How To Fill Out Form 15111

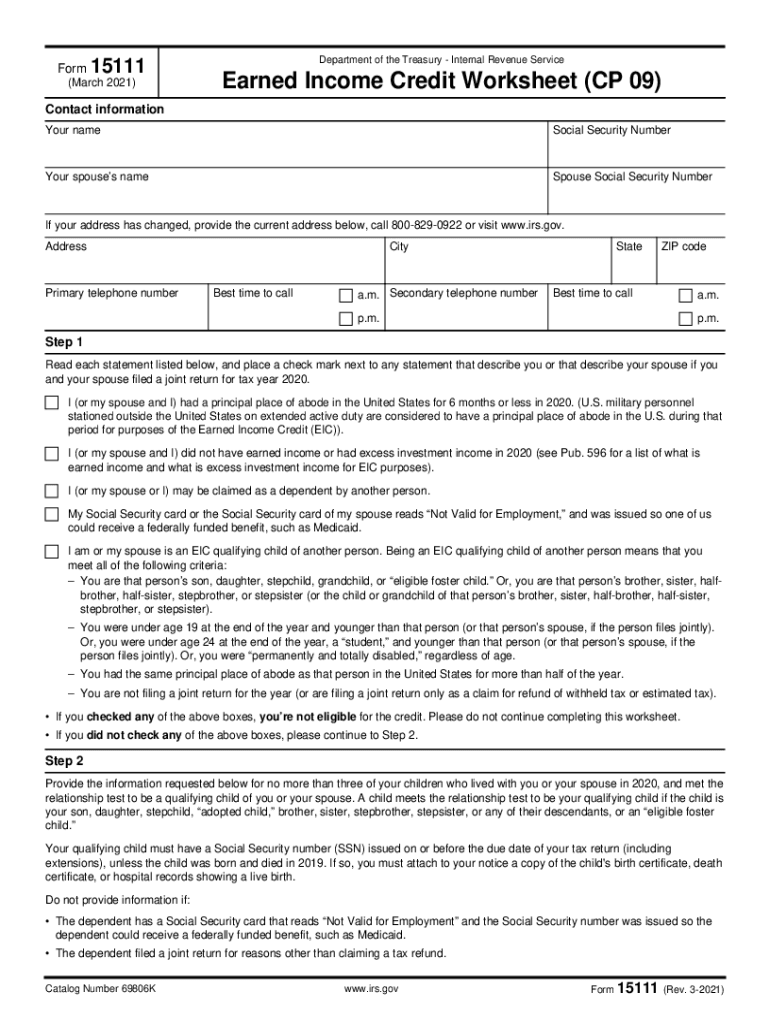

How To Fill Out Form 15111 - You may reply and ask them to calculate your. Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Earned income credit worksheet (cp 09) (irs) form. Read the recommendations to learn which data you need to give. Web fill online, printable, fillable, blank form 15111: Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check. Type text, add images, blackout confidential details, add comments, highlights and more. Web open the document in the online editor. Web how to amend your return to use 2019 income for 2020 eic. I may suggest to verify if the irs attached the form with that notice.

Here is a link to the us treasury form 15111 that you can fill out online and then print it to send back to. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check. I may suggest to verify if the irs attached the form with that notice. Irs sent a notification, follow instructions and return to the irs. Sign it in a few clicks. Use get form or simply click on the template preview to open it in the editor. Quickly add and highlight text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your document. Click the fillable fields and put the requested information. Web how can i get form 15111 i received a paper in the mail about me not claiming for the earned income credit i qualify for with 3 children being head of household making. Web got a notice to fill out and return the form to the irs because i'm eligible for eic but didn't claim it?

Earned income credit worksheet (cp 27) contact information. Web edit form 15111 (rev. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. Use get form or simply click on the template preview to open it in the editor. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice. This notice urges taxpayers to. Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. I some how managed to lose the return envelope to send it back. Web i never saw form 15111 and was not able to locate it. You may reply and ask them to calculate your.

Applications By Program CITE

Sign it in a few clicks. Web how to amend your return to use 2019 income for 2020 eic. Earned income credit worksheet (cp 09) (irs) form. Web open the document in the online editor. Type text, add images, blackout confidential details, add comments, highlights and more.

