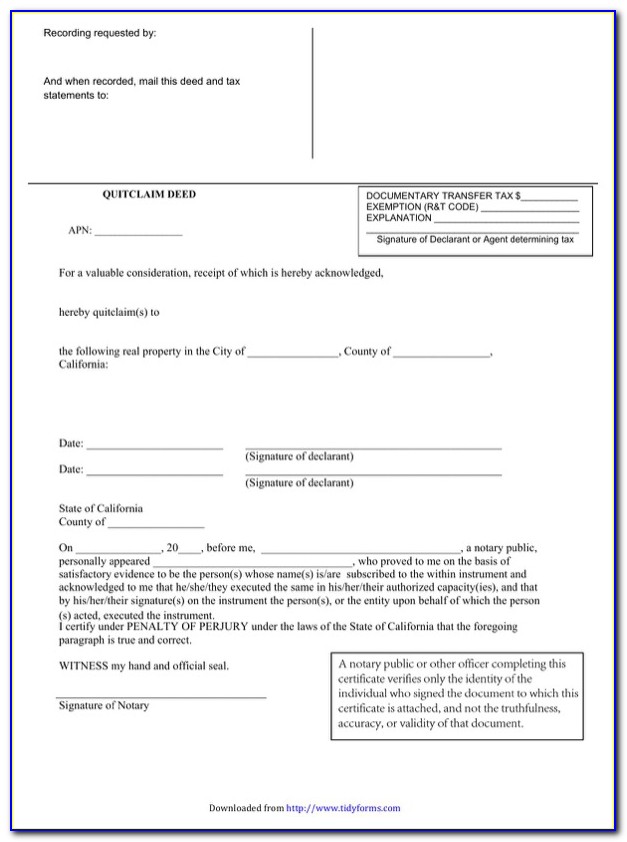

Free Trust Transfer Deed California Form

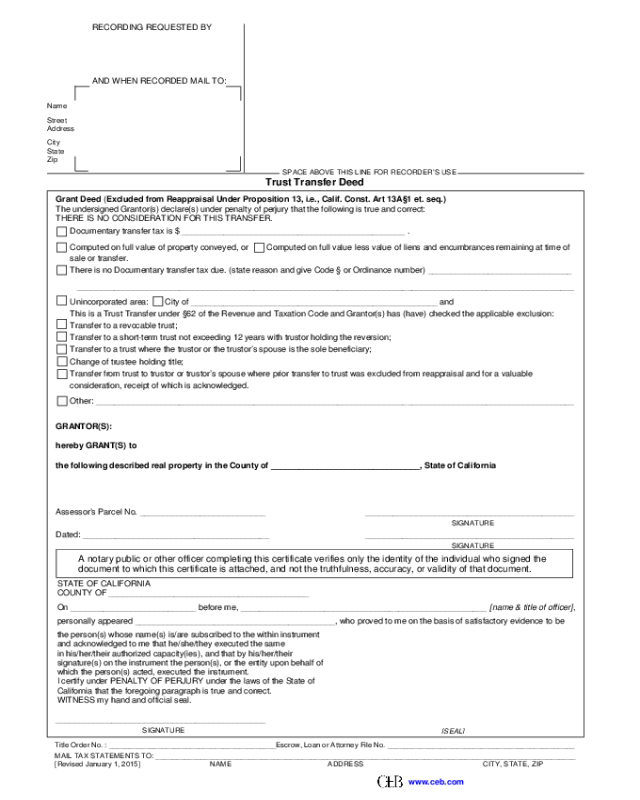

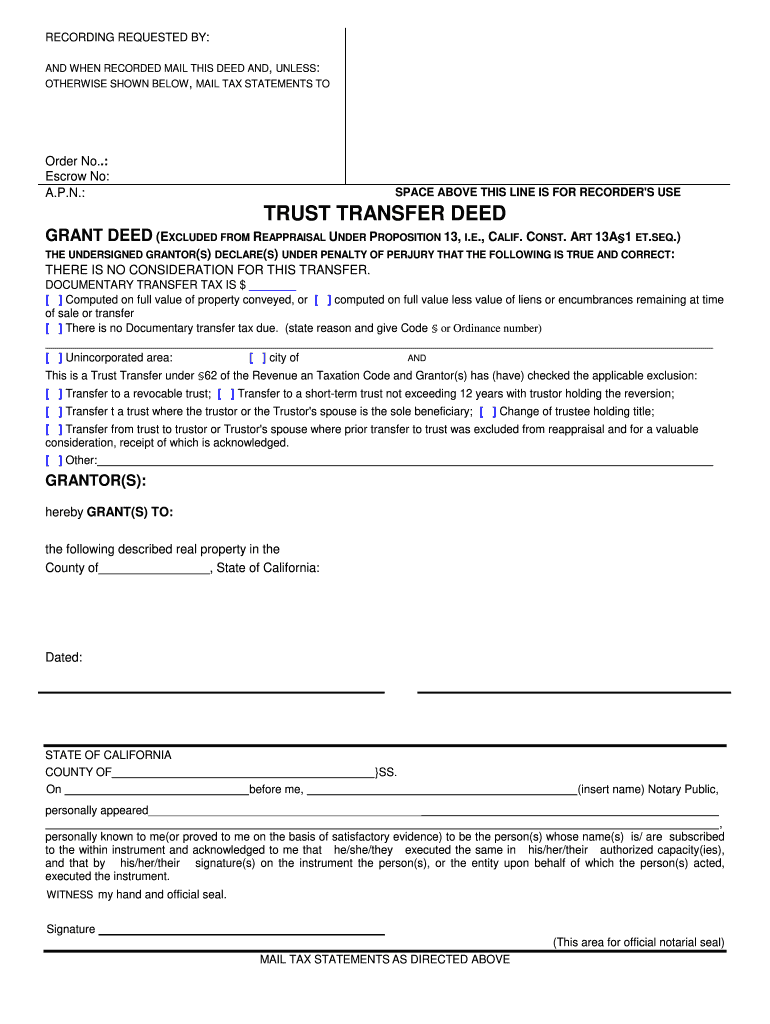

Free Trust Transfer Deed California Form - Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes. Computed on full value of property conveyed, or computed on full value less value of liens or encumbrances remaining at time of sale or transfer. The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. Transfer to a revocable trust; The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicableexclusion: There are also some simplified procedures for estates that are under $166,250. A deed of trust is on file with the county recorder along with a deed showing that the owner was granted the property. The california general warranty deed entails the same legal transfer of ownership from the grantor’s real estate property to the grantee. Documentary transfer tax is $ __________________.

