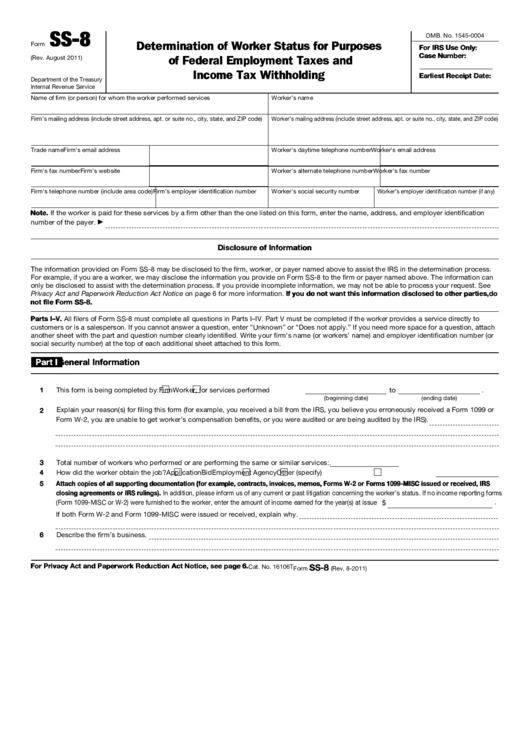

Form Ss 8

Form Ss 8 - Installment agreement request popular for tax pros; Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Determination of worker status for purposes of federal employment taxes and income tax withholding. Employee's withholding certificate form 941; What happens after i file the form? May 2014) department of the treasury internal revenue service. Employers engaged in a trade or business who pay compensation form 9465;

Employee's withholding certificate form 941; What happens after i file the form? Employers engaged in a trade or business who pay compensation form 9465; Determination of worker status for purposes of federal employment taxes and income tax withholding. May 2014) department of the treasury internal revenue service. Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Installment agreement request popular for tax pros;

May 2014) department of the treasury internal revenue service. Employers engaged in a trade or business who pay compensation form 9465; Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Installment agreement request popular for tax pros; What happens after i file the form? Determination of worker status for purposes of federal employment taxes and income tax withholding. Employee's withholding certificate form 941;