How To Fill Out Form 2290 Online Form Resume Examples aEDvLABO1Y

Click the fillable fields and put the requested information. Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. Earned income credit worksheet (cp 09) (irs) form. You can view a sample form 15111 worksheet on the irs website. This notice.

How To Fill Out Form I751 StepByStep Instructions [Newest Guide 2020]

Web recently received a notice cp09 from the irs asking me to fill out and return form 15111. Web that notice could very well be a scam since there is no such irs form 15111. Web how can i get form 15111 i received a paper in the mail about me not claiming for the earned income credit i qualify.

WhoodleDOGFemaleDark Chocolate2715694Petland Wichita, Kansas

Earned income credit worksheet (cp 09) contact information. Web edit form 15111 (rev. If you qualify, all the necessary. Web how to amend your return to use 2019 income for 2020 eic. Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit.

How To Fill Out A Pdf Form And Email It? Complete Guide ByteVarsity

Web fill online, printable, fillable, blank form 15111: Web recently received a notice cp09 from the irs asking me to fill out and return form 15111. Web open the document in the online editor. Type text, add images, blackout confidential details, add comments, highlights and more. Web understanding your cp27 notice what this notice is about we've sent you this.

Fill Out The Form Royalty Free Stock Photos Image 20821568

Web fill online, printable, fillable, blank form 15111: Start completing the fillable fields and carefully. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check. Type text, add images, blackout confidential details, add comments, highlights and more. Use.

How to Fill Out PDF Forms and Documents on Mac

Web how can i get form 15111 i received a paper in the mail about me not claiming for the earned income credit i qualify for with 3 children being head of household making. Use fill to complete blank online irs pdf forms for free. Web fill in the name as it appears on the social security card for each.

2021 Form IRS 15111 Fill Online, Printable, Fillable, Blank pdfFiller

Type text, add images, blackout confidential details, add comments, highlights and more. Web open the document in the online editor. You may reply and ask them to calculate your. Web how can i get form 15111 i received a paper in the mail about me not claiming for the earned income credit i qualify for with 3 children being head.

Form 15111? r/IRS

Web that notice could very well be a scam since there is no such irs form 15111. If you qualify, all the necessary. Web fill online, printable, fillable, blank form 15111: Web recently received a notice cp09 from the irs asking me to fill out and return form 15111. Earned income credit worksheet (cp 27) contact information.

Fill Free fillable Form 15111 Earned Credit Worksheet (CP 09

Web level 1 received notice cp09 to fill out form 15111 i filed my taxes at the end of january and received my return at the beginning of february. If you qualify, all the necessary. I may suggest to verify if the irs attached the form with that notice. Web that notice could very well be a scam since there.

Quickly Add And Highlight Text, Insert Pictures, Checkmarks, And Icons, Drop New Fillable Areas, And Rearrange Or Delete Pages From Your Document.

Sign it in a few clicks. Web i never saw form 15111 and was not able to locate it. Use get form or simply click on the template preview to open it in the editor. You may reply and ask them to calculate your.

Web Got A Notice To Fill Out And Return The Form To The Irs Because I'm Eligible For Eic But Didn't Claim It?

Web open the document in the online editor. You can view a sample form 15111 worksheet on the irs website. Web the irs will use the information in form 15111 along with the tax return to determine if the taxpayer qualifies for eic and for how much and will mail a check. Edit your form 15111 online.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

If you qualify, all the necessary. Web edit form 15111 (rev. Instead, you must file a. Irs sent a notification, follow instructions and return to the irs.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web understanding your cp27 notice what this notice is about we've sent you this notice because our records indicate you may be eligible for the earned income credit (eic) but. I may suggest to verify if the irs attached the form with that notice. Web fill in the name as it appears on the social security card for each dependent child you claimed on your 2022 tax return. Web the irs includes a form 15111 earned income credit worksheet with each cp09 notice.

![How To Fill Out Form I751 StepByStep Instructions [Newest Guide 2020]](https://self-lawyer.com/wp-content/uploads/2020/06/How-to-Fill-Out-Form-I-751-1080x675.jpeg)