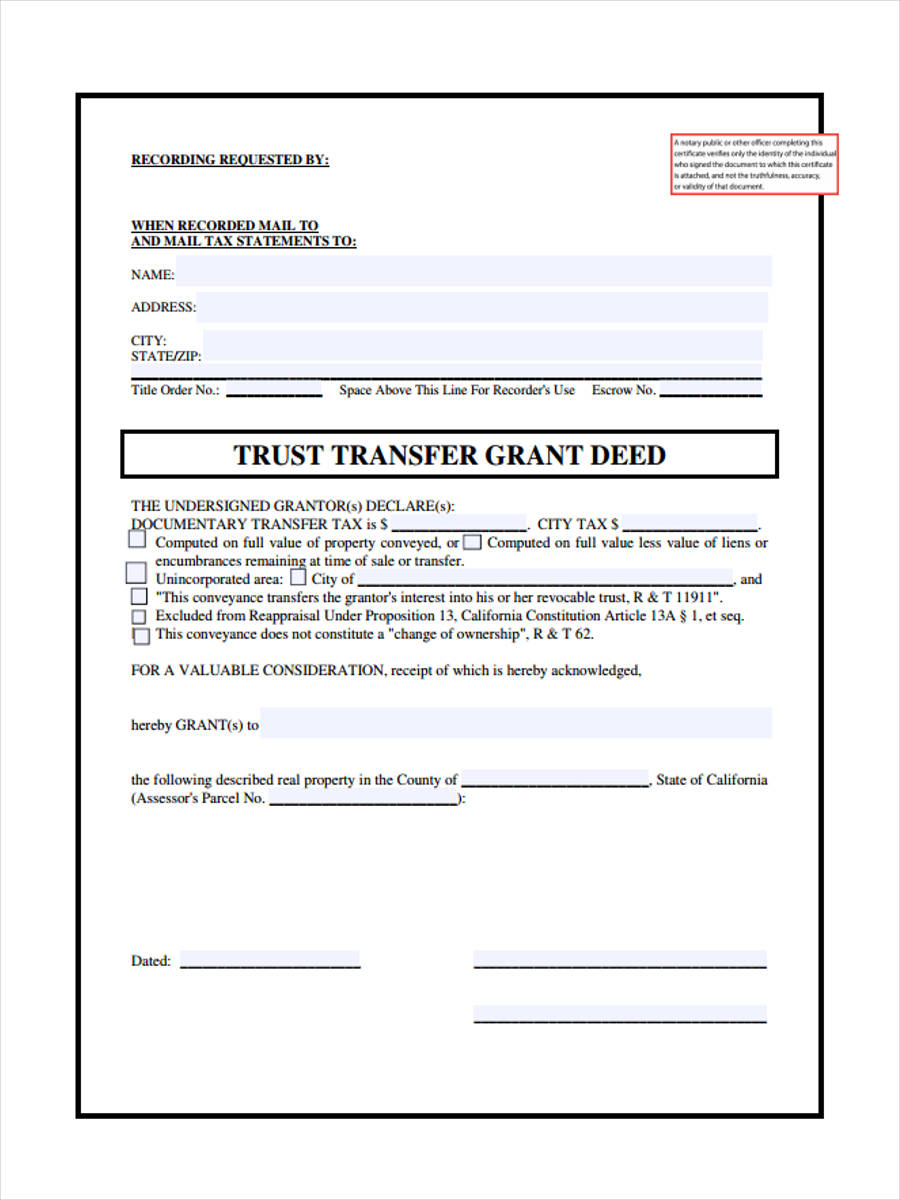

Web trust transfer grant deed the undersigned grantor(s) declare(s): Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; There is no consideration for this transfer. A deed of trust is on file with the county recorder along with a deed showing that the owner was granted the property. There are also some simplified procedures for estates that are under $166,250. Property in living trusts can be transferred without going to court. The california general warranty deed entails the same legal transfer of ownership from the grantor’s real estate property to the grantee. Documentary transfer tax is $ __________________. Trust transfer deed grant deed, excluded from reassessment under proposition 13, california constitution article 13 a §1 et seq. Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes.

Transfer to a revocable trust; Web the california government code provides that, after being acknowledged (executed in front of a notary public, or properly witnessed as provided by applicable law), any instrument or judgment affecting the title to or possession of real property may be recorded. The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. Property in living trusts can be transferred without going to court. Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes. A deed of trust is on file with the county recorder along with a deed showing that the owner was granted the property. There are also some simplified procedures for estates that are under $166,250. Trust transfer deed grant deed, excluded from reassessment under proposition 13, california constitution article 13 a §1 et seq. Computed on full value of property conveyed, or computed on full value less value of liens or encumbrances remaining at time of sale or transfer. Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer.

