How Do You Fill Out Form 8862

How Do You Fill Out Form 8862 - Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Start completing the fillable fields and. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web credit, for the year for which you are filing form 8862. Web you can download form 8862 from the irs website and file it electronically or by mail. Save or instantly send your ready documents. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Web 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Save or instantly send your ready documents. Specific instructions need more space for an item? Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web step 1 enter your name and social security number at the top of form 8862 as it is shown on your current tax return. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; How do i enter form 8862?. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. The notice instructs you to file form 8862 for any future years you are. Use get form or simply click on the template preview to open it in the editor.

The notice instructs you to file form 8862 for any future years you are. Use get form or simply click on the template preview to open it in the editor. Complete, edit or print tax forms instantly. Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. Web more about the federal form 8862 tax credit. Web if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Start completing the fillable fields and. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Save or instantly send your ready documents.

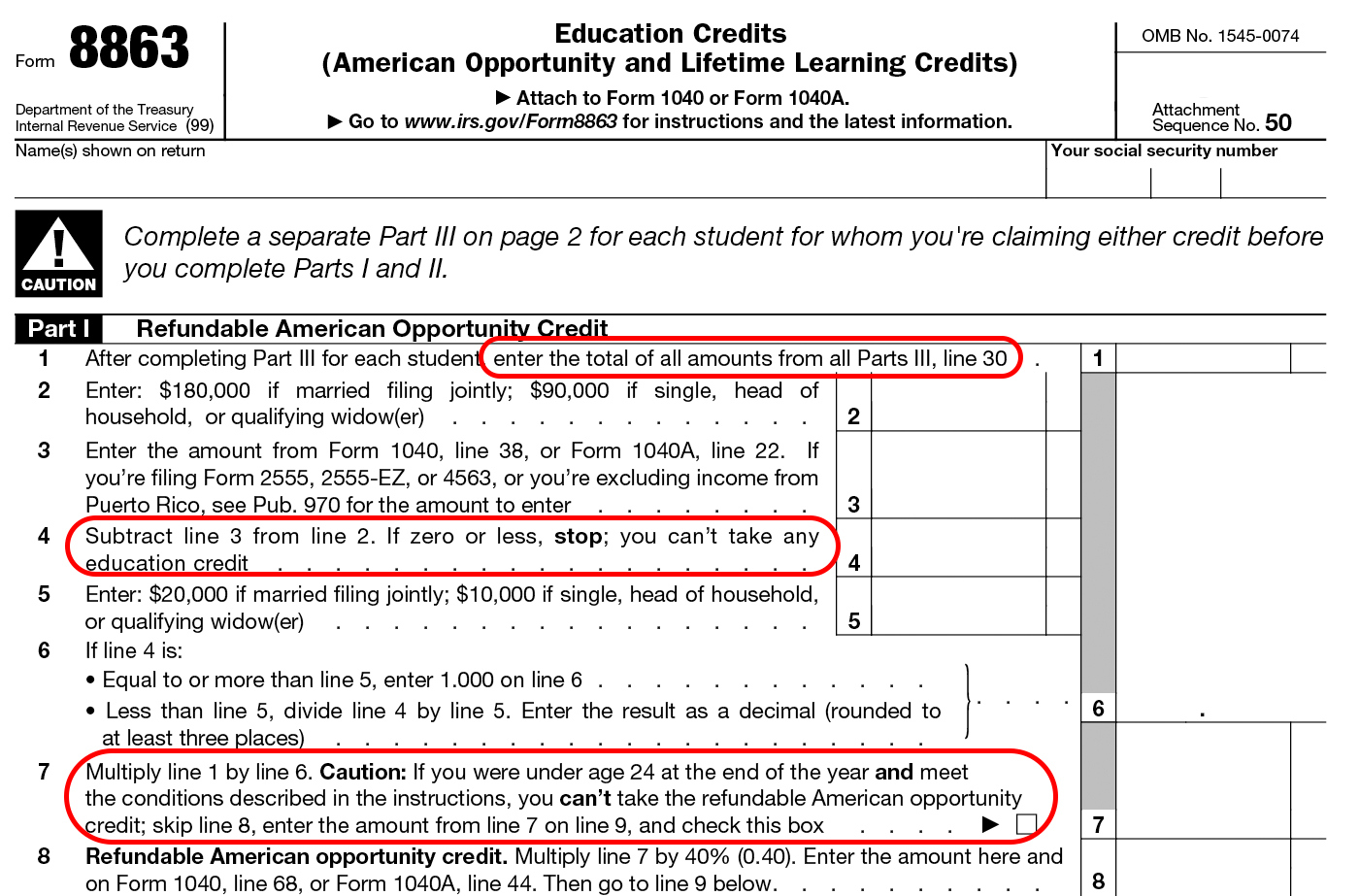

Learn How to Fill the Form 8863 Education Credits YouTube

Save or instantly send your ready documents. Web if you had a child tax credit (ctc) disallowed in a prior year, you likely received an irs cp79 tax notice. Use get form or simply click on the template preview to open it in the editor. Ad download or email irs 8862 & more fillable forms, try for free now! Web.

