Ftb 3522 Form

Ftb 3522 Form - When a new llc is formed in california, it has four months from the. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Open it with online editor and start adjusting. When a new llc is formed in california, it has four months from the date of its formation to pay this fee. The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Follow the simple instructions below: Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Enjoy smart fillable fields and interactivity. Web form ftb 3522 is a form that is used to report the sale or other disposition of california real property.

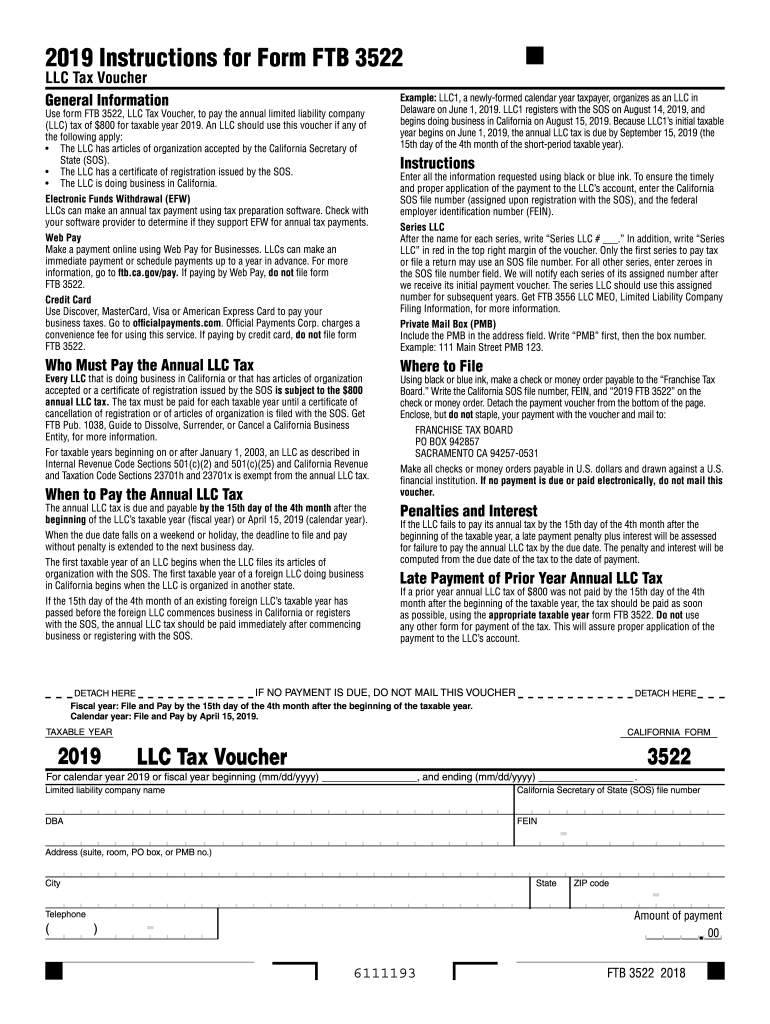

Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. This form must be filed in order to report the gain or loss from the sale or other disposition. Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Web does my california llc need to file form 3522 (limited liability company tax voucher) in the 1st year? All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Follow the simple instructions below: When a new llc is formed in california, it has four months from the. Does my california llc need to file form 3536 (estimated fee for llcs) in the 1st year? Web find the ca ftb 3522 you require. When a new llc is formed in california, it has four months from the.

Get your online template and fill it in using progressive features. Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. When a new llc is formed in california, it has four months from the. An llc should use this voucher if any of the following apply: When a new llc is formed in california, it has four months from the date of its formation to pay this fee. Follow the simple instructions below: The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? The llc has a certificate of registration issued by the sos.

