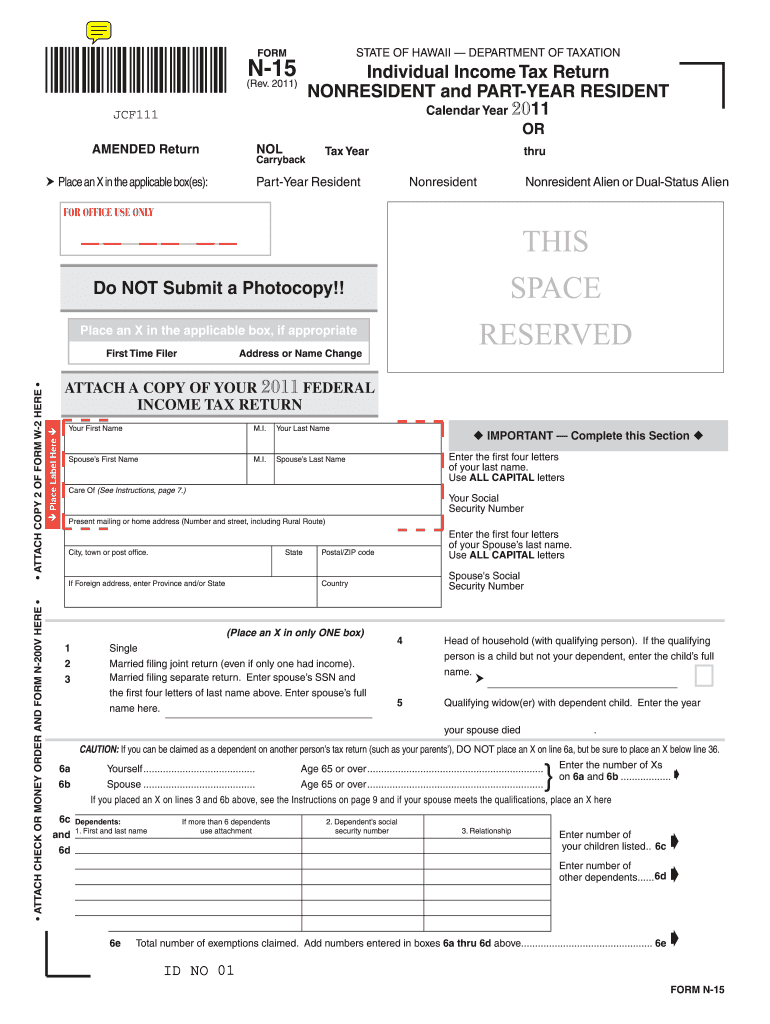

Hawaii N-15 Form

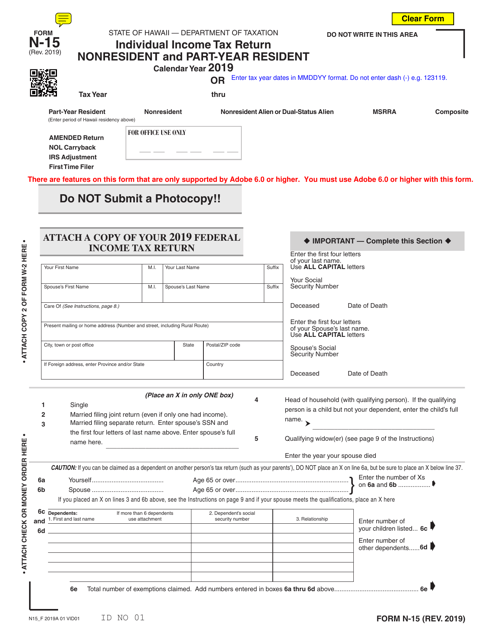

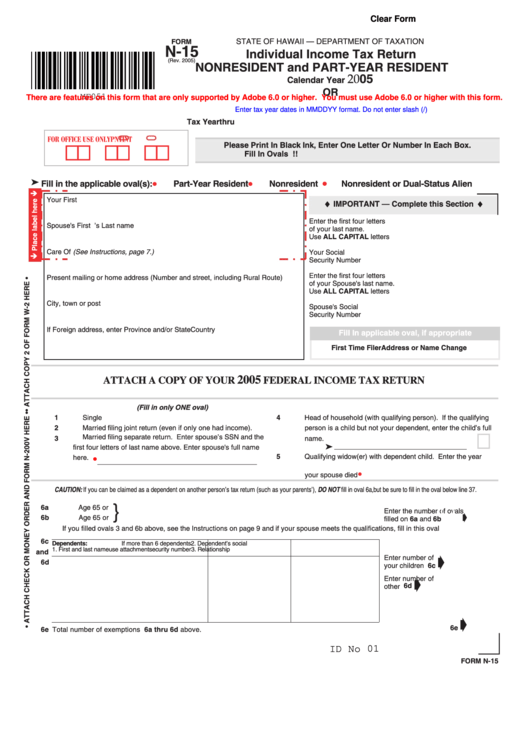

Hawaii N-15 Form - Web state of hawaii — department of taxation do not write in this area (rev. Otherwise go to page 21 of the instructions and enter. For information and guidance in its preparation, we have helpful publications and other instructions on our website at tax.hawaii.gov. Partner’s share of income, credits, deductions, etc. Partner’s share of income, credits, deductions, etc. We will update this page with a new version of the form for 2024 as soon as it is made available by the hawaii government. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web f state of hawaii department of taxation n15 i i t (rev. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a.

Otherwise go to page 21 of the instructions and enter. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return. Partner’s share of income, credits, deductions, etc. Web state of hawaii — department of taxation do not write in this area individual incometax return (rev. Partner’s share of income, credits, deductions, etc. This form is for income earned in tax year 2022, with tax returns due in april 2023. Thru m d d y y !! We will update this page with a new version of the form for 2024 as soon as it is made available by the hawaii government. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web f state of hawaii department of taxation n15 i i t (rev.

Web f state of hawaii department of taxation n15 i i t (rev. Web state of hawaii — department of taxation do not write in this area (rev. Thru m d d y y !! For information and guidance in its preparation, we have helpful publications and other instructions on our website at tax.hawaii.gov. Partner’s share of income, credits, deductions, etc. We will update this page with a new version of the form for 2024 as soon as it is made available by the hawaii government. Otherwise go to page 21 of the instructions and enter. Partner’s share of income, credits, deductions, etc. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return.

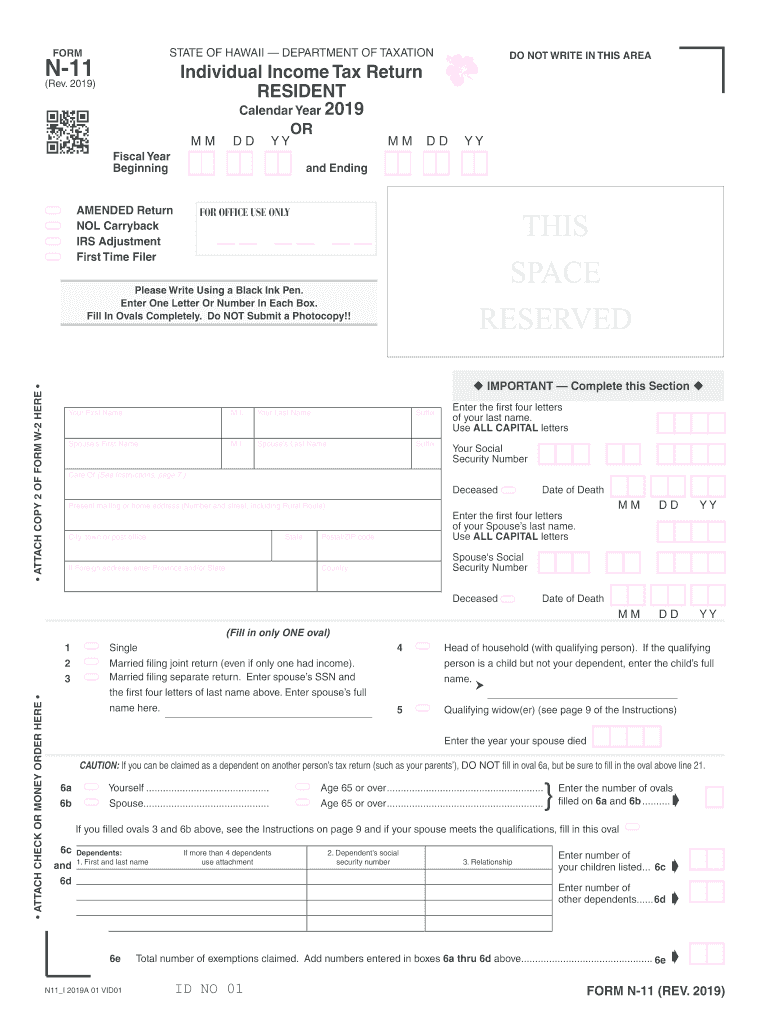

2019 Form HI N11 Fill Online, Printable, Fillable, Blank pdfFiller

Partner’s share of income, credits, deductions, etc. Otherwise go to page 21 of the instructions and enter. Partner’s share of income, credits, deductions, etc. For information and guidance in its preparation, we have helpful publications and other instructions on our website at tax.hawaii.gov. Thru m d d y y !!

