Georgia Form 600

Georgia Form 600 - To successfully complete the form, you must download and use the current version of adobe acrobat reader. Page 2 (corporation) name fein. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Web complete, save and print the form online using your browser. Name (corporate title) please give former name if applicable. Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Computation of tax due or overpayment (round to nearest dollar) schedule 3. This form is for income earned in tax year 2022, with tax returns due in april 2023.

Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Georgia taxable income (enter also on schedule 1, line 7). Business street address payroll wh number nonresident wh number Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar) schedule 5 1. Web georgia form 600s (rev. See page 3 signature section for direct deposit options. Web complete, save and print the form online using your browser. Page 2 (corporation) name fein. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year.

We will update this page with a new version of the form for 2024 as soon as it is made available by the georgia government. You can print other georgia tax forms here. Georgia taxable income (enter also on schedule 1, line 7). Additions to federal taxable income (round to nearest dollar) schedule 4. Web complete, save and print the form online using your browser. Web georgia form 600s (rev. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar) schedule 5 1. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. Business street address payroll wh number nonresident wh number

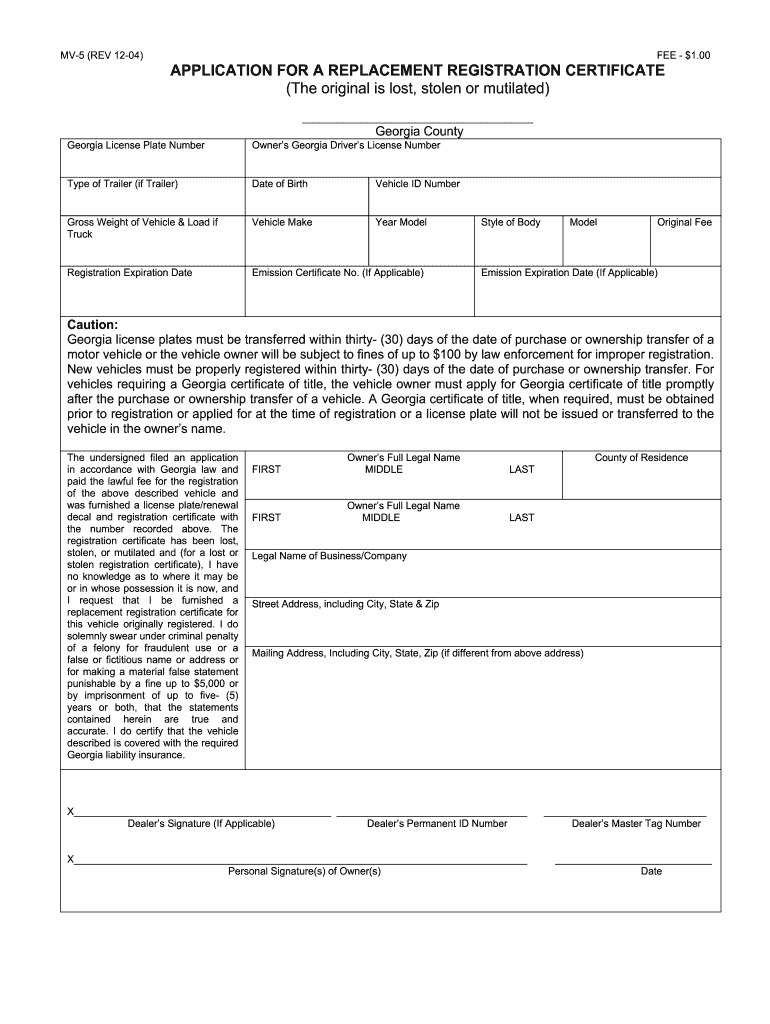

Mv 5 Form Fill Out and Sign Printable PDF Template signNow

Name (corporate title) please give former name if applicable. We will update this page with a new version of the form for 2024 as soon as it is made available by the georgia government. Web georgia form 600s (rev. To successfully complete the form, you must download and use the current version of adobe acrobat reader. 07/20/22) corporation tax return.

Get The Form T 22c 20202022 Fill and Sign Printable Template

Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Name (corporate title) please give former name if applicable. Web georgia form 600s (rev. Page 2 (corporation) name fein. Web georgia department of revenue (approved web2 version) 2022 income tax return 2023 net nworth tax return beginning.

