Ga Form 500 Es

Ga Form 500 Es - Web georgia — estimated quarterly tax return download this form print this form it appears you don't have a pdf plugin for this browser. Sign it in a few clicks draw your signature, type. Web form 500 is the general income tax return form for all georgia residents. Web georgia department of revenue save form. Please use the link below to. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e1 fiscal yearbeginning rfission)cal. The purpose is to enable taxpayers having income not subject to. Complete, save and print the form online using your browser. Follow all instructions on the form and be sure to. Web complete, save and print the form online using your browser.

Web georgia department of revenue save form. Web form 500 is the general income tax return form for all georgia residents. The purpose is to enable taxpayers. Edit your georgia 500 es tax online type text, add images, blackout confidential details, add comments, highlights and more. Web georgia department of revenue save form. 08/02/21) individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal. Sign it in a few clicks draw your signature, type. The purpose is to enable taxpayers having income not subject to. 05/29/20) individual and fiduciary estimated tax payment voucher. Follow all instructions on the form and be sure to.

Web 500 es ( rev. Complete, save and print the form online using your browser. Web form 500 is the general income tax return form for all georgia residents. Web georgia department of revenue save form. Sign it in a few clicks draw your signature, type. 08/02/21) individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal. Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Edit your georgia 500 es tax online type text, add images, blackout confidential details, add comments, highlights and more. Web georgia — estimated quarterly tax return download this form print this form it appears you don't have a pdf plugin for this browser. Sign it in a few clicks.

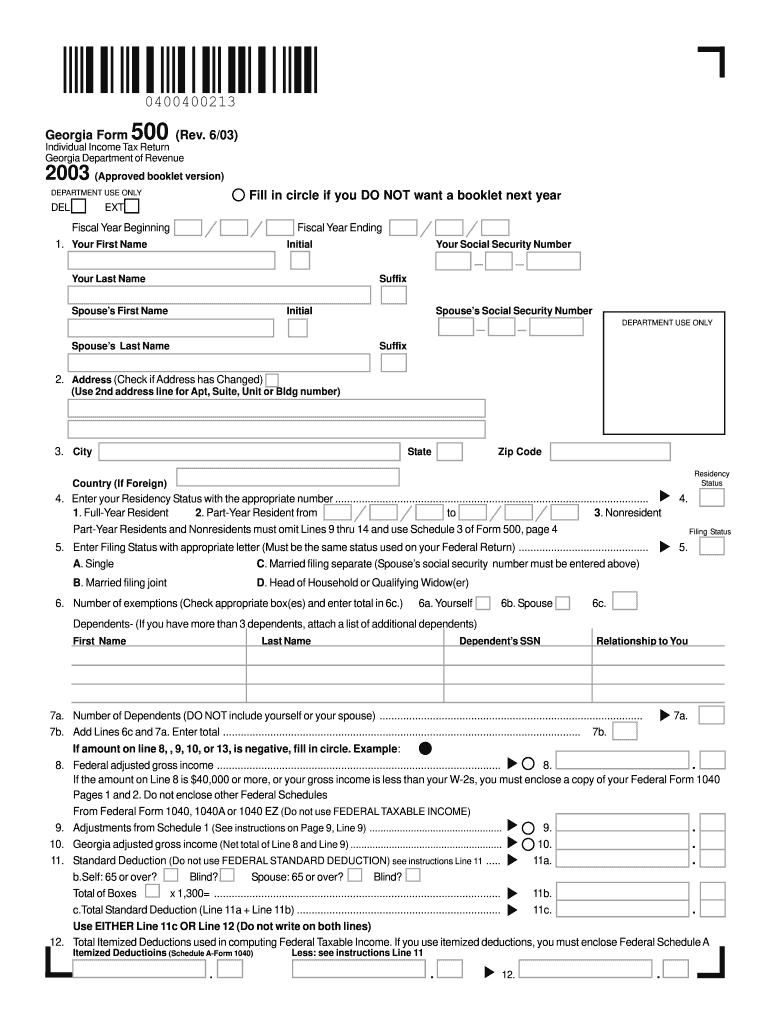

2003 Form GA DoR 500 Fill Online, Printable, Fillable, Blank pdfFiller

We last updated the estimated quarterly tax return in. Please use the link below to. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Edit your georgia 500 es tax online type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents.