Form N 15 Fill Out and Sign Printable PDF Template signNow

This form is for income earned in tax year 2022, with tax returns due in april 2023. 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Partner’s share of income, credits, deductions, etc. Thru m d d y y !! Web state of hawaii — department.

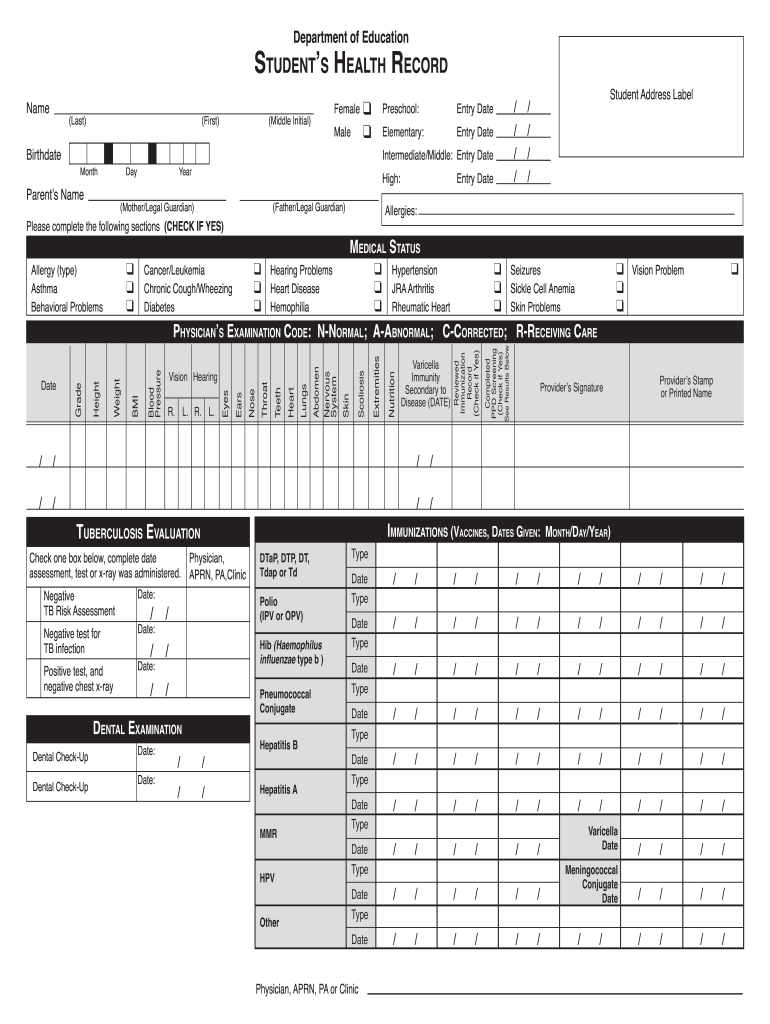

20182021 HI Form 14 Fill Online, Printable, Fillable, Blank pdfFiller

Web state of hawaii — department of taxation do not write in this area (rev. Otherwise go to page 21 of the instructions and enter. Web state of hawaii — department of taxation do not write in this area individual incometax return (rev. Partner’s share of income, credits, deductions, etc. This form is for income earned in tax year 2022,.