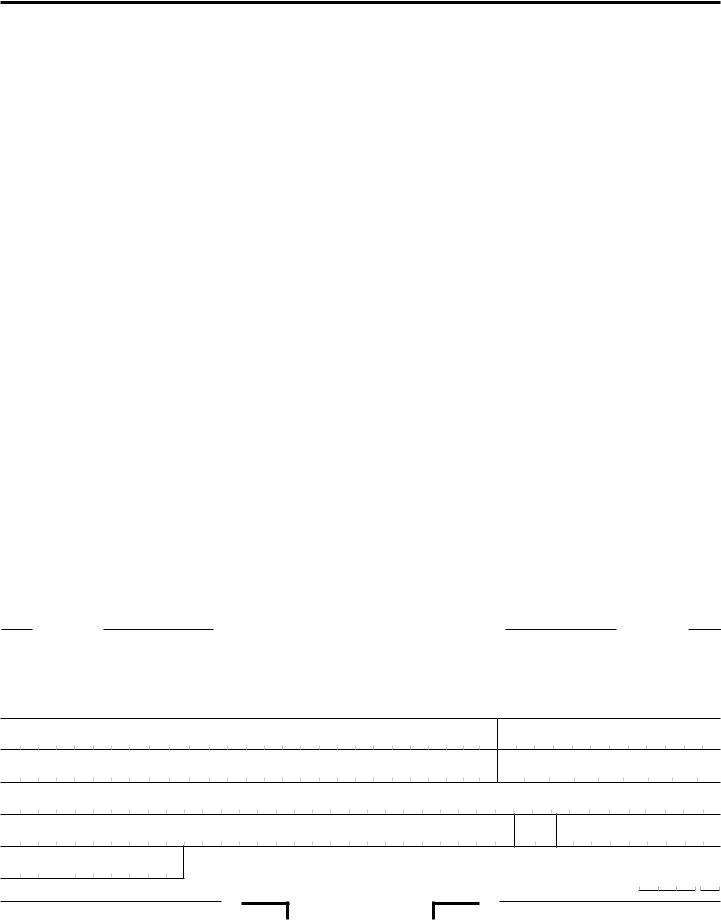

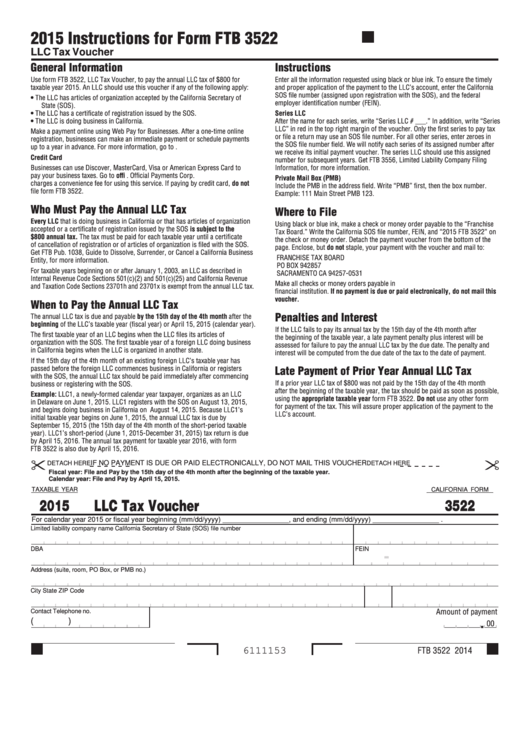

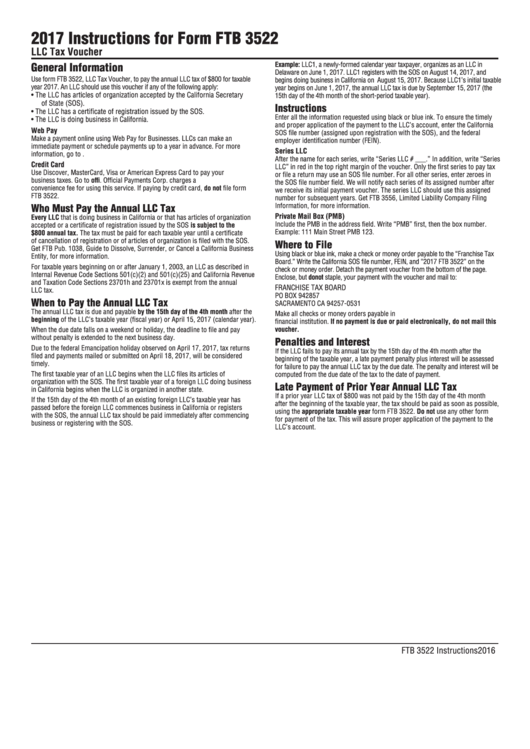

California Tax Form 3522 (Draft) Instructions For Form Ftb 3522 Llc

Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Web form.

Nj form 500 instructions Australian tutorials Working Examples

The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Get your online template and fill it in using progressive features. The llc has articles of organization accepted by the california secretary of state (sos). Web form 3522 is a form used by llcs in california to pay a business's annual tax of.

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

Web find the ca ftb 3522 you require. Fill out the empty fields; What is the estimated fee for california llcs? Get your online template and fill it in using progressive features. All llcs in the state are required to pay this annual tax to stay compliant and in good standing.