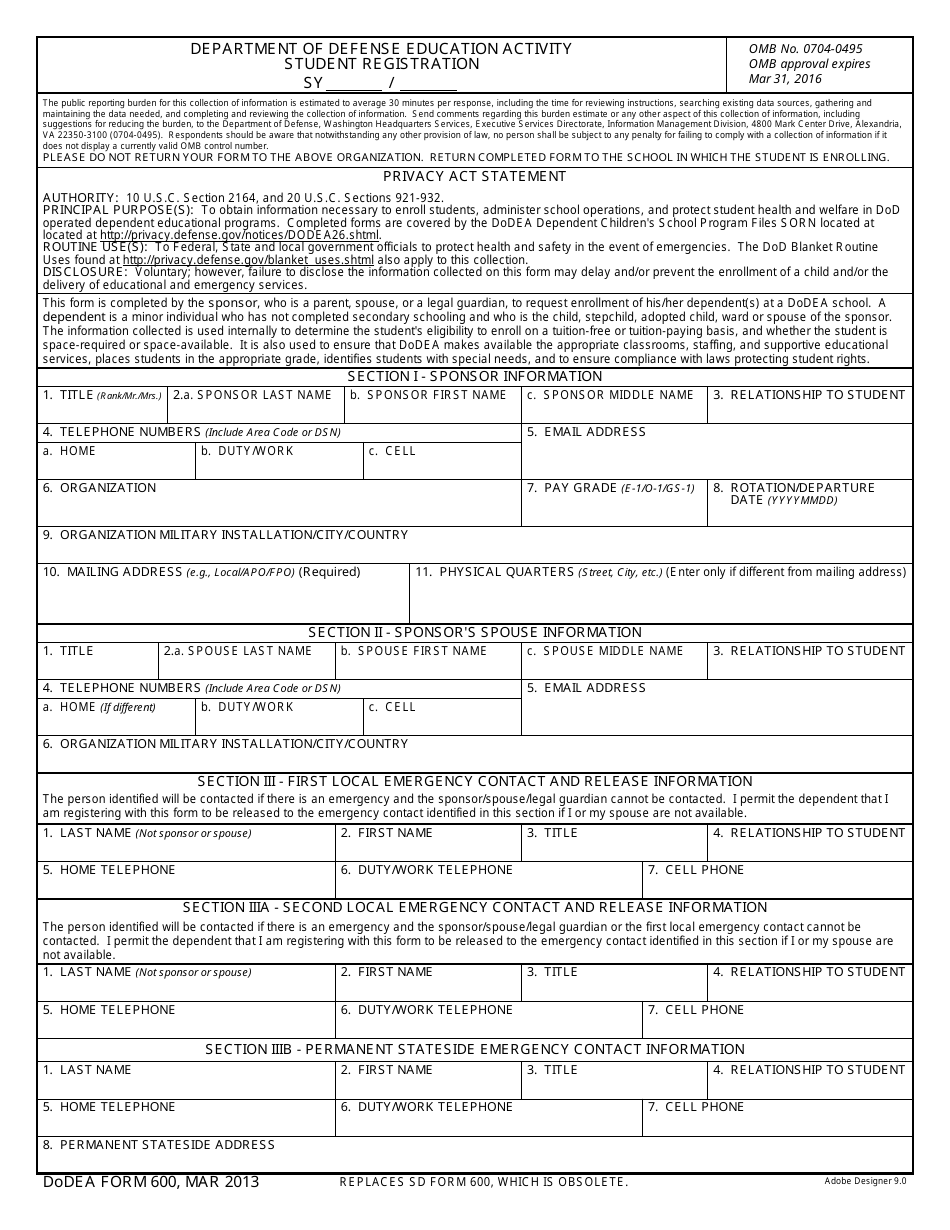

DoDEA Form 600 Download Fillable PDF or Fill Online Department of

To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web georgia form 600s (rev. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Name (corporate title) please give former name if applicable. Web we last updated georgia form 600 in january 2023 from the georgia department of.

Entertainment & Film Credits Investor FAQ Churchill Stateside Group

Business street address payroll wh number nonresident wh number You can print other georgia tax forms here. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Web georgia department of revenue (approved web2 version) 2022 income tax return 2023.

