Form W8 Instructions

Form W8 Instructions - Web certificate of foreign status of beneficial owner for united states tax withholding. October 2021) to incorporate the use of those forms by brokers and transferors of. Give this form to thewithholding agent or payer. For general information and the purpose of. Web what is a w8 form? A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. February 2006) certificate of foreign status of beneficial owner for united states tax.

Web what is a w8 form? A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. Web certificate of foreign status of beneficial owner for united states tax withholding. Give this form to thewithholding agent or payer. For general information and the purpose of. February 2006) certificate of foreign status of beneficial owner for united states tax. October 2021) to incorporate the use of those forms by brokers and transferors of.

Web what is a w8 form? For general information and the purpose of. Web certificate of foreign status of beneficial owner for united states tax withholding. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. October 2021) to incorporate the use of those forms by brokers and transferors of. February 2006) certificate of foreign status of beneficial owner for united states tax. Give this form to thewithholding agent or payer.

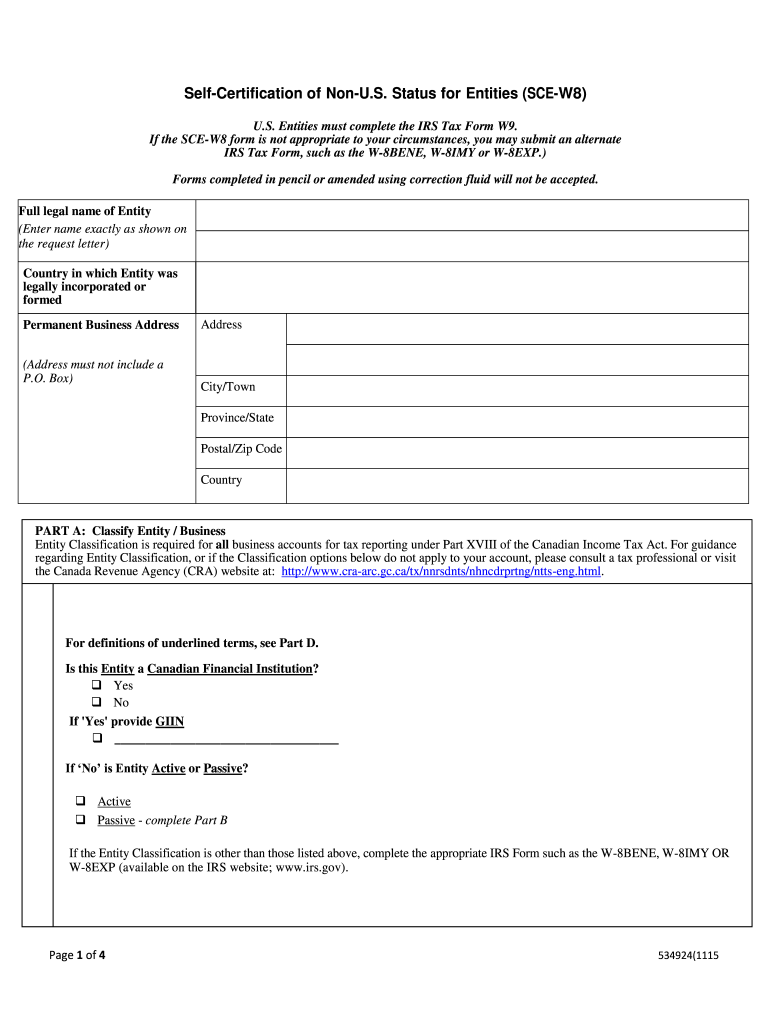

Sci W8 Fill Online, Printable, Fillable, Blank pdfFiller

A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. For general information and the purpose of. October 2021) to incorporate the use of those forms by brokers and transferors of. Give this form to thewithholding agent or payer. February 2006) certificate of.