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

Sign it in a few clicks. The purpose is to enable taxpayers having income not subject to. Web we last updated georgia form 500 in january 2023 from the georgia department of revenue. Web georgia form 500 (rev. Web complete, save and print the form online using your browser.

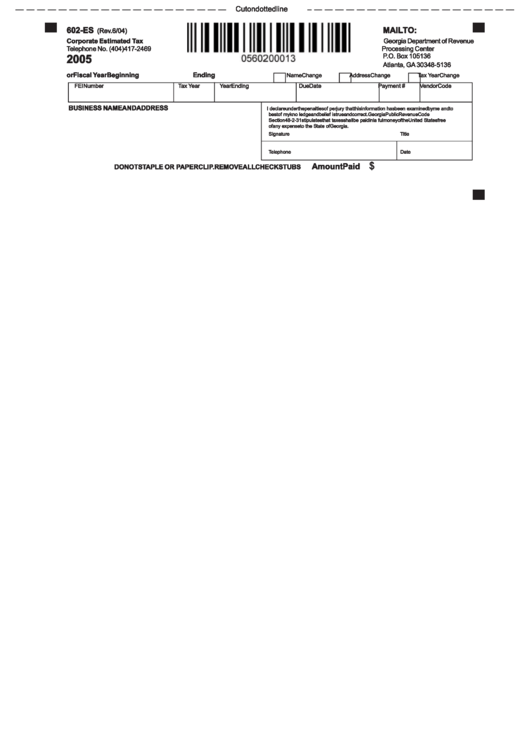

Form 602Es Corporate Estimated Tax Department Of Revenue

Edit your georgia 500 es tax online type text, add images, blackout confidential details, add comments, highlights and more. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your fillbable form 500 online. We last updated the estimated quarterly tax return in. Web find georgia form 500 instructions at esmart tax today.

Entertainment & Film Credits Investor FAQ Churchill Stateside Group

Web form 500 is the general income tax return form for all georgia residents. Edit your georgia 500 es tax online type text, add images, blackout confidential details, add comments, highlights and more. Web find georgia form 500 instructions at esmart tax today. Web complete, save and print the form online using your browser. Web georgia form 500 (rev.