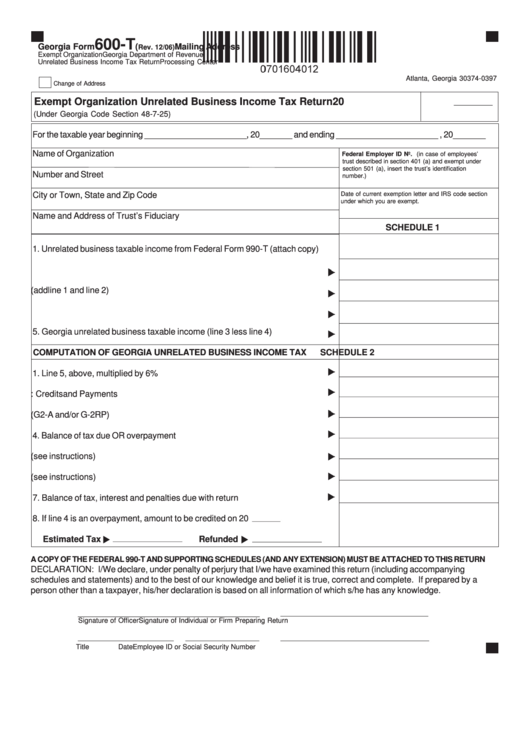

Form 600T Exempt Organization Unrelated Business Tax

Page 2 (corporation) name fein. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Web complete, save and print the form online using your browser. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Due dates for partnership returns partnership returns are due on or before the 15th.

2005 Form GA DoR 600S Fill Online, Printable, Fillable, Blank pdfFiller

07/20/22) corporation tax return 1. You can print other georgia tax forms here. To successfully complete the form, you must download and use the current version of adobe acrobat reader. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Web georgia department of revenue (approved web2 version) 2022 income tax return 2023 net nworth tax.

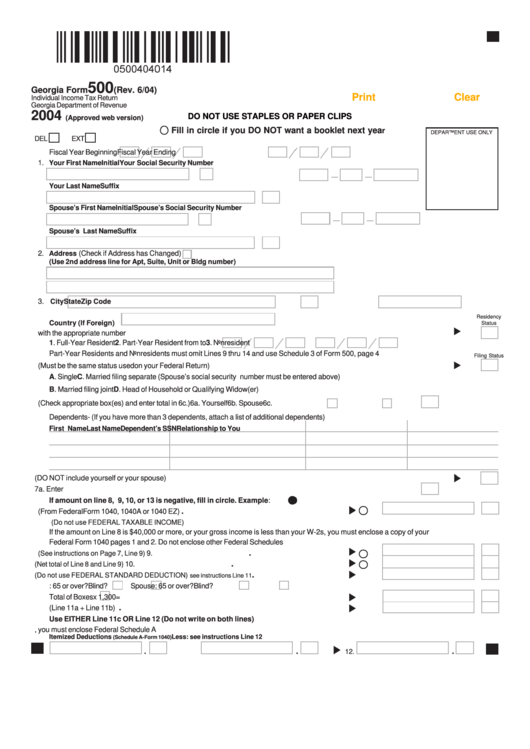

Fillable Form 500 Individual Tax Return 2004

Page 2 (corporation) name fein. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a. Web complete, save and print the form online using your browser. Computation of tax due or overpayment (round to nearest dollar) schedule 3. Name (corporate title) please give former name if applicable.

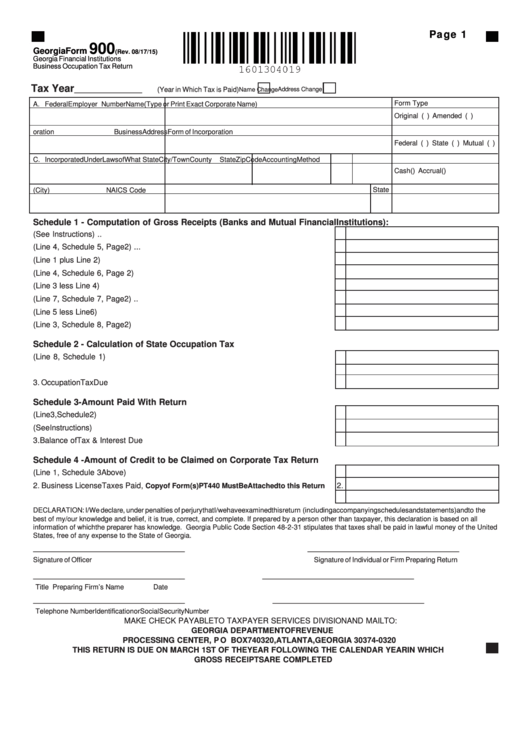

Fillable Form 900 Financial Institutions Business

Name (corporate title) please give former name if applicable. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Federal taxable income (copy of federal return and supporting schedules must be attached). Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the.