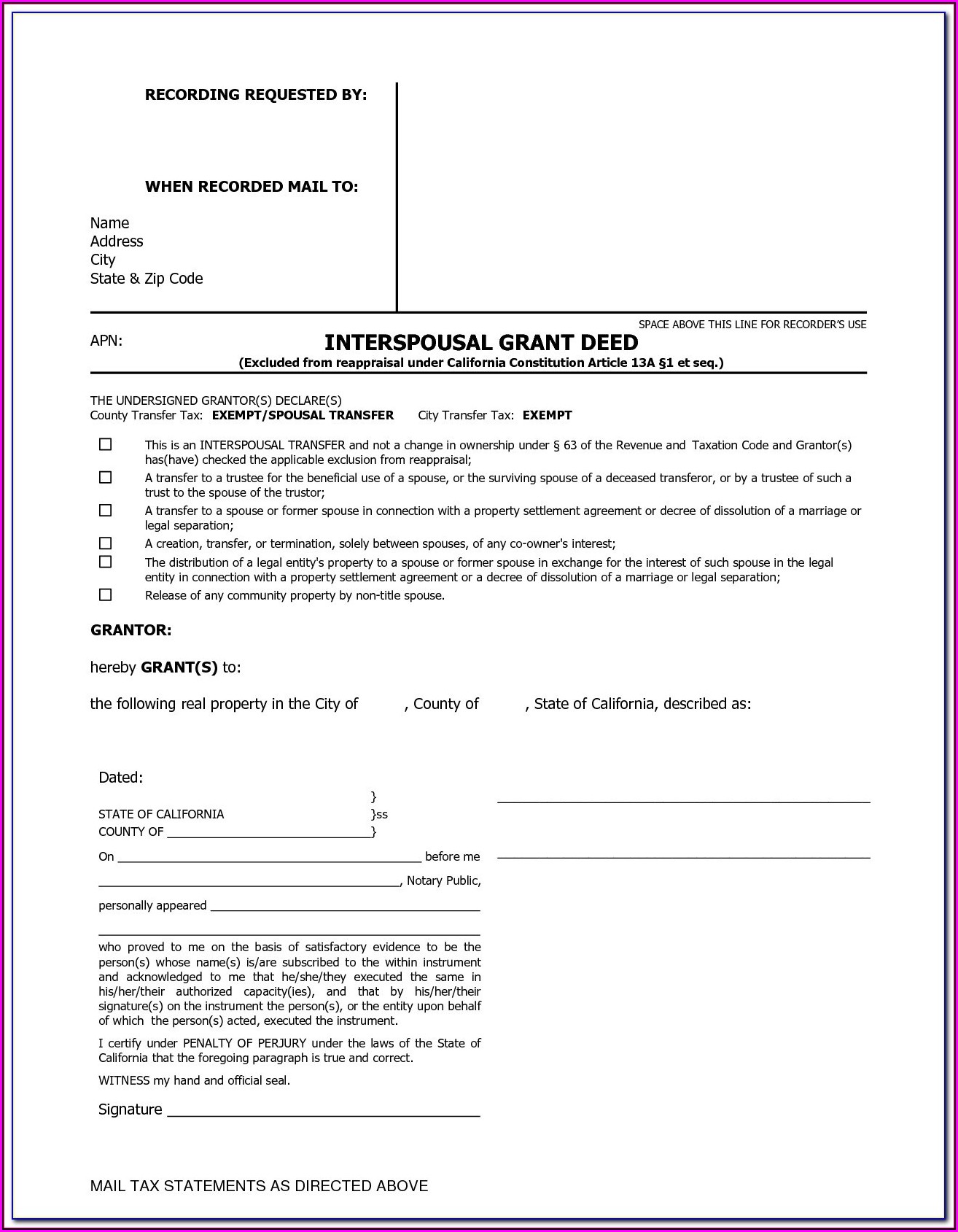

Free Interspousal Transfer Deed California Form Form Resume

The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: Property in living trusts can be transferred without going to court. Word odt pdf the document guarantees that there are no liens on the property. Computed on full value of property conveyed, or computed on full value less value of liens or encumbrances remaining at.

