How To Fill Out Form 8862 Step By Step

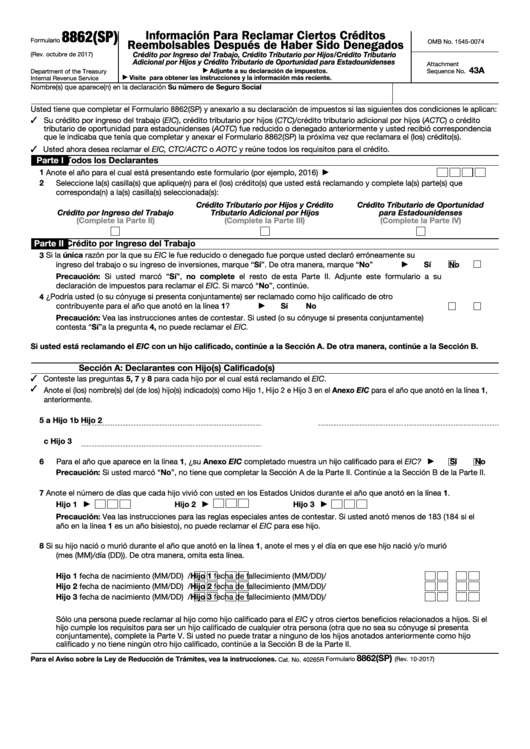

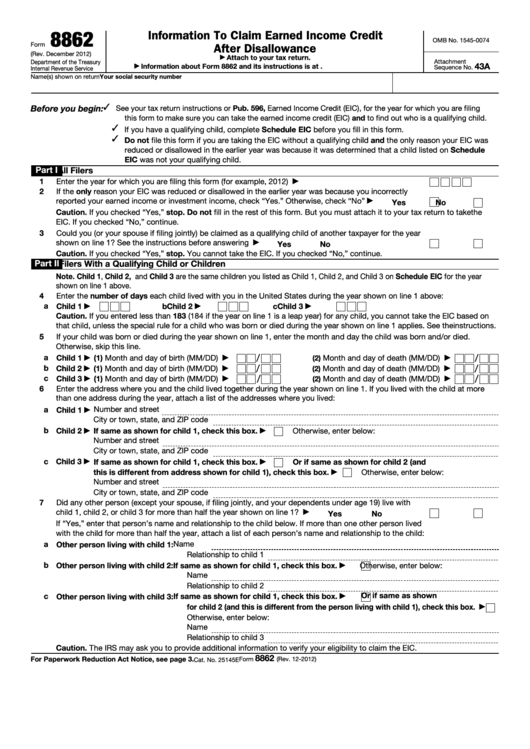

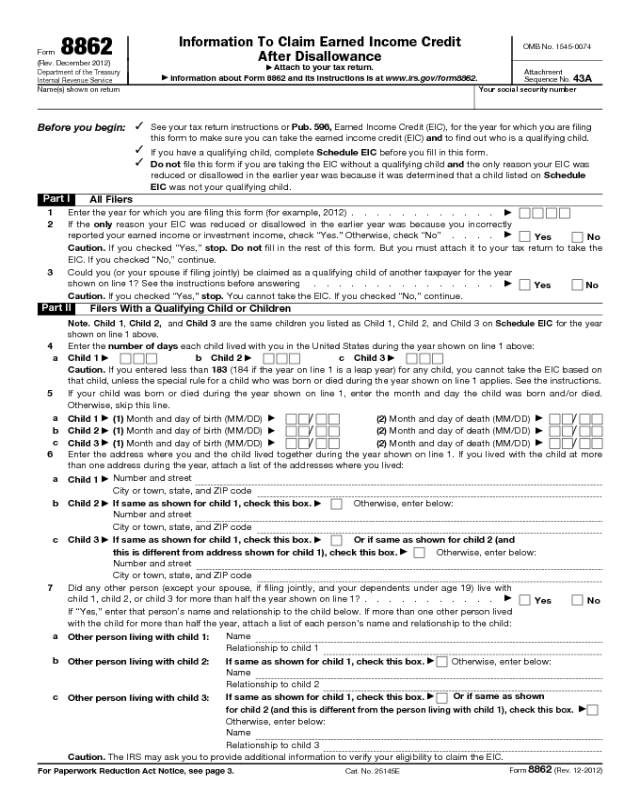

How To Fill Out Form 8862 Step By Step - Web instructions to fill out irs form 8862. Web español taxpayers complete form 8862 and attach it to their tax return if: Web satisfied 124 votes quick guide on how to complete what is 8862 form forget about scanning and printing out forms. To find the 8862 in. Ad access irs tax forms. Do not enter the year the credit (s) was disallowed. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search. Web enter the year for which you are filing this form to claim the credit (s) (for example, 2022). Go to search box in top right cover and click there to type in 8862 and hit. Try it for free now!

Go to search box in top right cover and click there to type in 8862 and hit. Web español taxpayers complete form 8862 and attach it to their tax return if: Web how to complete the irs 8862 online: Fill in the applicable credit information (earned income credit, child tax credit, etc.). Enter the year for which you are filing this form to claim the credit(s) (for. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Upload, modify or create forms. Check the box (es) that applies to the credit (s) you are now claiming. Web how do i file form 8862?? Try it for free now!

