H Ez Form

H Ez Form - If i qualify for homestead. Use get form or simply click on the template preview to open it in the editor. Web up to $40 cash back edit h ez wisconsin homestead credit form. Schedule h (form 1040) for figuring your household employment taxes. Web •schedule h (form 1040) for figuring your household employment taxes. What is the deadline for filing my 2022 homestead credit claim? Federal privacy act in compliance with federal law, you are hereby notified that the request. See pages 14 to 17 of the schedule h instructions. You can download or print current or past. Complete, sign, print and send your tax documents easily with us legal forms.

If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2017,. Use get form or simply click on the template preview to open it in the editor. What is the deadline for filing my 2022 homestead credit claim? If i qualify for homestead. Schedule h (form 1040) for figuring your household employment taxes. Web up to $40 cash back edit h ez wisconsin homestead credit form. If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2020,. Web if filing a wisconsin income tax return, fill in your homestead credit (line 14) on line 32 of form 1 or line 63 of form 1npr. Start completing the fillable fields and carefully. Web we last updated the homestead credit claim in march 2023, so this is the latest version of schedule h, fully updated for tax year 2022.

If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2020,. See pages 14 to 17 of the schedule h instructions. This form is for income earned in tax year 2022, with tax returns due in april. Web if filing a wisconsin income tax return, fill in your homestead credit (line 14) on line 32 of form 1 or line 63 of form 1npr. Web go to catalog establishing secure connection…loading editor…preparing document… electronic signature forms library other forms all forms h ez form 2020 h ez form. Web we last updated the homestead credit claim in march 2023, so this is the latest version of schedule h, fully updated for tax year 2022. If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2017,. Federal privacy act in compliance with federal law, you are hereby notified that the request. Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue. Web up to $40 cash back edit h ez wisconsin homestead credit form.

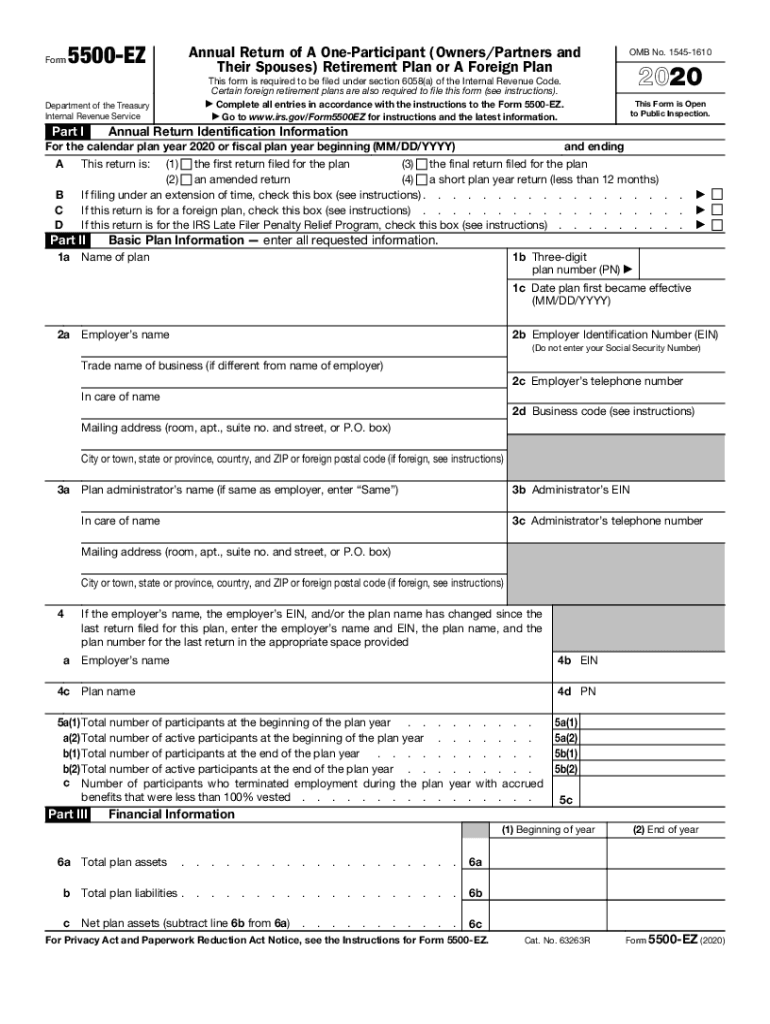

Form 5500 Fill Out and Sign Printable PDF Template signNow

Web •schedule h (form 1040) for figuring your household employment taxes. Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue. Schedule h (form 1040) for figuring your household employment taxes. What is the deadline for filing my 2022 homestead credit claim? Rearrange and rotate pages, insert new and alter existing texts, add new.