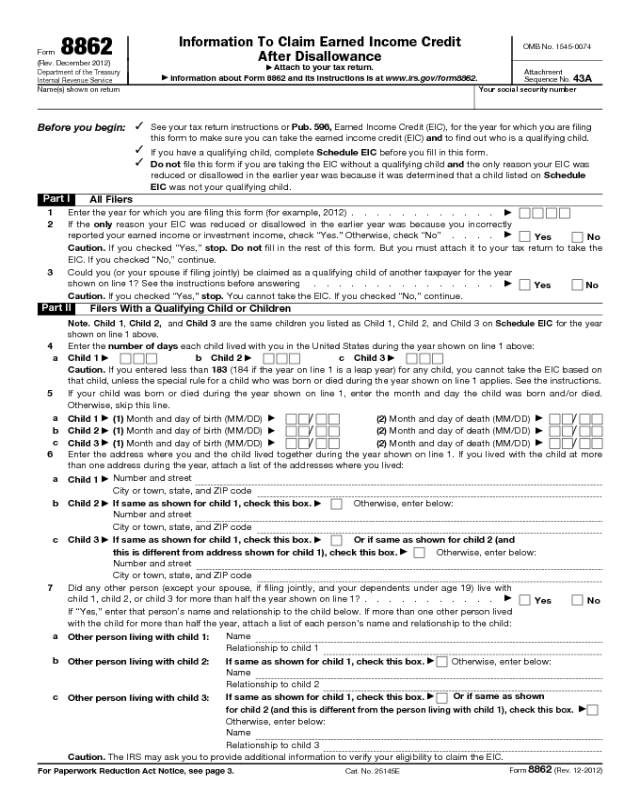

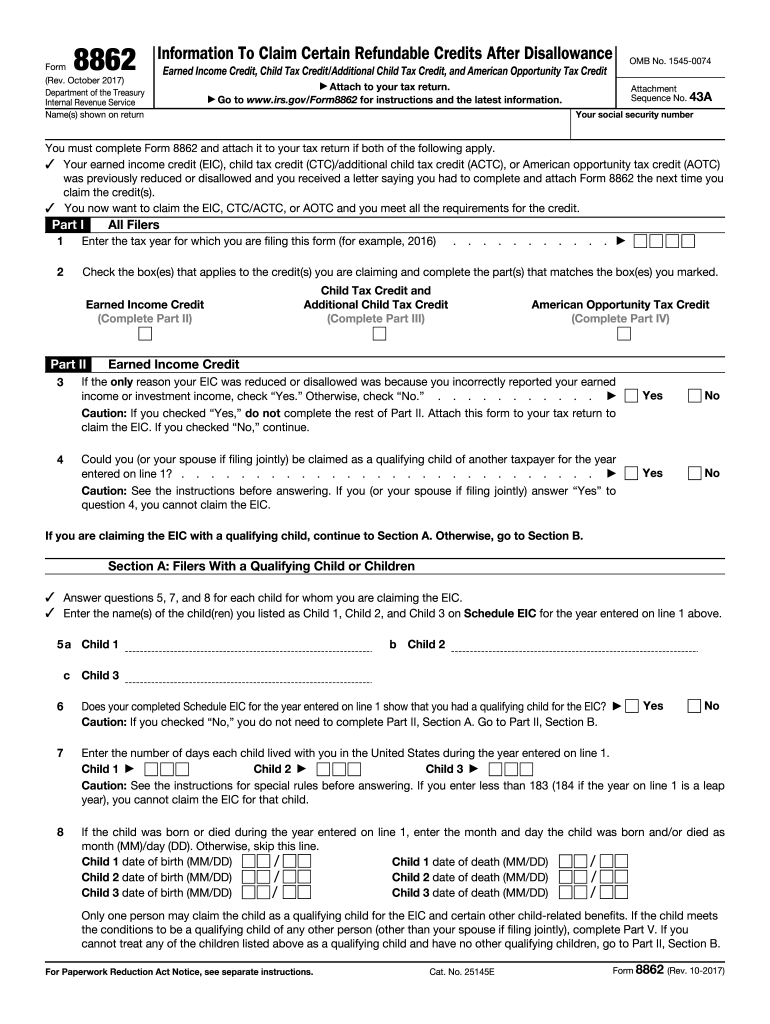

Form 8862 Information to Claim Earned Credit After

Web more about the federal form 8862 tax credit. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Web 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Web if you had a child.

