Fuel Tax Form 2290

Fuel Tax Form 2290 - Report washington ifta fuel tax online with expressifta. Easy2290 is an irs authorized and approved hvut provider for. Web 1 day agouse form 2290 to file in the following circumstances: Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is. Ad file your irs 2290 form online. Web irs form 2290 is used to report and pay heavy vehicle use tax, or hvut. It is a fee that the irs requires all. Current revision form 8849 pdf recent developments none at this time. Web irs form 2290 is what is used by the government to collect what is referred to as the heavy vehicle use tax or hvut tax. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs.

The tax year for form 2290 starts from july of any year and ends the june of next year. Web what is form 2290? Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web simplify your form 2290 reporting by having these information handy. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is. If the gross taxable weight is from 55,000 to 75,000 pounds, the hvut. Web form 2290 also known as heavy highway use tax is a weight permit required by the state to operate any vehicle that weighs over 54,999 lbs. Web you must file form 2290 for these trucks by the last day of the month following the month the vehicle was first used on public highways. Web use this form to claim a refund of excise taxes on certain fuel related sales. It is a fee that the irs requires all.

Web tcs services irp / title & registration fuel tax reporting annual form 2290 authority filings fuel taxes are due quarterly (and in some cases monthly or annually). Report washington ifta fuel tax online with expressifta. You must file form 2290 with schedule 1 annually if a taxable highway motor vehicle, in this case any. Vin, and gross weight of the vehicle. Web this tax form is used to determine how much taxes are due during a select tax year for all highway motor vehicles that are in equal or excess of 55,000 pounds. Free vin checker & correction. Use the table below to. File your 2290 tax online in minutes. Easy, fast, secure & free to try. The tax year for form 2290 starts from july of any year and ends the june of next year.

irs tax form 2290 ThinkTrade Inc Blog

Current revision form 8849 pdf recent developments none at this time. Ad file your irs 2290 form online. Ifta stands for the international fuel tax agreement. Web simplify your form 2290 reporting by having these information handy. Web 1 day agouse form 2290 to file in the following circumstances:

2290 Tax Form 2017 Universal Network

It is a fee that the irs requires all. Use the table below to. Ad need help with irs form 2290 tax filing? Web what is form 2290? Easy, fast, secure & free to try.

Heavy Highway Use Tax Form 2290 Instructions Form Resume Examples

Web simplify your form 2290 reporting by having these information handy. Use the table below to. Get expert assistance with simple 2290 @ $6.95. Web irs form 2290 is what is used by the government to collect what is referred to as the heavy vehicle use tax or hvut tax. It is a tax collection agreement between the 48 contiguous.

Efile Your Form 2290 Tax with YouTube

Web this tax form is used to determine how much taxes are due during a select tax year for all highway motor vehicles that are in equal or excess of 55,000 pounds. Web form 2290 also known as heavy highway use tax is a weight permit required by the state to operate any vehicle that weighs over 54,999 lbs. Vin,.

Free Printable 2290 Tax Form Printable Templates

File your 2290 tax online in minutes. Ad file your irs 2290 form online. Ifta stands for the international fuel tax agreement. It is a fee that the irs requires all. You must file form 2290 with schedule 1 annually if a taxable highway motor vehicle, in this case any.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Do your truck tax online & have it efiled to the irs! Get expert assistance with simple 2290 @ $6.95. Web simplify your form 2290 reporting by having these information handy. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor.

