How To Fill Form 8938

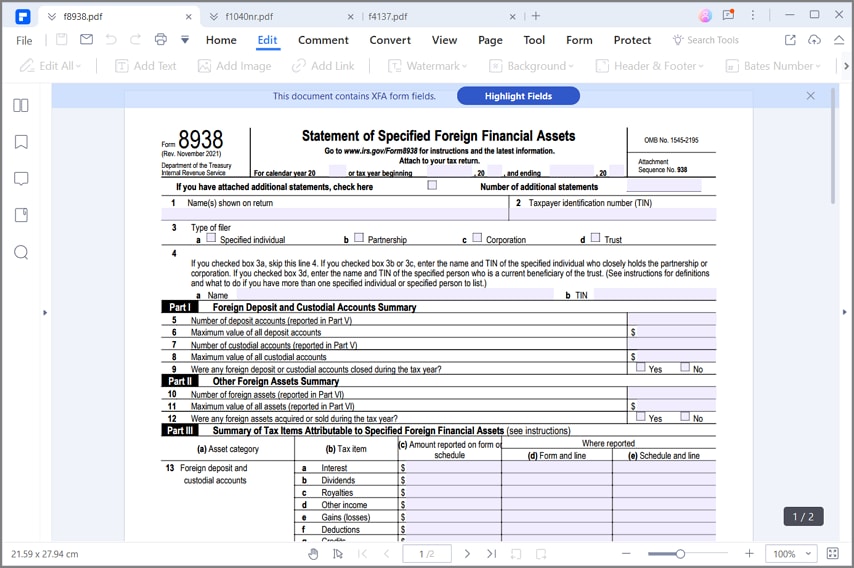

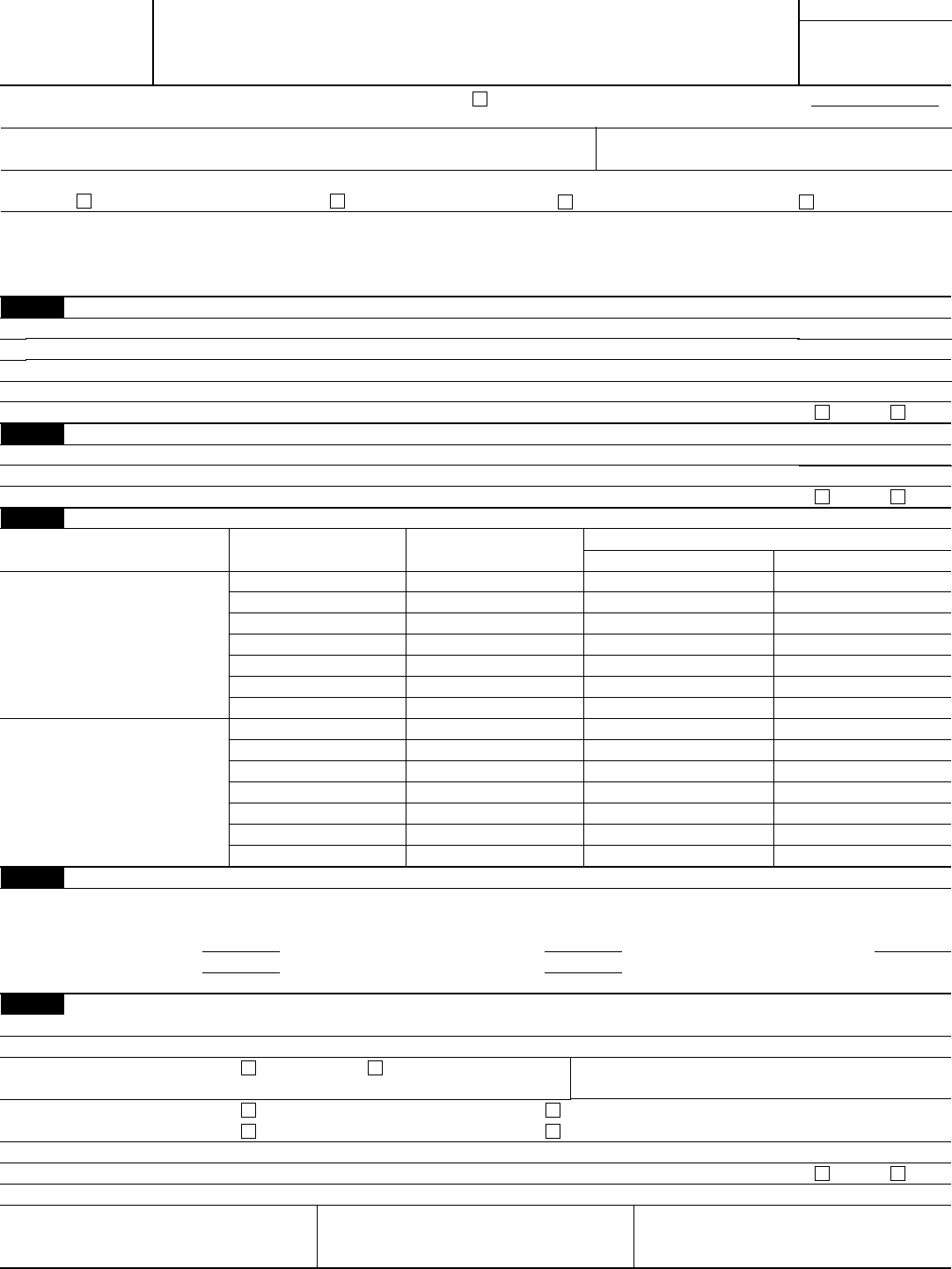

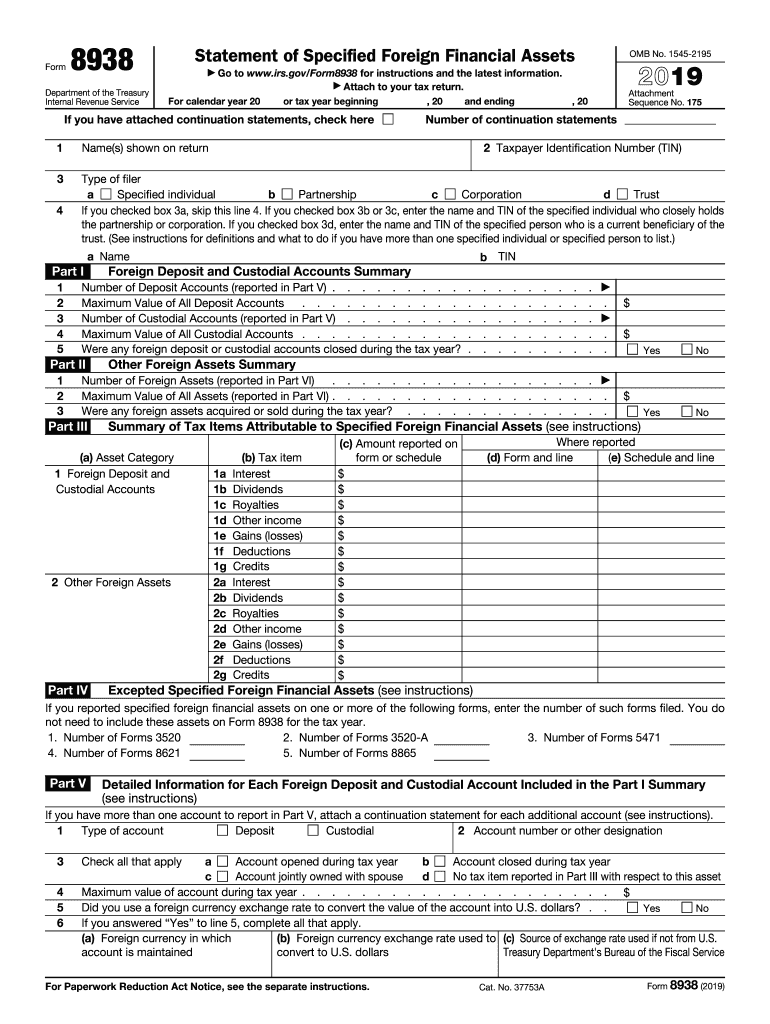

How To Fill Form 8938 - Part i foreign deposit and custodial accounts (see. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Web attach form 8938 to your annual return and file by the due date (including extensions) for that return. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Irs requirements and step by step instructions on how to fill it out. Web to enter the information for form 8938 in the taxact program: Web key takeaways form 8938 is used by certain u.s. Complete, edit or print tax forms instantly. Web failing to file form 8938 when required can result in severe penalties. Ad get ready for tax season deadlines by completing any required tax forms today.

Return to data entry and enter a valid address on either screen frgn or co38. Web key takeaways form 8938 is used by certain u.s. Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form. Do i still need to fill form 8938 ? Web form 8938, statement of specified foreign financial assets. Web form 8938 instructions (how to report): Web there are several ways to submit form 4868. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web the form 8938 must be attached to the taxpayer's annual tax return. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign.

Do i still need to fill form 8938 ? The form 8938 instructions are complex. Web check this box if this is an original, amended, or supplemental form 8938 for attachment to a previously filed return. Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca. Web form 8938 instructions (how to report): Web failing to file form 8938 when required can result in severe penalties. Web form 8938, statement of specified foreign financial assets. You must specify the applicable calendar year or tax year to which your. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Taxpayers to report specified foreign financial assets each year on a form 8938.