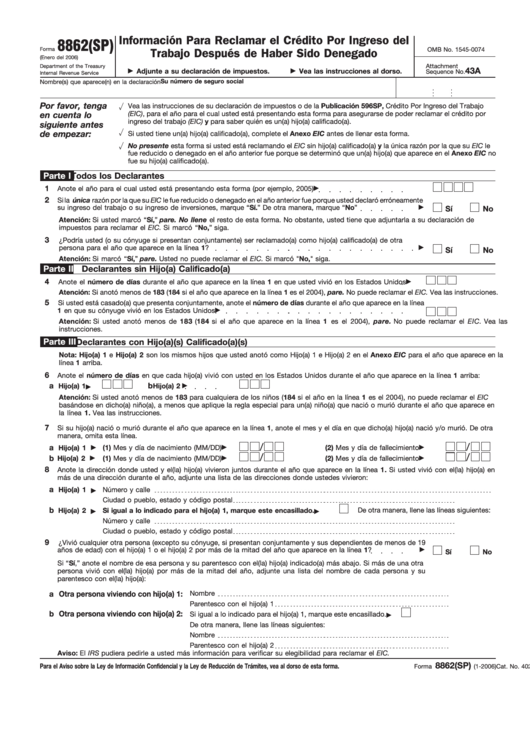

Fillable Form 8862(Sp) Informacion Para Reclamar El Credito Por

Web 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. If you do, attach a statement that is the same size as form 8862. Web step 1 enter your name and social security number at the top of form 8862 as it.

Irs Form 8862 Printable Master of Documents

The notice instructs you to file form 8862 for any future years you are. Web 1,468 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits;.

Form 8862 Edit, Fill, Sign Online Handypdf

Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits; Save or instantly send your ready documents. Web credit, for the year for which you are filing form 8862. The notice instructs you to file form 8862 for any future years you are. This form is for income.

IRS Formulario 8862(SP) Download Fillable PDF or Fill Online

Web correspond with the line number on form 8862. We last updated federal form 8862 in december 2022 from the federal internal revenue service. The earned income credit, or eic, is. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for.

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

Enter the year for which you are filing this form to claim the credit(s) (for. Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. Ad register and subscribe now to work on your irs form 8862 & more fillable forms. Web 1 best answer andreac1 level 9 june.

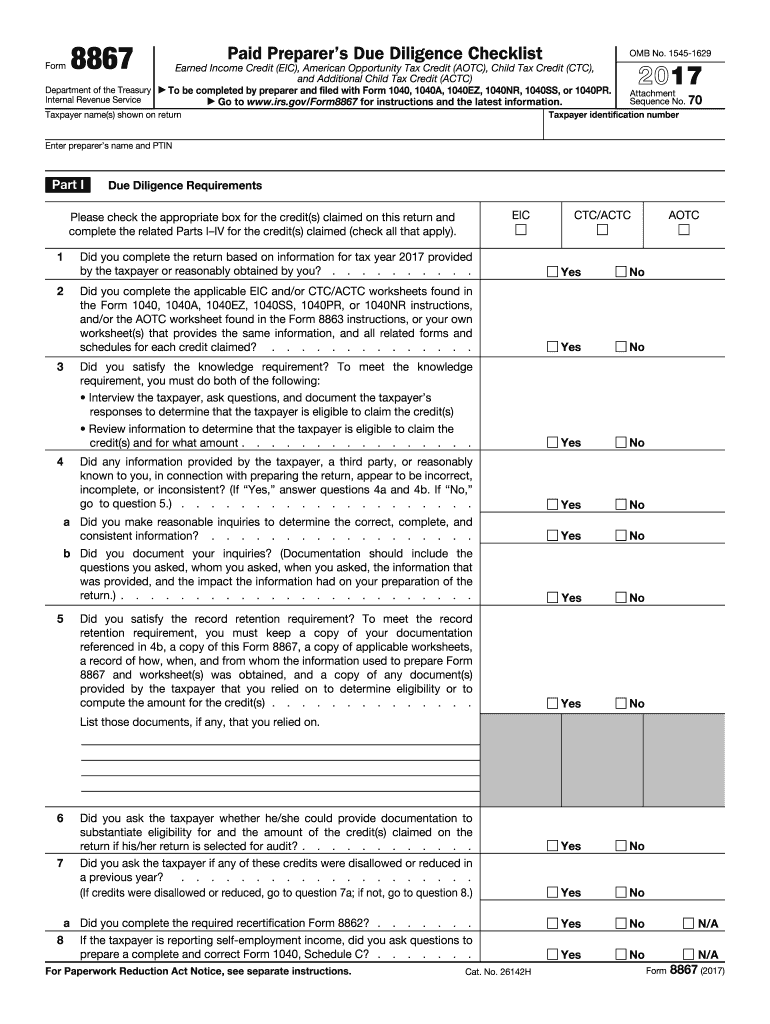

Form 8867 Fill Out and Sign Printable PDF Template signNow

This form comes in pdf format and is automatically downloaded. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web if this happens,.