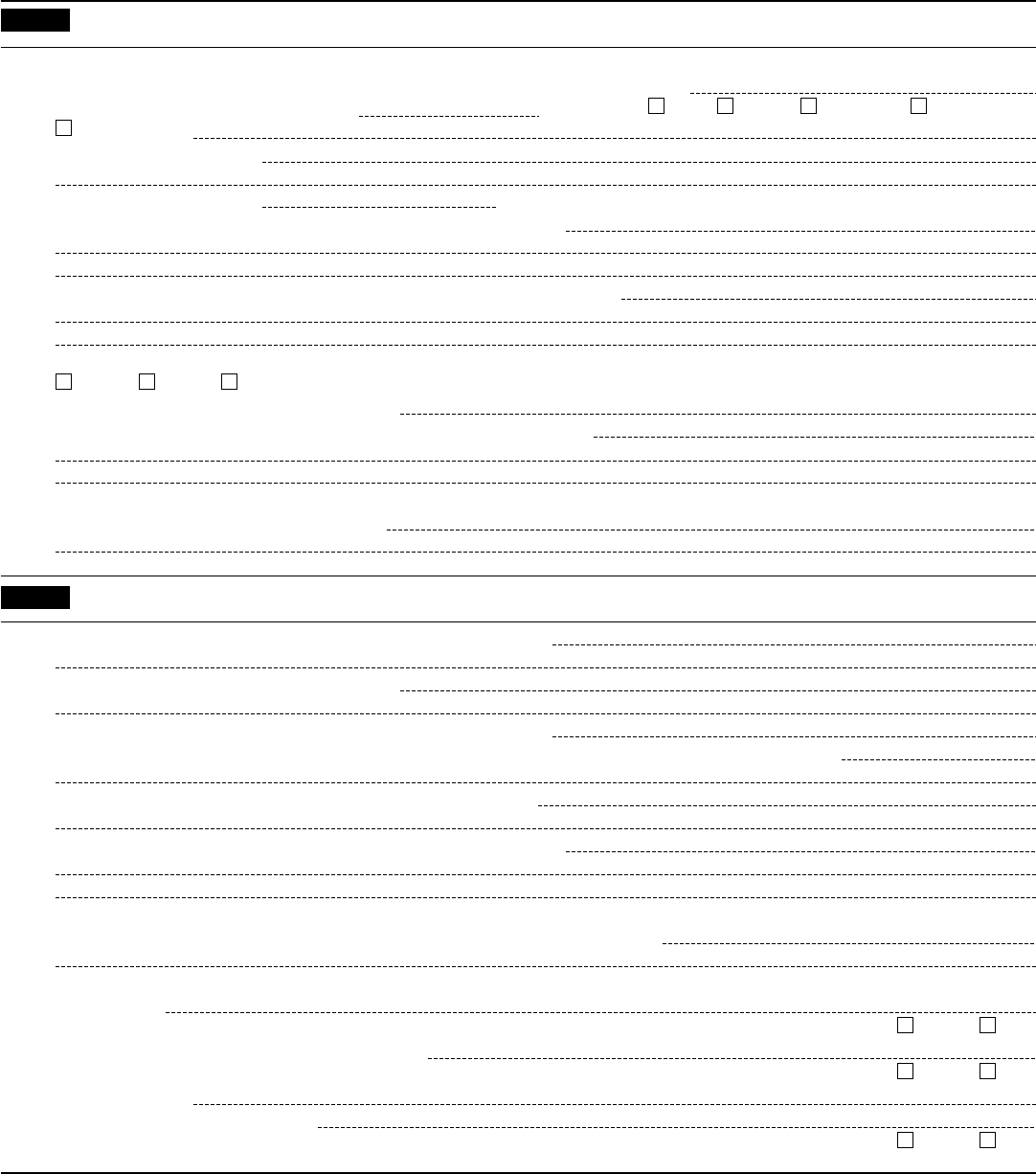

IRS Form SS8 What Is It?

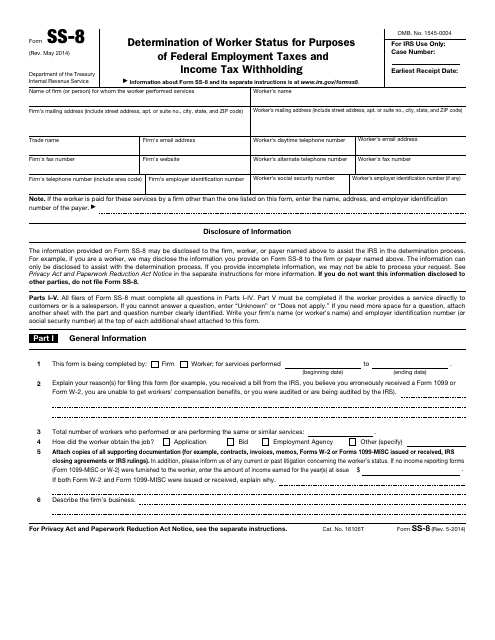

Employers engaged in a trade or business who pay compensation form 9465; Determination of worker status for purposes of federal employment taxes and income tax withholding. May 2014) department of the treasury internal revenue service. Employee's withholding certificate form 941; Installment agreement request popular for tax pros;

20142021 Form IRS SS8 Fill Online, Printable, Fillable, Blank pdfFiller

Employee's withholding certificate form 941; Installment agreement request popular for tax pros; May 2014) department of the treasury internal revenue service. Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. What happens after i file the form?