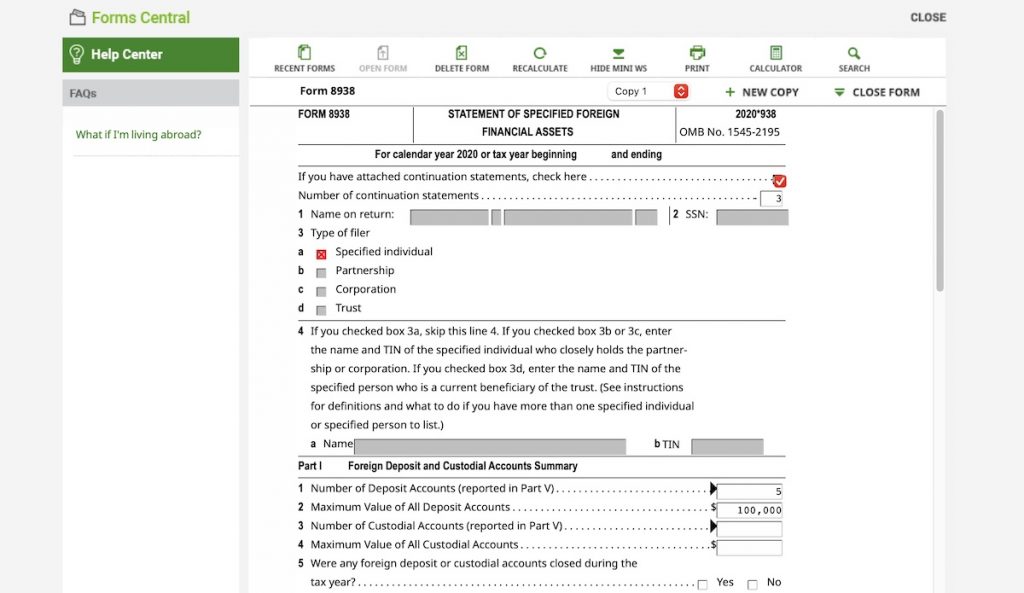

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Taxpayers who do not have to file an income tax return for the tax.

What is FATCA? (Foreign Account Tax Compliance Act)

Taxpayers to report specified foreign financial assets each year on a form 8938. Ad get ready for tax season deadlines by completing any required tax forms today. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Web about form 8938, statement of.

Do YOU need to file Form 8938? “Statement of Specified Foreign

From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Taxpayers who do not have to file an income tax return for the tax year do not have to file form 8938,. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web check this box.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Web to enter the information for form 8938 in the taxact program: Do.

1098 Form 2021 IRS Forms Zrivo

Part i foreign deposit and custodial accounts (see. Taxpayers to report specified foreign financial assets each year on a form 8938. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web form 8938, statement of specified foreign financial assets. Fincen form 114, report of foreign bank and financial accounts (fbar).

What Is IRS Form 8938? (2023)

Taxpayers who do not have to file an income tax return for the tax year do not have to file form 8938,. Do i still need to fill form 8938 ? Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. If the irs notifies taxpayers that they are delinquent, they..

The Counting Thread v2 (Page 298) EVGA Forums

You must specify the applicable calendar year or tax year to which your. Web form 8938 instructions (how to report): Web filing form 8938 is only available to those using turbotax deluxe or higher. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web check this box if this is.

Form 8938 Edit, Fill, Sign Online Handypdf

From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Web check this box if this is an original, amended, or supplemental form 8938 for attachment to a previously filed return. I searched this question on the forum, but can not find out the. Web failing to file form 8938.

USCs and LPRs residing outside the U.S. and IRS Form 8938 « Tax

Web check this box if this is an original, amended, or supplemental form 8938 for attachment to a previously filed return. Do i still need to fill form 8938 ? Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web failing to file form 8938 when required can result in severe penalties. Person must complete.

How to fill fbar form Fill online, Printable, Fillable Blank

Web about form 8938, statement of specified foreign financial assets. Taxpayers who do not have to file an income tax return for the tax year do not have to file form 8938,. If the irs notifies taxpayers that they are delinquent, they. Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance.

I Searched This Question On The Forum, But Can Not Find Out The.

Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. If the irs notifies taxpayers that they are delinquent, they. Ad get ready for tax season deadlines by completing any required tax forms today. Web form 8938 instructions (how to report):

Web Each Year, The Us Government Requires Us Taxpayers Who Own Foreign Assets, Investments And Accounts To Disclose This Information On Internal Revenue Service Form.

Many people may confuse form 8938, which is an irs requirement, with fincen. Web failing to file form 8938 when required can result in severe penalties. Web attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web to enter the information for form 8938 in the taxact program:

Person Must Complete Form 8938 And Attach It To Their Form 1040 If.

Taxpayers who do not have to file an income tax return for the tax year do not have to file form 8938,. Part i foreign deposit and custodial accounts (see. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web check this box if this is an original, amended, or supplemental form 8938 for attachment to a previously filed return.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

The form 8938 instructions are complex. Do i still need to fill form 8938 ? Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Download the irs form 8938 from the official website of the internal revenue service.

:max_bytes(150000):strip_icc()/TaxForm8938-31bd8f0fd53f4dc8a8dea33f06fdf460.png)