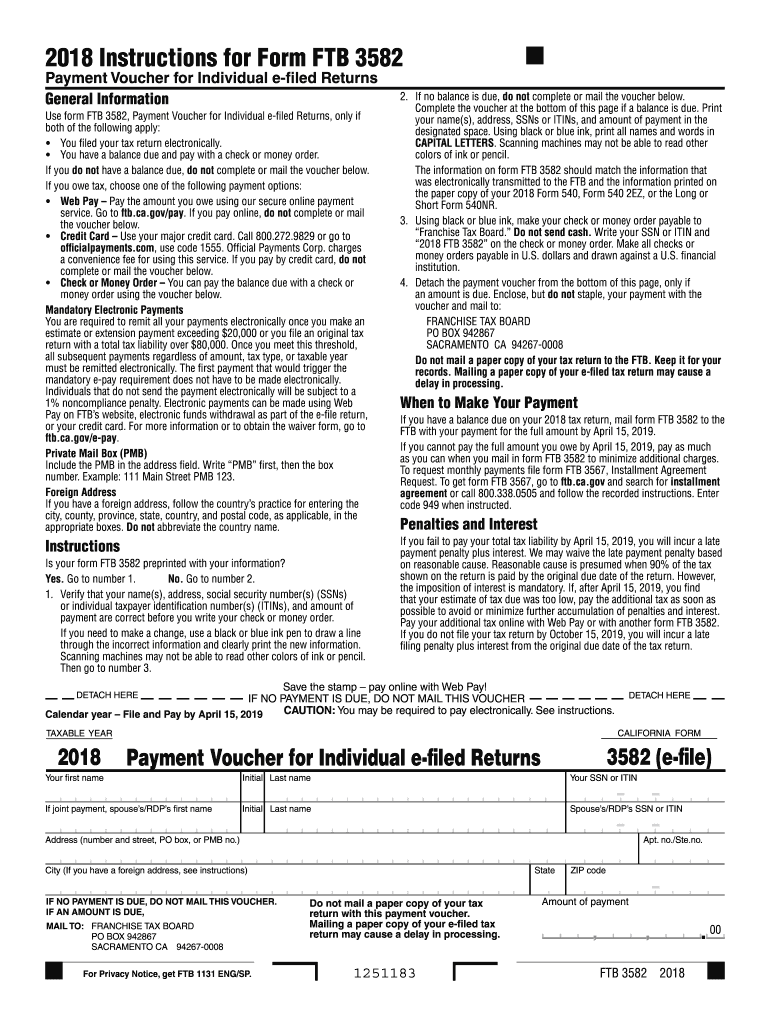

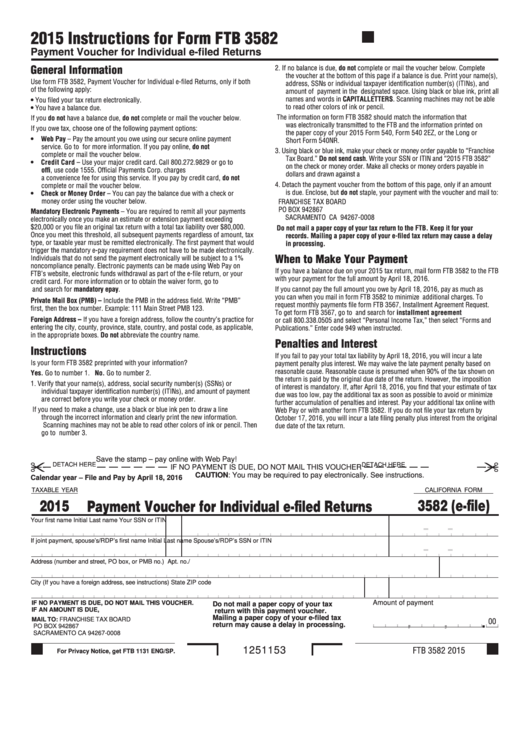

Form 3582 Fill Out and Sign Printable PDF Template signNow

Enjoy smart fillable fields and interactivity. Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Include the date and place your electronic signature. Customize the blanks with smart fillable fields. The llc has articles of organization accepted by the california secretary of state (sos).

Fillable Form 3582 California Payment Voucher For Individual EFiled

Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? Engaged parties names, addresses and numbers etc. The llc has a certificate of registration issued by the sos. An llc should use this voucher if.

Form Ftb 3522 ≡ Fill Out Printable PDF Forms Online

Get your online template and fill it in using progressive features. When a new llc is formed in california, it has four months from the date of its formation to pay this fee. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to.

공장등록증명(신청)서(자가공장, 임대공장) 샘플, 양식 다운로드

Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Web find the ca ftb 3522 you require. Fill out the empty fields; Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Does my california llc need to file form 3536 (estimated fee for llcs) in the 1st year? All llcs in the state are required to pay this annual.

2017 Instructions For Form Ftb 3522 Llc Tax Voucher printable pdf

Fill out the empty fields; An llc should use this voucher if any of the following apply: All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Web use limited liability company tax voucher (ftb 3522) estimate and pay the llc fee by the 15th day of the 6th month after.

2015 Form Ftb 3522 Llc Tax Voucher Tax Walls

Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Enjoy smart fillable fields and interactivity. The llc has a certificate of registration issued by the sos. Fill out the empty fields; Open it with online editor and start adjusting.

Use Estimated Fee For Llcs (Ftb 3536) File Limited Liability Company Return Of Income (Form 568) By The Original Return Due Date.

Engaged parties names, addresses and numbers etc. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Include the date and place your electronic signature. Customize the blanks with smart fillable fields.

Does My California Llc Need To File Form 3536 (Estimated Fee For Llcs) In The 1St Year?

The llc has a certificate of registration issued by the sos. An llc should use this voucher if any of the following apply: When a new llc is formed in california, it has four months from the. What's the goal of assembly bill 85 for business owners?

Enjoy Smart Fillable Fields And Interactivity.

Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Web find the ca ftb 3522 you require. Get your online template and fill it in using progressive features.

Open It With Online Editor And Start Adjusting.

This form must be filed in order to report the gain or loss from the sale or other disposition. Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. All llcs in the state are required to pay this annual tax to stay compliant and in good standing. All llcs in the state are required to pay this annual tax to stay compliant and in good standing.