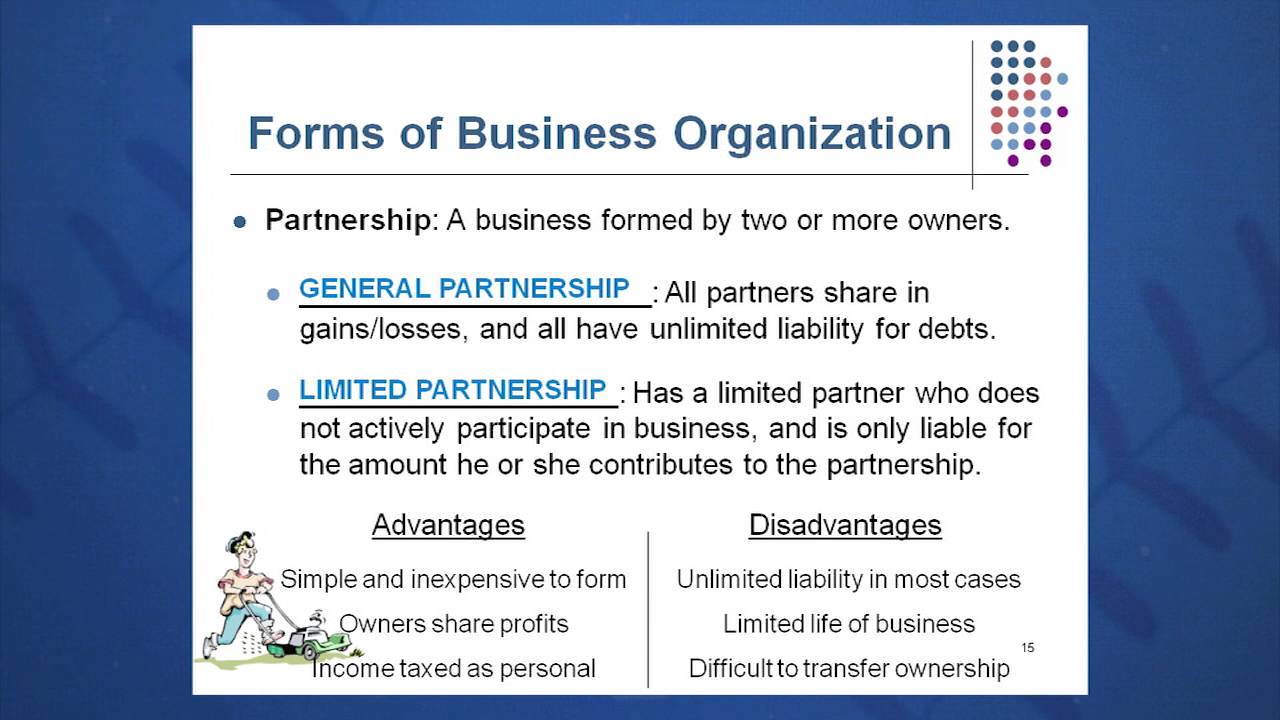

Business enterprises customarily take one of three forms: A corporation is a business organization that acts as a unique and separate entity from its shareholders. A corporate structure is more complex than other business structures. While not difficult, there are certain steps you must take and. Business is sometimes called a “taxable corporation” 2. Business is an unincorporated hybrid entity with traits of a corporation and a general partnership c. You can classify a business partnership as either general or limited. (a) sole proprietorship, (b) joint hindu family business, (c) partnership, (d) cooperative societies, and (e) joint stock company. Sole proprietorship — the simplest form of business organisation, and then What should be considered when selecting a business organizational.

U vs Mform Organizational Structure FourWeekMBA

Corporations are formed under the laws of each state and are subject to corporate income tax. Such an organization is predicated on systems of law governing contract and exchange, property rights, and incorporation. You will find all the specifics and information you need, including links to forms, government agencies, and other helpful resources for forming a corporation in your state..