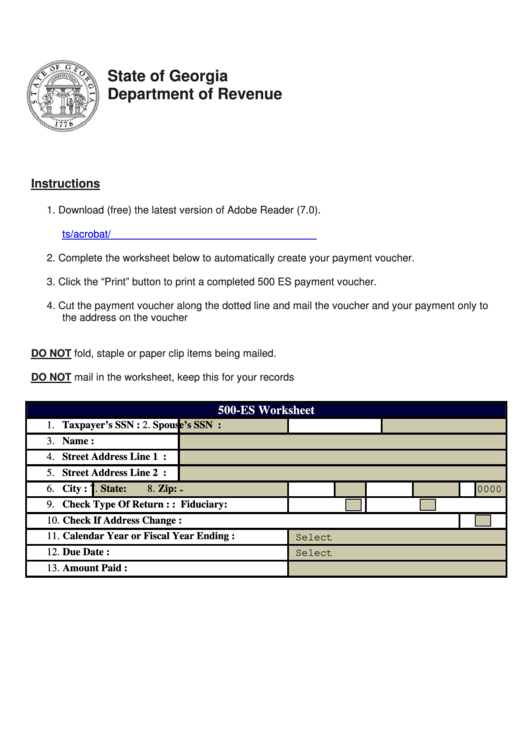

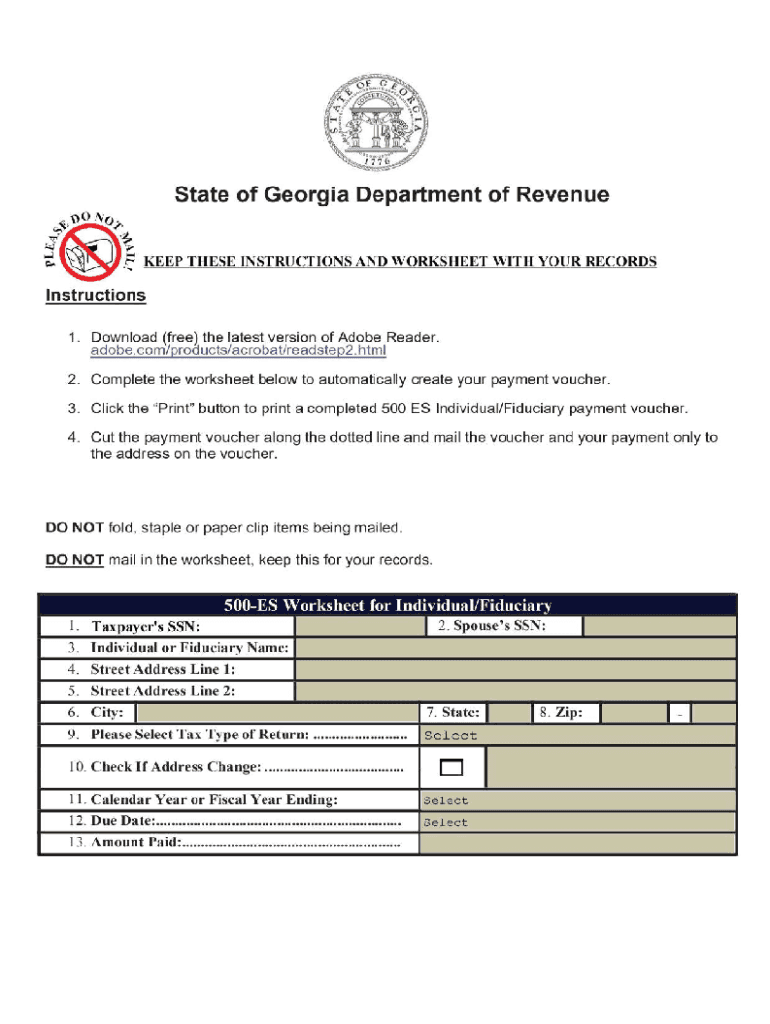

Fillable Form 500 Es 500Es Worksheet/individual Estimated Tax

Web georgia department of revenue save form. Please use the link below to. Web we last updated georgia form 500 in january 2023 from the georgia department of revenue. Sign it in a few clicks draw your signature, type. Sign it in a few clicks.

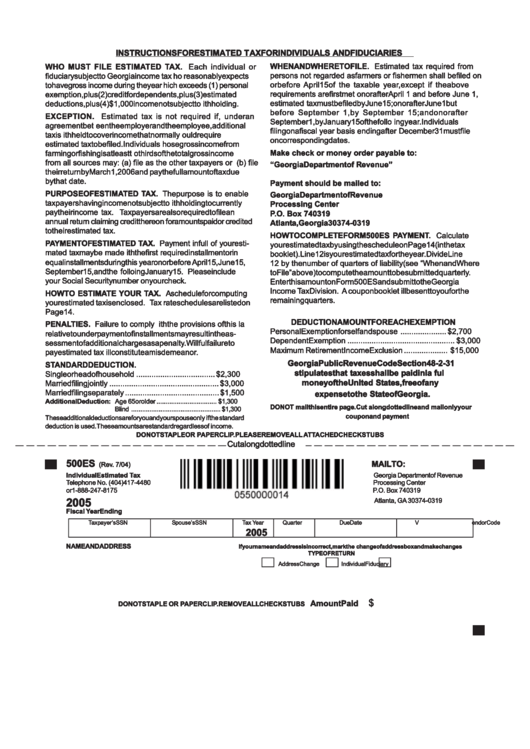

Form 500 Es Individual Estimated Tax Department Of Revenue

This form is for income earned in tax year 2022, with tax returns due in april. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e1 fiscal yearbeginning rfission)cal. Web form 500 es and submit to the georgia department of revenue. Edit your georgia 500 es tax online type text, add images, blackout confidential details,.

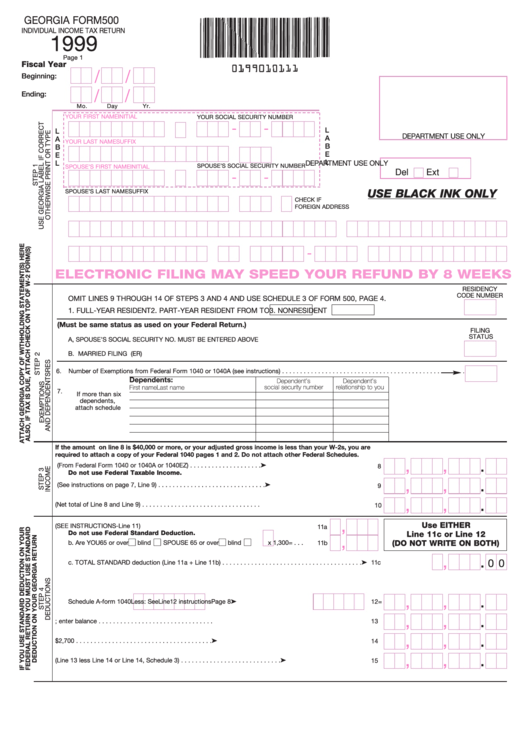

Form 500 Individual Tax Return 1999 printable pdf

Please use the link below to. The purpose is to enable taxpayers having income not subject to. The purpose is to enable taxpayers. Edit your fillbable form 500 online. Follow all instructions on the form and be sure to.