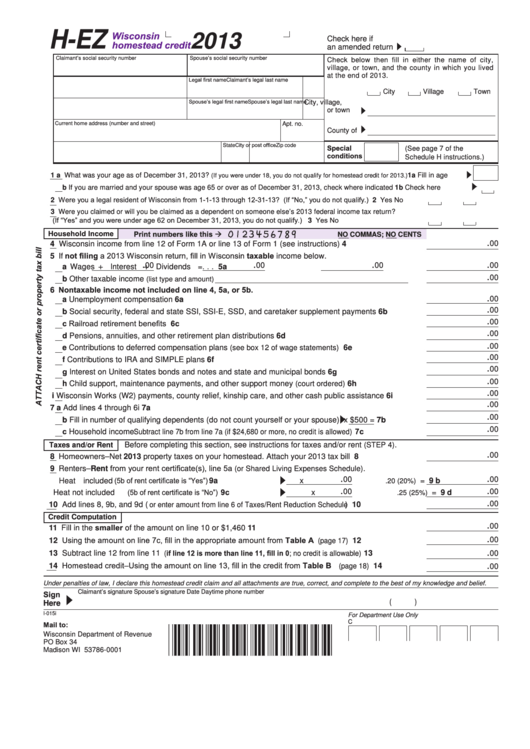

2015 Form WI DoR Schedule HEZ Fill Online, Printable, Fillable, Blank

Complete, sign, print and send your tax documents easily with us legal forms. Web to complete schedule h, from the wisconsin tax return menu in taxslayer pro select: Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue. If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more.

Fillable Form HEz Wisconsin Homestead Credit 2013 printable pdf

Schedule h (form 1040) for figuring your household employment taxes. You can download or print current or past. Web go to catalog establishing secure connection…loading editor…preparing document… electronic signature forms library other forms all forms h ez form 2020 h ez form. Complete, sign, print and send your tax documents easily with us legal forms. Rearrange and rotate pages, insert.

Ez Form Fill Out and Sign Printable PDF Template signNow

Download blank or fill out online in pdf format. Use get form or simply click on the template preview to open it in the editor. Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue. Web if filing a wisconsin income tax return, fill in your homestead credit (line 14) on line 32 of.

EZ Form March 2015 Release YouTube

This form is for income earned in tax year 2022, with tax returns due in april. Start completing the fillable fields and carefully. Download blank or fill out online in pdf format. If i qualify for homestead. Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue.

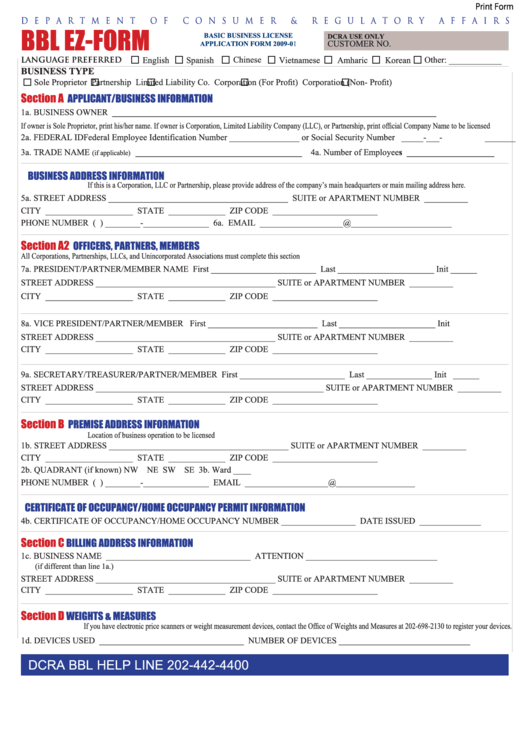

Fillable Bbl EzForm Basic Business License Application Form 200901

What is the deadline for filing my 2022 homestead credit claim? Web here is a list of forms that household employers need to complete. You can download or print current or past. Schedule h (form 1040) for figuring your household employment taxes. If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any.