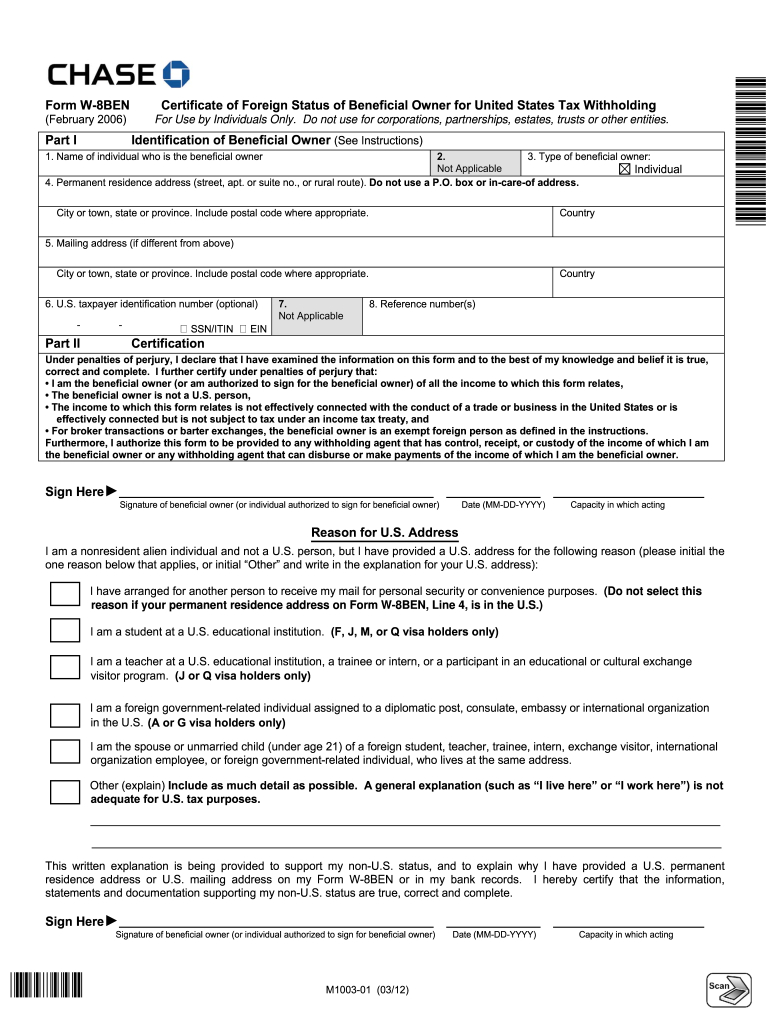

Irs Form W8 Printable Example Calendar Printable

Web certificate of foreign status of beneficial owner for united states tax withholding. October 2021) to incorporate the use of those forms by brokers and transferors of. Give this form to thewithholding agent or payer. Web what is a w8 form? A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign.

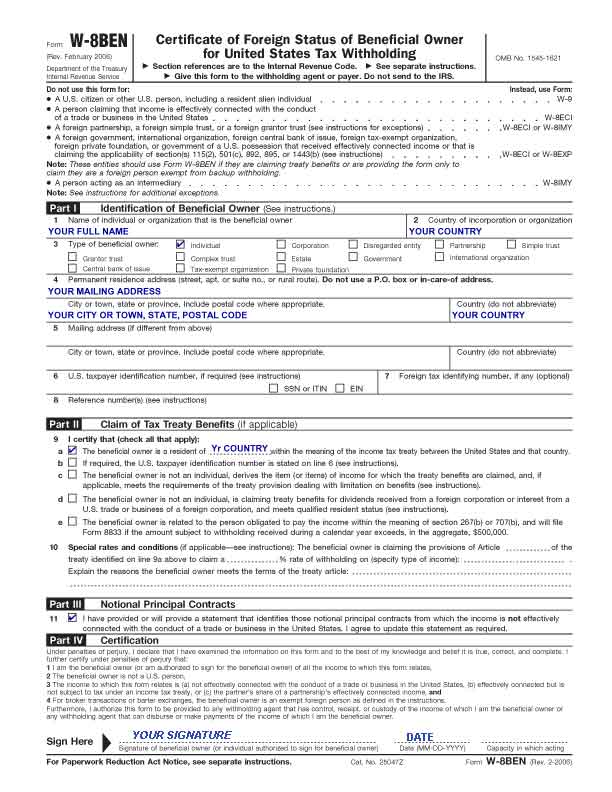

IRS Form W8

October 2021) to incorporate the use of those forms by brokers and transferors of. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. For general information and the purpose of. Web certificate of foreign status of beneficial owner for united states tax.

W8BEN Form Filling Guide AdsWiki Ad Network Listing, Reviews

October 2021) to incorporate the use of those forms by brokers and transferors of. Give this form to thewithholding agent or payer. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. Web what is a w8 form? February 2006) certificate of foreign.

Part II IRS Form W8IMY FATCA Driven More on the W9 and W8

A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. October 2021) to incorporate the use of those forms by brokers and transferors of. February 2006) certificate of foreign status of beneficial owner for united states tax. Web what is a w8 form?.

Form W8 Instructions & Information about IRS Tax Form W8

Give this form to thewithholding agent or payer. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. October 2021) to incorporate the use of those forms by brokers and transferors of. Web what is a w8 form? February 2006) certificate of foreign.

Irs Form W8 Printable Example Calendar Printable

February 2006) certificate of foreign status of beneficial owner for united states tax. For general information and the purpose of. Web certificate of foreign status of beneficial owner for united states tax withholding. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their..