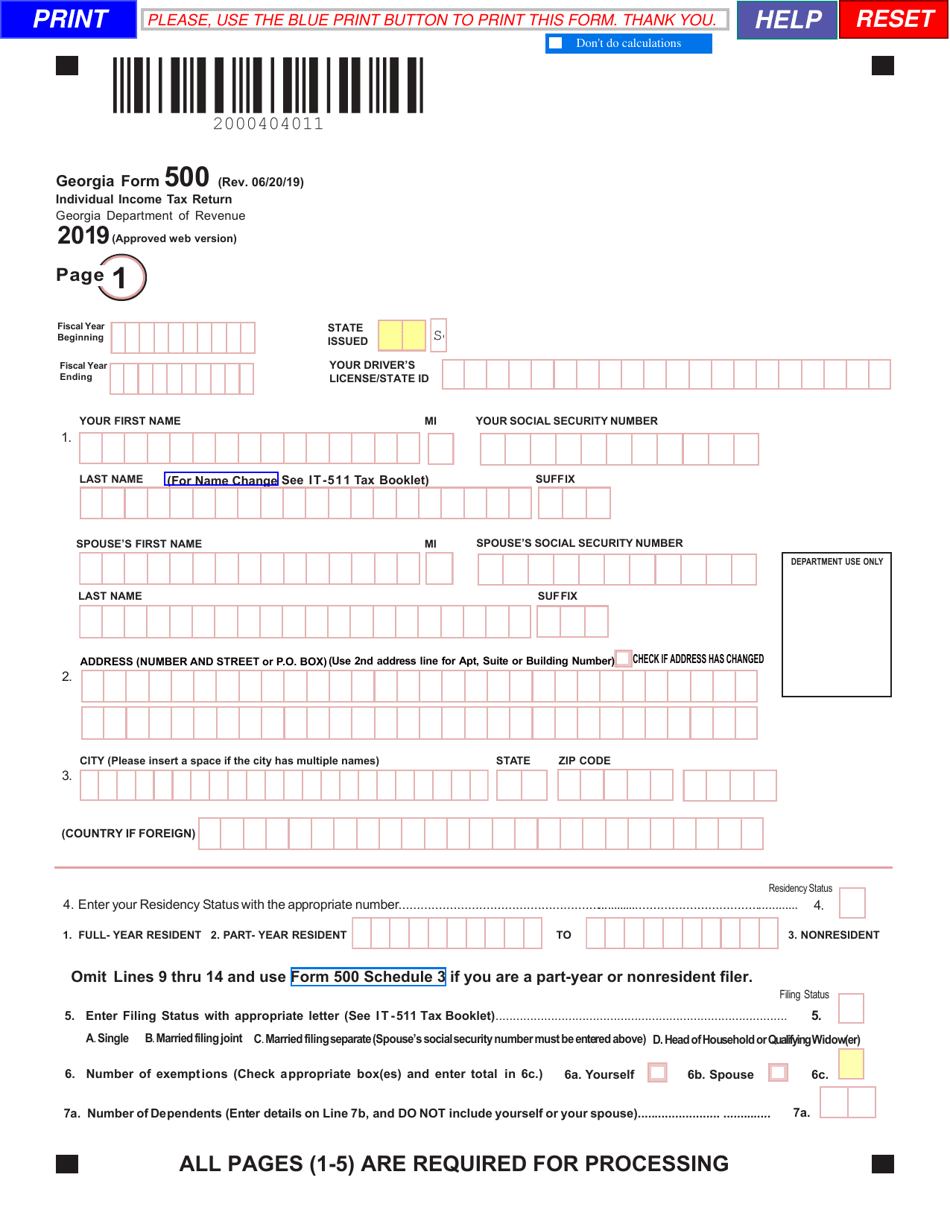

Form 500 Download Fillable PDF or Fill Online Individual Tax

Web georgia — estimated quarterly tax return download this form print this form it appears you don't have a pdf plugin for this browser. Web georgia form 500 (rev. Please use the link below to. Follow all instructions on the form and be sure to. Web find georgia form 500 instructions at esmart tax today.