Business Organization Types

A corporate structure is more complex than other business structures. You will find all the specifics and information you need, including links to forms, government agencies, and other helpful resources for forming a corporation in your state. Business enterprises customarily take one of three forms: Therefore, you may need to. Web whether your business or organization was fully or partially.

Session 01 Objective 2 Forms of Business Organization YouTube

Business enterprises customarily take one of three forms: It requires complying with more regulations and tax requirements. You will find all the specifics and information you need, including links to forms, government agencies, and other helpful resources for forming a corporation in your state. Corporations are formed under the laws of each state and are subject to corporate income tax..

The Seven Most Popular Types of Businesses Online Accounting

A corporate structure is more complex than other business structures. Business is an incorporated hybrid entity with traits of a limited liability company and a general partnership d. Therefore, you may need to. (a) sole proprietorship, (b) joint hindu family business, (c) partnership, (d) cooperative societies, and (e) joint stock company. Cyber threats are increasing across all business sectors, with.

Forms of Business Organization Teaching Resources

Therefore, you may need to. Such an organization is predicated on systems of law governing contract and exchange, property rights, and incorporation. What should be considered when selecting a business organizational. Organisations from which one can choose the right one include: Let us start our discussion with.

Different Forms Of Business Organizations And Their Advantages And

Web whether your business or organization was fully or partially suspended depends on your specific situation. A corporate structure is more complex than other business structures. Business is sometimes called a “taxable corporation” 2. Sole proprietorship — the simplest form of business organisation, and then Therefore, you may need to.

Forms Of Business Organization

Therefore, you may need to. Business enterprises customarily take one of three forms: Organisations from which one can choose the right one include: Corporations are formed under the laws of each state and are subject to corporate income tax. You will need a unique entity id (uei) and your tax identification number (request by visiting.

What are the Forms of Business Organization s? Leverage Edu

Therefore, you may need to. A corporate structure is more complex than other business structures. It requires complying with more regulations and tax requirements. You can classify a business partnership as either general or limited. Organisations from which one can choose the right one include:

What Form Of Business Organization Works Best? Taisha Associates

Business is an incorporated hybrid entity with traits of a limited liability company and a general partnership d. Web whether your business or organization was fully or partially suspended depends on your specific situation. You can classify a business partnership as either general or limited. You will need a unique entity id (uei) and your tax identification number (request by.

The Simplest Form Of Business Organization Is The Business Walls

Web to find out what you need to do to form a corporation in your state, choose your state from the list below. While not difficult, there are certain steps you must take and. Business is an incorporated hybrid entity with traits of a limited liability company and a general partnership d. Corporations are formed under the laws of each.

Therefore, You May Need To.

A corporate structure is more complex than other business structures. While not difficult, there are certain steps you must take and. Web various forms of business. You will need a unique entity id (uei) and your tax identification number (request by visiting.

A Corporation Is A Business Organization That Acts As A Unique And Separate Entity From Its Shareholders.

Register in system for award management (sam) once you have an understanding of the process from the ptac counselor, you must register to do business with the federal government through the system for award management (sam). Business enterprises customarily take one of three forms: What should be considered when selecting a business organizational. Web to find out what you need to do to form a corporation in your state, choose your state from the list below.

Corporations Are Formed Under The Laws Of Each State And Are Subject To Corporate Income Tax.

Let us start our discussion with. Cyber threats are increasing across all business sectors, with health care being a prominent domain. You will find all the specifics and information you need, including links to forms, government agencies, and other helpful resources for forming a corporation in your state. Web whether your business or organization was fully or partially suspended depends on your specific situation.

Web Business Organization, An Entity Formed For The Purpose Of Carrying On Commercial Enterprise.

Business is sometimes called a “taxable corporation” 2. You can classify a business partnership as either general or limited. Such an organization is predicated on systems of law governing contract and exchange, property rights, and incorporation. Business is an incorporated hybrid entity with traits of a limited liability company and a general partnership d.