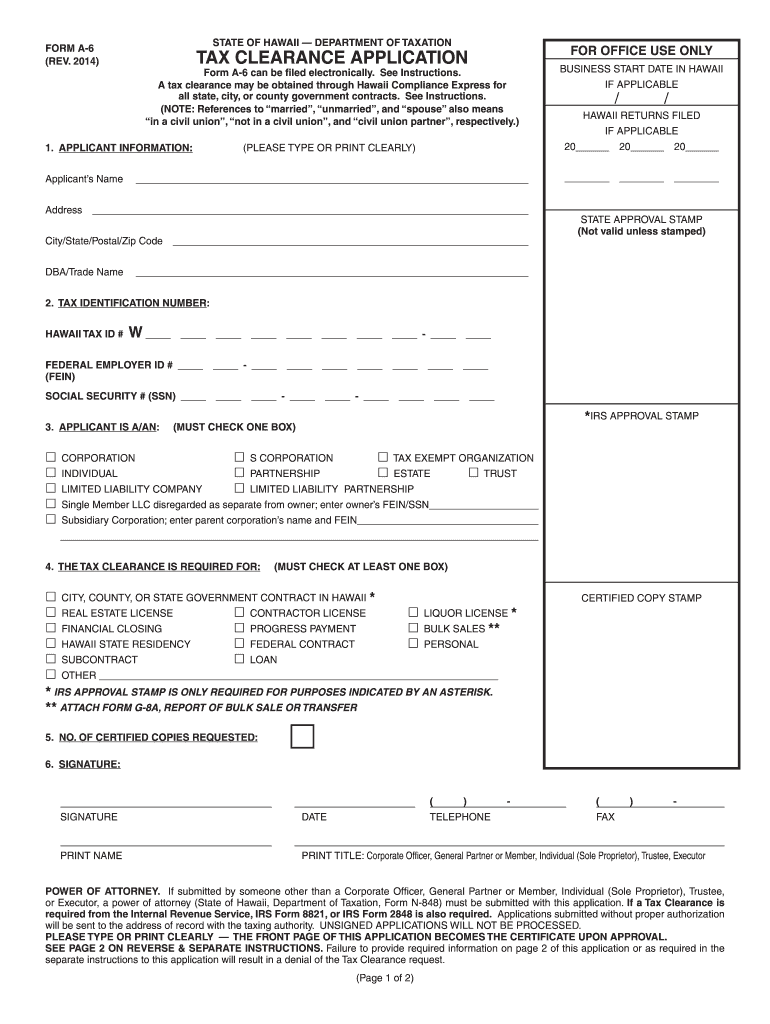

Hawaii Form A 6 Fill Out and Sign Printable PDF Template signNow

Thru m d d y y !! Partner’s share of income, credits, deductions, etc. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return. Web f state of hawaii department of taxation n15 i i t (rev. For information and guidance in its preparation, we have helpful publications and other instructions.

Hawaii Form N 20 Fill Out and Sign Printable PDF Template signNow

2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return. Otherwise go to page 21 of the instructions and enter. This form is for income earned in tax year 2022, with tax returns due in april 2023. Partner’s share of income, credits, deductions, etc. We will update this page with a.

Form N15 Download Fillable PDF or Fill Online Individual Tax

Partner’s share of income, credits, deductions, etc. Partner’s share of income, credits, deductions, etc. Web state of hawaii — department of taxation do not write in this area (rev. Web f state of hawaii department of taxation n15 i i t (rev. Otherwise go to page 21 of the instructions and enter.

Fillable Form N15 Individual Tax Return Nonresident And Part

Web state of hawaii — department of taxation do not write in this area individual incometax return (rev. Web state of hawaii — department of taxation do not write in this area (rev. Partner’s share of income, credits, deductions, etc. Partner’s share of income, credits, deductions, etc. Otherwise go to page 21 of the instructions and enter.