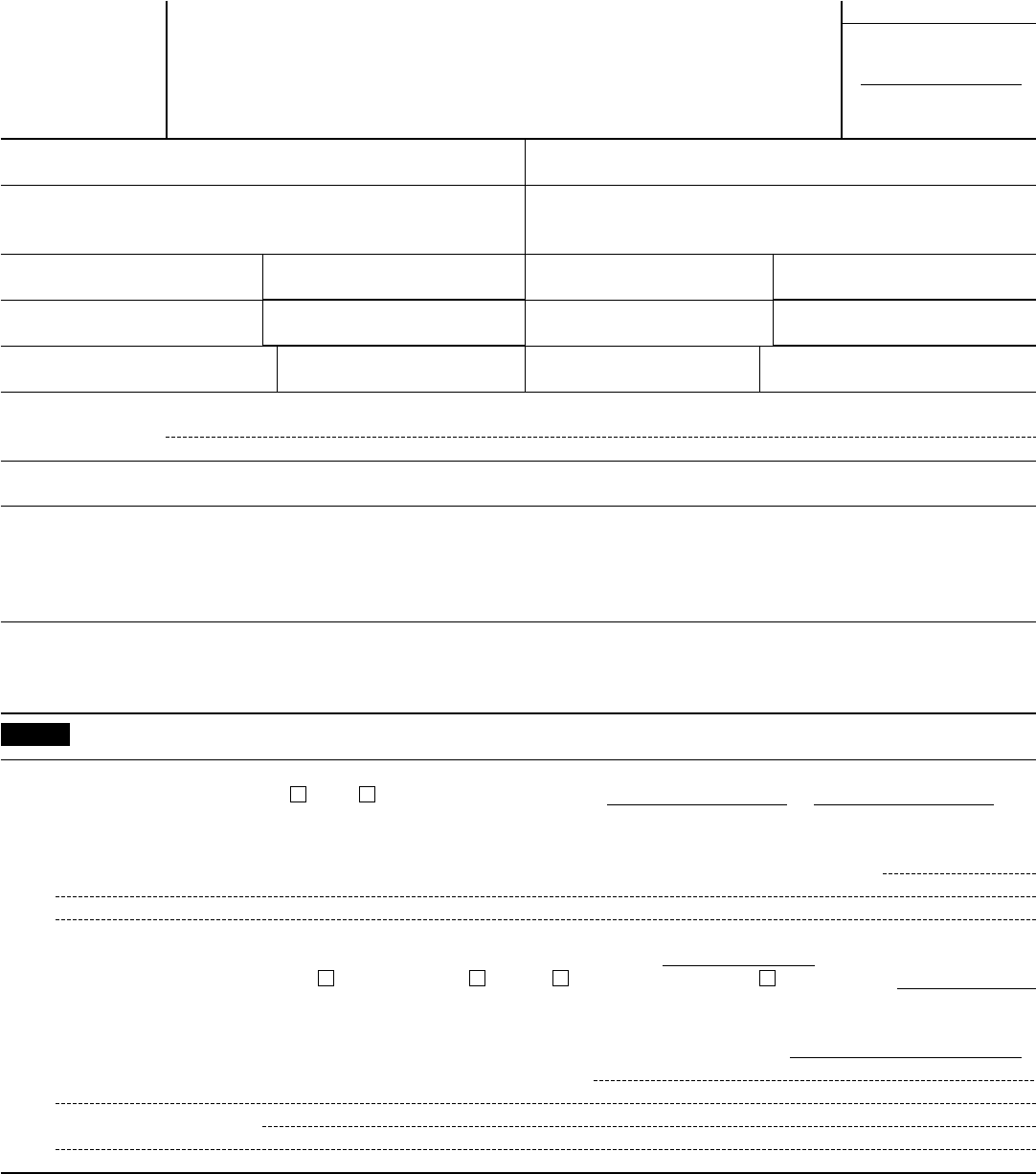

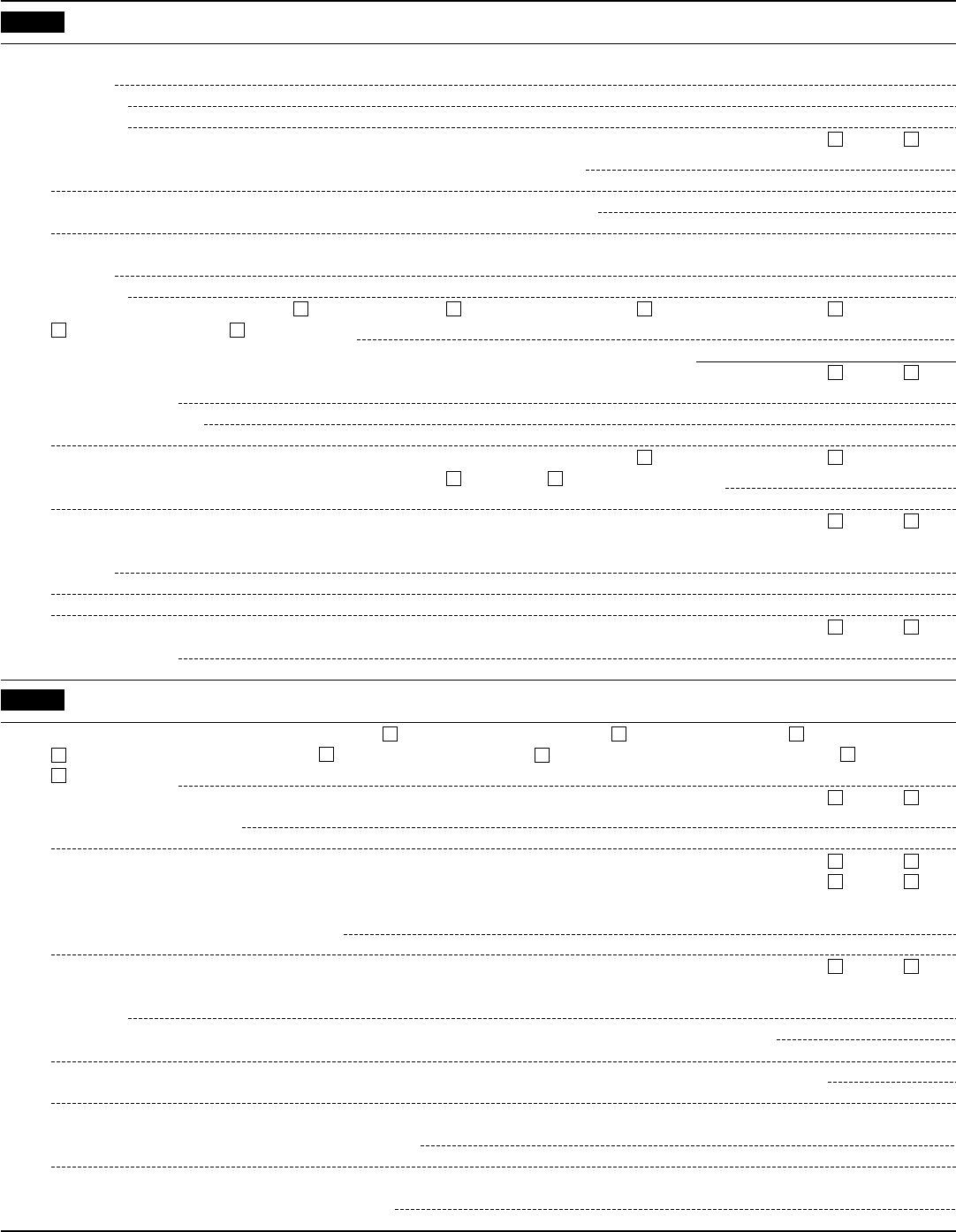

Form SS8 Edit, Fill, Sign Online Handypdf

What happens after i file the form? Employers engaged in a trade or business who pay compensation form 9465; May 2014) department of the treasury internal revenue service. Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Employee's.