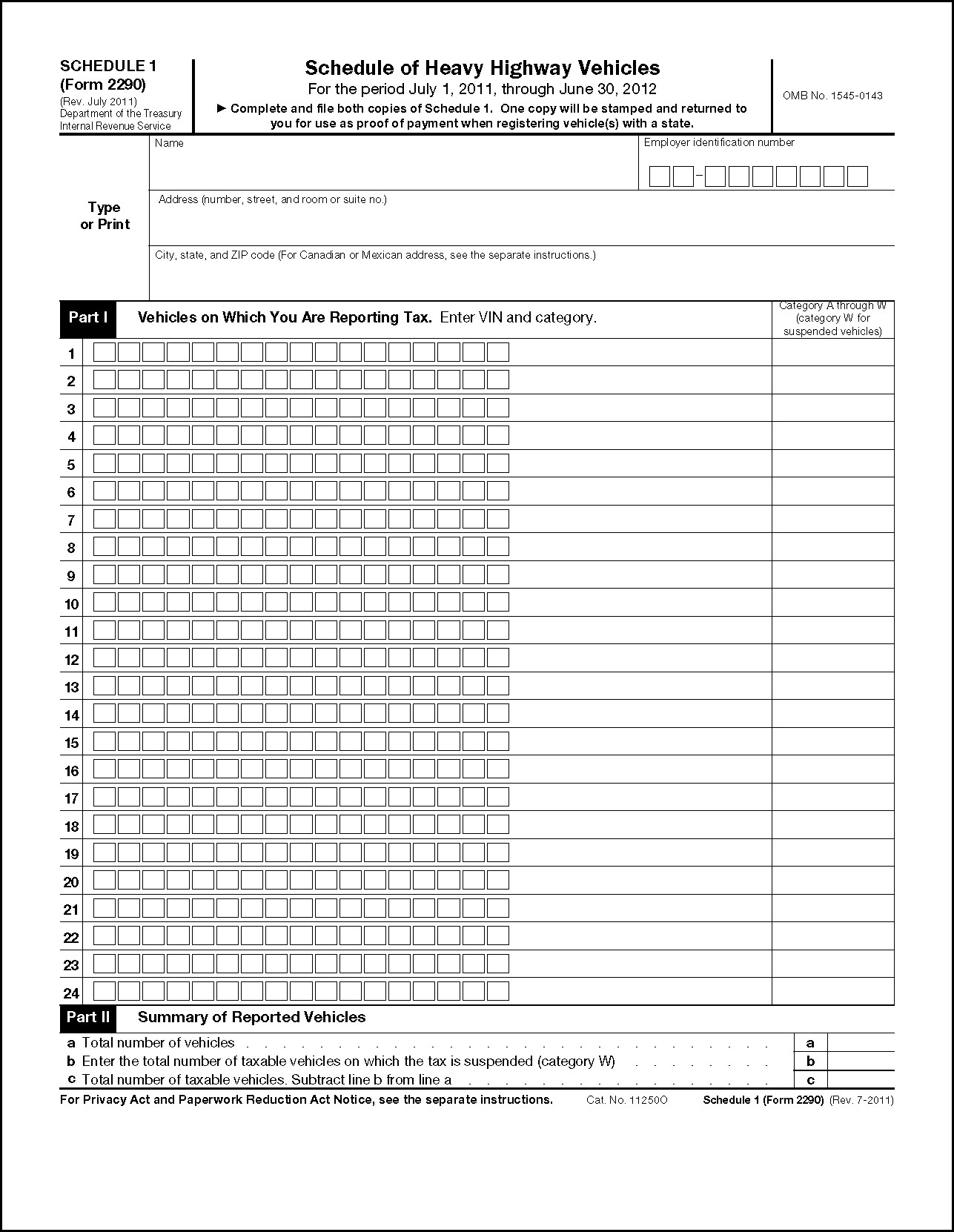

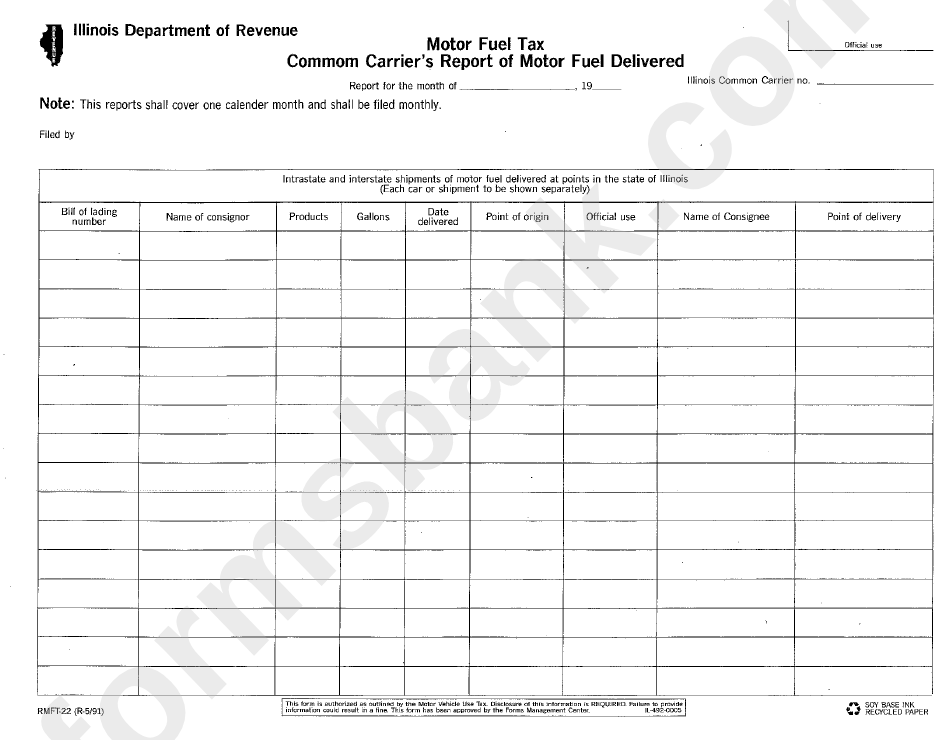

Form Rmft22 Motor Fuel Tax Common Carrier'S Report Of Motor Fuel

Get schedule 1 or your money back. Web tcs services irp / title & registration fuel tax reporting annual form 2290 authority filings fuel taxes are due quarterly (and in some cases monthly or annually). Web what is form 2290? Report washington ifta fuel tax online with expressifta. Web 1 day agouse form 2290 to file in the following circumstances:

Truck Tax Form 2290 Reporting is Due Now and Just couple of Days Left

Web this tax form is used to determine how much taxes are due during a select tax year for all highway motor vehicles that are in equal or excess of 55,000 pounds. If the gross taxable weight is from 55,000 to 75,000 pounds, the hvut. Web what is form 2290? Web you must file form 2290 for these trucks by.

Irs Form 2290 Due Date Form Resume Examples EY392gD82V

Ad need help with irs form 2290 tax filing? If the gross taxable weight is from 55,000 to 75,000 pounds, the hvut. The tax year for form 2290 starts from july of any year and ends the june of next year. File your 2290 tax online in minutes. Web 1 day agouse form 2290 to file in the following circumstances:

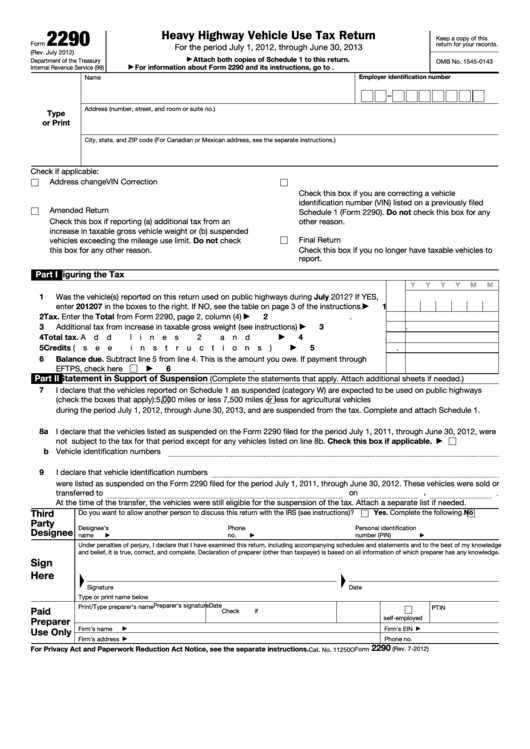

Figure And Pay Tax Due On Vehicles Used During The Reporting Period With A Taxable Gross Weight Of 55,000 Pounds.

Ad need help with irs form 2290 tax filing? Report washington ifta fuel tax online with expressifta. If the gross taxable weight is from 55,000 to 75,000 pounds, the hvut. Web this tax form is used to determine how much taxes are due during a select tax year for all highway motor vehicles that are in equal or excess of 55,000 pounds.

Form 2290 Is Used To Report And Pay The Hvut For Vehicles Having A Taxable Gross Weight Of 55,000 Pounds Or More That You Operate On Public Highways.

Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is. Get expert assistance with simple 2290 @ $6.95. Ad online 2290 tax filing in minutes. Vin, and gross weight of the vehicle.

Use The Table Below To.

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. It is a tax collection agreement between the 48 contiguous states of the united states and the 10 provinces. Web simplify your form 2290 reporting by having these information handy. The tax year for form 2290 starts from july of any year and ends the june of next year.

File Your 2290 Tax Online In Minutes.

You must file form 2290 with schedule 1 annually if a taxable highway motor vehicle, in this case any. It is a fee that the irs requires all. Web tcs services irp / title & registration fuel tax reporting annual form 2290 authority filings fuel taxes are due quarterly (and in some cases monthly or annually). Ad file your irs 2290 form online.