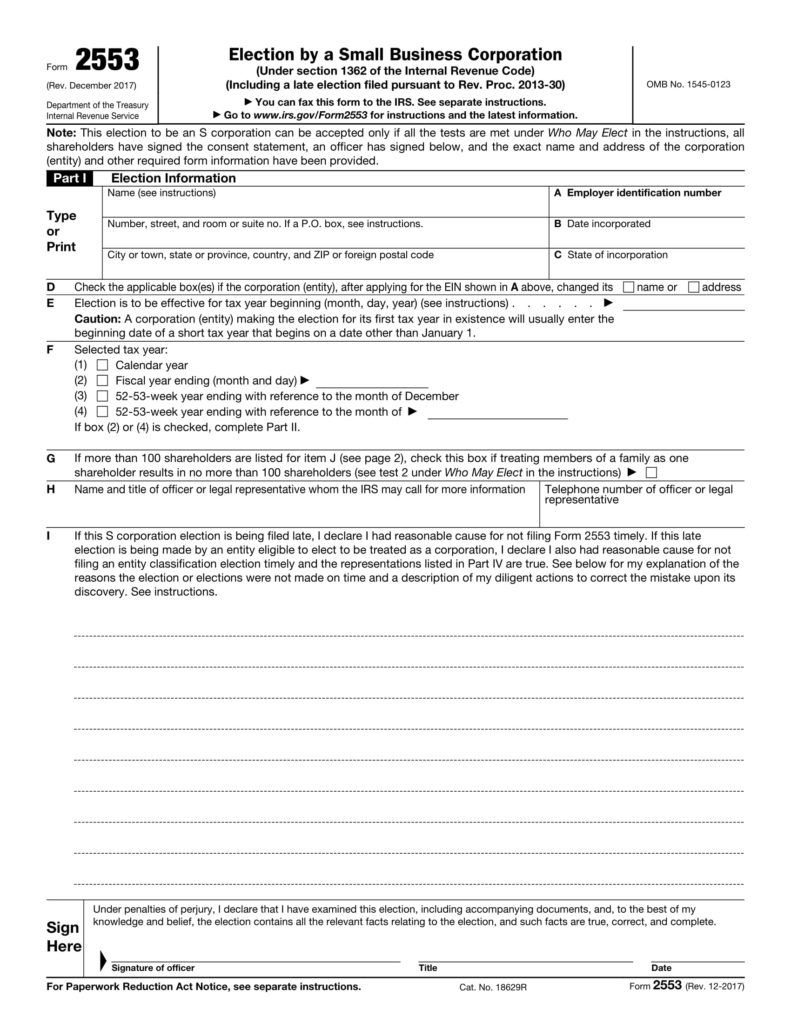

How Do You Fill Out Form 2553 Get Help Tax Remote Tax Accountants

Web 1 best answer andreac1 level 9 june 7, 2019 4:10 pm you can use the steps below to help you add form 8862. Easily fill out pdf blank, edit, and sign them. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Specific instructions need more space for an item? Video of the day.

Form 8863 Instructions Information On The Education 1040 Form Printable

Web here's how to file form 8862 in turbotax. Ad download or email irs 8862 & more fillable forms, try for free now! Web step 1 enter your name and social security number at the top of form 8862 as it is shown on your current tax return. Web taxpayers complete form 8862 and attach it to their tax return.

Video Of The Day Step 2 Enter The Year For The Tax Year You.

The notice instructs you to file form 8862 for any future years you are. Start completing the fillable fields and. Save or instantly send your ready documents. Web more about the federal form 8862 tax credit.

Web Step 1 Using A Suitable Browser On Your Computer, Navigate To The Irs Homepage And Click The Form 8862 Link.

Web credit, for the year for which you are filing form 8862. Web if this happens, you then must fill out form 8862 when reapplying for one of these credits in the future. Ad register and subscribe now to work on your irs form 8862 & more fillable forms. Complete, edit or print tax forms instantly.

This Form Comes In Pdf Format And Is Automatically Downloaded.

Web you can download form 8862 from the irs website and file it electronically or by mail. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. How do i enter form 8862?. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math.

Web 1 Best Answer Andreac1 Level 9 June 7, 2019 4:10 Pm You Can Use The Steps Below To Help You Add Form 8862.

Web irs form 8862 is used to claim the earned income tax credit (eitc), it the eitc was disallowed or reduced, for reasons other than math or clerical errors, after. Easily fill out pdf blank, edit, and sign them. This form is for income. Specific instructions need more space for an item?