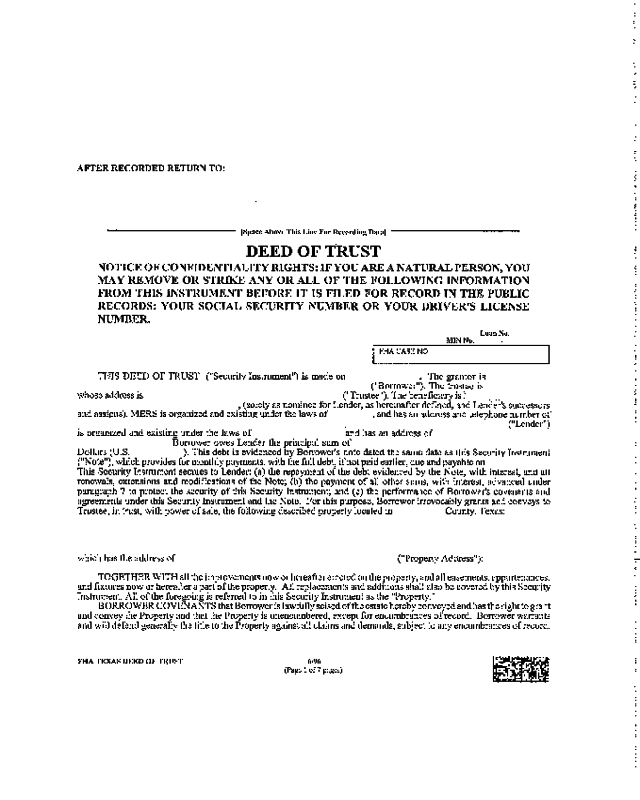

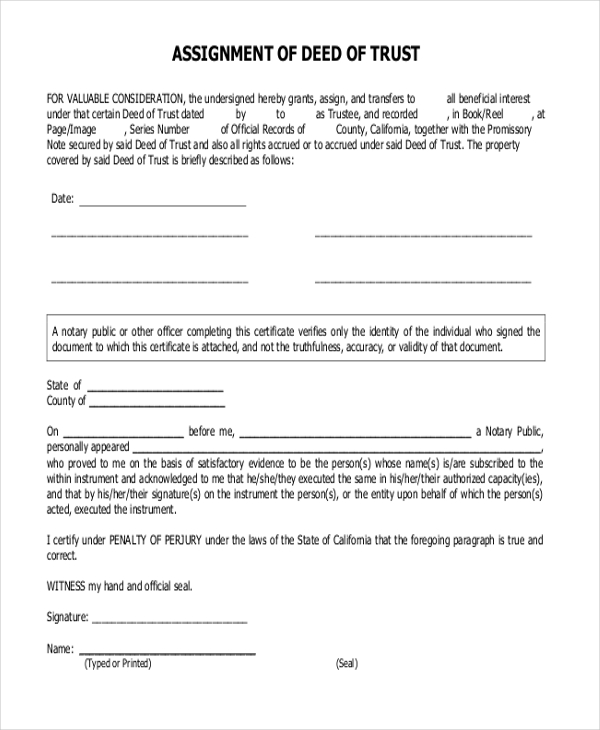

2023 Deed of Trust Form Fillable, Printable PDF & Forms Handypdf

The california general warranty deed entails the same legal transfer of ownership from the grantor’s real estate property to the grantee. Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer. Web the california government code provides that, after being acknowledged (executed in front of a notary public, or properly.

interspousal transfer deed california Fill Online, Printable

Property in living trusts can be transferred without going to court. Transfer to a revocable trust; The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. Web ca trust transfer deed form is required for the purpose of preparing or registering for property.

Grant Deed Form California Word Document Form Resume Examples

There are also some simplified procedures for estates that are under $166,250. The california general warranty deed entails the same legal transfer of ownership from the grantor’s real estate property to the grantee. The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: The process of completing california trust transfer deed form is a very.

Free Arizona Transfer On Death Deed Form Form Resume Examples

Web trust transfer grant deed the undersigned grantor(s) declare(s): Web the california government code provides that, after being acknowledged (executed in front of a notary public, or properly witnessed as provided by applicable law), any instrument or judgment affecting the title to or possession of real property may be recorded. Web this is a trust transfer under §62 of the.

😍 Assignment of deed of trust california. California Mortgage vs. Deed

Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; Word odt pdf the document guarantees that there are no liens on the property. Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes. The process of completing california trust transfer deed form.

FREE 7+ Deed Transfer Forms in PDF Ms Word

Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicableexclusion: Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer. There is no consideration for this transfer. The process of completing california trust transfer deed form is a very.

FREE 16+ Sample Will and Trust Forms in PDF MS Word

There is no consideration for this transfer. Property in living trusts can be transferred without going to court. There are also some simplified procedures for estates that are under $166,250. Documentary transfer tax is $ __________________. The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or.

Fillable Trust Transfer Grant Deed Form State Of California Printable

