How To Fill Out Form 2553

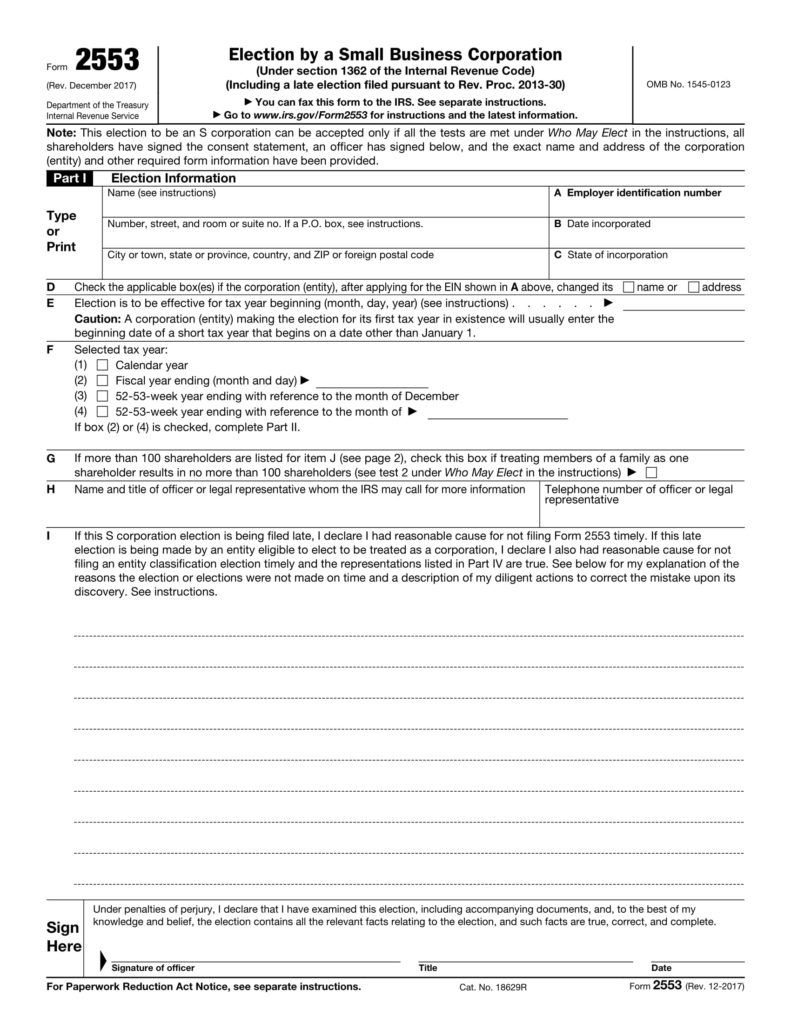

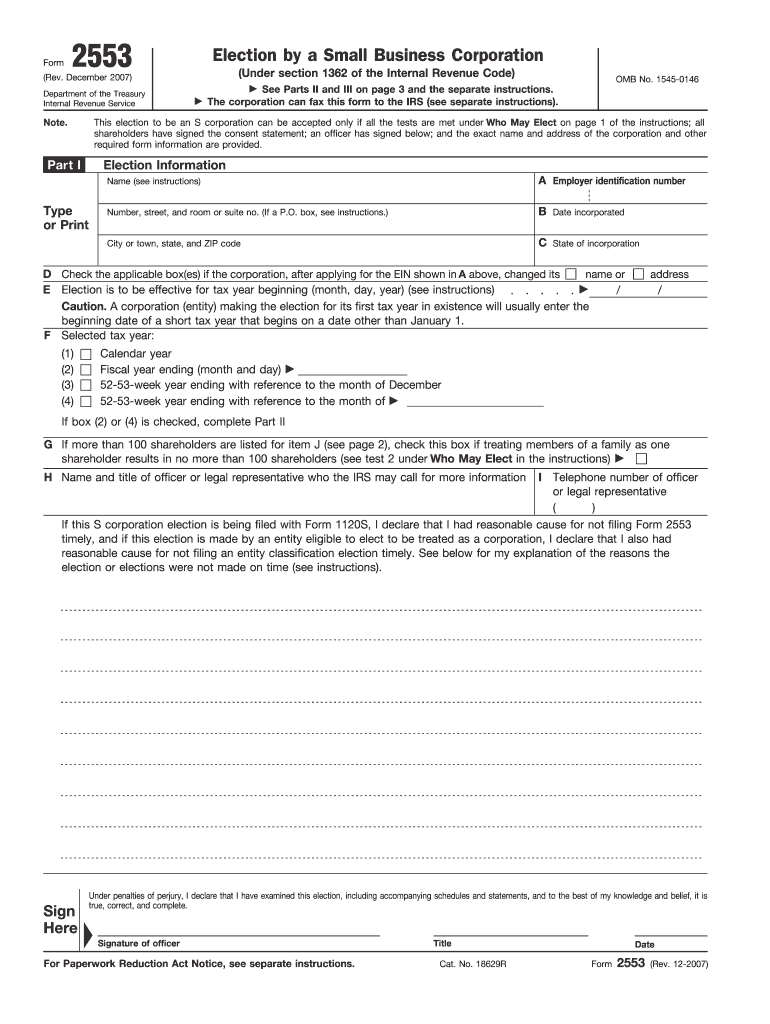

How To Fill Out Form 2553 - $ what is irs form 2553? Web up to $40 cash back 2. This means that all income and losses that. If you are confused by form 2553’s instructions, follow. Web when filing form 2553 for a late s corporation election, the corporation (entity) must enter in the top margin of the first page of form 2553 “filed pursuant to rev. Streamline the 1040 preparation process for your firm & your clients with automation. Name and address of each shareholder or former. By default, the irs will file your business. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web how to fill out form 2553 form 2553 includes four parts and is relatively complex.

If you need more rows, use additional copies of page 2. Web how to fill out form 2553 form 2553 includes four parts and is relatively complex. Streamline the 1040 preparation process for your firm & your clients with automation. How to fill out form 2553 how much funding do you need? Web how do i fill out form 2553? Web up to $40 cash back 2. If you want to file your forms early, you will need to attach a. Web how to fill out form 2553? Use the add new button. Web irs form 2553 instructions:

$ what is irs form 2553? Web filling out your form 2553 frequently asked questions the united states tax system affords small business owners a great deal of flexibility when it comes to. By default, the irs will file your business. If you want to file your forms early, you will need to attach a. Name and address of each shareholder or former. Web form 2553 part i election information (continued) note: Streamline the 1040 preparation process for your firm & your clients with automation. We know the irs from the inside out. Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. Web up to $40 cash back 2.

Form 2553 Fill Out and Sign Printable PDF Template signNow

By default, the irs will file your business. If you are confused by form 2553’s instructions, follow. $ what is irs form 2553? Web filling out your form 2553 frequently asked questions the united states tax system affords small business owners a great deal of flexibility when it comes to. Ad used by over 23,000 tax pros across the us,.

How to Fill Out IRS Form 2553

How to fill out form 2553 how much funding do you need? Web learn exactly how to fill out irs form 2553. Use the add new button. Streamline the 1040 preparation process for your firm & your clients with automation. Web when filing form 2553 for a late s corporation election, the corporation (entity) must enter in the top margin.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Web how to fill out form 2553 form 2553 includes four parts and is relatively complex. By default, the irs will file your business. Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. Part i mostly asks for general information, such as your employer.

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank PDFfiller

Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its. Irs form 2553 is designed for businesses that want to elect to. We know the irs from the inside out. If you want to file your forms early, you will need to attach a. Name and address of each.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Web how do i fill out form 2553? Irs form 2553 is designed for businesses that want to elect to. Web up to $40 cash back 2. Use the add new button. $ what is irs form 2553?

Learn How to Fill the Form 2553 Election by a Small Business

This means that all income and losses that. Use the add new button. Part i mostly asks for general information, such as your employer identification. Irs form 2553 is designed for businesses that want to elect to. Web learn exactly how to fill out irs form 2553.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Web learn exactly how to fill out irs form 2553. Name and address of each shareholder or former. If you need more rows, use additional copies of page 2. Web how to fill out form 2553? Web how to fill out form 2553 form 2553 includes four parts and is relatively complex.

How to Fill in Form 2553 Election by a Small Business Corporation S

If you want to file your forms early, you will need to attach a. Irs form 2553 is designed for businesses that want to elect to. Web up to $40 cash back 2. Name and address of each shareholder or former. Web form 2553 part i election information (continued) note:

How Do You Fill Out Form 2553 Get Help Tax Remote Tax Accountants

Web how do i fill out form 2553? Use the add new button. $ what is irs form 2553? The form is due no later t. Web irs form 2553 instructions:

How To Fill Out Form 2553 Make it simple, Filling, Tax forms

If you want to file your forms early, you will need to attach a. Name and address of each shareholder or former. If you need more rows, use additional copies of page 2. Web irs form 2553 instructions: If you are confused by form 2553’s instructions, follow.

If You Need More Rows, Use Additional Copies Of Page 2.

By default, the irs will file your business. Part i mostly asks for general information, such as your employer identification. Name and address of each shareholder or former. Web irs form 2553 instructions:

Irs Form 2553 Is Designed For Businesses That Want To Elect To.

Web filling out your form 2553 frequently asked questions the united states tax system affords small business owners a great deal of flexibility when it comes to. Web how to fill out form 2553? This means that all income and losses that. Use the add new button.

How To Fill Out Form 2553 How Much Funding Do You Need?

Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its. Ad used by over 23,000 tax pros across the us, from 3 of the big 4 to sole practitioners. Web how to fill out form 2553 form 2553 includes four parts and is relatively complex. Web learn exactly how to fill out irs form 2553.

$ What Is Irs Form 2553?

Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. Web form 2553 part i election information (continued) note: If you want to file your forms early, you will need to attach a. The form is due no later t.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)