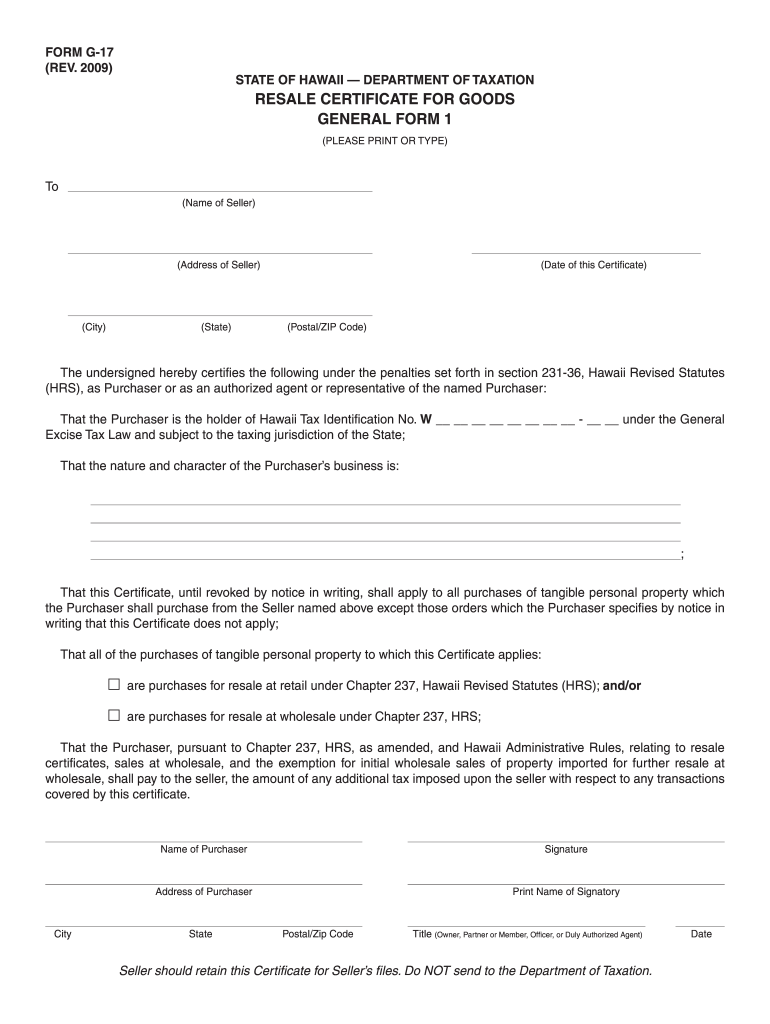

Hawaii Form Certificate Fill Out and Sign Printable PDF Template

Thru m d d y y !! 2019) p age 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. For information and guidance in its preparation, we have helpful publications and other instructions on our website at tax.hawaii.gov. 2019) nnidnt ata idnt c 2019 or tear thru attach a.

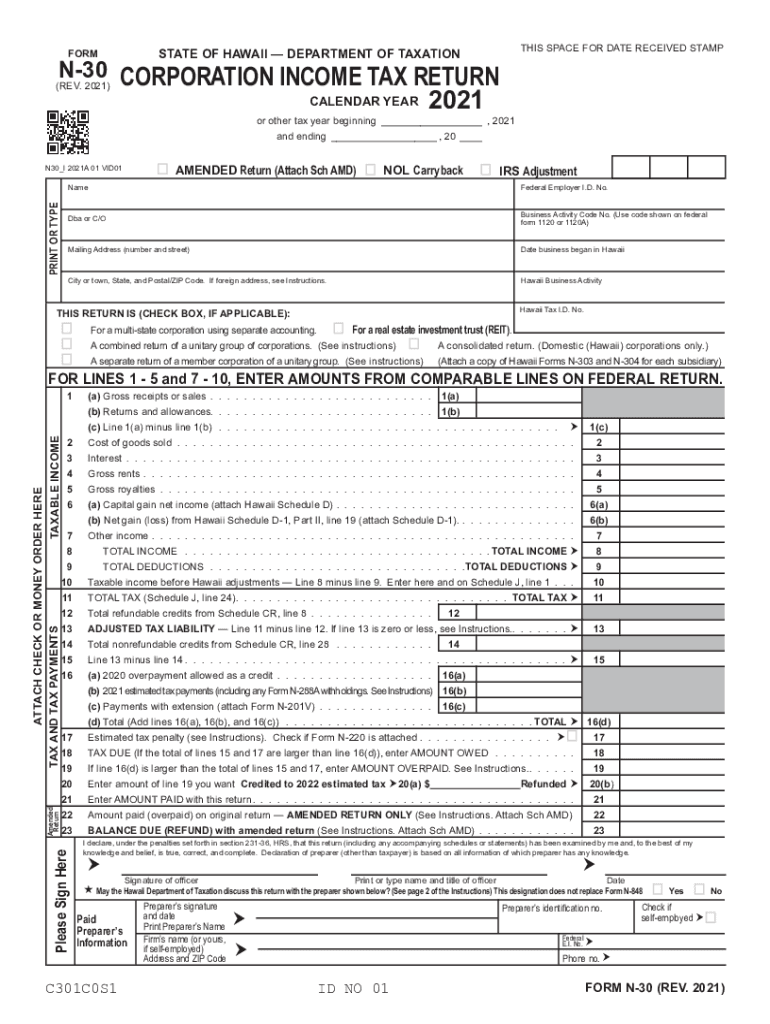

2021 Form HI DoT N30 Fill Online, Printable, Fillable, Blank pdfFiller

2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return. Thru m d d y y !! Partner’s share of income, credits, deductions, etc. Otherwise go to page 21 of the instructions and enter. Partner’s share of income, credits, deductions, etc.