To find the 8862 in. Web satisfied 124 votes quick guide on how to complete what is 8862 form forget about scanning and printing out forms. Web enter the year for which you are filing this form to claim the credit (s) (for example, 2022). Web español taxpayers complete form 8862 and attach it to their tax return if: Filing this form allows you to reclaim credits for which you are now. Web form 8862 is required when the irs has previously disallowed one or more specific tax credits. This form comes in pdf format and is automatically downloaded. Web fillable form 8862 (2021) easily fill out and sign forms in a few minutes with pdfliner download blank or edit pdf online. Go to search box in top right cover and click there to type in 8862 and hit. Step into the future the irs.

Form 8862 Information to Claim Earned Credit After

Fill in all necessary fields in the selected file making use of our advantageous. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Enter your name and social security number at the top of form 8862 as it is shown on your current tax return. Step into the.

Irs Form 8862 Printable Master of Documents

Ad access irs tax forms. Web here's how to file form 8862 in turbotax. Web enter the year for which you are filing this form to claim the credit (s) (for example, 2022). Enter your name, ssn, and the year you require credits for, and select one of the options. Web instructions to fill out irs form 8862.

Top 14 Form 8862 Templates free to download in PDF format

Web enter the year for which you are filing this form to claim the credit (s) (for example, 2022). Web up to $40 cash back also see part ii, page 9, of form 8862 to figure the credit. Enter your name, ssn, and the year you require credits for, and select one of the options. Ad download or email irs.

Fillable Form 8862 Information To Claim Earned Credit After

Use our detailed instructions to fill out and esign your. Edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Log into your account and click take me to my return. Complete, edit or print tax forms instantly. When you review your return, the form 8862.

Irs Form 8862 Printable Master of Documents

Enter your name, ssn, and the year you require credits for, and select one of the options. Reminders applicable federal poverty line. Web here's how to file form 8862 in turbotax. Fill in the applicable credit information (earned income credit, child tax credit, etc.). Web up to $40 cash back also see part ii, page 9, of form 8862 to.

Form 8862 Edit, Fill, Sign Online Handypdf

Reminders applicable federal poverty line. Use our detailed instructions to fill out and esign your. Web fillable form 8862 (2021) easily fill out and sign forms in a few minutes with pdfliner download blank or edit pdf online. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. You.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web turbotax can help you fill out your 8862 form, see below for instructions on how to find this form in turbotax and on how to complete it. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for.

Instructions For Form 8862 Information To Claim Earned Credit

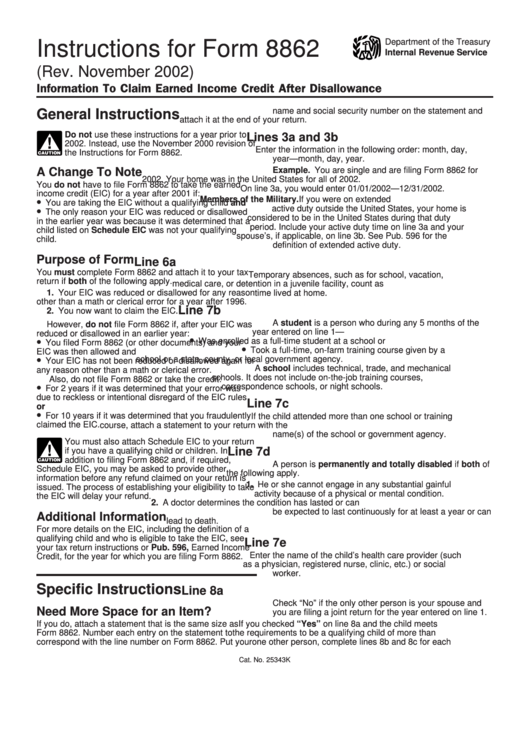

Do not enter the year the credit (s) was disallowed. Web correspond with the line number on form 8862. Try it for free now! Ad access irs tax forms. Step into the future the irs.

Top 14 Form 8862 Templates free to download in PDF format

Reminders applicable federal poverty line. Web correspond with the line number on form 8862. Sign in to turbotax and select pick up where you left off or review/edit under deductions & credits select search. Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Use our detailed instructions to.

Notice Of Disallowance Of Claim

Web here's how to file form 8862 in turbotax. Web español taxpayers complete form 8862 and attach it to their tax return if: Filing this form allows you to reclaim credits for which you are now. Enter the year for which you are filing this form to claim the credit(s) (for. Web how to complete the irs 8862 online:

Do Not Enter The Year The Credit (S) Was Disallowed.

Web see form 8862, information to claim certain credits after disallowance, and its instructions for more information, including whether an exception applies. Edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web fillable form 8862 (2021) easily fill out and sign forms in a few minutes with pdfliner download blank or edit pdf online. When you review your return, the form 8862.

Web Edit Fill Out Sign Export Or Print Download Your Fillable Irs Form 8862 In Pdf Table Of Contents Who Should Use Form 8862 Reasons For Disallowance How To Fill Out Form.

Web step 1 using a suitable browser on your computer, navigate to the irs homepage and click the form 8862 link. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Use our detailed instructions to fill out and esign your.

Go To Search Box In Top Right Cover And Click There To Type In 8862 And Hit.

Ad download or email irs 8862 & more fillable forms, register and subscribe now! Reminders applicable federal poverty line. Check the box (es) that applies to the credit (s) you are now claiming. Enter your name and social security number at the top of form 8862 as it is shown on your current tax return.

To Find The 8862 In.

Filing this form allows you to reclaim credits for which you are now. Fill in the applicable credit information (earned income credit, child tax credit, etc.). Web satisfied 124 votes quick guide on how to complete what is 8862 form forget about scanning and printing out forms. Log into your account and click take me to my return.