How To Fill Out Form 7203

How To Fill Out Form 7203 - To enter basis limitation info in the individual return: Press f6 to bring up open forms. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. I have read all of the instructions for form 7203,. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. Web if one of these requirements applies, then form 7203 is required. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Web in this part of the form, you will figure out your business’s current excise tax liability. Basis is handled as follows: Your basis calculation represents the value of the stock you own.

Typically, this amount is limited to their basis, or. Web form 7203 is generated for a 1040 return when: Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. The irs will take the w2, which lists income from wages and salaries. Web you must complete and file form 7203 if you’re an s corporation shareholder and you: To enter basis limitation info in the individual return: I have read all of the instructions for form 7203,. Your basis calculation represents the value of the stock you own. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that. Web bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:

Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. To enter basis limitation info in the individual return: Taxpayers need to report any type of income on their tax forms. Web bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers: Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Web in this part of the form, you will figure out your business’s current excise tax liability. Web if one of these requirements applies, then form 7203 is required. General instructions purpose of form use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax.

How to complete IRS Form 720 for the PatientCentered Research

Once you finish part three, you will know whether you need to pay more in excise. Your basis calculation represents the value of the stock you own. Taxpayers need to report any type of income on their tax forms. Press f6 to bring up open forms. Web generate form 7203, s corporation shareholder stock and debt basis limitations.

IRS Issues New Form 7203 for Farmers and Fishermen

Once you finish part three, you will know whether you need to pay more in excise. The irs will take the w2, which lists income from wages and salaries. Computing stock basis in computing stock. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Learn more about what will be covered.

How to Fill Out PDF Forms and Documents on Mac

Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. The irs will take the w2, which lists income from wages and salaries. Press f6 to bring up open forms. Web 1 best answer julies expert alumni if you have an entry.

Peerless Turbotax Profit And Loss Statement Cvp

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. Web if one of these requirements applies, then form 7203 is required. To enter basis.

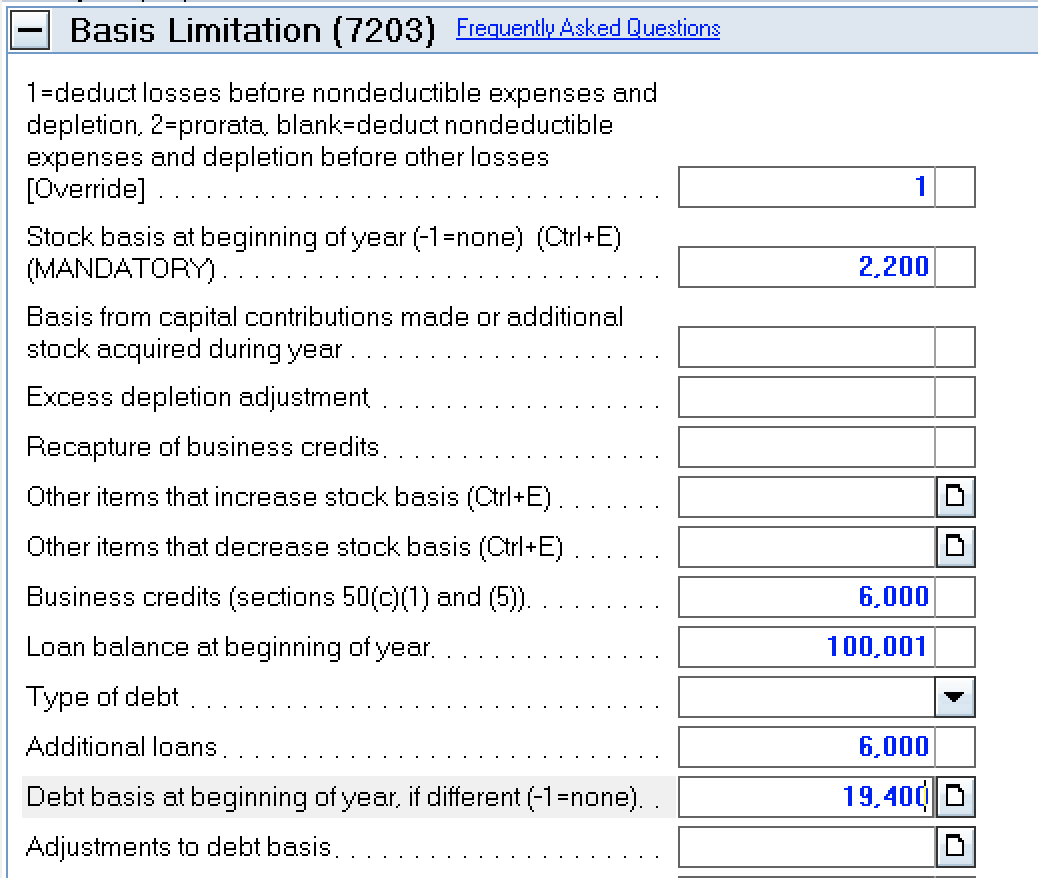

How to complete Form 7203 in Lacerte

I have read all of the instructions for form 7203,. Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. Web in this part of the form, you will figure out your business’s current excise tax liability. Your basis calculation represents the value of the stock you own..

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Basis is handled as follows: Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis. Web form 7203 is generated for a 1040 return when: Go to screen 20.2, s corporation. Web community discussions taxes get your taxes done dkroc level 2 please explain stock block on form.

Form7203PartI PBMares

Learn more about what will be covered in this webinar. Once you finish part three, you will know whether you need to pay more in excise. Web bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers: December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax..

More Basis Disclosures This Year for S corporation Shareholders Need

Your basis calculation represents the value of the stock you own. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Computing stock basis in computing stock. Learn more about what will be covered in this webinar. Once you finish part three, you will know whether you need to.

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Web form 7203 is generated for a 1040 return when: Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. To enter basis limitation info in the individual return: Once you finish part three, you will know whether you.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Basis is handled as follows: Your basis calculation represents the value of the stock you own. Once you finish part three, you will know whether you need to pay more in excise. Web in this part of the form, you will figure out your business’s current excise tax liability. I have read all of the instructions for form 7203,.

Taxpayers Need To Report Any Type Of Income On Their Tax Forms.

Web in this part of the form, you will figure out your business’s current excise tax liability. Once you finish part three, you will know whether you need to pay more in excise. Basis is handled as follows: Web bookmark icon aliciap1 expert alumni i'll answer your questions by your numbers:

Learn More About What Will Be Covered In This Webinar.

Typically, this amount is limited to their basis, or. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. To enter basis limitation info in the individual return: Web form 7203, s corporation shareholder stock and debt basis limitations, may be used to figure a shareholder’s stock and debt basis.

Web You Must Complete And File Form 7203 If You’re An S Corporation Shareholder And You:

Web form 7203 is generated for a 1040 return when: Go to screen 20.2, s corporation. Web 1 best answer julies expert alumni if you have an entry for distributions on line 16 d, you are required to complete form 7203, even if you believe the distributions. Your basis calculation represents the value of the stock you own.

Web Generate Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations.

Web form 7203 is used to figure potential limitations of a shareholder's share of the s corporation's deductions, credits, and other items that can be deducted on their. Computing stock basis in computing stock. The irs will take the w2, which lists income from wages and salaries. Press f6 to bring up open forms.