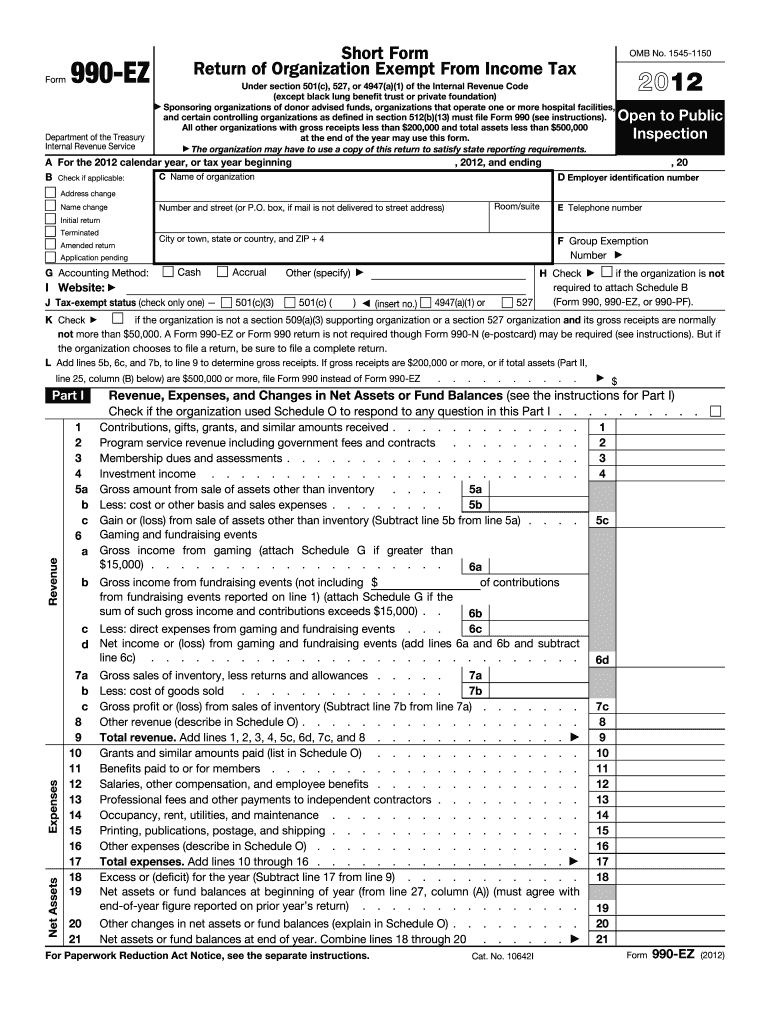

Nonprofit Forms 1023 & Form 1023EZ EPGD Business Law

This form is for income earned in tax year 2022, with tax returns due in april. If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2017,. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other. Federal privacy act in compliance.

Form H1200 Ez Fill Online, Printable, Fillable, Blank pdfFiller

If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2020,. Schedule h (form 1040) for figuring your household employment taxes. Web if filing a wisconsin income tax return, fill in your homestead credit (line 14) on line 32 of form 1 or line 63 of form 1npr. Rearrange and.

New IRS Form 1023EZ make applying for tax exempt status easier

If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2017,. See pages 14 to 17 of the schedule h instructions. Web we last updated the homestead credit claim in march 2023, so this is the latest version of schedule h, fully updated for tax year 2022. Web up to.

New tax forms could mean big penalties if not completed by end of the year

Web we last updated the homestead credit claim in march 2023, so this is the latest version of schedule h, fully updated for tax year 2022. Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue. Web if filing a wisconsin income tax return, fill in your homestead credit (line 14) on line 32.

Web Form Popularity Fillable & Printable;

Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other. Complete, sign, print and send your tax documents easily with us legal forms. Web to complete schedule h, from the wisconsin tax return menu in taxslayer pro select: What is the deadline for filing my 2022 homestead credit claim?

See Pages 17 To 19 Of The Schedule H Instructions.

Download blank or fill out online in pdf format. See pages 14 to 17 of the schedule h instructions. This form is for income earned in tax year 2022, with tax returns due in april. Web here is a list of forms that household employers need to complete.

Federal Privacy Act In Compliance With Federal Law, You Are Hereby Notified That The Request.

If you received a)any wisconsin works (w2) payments or b) county relief of $400 or more for any month of 2020,. Web we last updated wisconsin schedule h in march 2023 from the wisconsin department of revenue. Use get form or simply click on the template preview to open it in the editor. This form is for income earned in tax year 2022, with tax returns due in april.

Web We Last Updated The Homestead Credit Claim In March 2023, So This Is The Latest Version Of Schedule H, Fully Updated For Tax Year 2022.

Web •schedule h (form 1040) for figuring your household employment taxes. Start completing the fillable fields and carefully. Web go to catalog establishing secure connection…loading editor…preparing document… electronic signature forms library other forms all forms h ez form 2020 h ez form. Schedule h (form 1040) for figuring your household employment taxes.