There is no consideration for this transfer. Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; Web the california government code provides that, after being acknowledged (executed in front of a notary public, or properly witnessed as provided by applicable law), any instrument or judgment affecting the title to or possession of real property.

Trust Transfer Deed California Fill Online, Printable, Fillable

There is no consideration for this transfer. Word odt pdf the document guarantees that there are no liens on the property. Property in living trusts can be transferred without going to court. Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; Web a deed form entails the legal transfer of property from the grantor.

The California General Warranty Deed Entails The Same Legal Transfer Of Ownership From The Grantor’s Real Estate Property To The Grantee.

Documentary transfer tax is $ __________________. Web this is a trust transfer under §62 of the revenue and taxation code and grantor(s) has (have) checked the applicableexclusion: Web ca trust transfer deed form is required for the purpose of preparing or registering for property taxes or for other purposes. Web trust transfer grant deed the undersigned grantor(s) declare(s):

Word Odt Pdf The Document Guarantees That There Are No Liens On The Property.

The undersigned grantor(s) declare(s) under penalty of perjury that the following is true and correct: Transfer to a revocable trust; Web a deed form entails the legal transfer of property from the grantor or seller to the grantee or buyer. There is no consideration for this transfer.

Web The California Government Code Provides That, After Being Acknowledged (Executed In Front Of A Notary Public, Or Properly Witnessed As Provided By Applicable Law), Any Instrument Or Judgment Affecting The Title To Or Possession Of Real Property May Be Recorded.

Computed on full value of property conveyed, or computed on full value less value of liens or encumbrances remaining at time of sale or transfer. There are also some simplified procedures for estates that are under $166,250. Transfer to a trust where the trustor or the trustor’s spouse is the sole beneficiary; Property in living trusts can be transferred without going to court.

Trust Transfer Deed Grant Deed, Excluded From Reassessment Under Proposition 13, California Constitution Article 13 A §1 Et Seq.

The process of completing california trust transfer deed form is a very simple and effective way of obtaining tax documents from the county or local taxing authority. A deed of trust is on file with the county recorder along with a deed showing that the owner was granted the property.