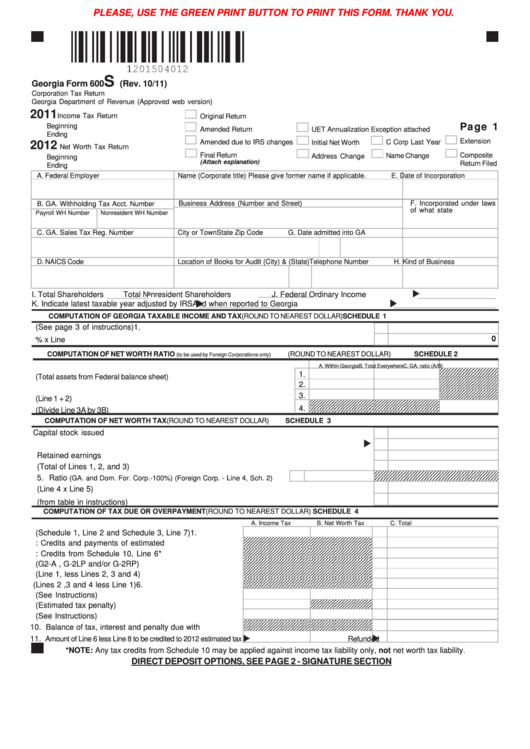

Fillable Form 600s Corporation Tax Return printable pdf download

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. This form is for income earned in tax year 2022, with tax returns due in april 2023. Georgia form 600/2020 apportionment of income schedule 6 subtractions from federal taxable income (round to nearest dollar).

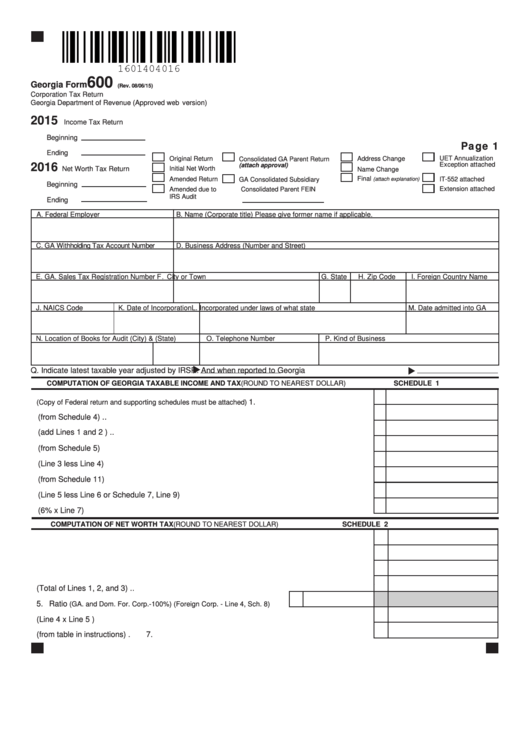

Fillable Form 600 Corporation Tax Return 2015 printable pdf

07/20/22) corporation tax return 1. Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Federal taxable income (copy of federal return and supporting schedules must be attached). Web complete, save and print the form online using your browser. Due dates for partnership returns partnership returns are due on or before the 15th day.

Additions To Federal Taxable Income (Round To Nearest Dollar) Schedule 4.

Web georgia form 600s (rev. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web complete, save and print the form online using your browser. You can print other georgia tax forms here.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Georgia Government.

Name (corporate title) please give former name if applicable. See page 3 signature section for direct deposit options. This form is for income earned in tax year 2022, with tax returns due in april 2023. To successfully complete the form, you must download and use the current version of adobe acrobat reader.

Federal Employer Id Number B.

Web we last updated georgia form 600 in january 2023 from the georgia department of revenue. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Georgia taxable income (enter also on schedule 1, line 7). Page 2 (corporation) name fein.

Web Georgia Department Of Revenue (Approved Web2 Version) 2022 Income Tax Return 2023 Net Nworth Tax Return Beginning Ending 1.

Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. Interest on obligations of united states (must be reduced by direct and indirect interest expense) 1. 07/20/22) corporation tax return 1. 07/20/22) page 1 corporation tax return georgia department of revenue (approved web version) a.