GA DoR 500 ES 2021 Fill out Tax Template Online US Legal Forms

Web georgia department of revenue save form. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Save or instantly send your ready documents. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e1 fiscal yearbeginning rfission)cal. The purpose is to enable taxpayers.

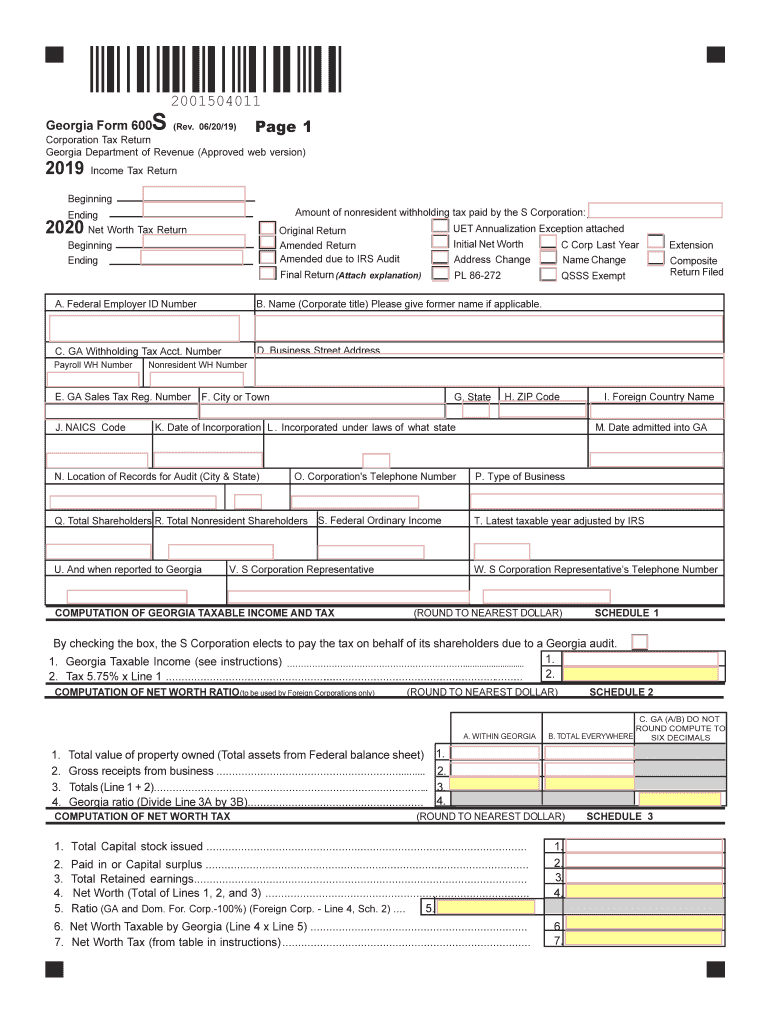

GA DoR 600S 20192022 Fill out Tax Template Online US Legal Forms

Web we last updated georgia form 500 in january 2023 from the georgia department of revenue. Complete, save and print the form online using your browser. The purpose is to enable taxpayers having income not subject to. Save or instantly send your ready documents. Web form 500 es and submit to the georgia department of revenue.

Print Blank Form > Georgia Department Of Revenue.

Follow all instructions on the form and be sure to. Web georgia department of revenue save form. This form is for income earned in tax year 2022, with tax returns due in april. Web georgia form 500 (rev.

Web Georgia Department Of Revenue Save Form.

Save or instantly send your ready documents. Edit your georgia 500 es tax online type text, add images, blackout confidential details, add comments, highlights and more. Type text, add images, blackout confidential details, add comments, highlights and more. Web form 500 is the general income tax return form for all georgia residents.

The Purpose Is To Enable Taxpayers Having Income Not Subject To.

Easily fill out pdf blank, edit, and sign them. Web form 500 es and submit to the georgia department of revenue. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. We last updated the estimated quarterly tax return in.

Edit Your Fillbable Form 500 Online.

Schedule 1, line 14 must be completed in order for line 9 on form 500 page 2 to populate. Web 500 es ( rev. Complete, save and print the form online using your browser. 05/29/20) individual and fiduciary estimated tax payment voucher.