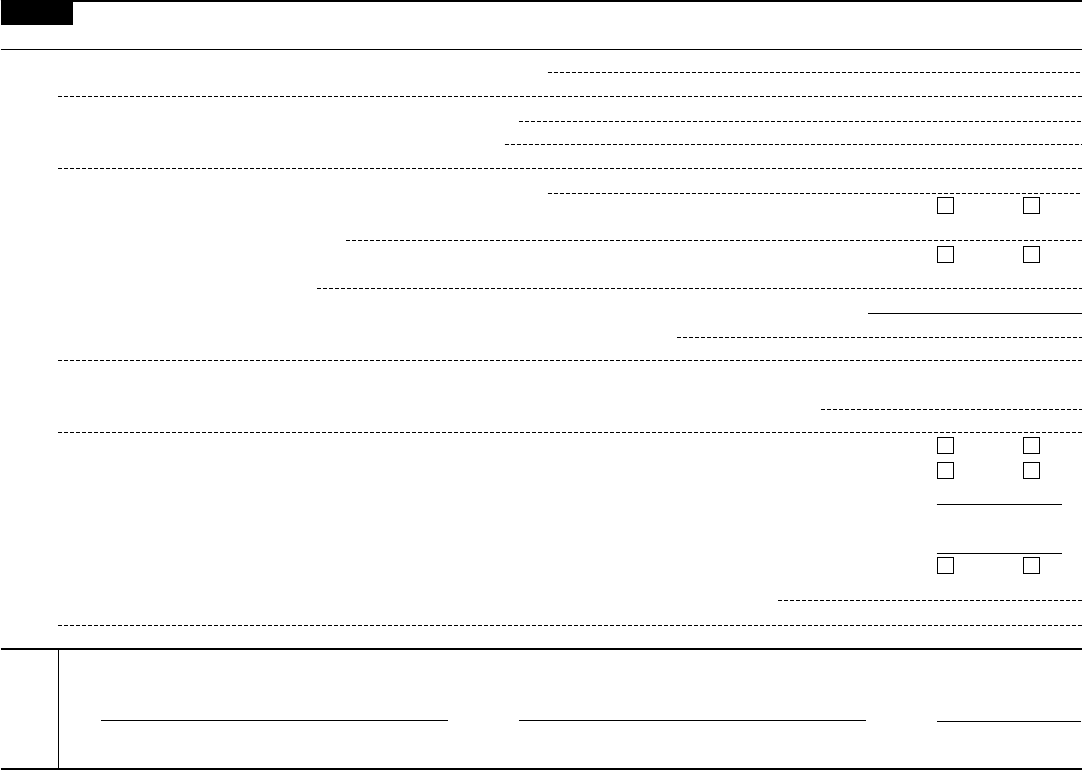

Form SS8 Edit, Fill, Sign Online Handypdf

Installment agreement request popular for tax pros; Determination of worker status for purposes of federal employment taxes and income tax withholding. Employers engaged in a trade or business who pay compensation form 9465; What happens after i file the form? May 2014) department of the treasury internal revenue service.

Form SS8 Edit, Fill, Sign Online Handypdf

What happens after i file the form? May 2014) department of the treasury internal revenue service. Employee's withholding certificate form 941; Installment agreement request popular for tax pros; Employers engaged in a trade or business who pay compensation form 9465;

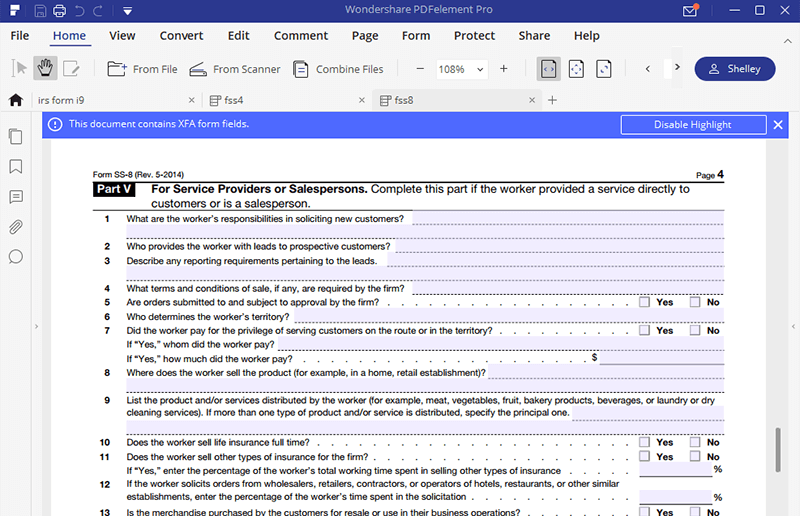

IRS Form SS8 Fill out With the Best Form Filler

May 2014) department of the treasury internal revenue service. Employers engaged in a trade or business who pay compensation form 9465; Determination of worker status for purposes of federal employment taxes and income tax withholding. Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker,.

Fillable Form Ss8 Determination Of Worker Status For Purposes Of

Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Employee's withholding certificate form 941; May 2014) department of the treasury internal revenue service. What happens after i file the form? Determination of worker status for purposes of federal.

IRS Form SS8 Download Fillable PDF or Fill Online Determination of

Employee's withholding certificate form 941; Employers engaged in a trade or business who pay compensation form 9465; May 2014) department of the treasury internal revenue service. What happens after i file the form? Determination of worker status for purposes of federal employment taxes and income tax withholding.

Form SS8 Edit, Fill, Sign Online Handypdf

Determination of worker status for purposes of federal employment taxes and income tax withholding. Installment agreement request popular for tax pros; Employee's withholding certificate form 941; Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Employers engaged in.

form ss8 Employee or Independent Contractor?

Determination of worker status for purposes of federal employment taxes and income tax withholding. Employers engaged in a trade or business who pay compensation form 9465; May 2014) department of the treasury internal revenue service. Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker,.

Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding.

Classifying a worker as an independent contractor can be beneficial for businesses because they don’t have to pay employment taxes for this type of worker, but misclassification is against irs rules. Employee's withholding certificate form 941; May 2014) department of the treasury internal revenue service. What happens after i file the form?

Installment Agreement Request Popular For Tax Pros;

Employers engaged in a trade or business who pay compensation form 9465;

:max_bytes(150000):strip_icc()/Screenshot76-6bdc4f074be3478d864d3e9960c5ab65.png)