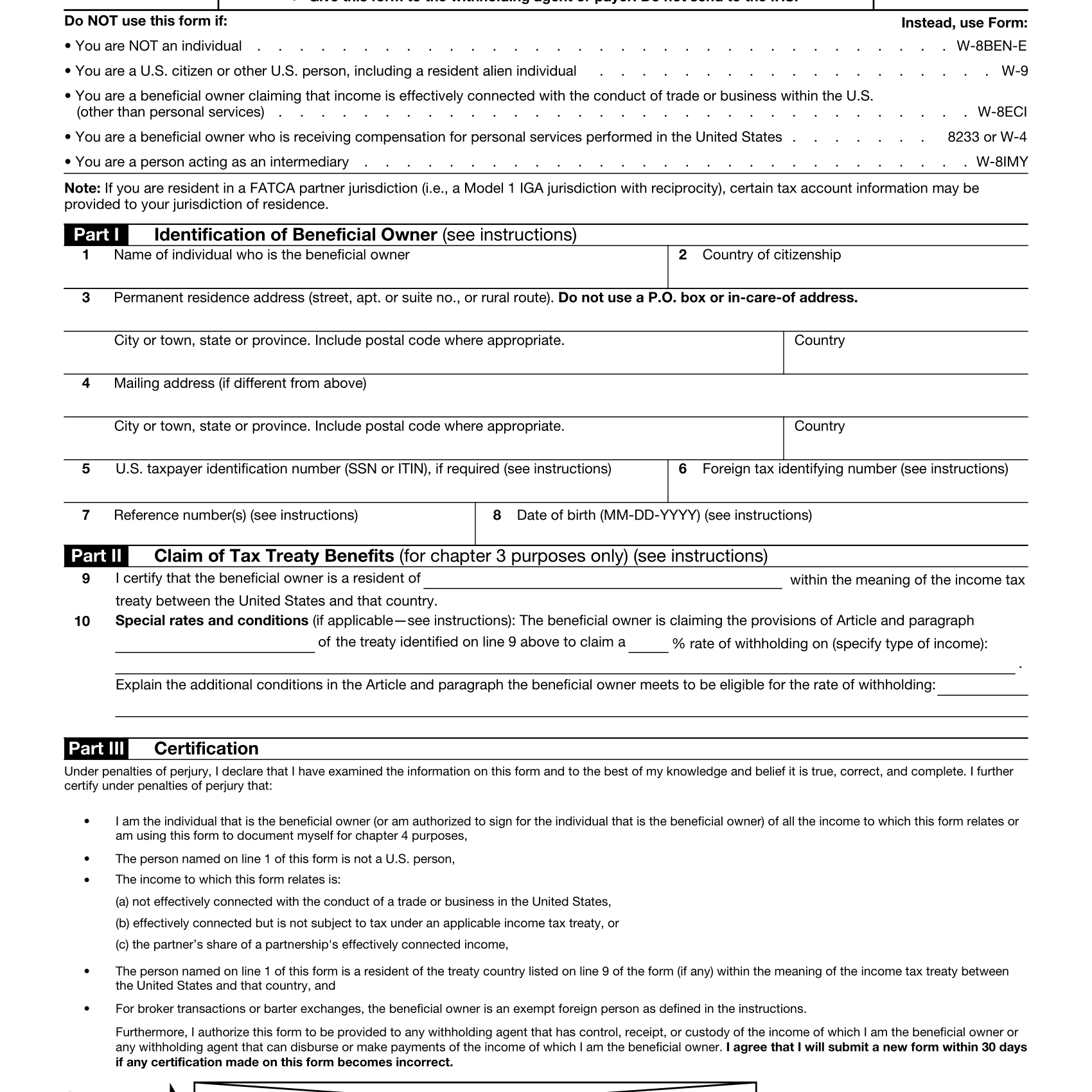

How do I fill up the W8BEN form from Singapore to invest in US stocks

A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. Give this form to thewithholding agent or payer. For general information and the purpose of. Web what is a w8 form? Web certificate of foreign status of beneficial owner for united states tax.

How To Fill Up W8BEN Form For US Manulife REIT My Sweet Retirement

Web certificate of foreign status of beneficial owner for united states tax withholding. February 2006) certificate of foreign status of beneficial owner for united states tax. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. October 2021) to incorporate the use of.

IRS Releases New IRS Form W8BEN. * U.S. citizens and LPRs beware of

Web certificate of foreign status of beneficial owner for united states tax withholding. February 2006) certificate of foreign status of beneficial owner for united states tax. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their. Web what is a w8 form? October.

February 2006) Certificate Of Foreign Status Of Beneficial Owner For United States Tax.

October 2021) to incorporate the use of those forms by brokers and transferors of. Web what is a w8 form? For general information and the purpose of. A w8 form is a form required by the internal revenue service (irs) to be filed by both foreign individuals and businesses in order to verify their.

Give This Form To Thewithholding Agent Or Payer.

Web certificate of foreign status of beneficial owner for united states tax withholding.