"Hawaii Five0" Ka Haunaele (TV Episode 2016) Full Cast & Crew IMDb

Partner’s share of income, credits, deductions, etc. Partner’s share of income, credits, deductions, etc. We will update this page with a new version of the form for 2024 as soon as it is made available by the hawaii government. Web state of hawaii — department of taxation do not write in this area individual incometax return (rev. 2019) nnidnt ata.

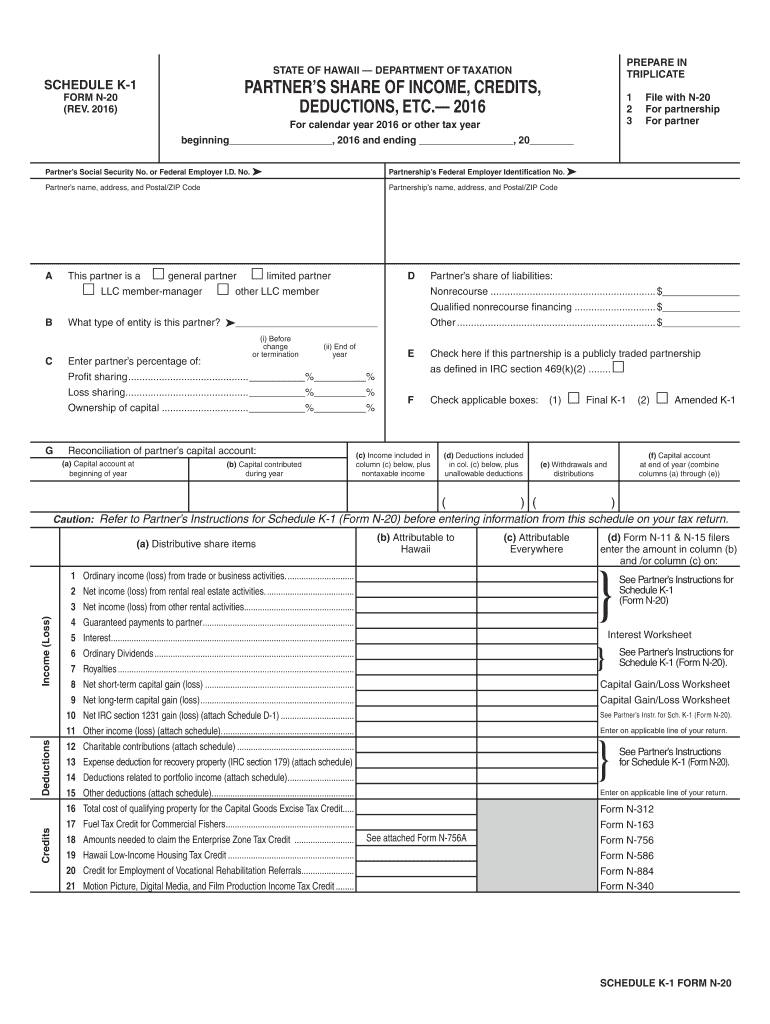

Partner’s Share Of Income, Credits, Deductions, Etc.

Partner’s share of income, credits, deductions, etc. Thru m d d y y !! We will update this page with a new version of the form for 2024 as soon as it is made available by the hawaii government. Otherwise go to page 21 of the instructions and enter.

Web State Of Hawaii — Department Of Taxation Do Not Write In This Area (Rev.

For information and guidance in its preparation, we have helpful publications and other instructions on our website at tax.hawaii.gov. Web f state of hawaii department of taxation n15 i i t (rev. Web state of hawaii — department of taxation do not write in this area individual incometax return (rev. 2019) nnidnt ata idnt c 2019 or tear thru attach a copy of your 2019 federal income tax return.

2019) P Age 3 Of 4 38 If You Do Not Itemize Deductions, Enter Zero On Line 39 And Go To Line 40A.

Partner’s share of income, credits, deductions, etc. Partner’s share of income, credits, deductions, etc. This form is for income earned in tax year 2022, with tax returns due in april 2023.